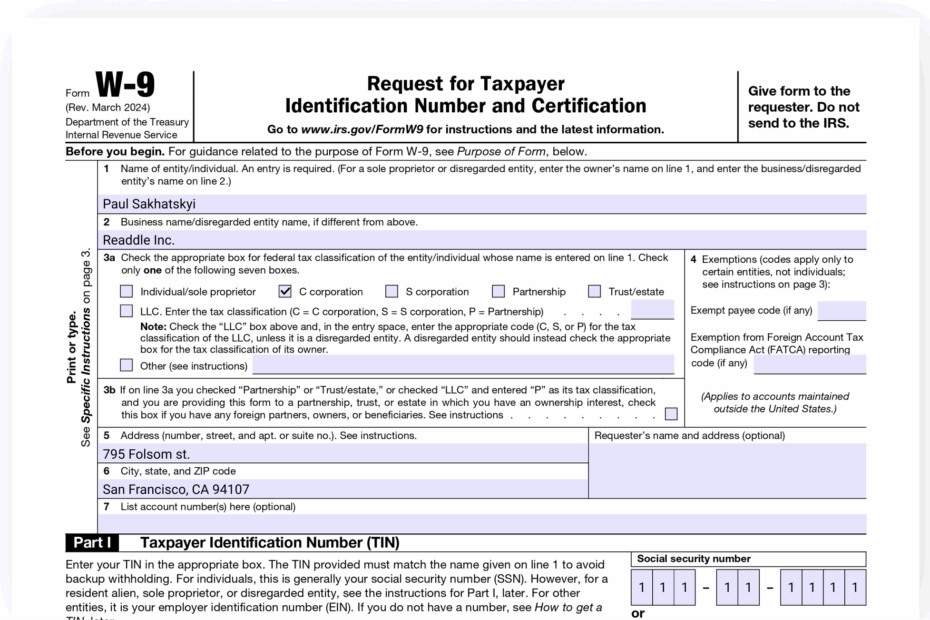

When it comes to tax forms, the IRS W9 Form 2025 Printable is one of the most important documents you’ll come across. This form is typically used by businesses to gather information from independent contractors, freelancers, and other non-employee workers. It is crucial for businesses to have this information on file to report payments made to these individuals to the IRS.

By completing the IRS W9 Form 2025 Printable, individuals are providing their taxpayer identification number (TIN) to the business that they are working for. This form also includes information such as the individual’s name, address, and business entity type. It is essential for individuals to accurately complete this form to avoid any issues with tax reporting in the future.

Get and Print Irs W9 Form 2025 Printable

Free Printable W9 Form 2025 Printable W9 Form 2025

Free Printable W9 Form 2025 Printable W9 Form 2025

IRS W9 Form 2025 Printable

The IRS W9 Form 2025 Printable is a simple one-page document that can be easily filled out and submitted. It is important for businesses to provide this form to any individual who will be receiving payments of $600 or more during the tax year. Failure to do so can result in penalties and fines from the IRS.

When completing the IRS W9 Form 2025 Printable, individuals should pay close attention to the instructions and provide accurate information. Any discrepancies or errors on the form can lead to delays in payment processing and potential issues with tax reporting. It is always best to double-check the information provided before submitting the form.

Once the IRS W9 Form 2025 Printable is completed and submitted, businesses can use this information to accurately report payments made to individuals on Form 1099-MISC. This form is used to report miscellaneous income to the IRS and the individual receiving the payment. Having accurate and up-to-date information on file is crucial for businesses to stay compliant with tax regulations.

In conclusion, the IRS W9 Form 2025 Printable is a vital document for businesses and individuals alike. By accurately completing and submitting this form, both parties can ensure that payments are reported correctly to the IRS. It is important to take the time to fill out this form correctly to avoid any potential issues in the future.