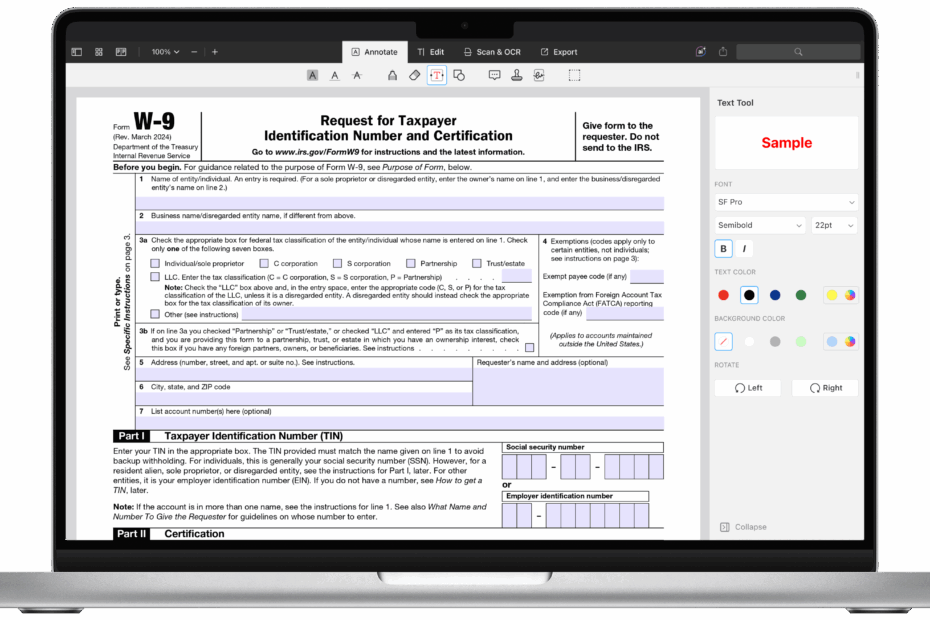

When it comes to tax season, one of the most important forms you may need to fill out is the IRS W-9 form. This form is used to collect the taxpayer identification number (TIN) of individuals and businesses who need to report income to the IRS. It is essential for businesses to have this information on file in order to accurately report payments made to contractors, freelancers, and other non-employee workers.

Having a printable version of the IRS W-9 form for 2024 can make the process much easier for both parties involved. It allows for quick and easy access to the necessary information, and ensures that all required fields are properly filled out. This can help to prevent any delays or errors in reporting income to the IRS, ultimately saving time and hassle for all parties.

Download and Print Irs W 9 Form 2024 Printable

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

With the IRS W-9 form for 2024 being readily available in a printable format, it is important for businesses to stay up-to-date with the latest version. This ensures that they are using the most current form and are in compliance with IRS regulations. By keeping a copy of the form on hand, businesses can streamline their processes and avoid any potential issues when it comes time to report income to the IRS.

It is also important for individuals who are required to fill out the IRS W-9 form to have access to a printable version. This can make it easier for them to provide the necessary information to businesses and organizations that require it. By having a printable form on hand, individuals can quickly and easily fill out the required fields and submit the form as needed.

In conclusion, having access to a printable version of the IRS W-9 form for 2024 is essential for both businesses and individuals. It streamlines the process of collecting taxpayer identification numbers and ensures that all required information is accurately reported to the IRS. By staying organized and up-to-date with the latest version of the form, businesses and individuals can avoid potential issues and ensure compliance with IRS regulations.