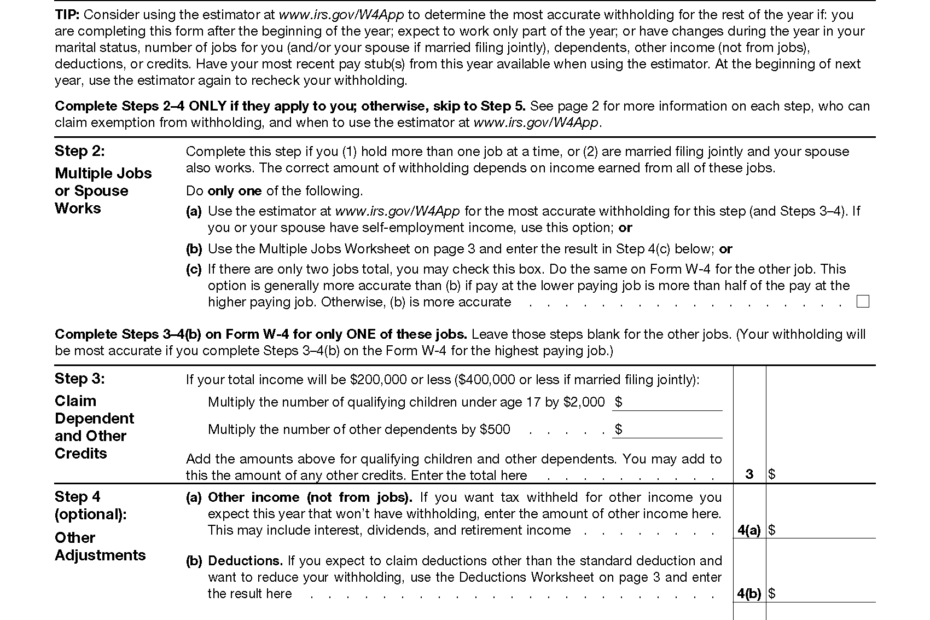

When it comes to tax forms, the IRS W4v Form 2025 Printable is an important document that individuals need to be familiar with. This form is used to request a withholding certificate for pension or annuity payments. It allows individuals to specify the amount of federal income tax they want to be withheld from their payments.

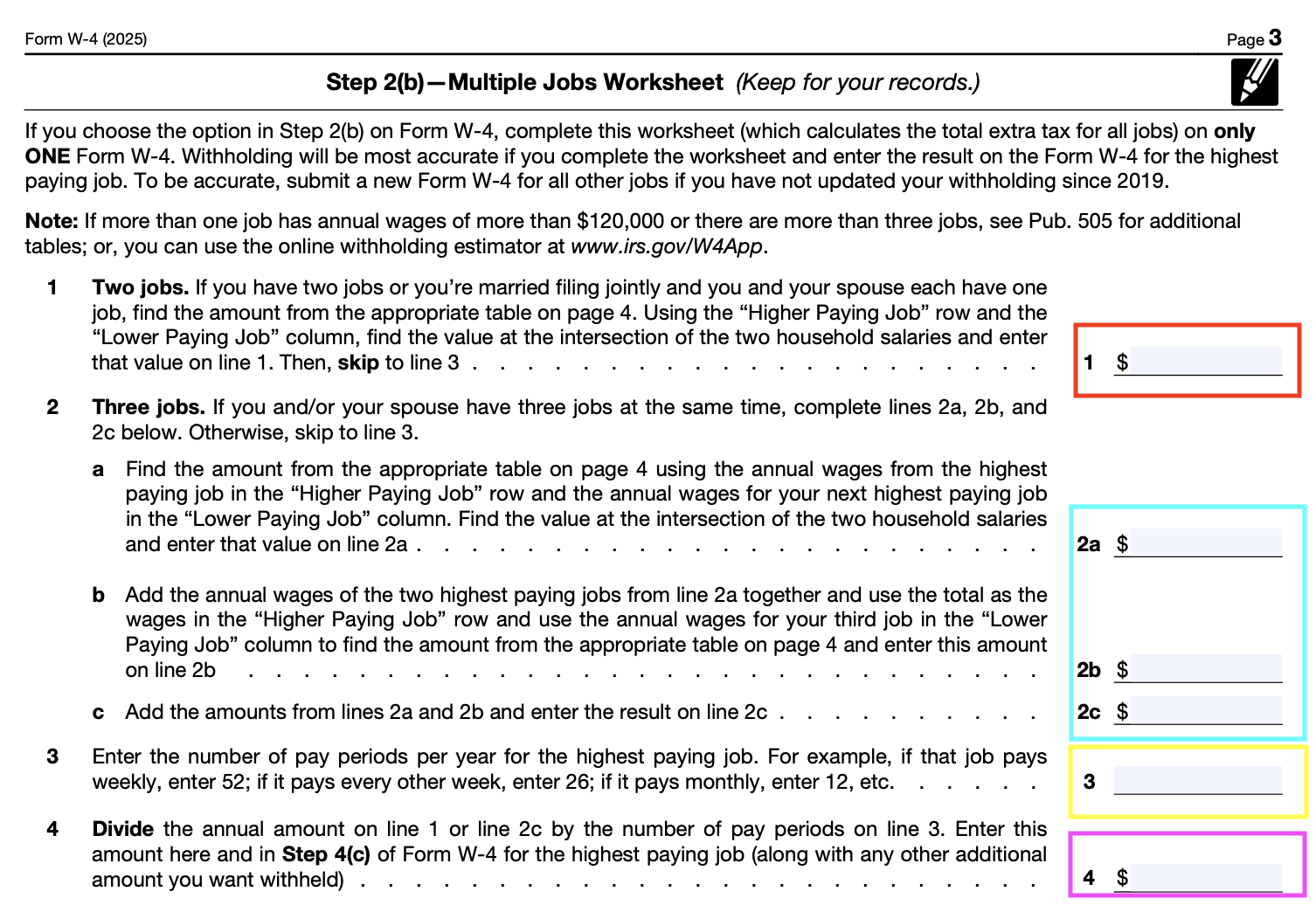

It is crucial to understand how to properly fill out the IRS W4v Form 2025 Printable to ensure that your tax withholding is accurate and in line with your financial situation. Failing to do so could result in underpayment or overpayment of taxes, which can have consequences when it comes time to file your tax return.

