When it comes to taxes, filling out the necessary forms correctly is crucial. One of the most important forms to complete is the IRS W-4 Form, which determines how much federal income tax should be withheld from your paycheck. The IRS recently released the updated W-4 Form for the year 2024, and it is essential to understand how to properly fill it out to avoid any issues with your taxes.

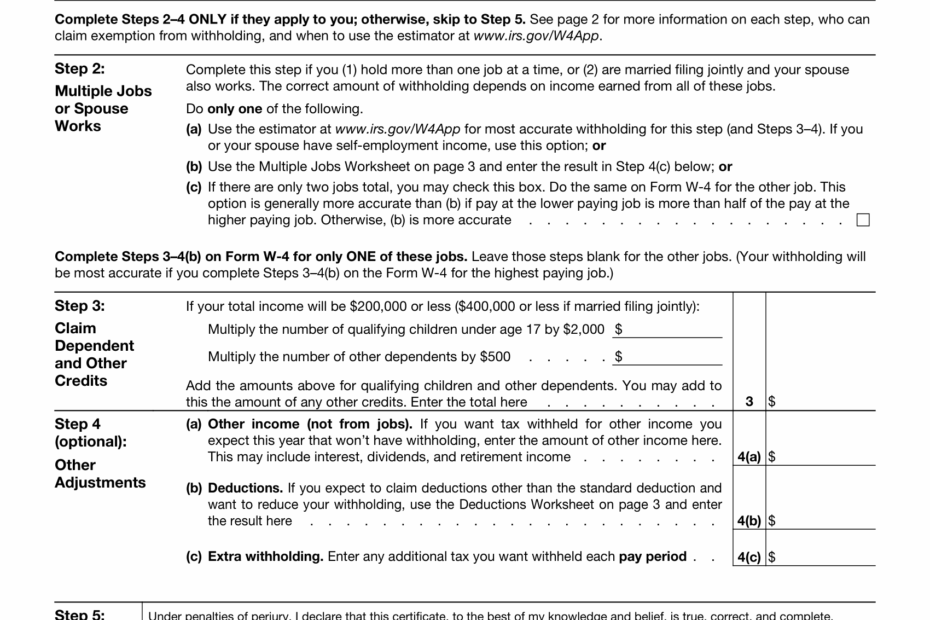

The IRS W-4 Form 2024 Printable is readily available online for individuals to download and complete. This form will require you to provide information such as your filing status, number of dependents, and any additional income you expect to receive throughout the year. It is important to accurately fill out this form to ensure the correct amount of tax is withheld from your paycheck.

