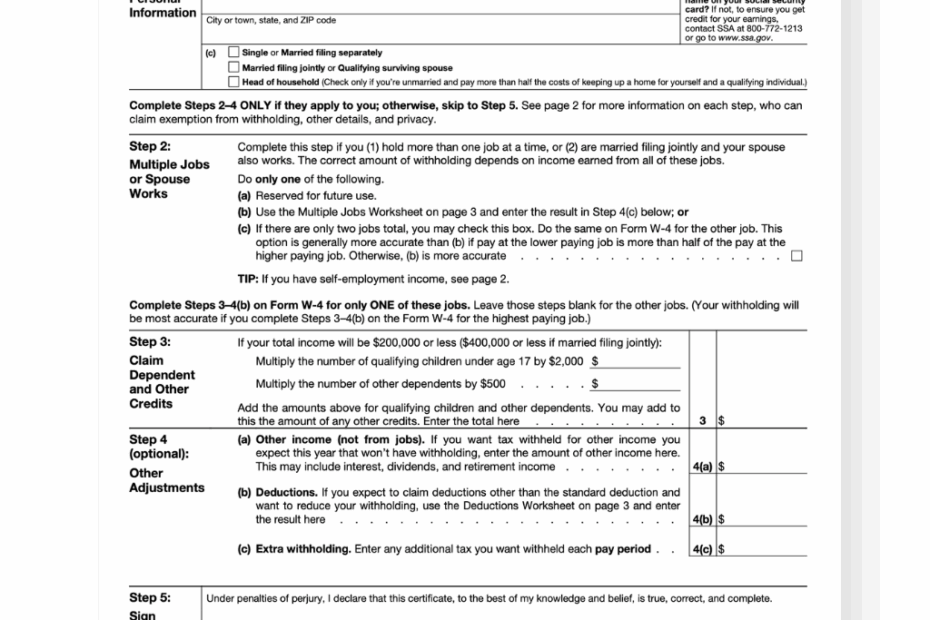

When starting a new job or experiencing a change in your tax situation, it’s important to fill out the IRS W-4 form. This form helps your employer withhold the correct amount of federal income tax from your paychecks. It also allows you to adjust your withholding based on your personal and financial situation.

With the IRS W-4 printable form, you can easily update your withholding information without the need for a physical copy. This makes it convenient for employees to make changes as needed, ensuring that the right amount of taxes are withheld from their pay.

Easily Download and Print Irs W 4 Printable Form

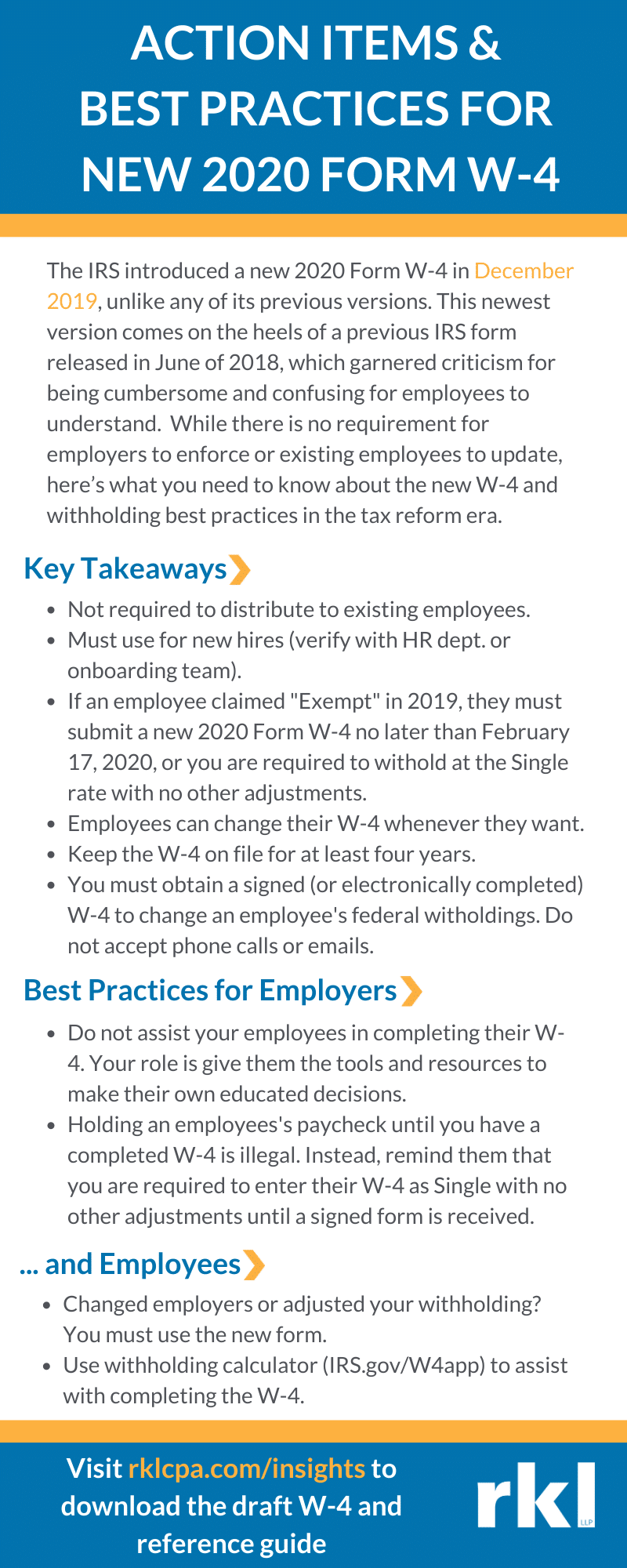

New 2020 Form W 4 Released With Changes RKL LLP

New 2020 Form W 4 Released With Changes RKL LLP

It’s important to accurately complete the IRS W-4 form to avoid overpaying or underpaying taxes throughout the year. By providing the correct information, you can ensure that your tax withholding aligns with your expected tax liability, preventing any surprises come tax season.

When filling out the IRS W-4 form, you will need to provide details such as your filing status, number of dependents, and any additional income you expect to receive. By accurately completing this form, you can help avoid owing taxes or receiving a large refund at the end of the year.

By utilizing the IRS W-4 printable form, you can easily update your withholding information as needed, ensuring that your tax situation remains in line with your financial circumstances. This form allows for flexibility and control over your tax withholding, giving you peace of mind when it comes to your tax obligations.

Overall, the IRS W-4 printable form is a valuable tool for managing your tax withholding and ensuring that you are in compliance with federal tax laws. By taking the time to accurately complete this form, you can avoid potential issues and make sure that your tax situation is on track.