When tax season rolls around, it’s important to have all your documents in order to ensure a smooth filing process. One crucial form that you’ll need is the IRS W2 Form 2024. This form provides information about your wages, tips, and other compensation received from your employer throughout the year. It’s essential for accurately reporting your income and ensuring that you pay the correct amount of taxes.

Without a completed W2 form, you may face delays in receiving your tax refund or even potential penalties from the IRS. That’s why it’s crucial to make sure you have this form filled out correctly and submitted on time.

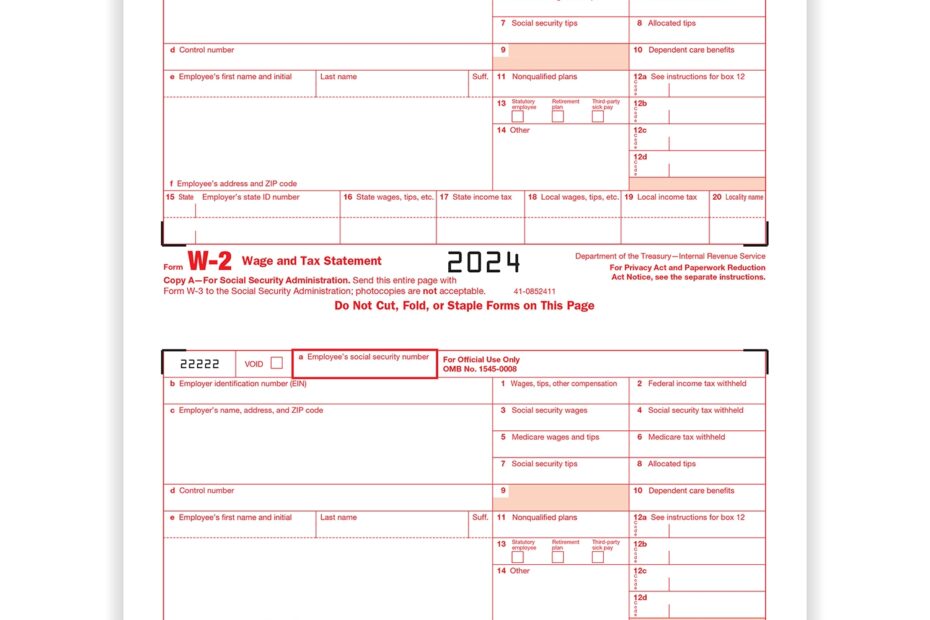

Download and Print Irs W2 Form 2024 Printable

Free IRS Form W 2 Wage And Tax Statement PDF EForms

Free IRS Form W 2 Wage And Tax Statement PDF EForms

IRS W2 Form 2024 Printable

The IRS provides a printable version of the W2 form on their website, making it easy for taxpayers to access and fill out the necessary information. This printable form can be downloaded and printed from the IRS website, ensuring that you have a clean and legible copy to submit with your tax return.

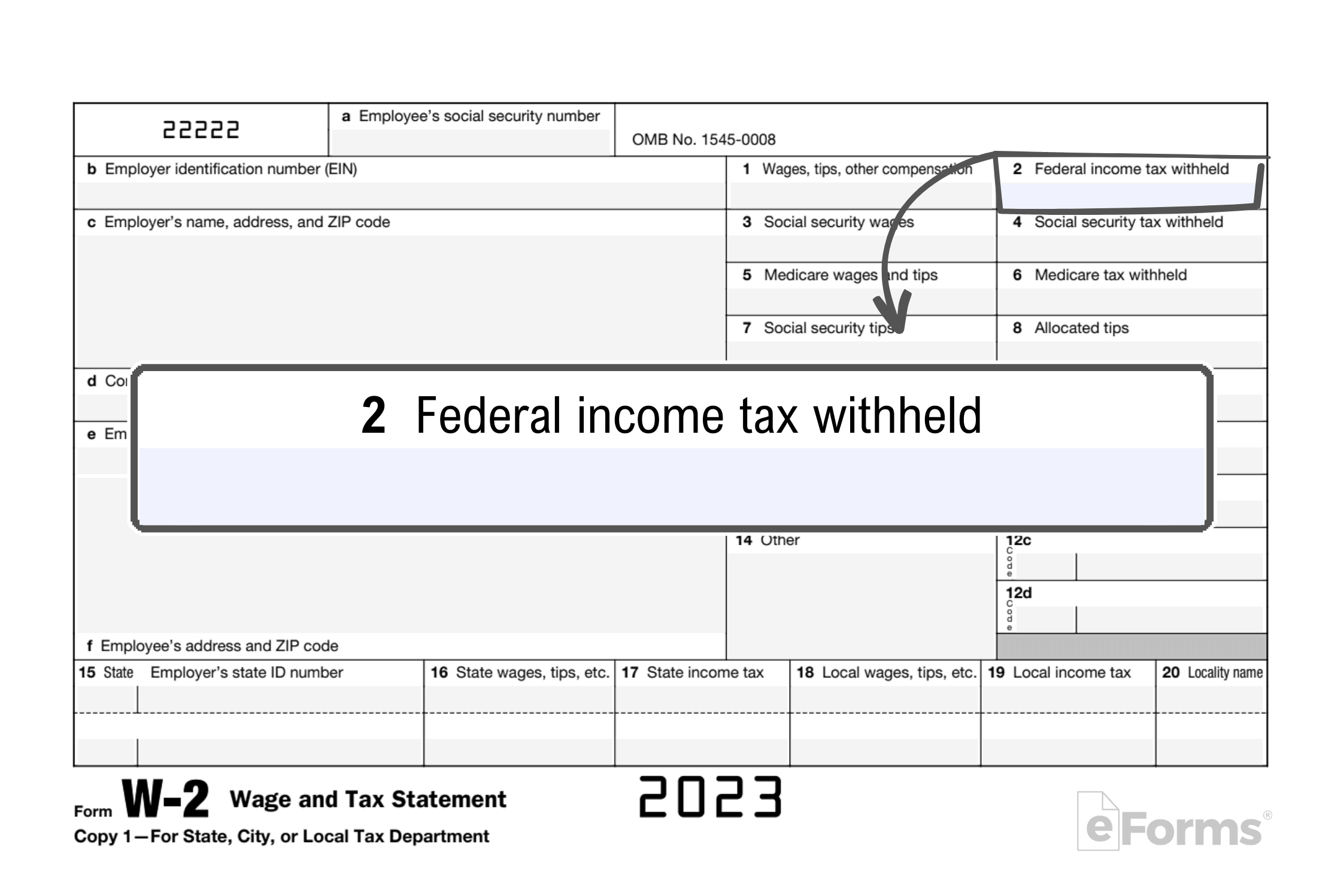

When filling out the W2 form, make sure to double-check all the information provided by your employer, including your wages, tips, and other compensation. Any discrepancies could lead to issues with your tax return and potential audits from the IRS. It’s always better to be thorough and accurate when filling out this form.

Once you have completed the W2 form, be sure to submit it along with your tax return by the deadline to avoid any penalties or delays in processing. The IRS typically requires employers to provide employees with their W2 forms by the end of January, so make sure to reach out to your employer if you haven’t received yours.

In conclusion, the IRS W2 Form 2024 is a critical document for accurately reporting your income and filing your taxes. By ensuring that you have a completed and accurate form, you can avoid potential issues with the IRS and ensure a smooth tax filing process. Be sure to take the time to fill out this form correctly and submit it on time to avoid any penalties or delays in processing.