When it comes to filing your taxes, having the necessary forms is crucial. The Internal Revenue Service (IRS) provides a variety of tax forms that individuals and businesses can use to report their income and deductions. While some forms can be filled out online, others may require you to print them out and fill them in by hand.

Printable tax forms are convenient for those who prefer to file their taxes offline or for those who may not have access to a computer or reliable internet connection. Having these forms readily available can make the tax filing process much smoother and efficient.

Save and Print Irs Tax Forms Printable

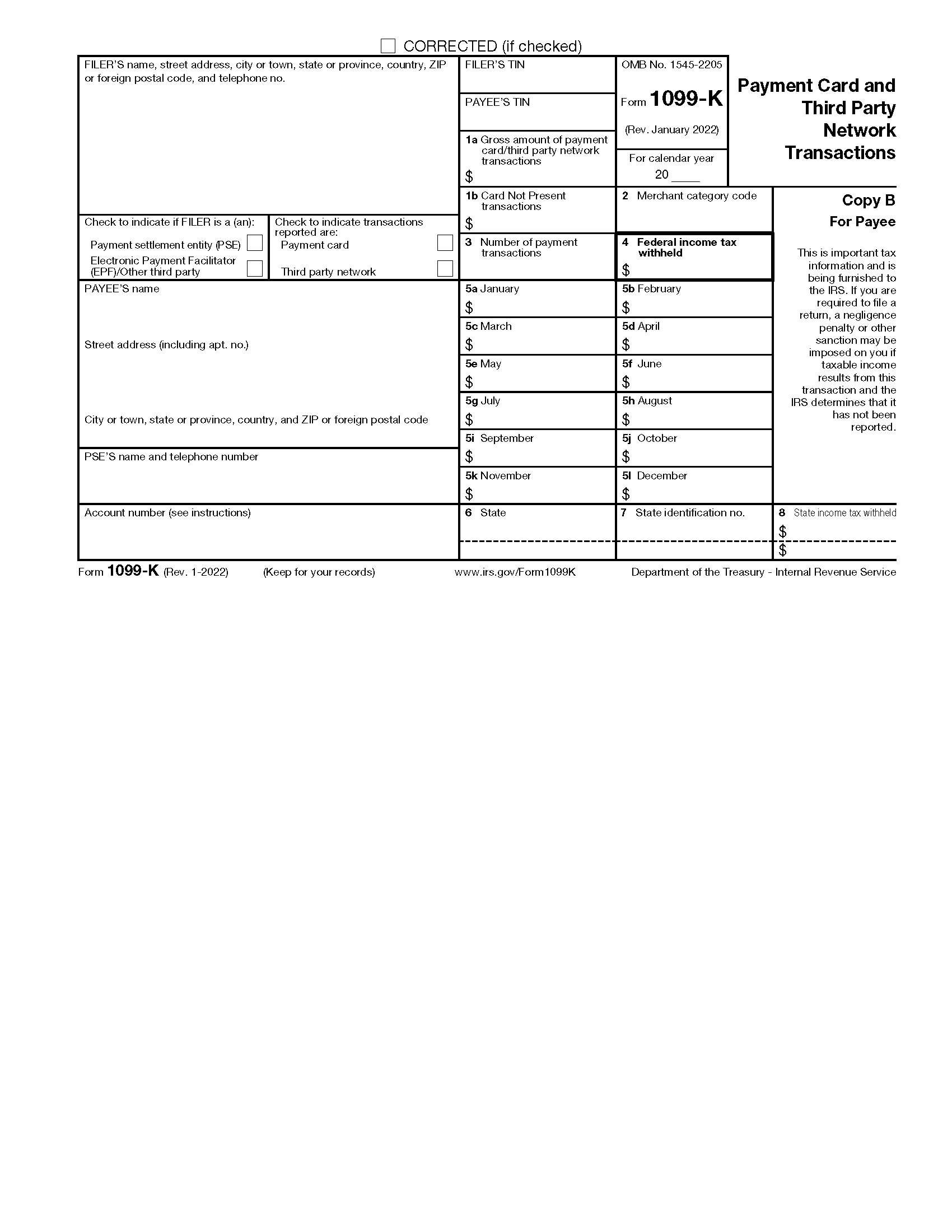

Free IRS 1099 K Form PDF EForms

Free IRS 1099 K Form PDF EForms

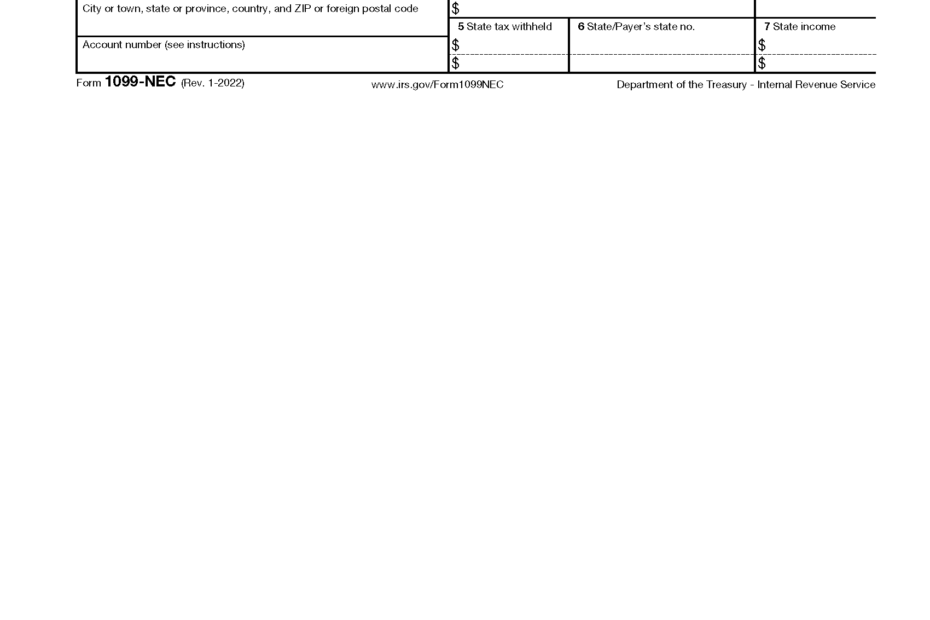

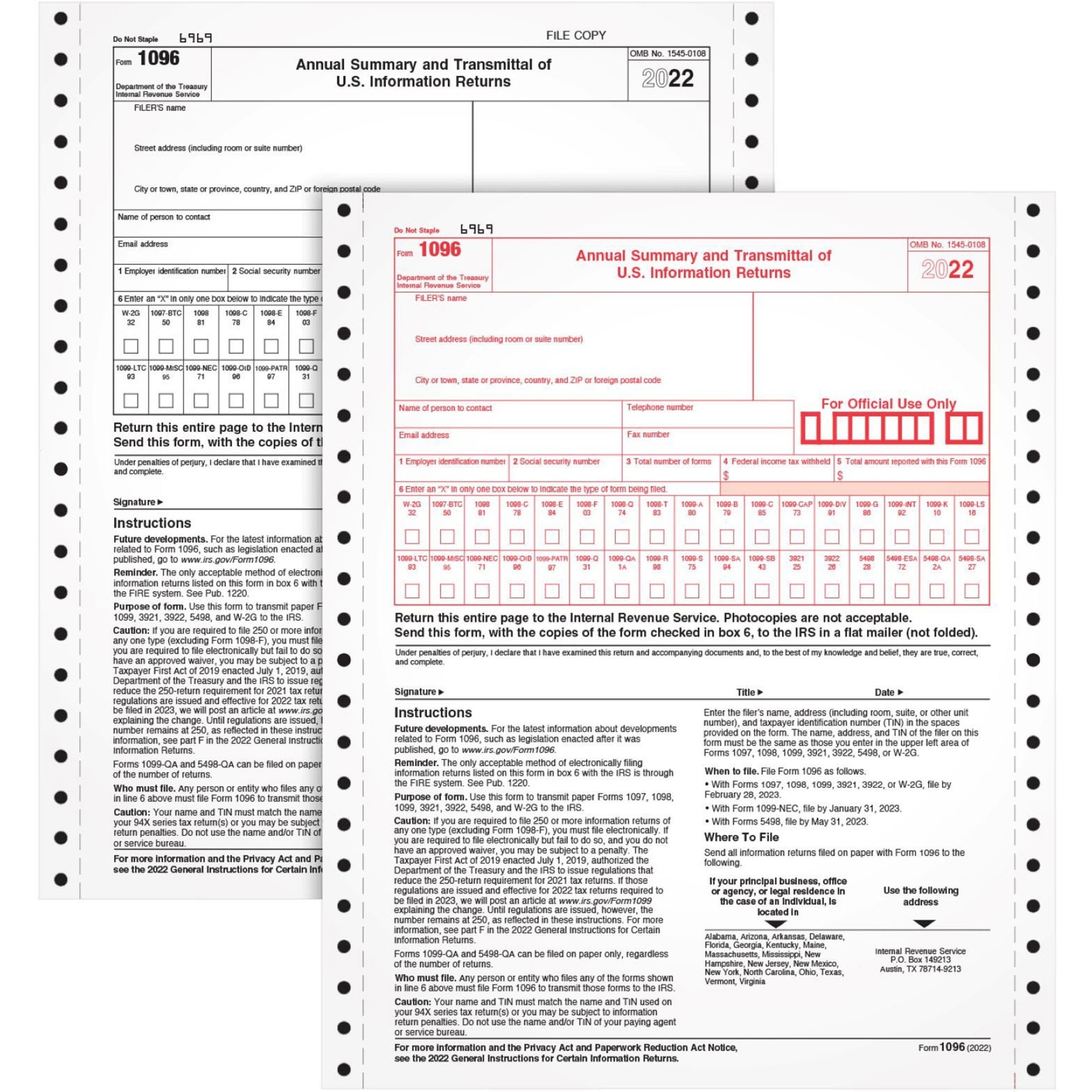

There are several IRS tax forms that are commonly used by individuals and businesses. Some of the most popular forms include the 1040, 1099, W-2, and Schedule A. These forms are essential for reporting various types of income, deductions, and credits.

It’s important to ensure that you are using the correct forms for your specific tax situation. The IRS website provides a comprehensive list of all available tax forms, along with instructions on how to fill them out correctly. You can easily download and print these forms directly from the IRS website.

Before filling out any tax forms, it’s recommended to gather all the necessary documentation, such as W-2s, 1099s, and receipts for deductions. This will help ensure that you accurately report your income and deductions, which can ultimately help you avoid any potential issues with the IRS.

In conclusion, having access to printable IRS tax forms can make the tax filing process much easier and more efficient. Whether you choose to file your taxes online or offline, having the necessary forms on hand is essential. Make sure to visit the IRS website to download and print the forms you need for your specific tax situation. By being proactive and organized, you can ensure a smooth and stress-free tax filing experience.