As tax season approaches, it’s important for taxpayers to be prepared with the necessary forms to file their taxes accurately and on time. The IRS provides various forms that individuals and businesses can use to report their income, deductions, and credits. One of the most convenient ways to access these forms is through printable PDF versions, which can be easily downloaded and filled out electronically or printed for manual completion.

IRS Tax Forms 2024 Printable PDF is a valuable resource for taxpayers who prefer to complete their tax returns offline or need physical copies for record-keeping purposes. These forms are available on the IRS website and can be accessed at any time, making it convenient for individuals to prepare their taxes at their own pace.

Irs Tax Forms 2024 Printable Pdf

Irs Tax Forms 2024 Printable Pdf

Save and Print Irs Tax Forms 2024 Printable Pdf

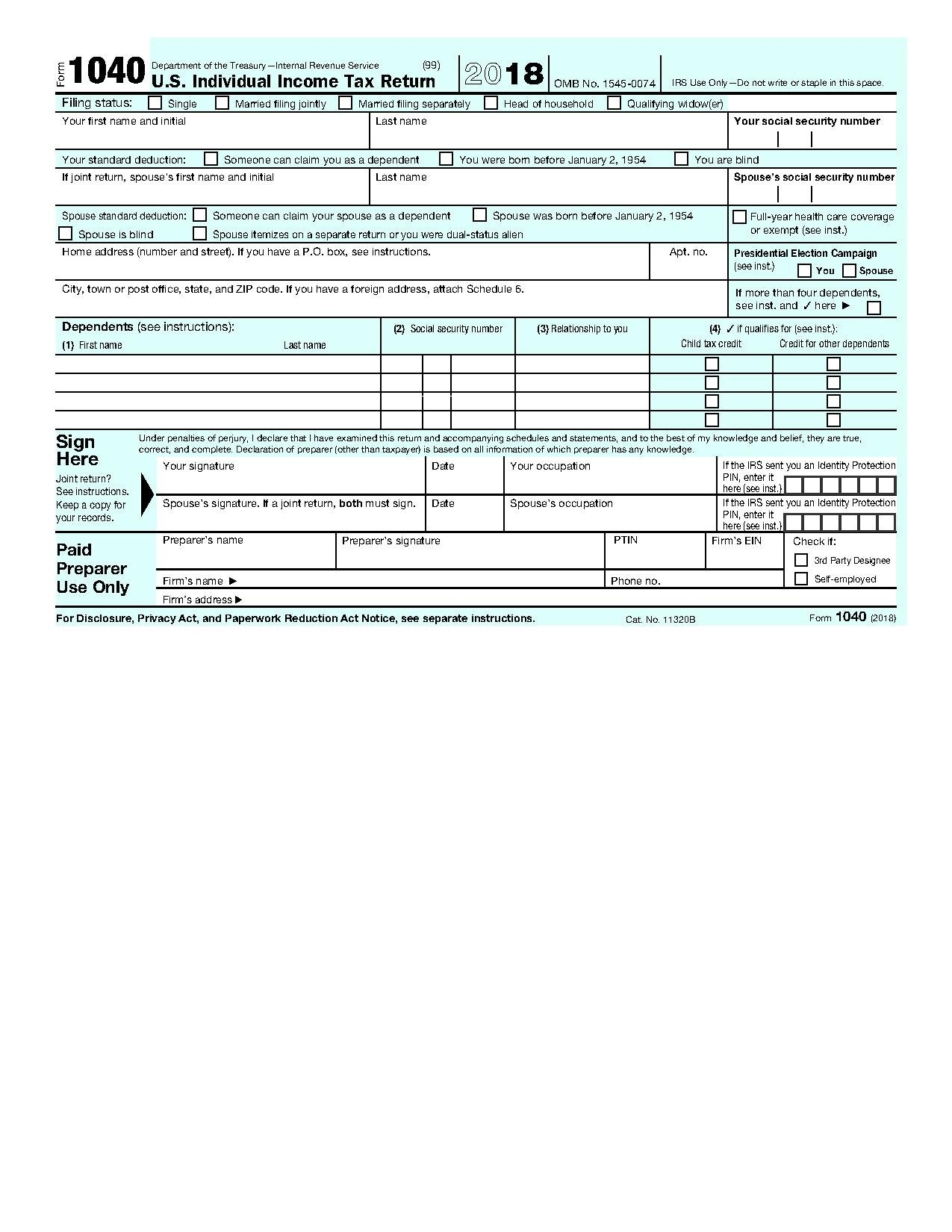

File IRS Form 1040 2018 Pdf Wikimedia Commons

File IRS Form 1040 2018 Pdf Wikimedia Commons

When using IRS Tax Forms 2024 Printable PDF, taxpayers should ensure they are using the most up-to-date version of the form to avoid any errors or delays in processing their returns. It’s also important to carefully follow the instructions provided with each form to ensure accurate reporting of income, deductions, and credits.