Get and Print Irs W4v Form 2025 Printable

2025 W 4 Form Step By Step Guide To Get Your Withholding Right

2025 W 4 Form Step By Step Guide To Get Your Withholding Right

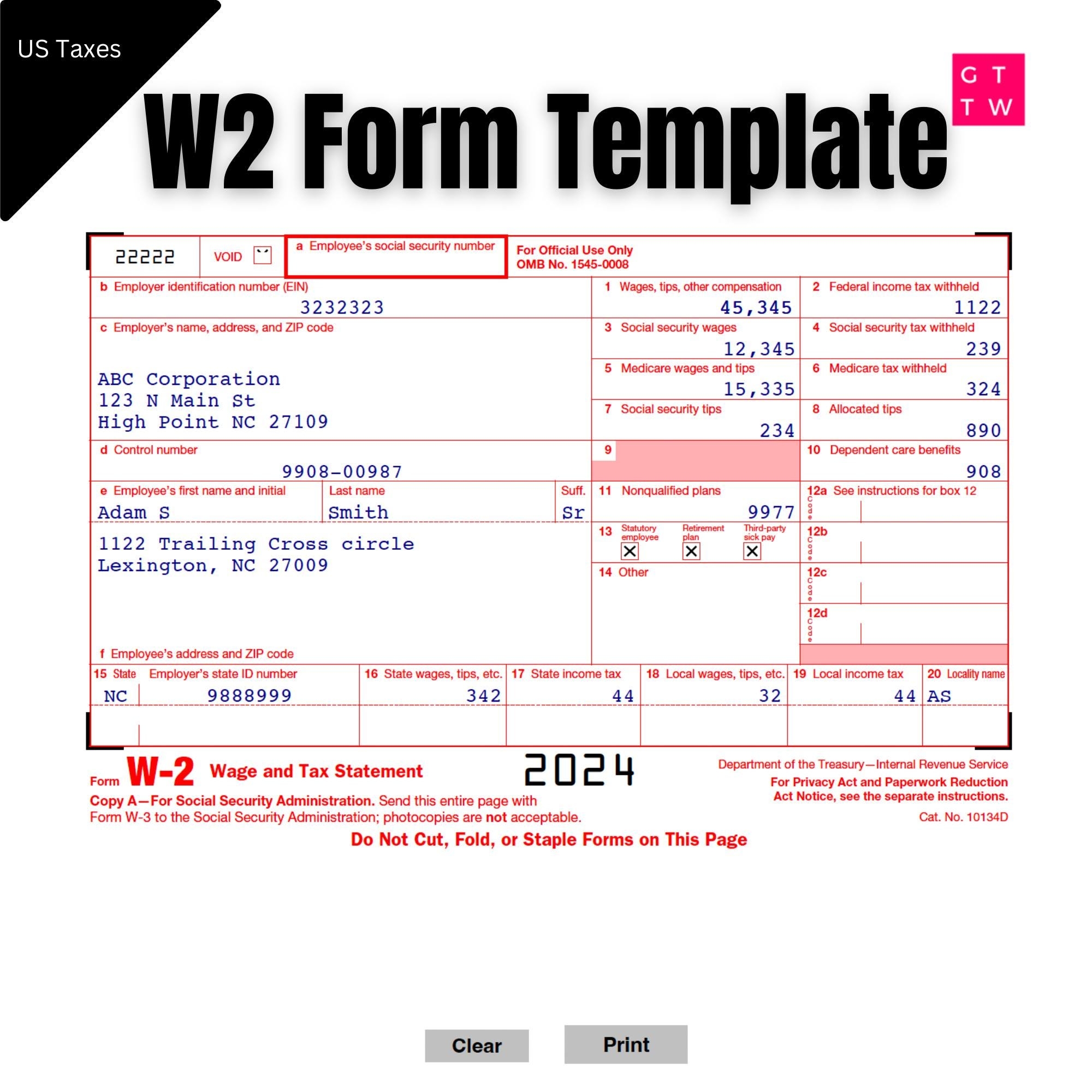

When filling out the form, you will need to provide your personal information, including your name, address, social security number, and the amount of withholding you want to claim. It is important to review the instructions carefully and seek guidance from a tax professional if needed.

Once you have completed the form, you can submit it to the IRS for processing. It is recommended to keep a copy for your records and to monitor your tax withholding throughout the year to ensure it remains accurate.

Overall, the IRS W4v Form 2025 Printable is a valuable tool for individuals receiving pension or annuity payments to manage their tax withholding effectively. By understanding how to properly fill out the form and staying informed about any changes in tax laws, you can ensure that your tax obligations are met in a timely and accurate manner.

It is always advisable to consult with a tax professional or financial advisor if you have any questions or concerns about your tax withholding or any other tax-related matters. Taking proactive steps to stay informed and compliant with tax laws can help you avoid potential issues and penalties in the future.