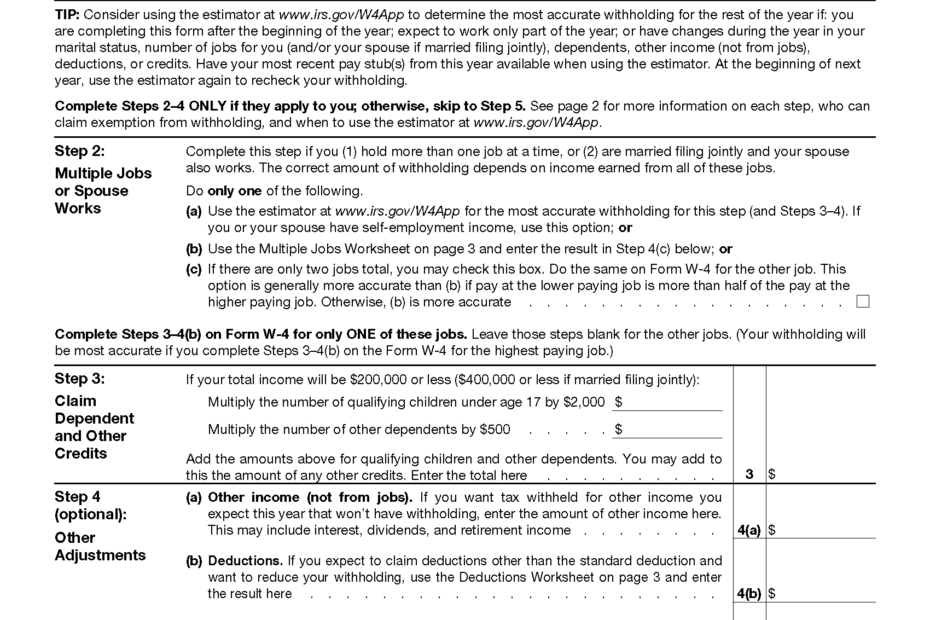

Completing the IRS W-4 form is an essential task for all employees when starting a new job or experiencing changes in their personal or financial situation. The W-4 form determines how much federal income tax is withheld from an employee’s paycheck, so it is crucial to fill it out accurately to avoid any surprises come tax season.

For the year 2025, the IRS has updated the W-4 form to reflect any changes in tax laws and regulations. It is important for employees to stay informed about these updates and ensure they are using the most current version of the form to avoid any issues with their taxes.

Download and Print Irs W 4 Form 2025 Printable

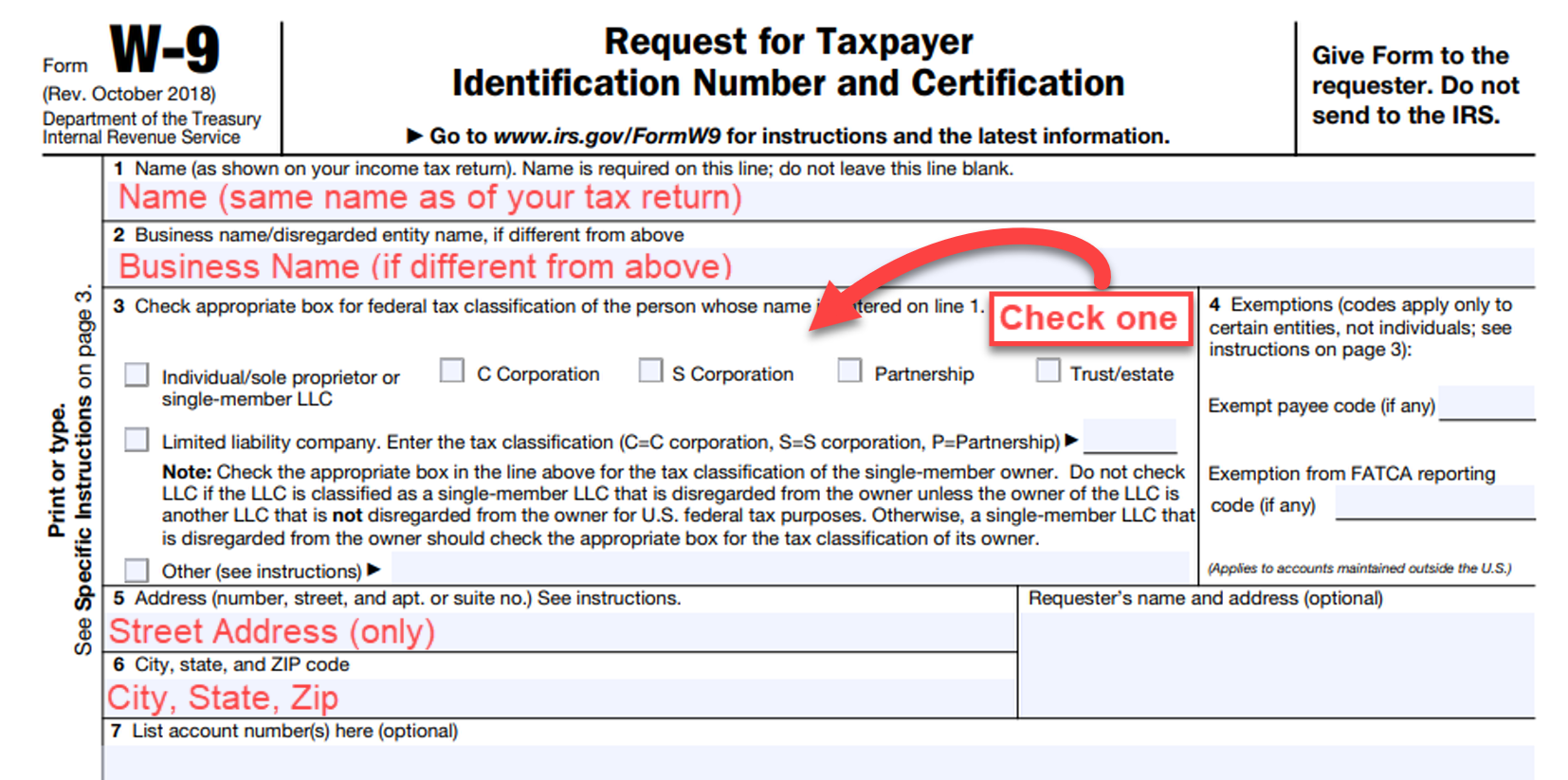

Free IRS Form W9 2025 PDF EForms

Free IRS Form W9 2025 PDF EForms

IRS W-4 Form 2025 Printable

The IRS W-4 form for 2025 can be easily accessed and printed from the IRS website. This printable form allows employees to fill out their information, including their filing status, number of dependents, and any additional income they may have. By accurately completing this form, employees can ensure that the correct amount of tax is withheld from their paychecks.

It is important for employees to review and update their W-4 forms regularly, especially if there have been significant changes in their personal or financial circumstances. This can help prevent under or over-withholding of taxes and ensure that they are not hit with a large tax bill or penalty at the end of the year.

Employers also play a role in ensuring that their employees are using the correct W-4 form and that the information provided is accurate. By staying informed about any updates to the form and providing guidance to employees, employers can help their staff navigate the sometimes complex world of taxes.

In conclusion, the IRS W-4 form for 2025 is a crucial document that all employees should pay attention to. By using the printable form provided by the IRS and staying informed about any updates or changes, employees can ensure that their taxes are being withheld accurately and avoid any surprises when it comes time to file their tax return.