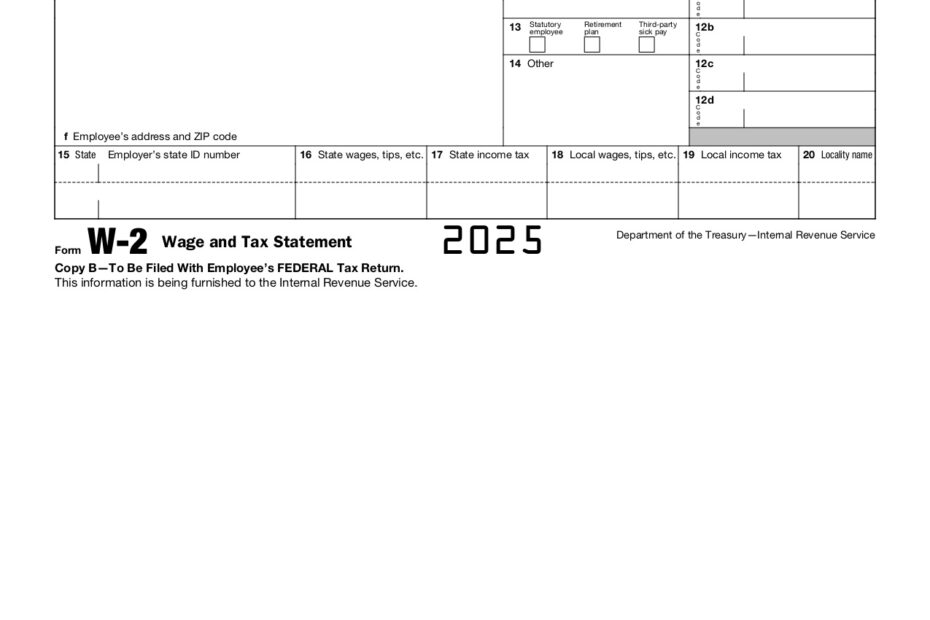

As we approach tax season, it’s important to be prepared with all the necessary forms to ensure a smooth filing process. One of the key documents you’ll need is the IRS W2 Form, which provides information about your earnings and taxes withheld for the year. In 2025, the IRS has made the W2 Form available for printing, making it easier for taxpayers to access and file their taxes.

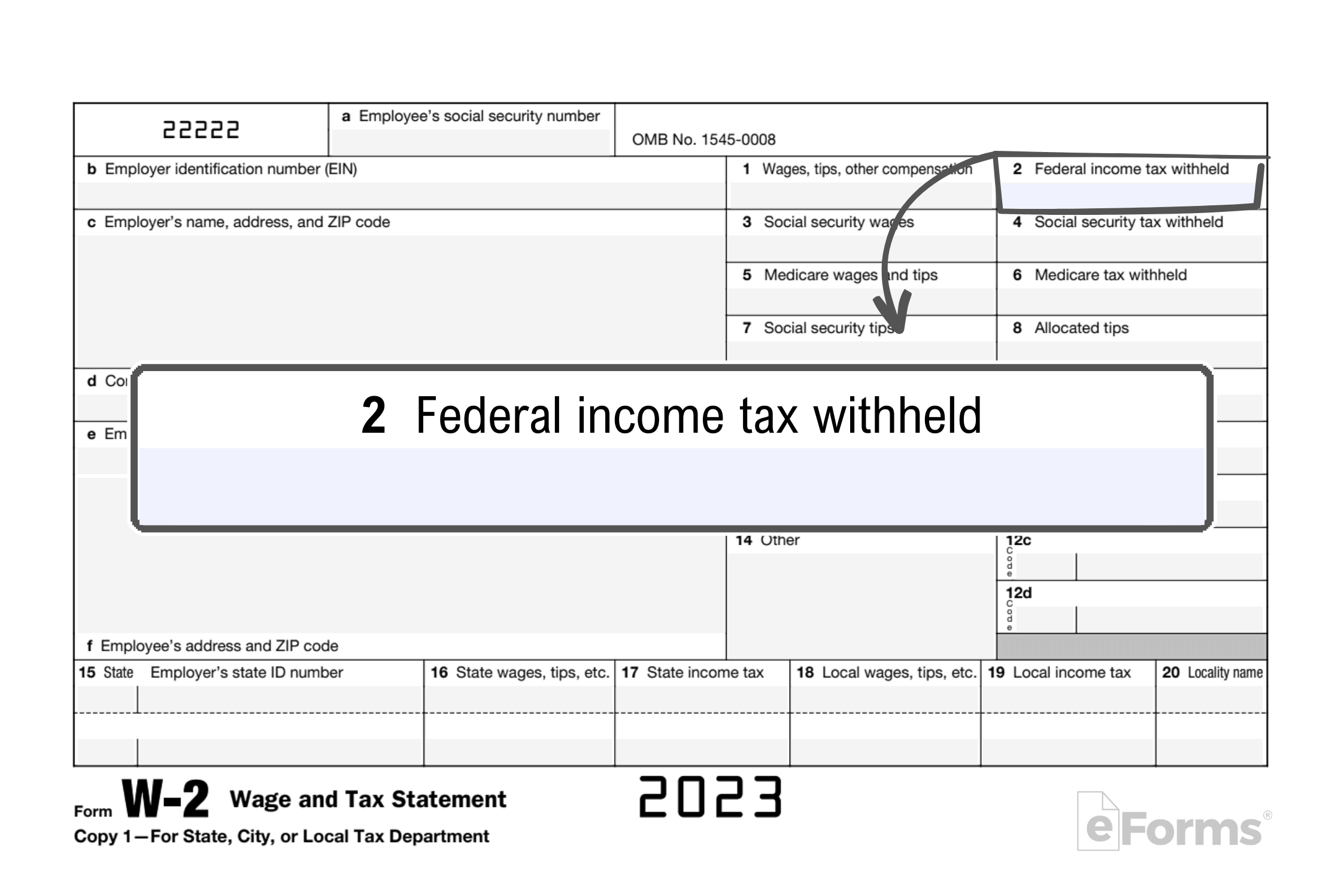

Whether you’re an employee or an employer, the IRS W2 Form is a crucial document that must be completed accurately. This form includes details such as your total wages, tips, and other compensation, as well as the amount of federal and state taxes withheld from your paycheck. By having this information readily available in printable format, you can easily reference it when preparing your tax return.

Download and Print Irs W2 Form 2025 Printable

Free IRS Form W 2 Wage And Tax Statement PDF EForms

Free IRS Form W 2 Wage And Tax Statement PDF EForms

When it comes to tax season, having the IRS W2 Form 2025 Printable can save you time and hassle. With this form, you can quickly gather all the necessary information needed to file your taxes accurately and on time. Whether you choose to file your taxes online or through a tax professional, having a printed copy of your W2 Form will ensure that you have all the information you need at your fingertips.

Additionally, having the IRS W2 Form 2025 Printable can also be beneficial for employers. By providing employees with easy access to their W2 forms, employers can help streamline the tax filing process and ensure that all employees receive their forms in a timely manner. This can help avoid delays in tax filing and ensure that both employees and employers are in compliance with IRS regulations.

In conclusion, the IRS W2 Form 2025 Printable is a valuable tool for taxpayers and employers alike. By making this form accessible for printing, the IRS has made it easier for individuals to gather the necessary information needed for tax filing. Whether you’re an employee or an employer, having a printed copy of your W2 form can help simplify the tax filing process and ensure that you meet all IRS requirements.