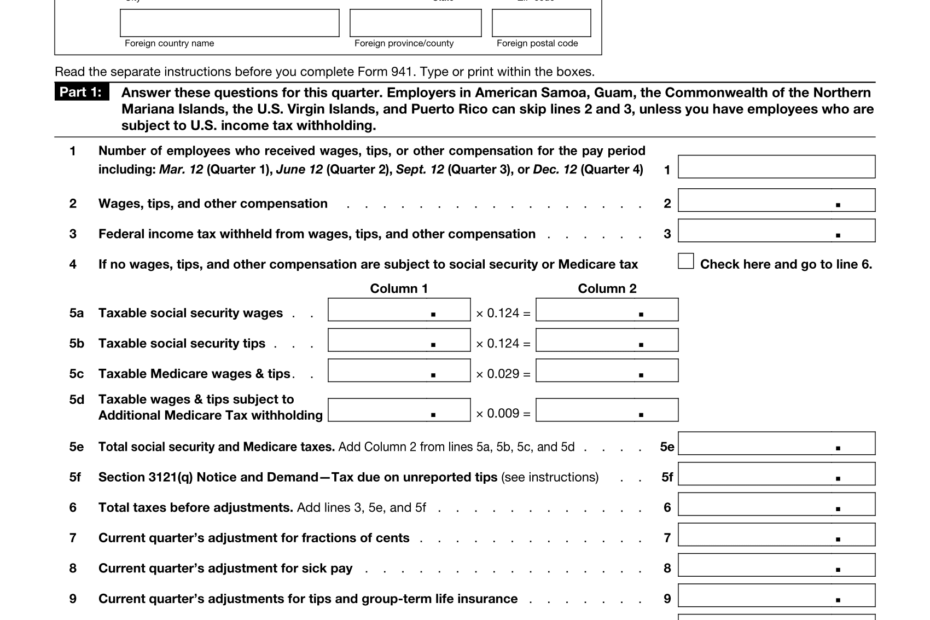

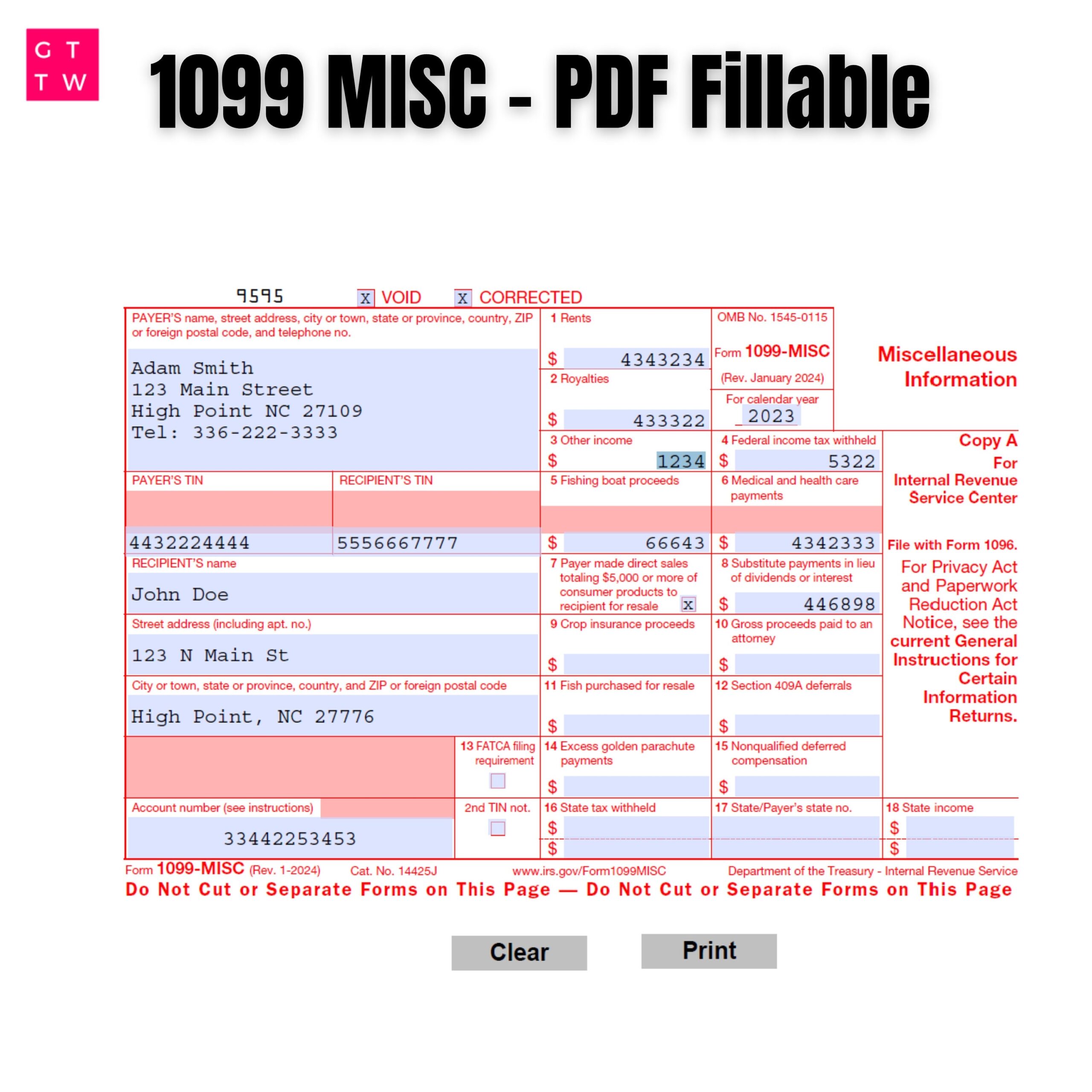

Some of the common IRS Tax Forms 2024 Printable PDF that individuals may need to file their taxes include Form 1040 for individual income tax returns, Form 1099 for reporting various types of income, and Form W-2 for reporting wages and salaries. Businesses may need to use forms such as Form 1120 for corporate tax returns and Form 941 for reporting payroll taxes.

By utilizing IRS Tax Forms 2024 Printable PDF, taxpayers can streamline the tax preparation process and ensure that they are meeting their obligations to the IRS. These forms provide a convenient and efficient way to report income and deductions accurately, helping individuals and businesses avoid potential penalties for incorrect or late filings.

In conclusion, IRS Tax Forms 2024 Printable PDF are essential tools for taxpayers to fulfill their tax obligations and accurately report their income, deductions, and credits. By accessing and using these forms, individuals and businesses can simplify the tax filing process and ensure compliance with IRS regulations. Make sure to download the necessary forms from the IRS website and consult with a tax professional if needed to ensure accurate and timely filing.