Download and Print Irs W 4 Form 2024 Printable

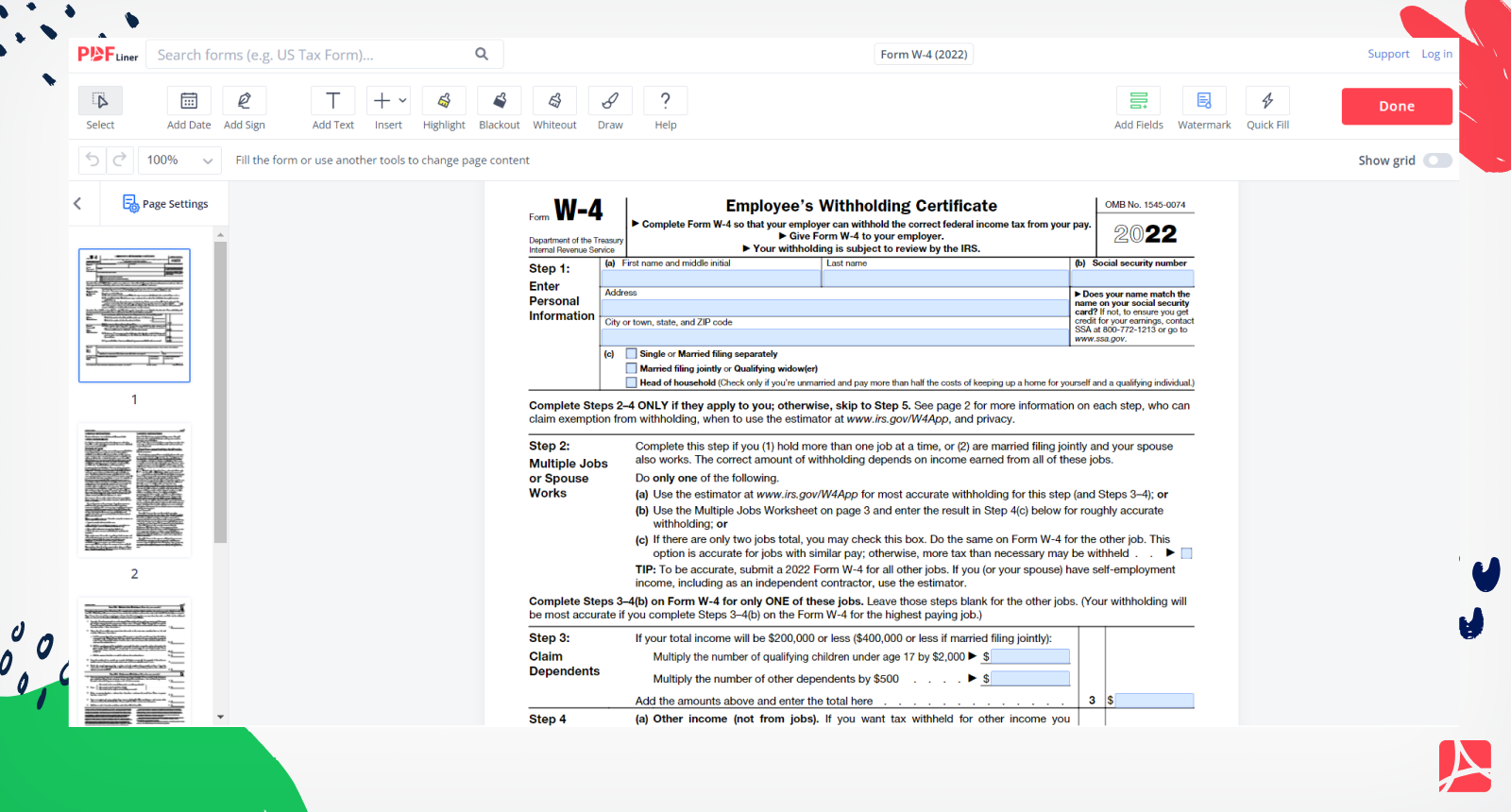

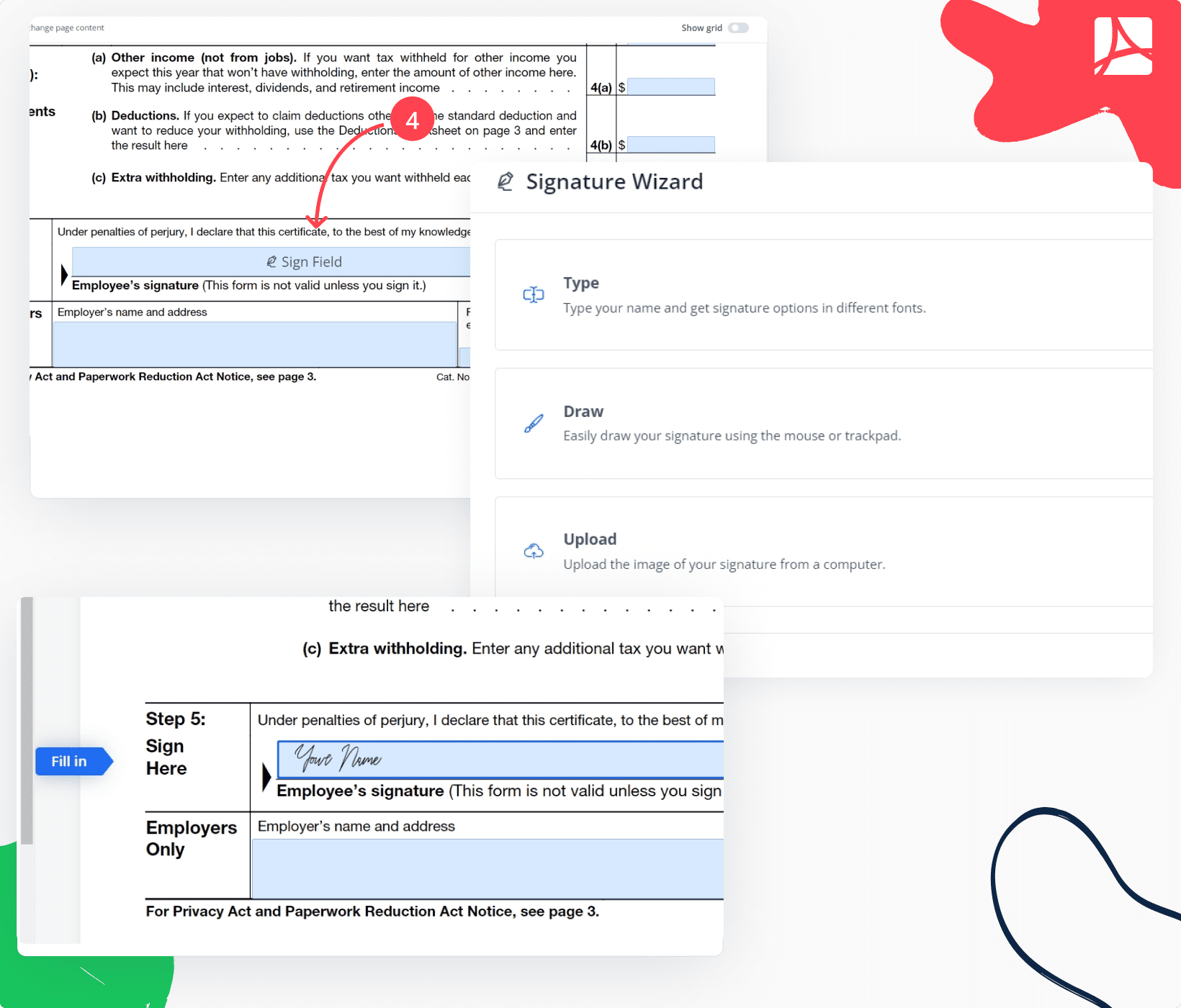

Fill Form W 4 2025 Online Simplify Tax Withholding PDFLiner

Fill Form W 4 2025 Online Simplify Tax Withholding PDFLiner

When filling out the IRS W-4 Form, it is crucial to carefully follow the instructions provided by the IRS. Make sure to enter accurate information and double-check your entries before submitting the form to your employer. Incorrect information could result in under or over-withholding of taxes, which could lead to a tax bill or a smaller refund at the end of the year.

It is also important to review and update your W-4 Form whenever there are significant changes in your life, such as getting married, having a child, or changing jobs. By keeping your W-4 Form up to date, you can ensure that the correct amount of tax is withheld from your paycheck, avoiding any surprises come tax season.

Overall, the IRS W-4 Form 2024 Printable is a crucial document that every taxpayer should be familiar with. By understanding how to properly fill out this form and keeping it up to date, you can avoid any potential issues with your taxes and ensure that you are paying the correct amount of tax throughout the year.

Make sure to download the IRS W-4 Form 2024 Printable from the IRS website and take the time to fill it out accurately. If you have any questions or are unsure about how to complete the form, consider seeking assistance from a tax professional to ensure that everything is done correctly.