In the year 2025, taxpayers will still need to file their taxes accurately and on time. The IRS will continue to provide various tax forms to help individuals and businesses report their income and deductions. It is important to stay informed about the latest tax forms and regulations to avoid any penalties or fines.

One of the key tools that taxpayers will need in 2025 is access to printable IRS tax forms. These forms are essential for accurately reporting income, deductions, and credits. Having printable forms on hand can make the tax filing process much easier and more convenient for taxpayers.

Get and Print Irs Tax Forms 2025 Printable

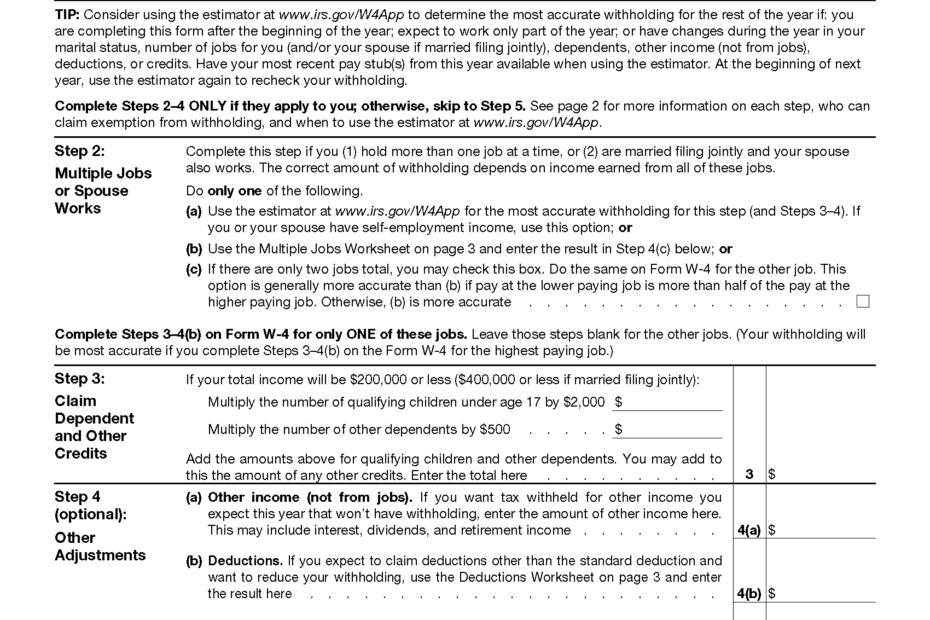

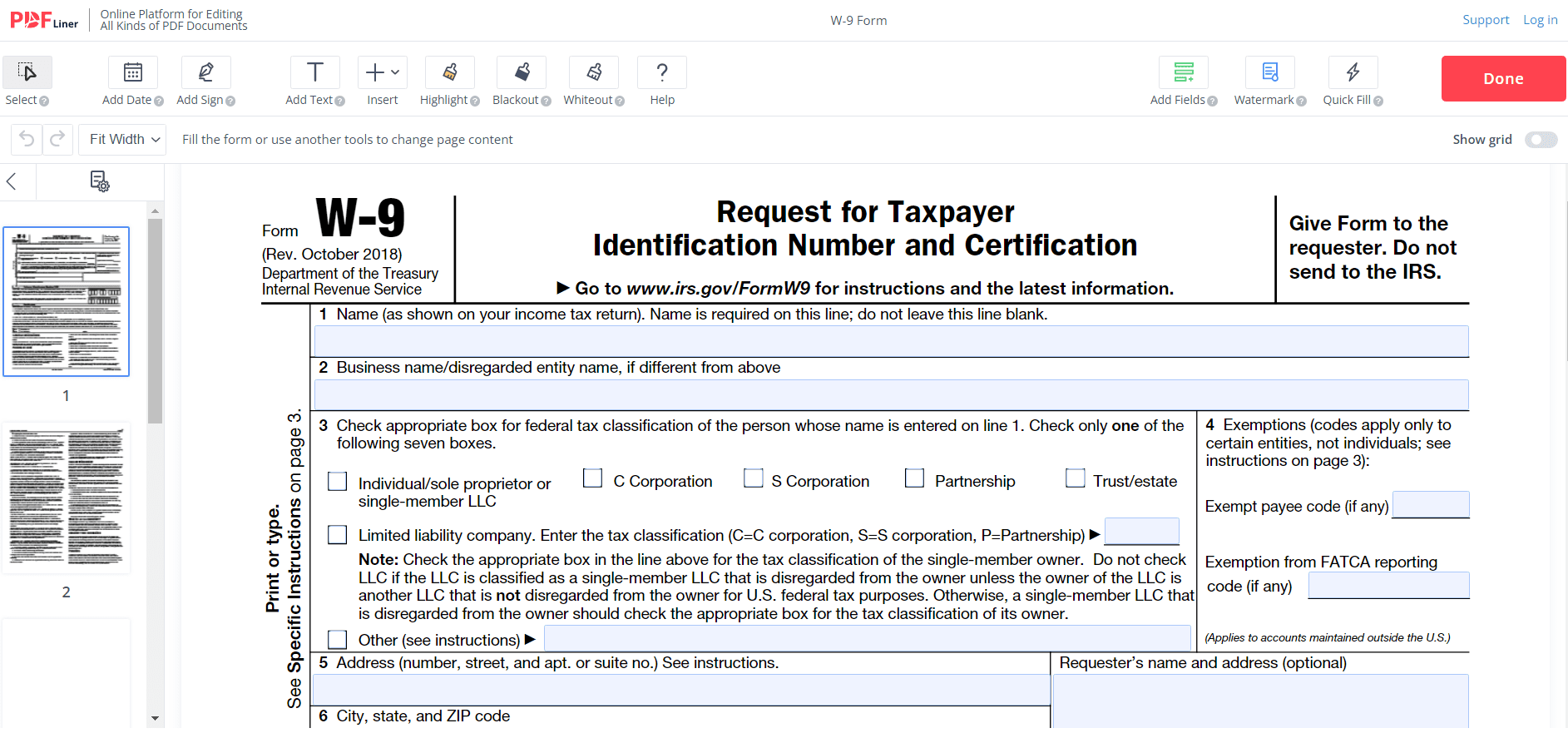

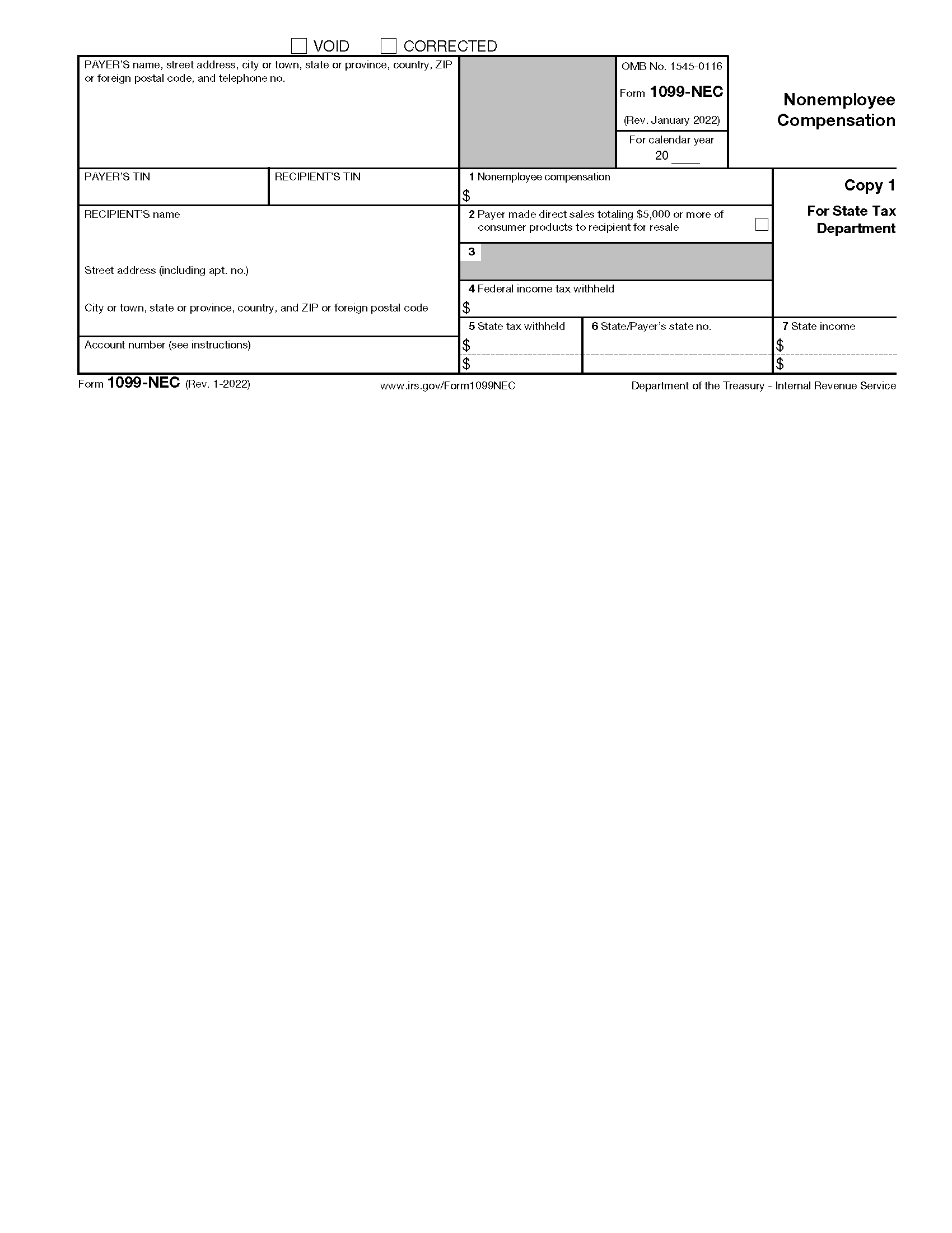

There are several IRS tax forms that individuals and businesses may need to use in 2025. These include forms for reporting income, such as the 1040 series for individual tax returns and the 1120 series for corporate tax returns. Additionally, there are forms for claiming deductions and credits, such as the Schedule A for itemized deductions and the 8863 for education credits.

It is important for taxpayers to carefully review the instructions for each form to ensure that they are completing them accurately. Mistakes on tax forms can lead to delays in processing or even audits by the IRS. By using printable forms and following the instructions carefully, taxpayers can help ensure a smooth tax filing process in 2025.

In conclusion, IRS tax forms will continue to be a crucial tool for taxpayers in the year 2025. By staying informed about the latest forms and regulations, individuals and businesses can accurately report their income and deductions. Utilizing printable forms can make the tax filing process more convenient and efficient. Remember to double-check all information before submitting your tax forms to the IRS to avoid any issues.