When it comes to filing your taxes, it’s important to be aware of all the forms and documents that may be required. One such form is the IRS Tax Form 8962, also known as the Premium Tax Credit form. This form is used to reconcile the amount of advance premium tax credit you received during the year with the amount you were actually eligible for based on your income.

Form 8962 is essential for individuals who have purchased health insurance through the Health Insurance Marketplace and have received advance premium tax credits to help lower the cost of their monthly premiums. It is important to fill out this form accurately to avoid any discrepancies in the amount of tax credit you are eligible for.

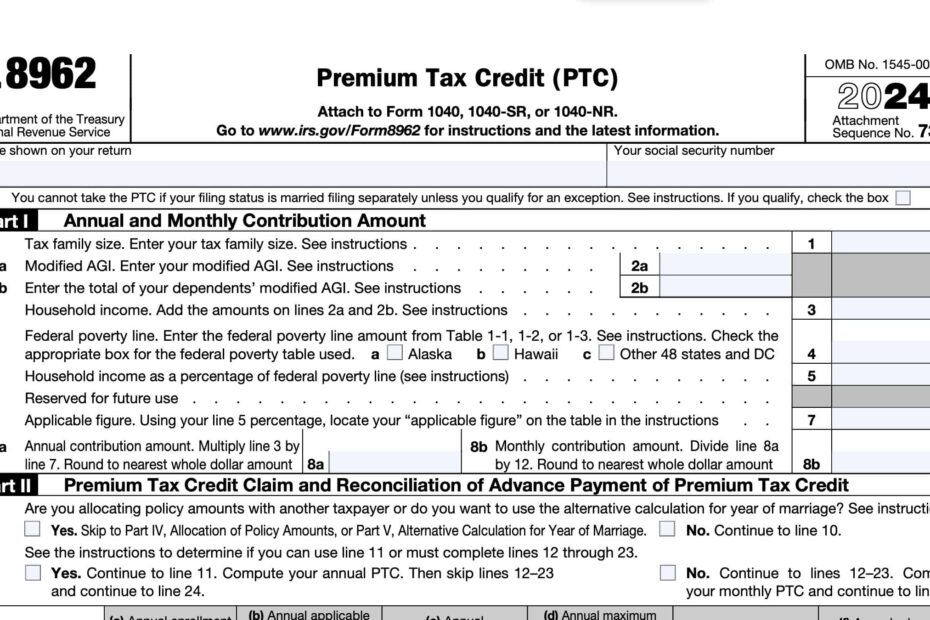

Download and Print Irs Tax Form 8962 Printable

Irs Federal Tax Form 8962 For Reporting The Premium Tax Credit

Irs Federal Tax Form 8962 For Reporting The Premium Tax Credit

IRS Tax Form 8962 Printable

IRS Tax Form 8962 is available for download on the IRS website in a printable format. This form can be easily accessed and filled out electronically or printed and filled out by hand. It is important to ensure that all information provided on the form is accurate and up to date to avoid any delays in processing your tax return.

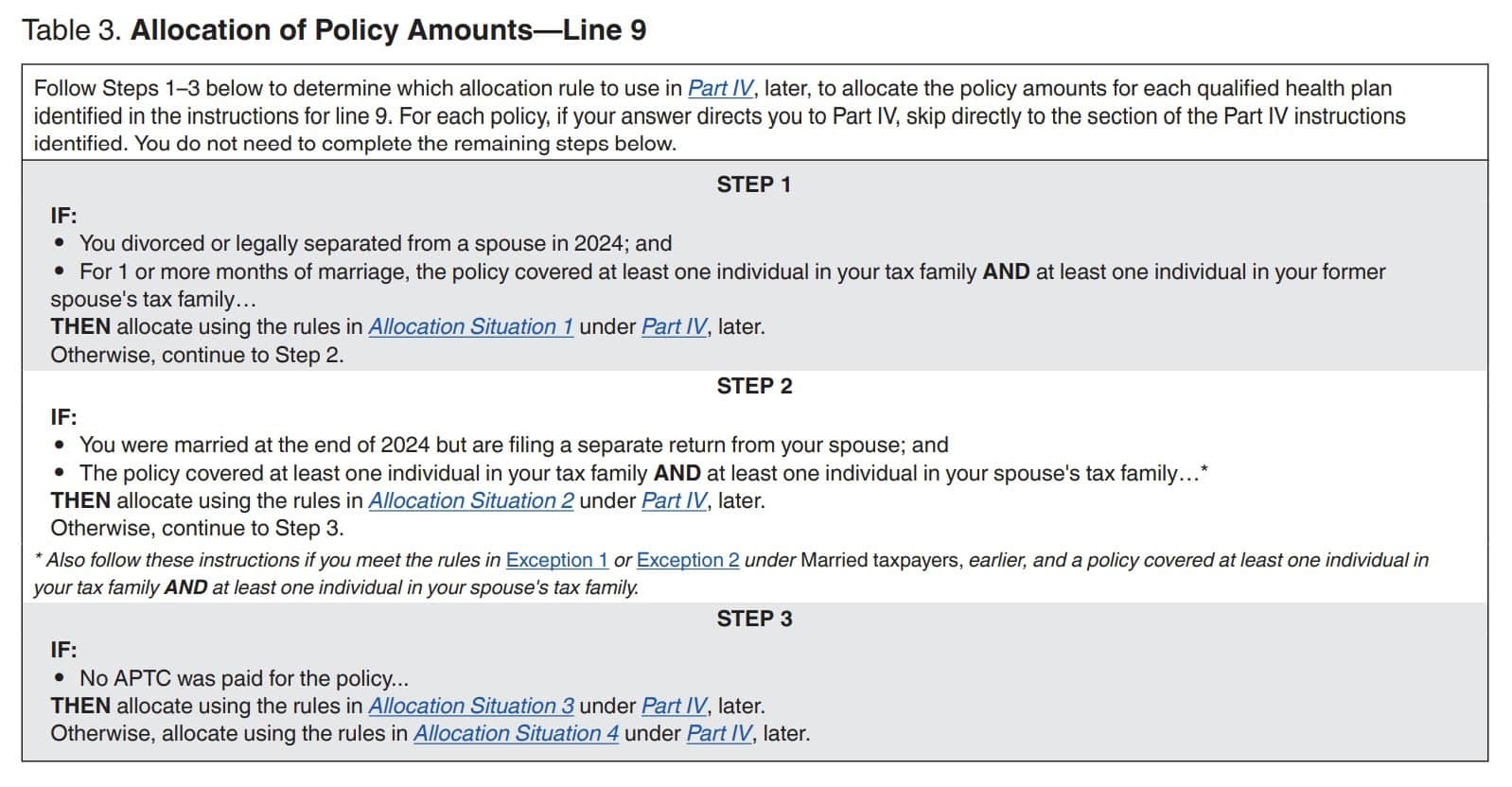

When filling out Form 8962, you will need to provide information about your household income, the amount of advance premium tax credits received, and any changes in your household size or income throughout the year. It is important to carefully review the instructions provided with the form to ensure that you are filling it out correctly.

Once you have completed Form 8962, you will need to include it with your tax return when filing with the IRS. It is important to keep a copy of the form for your records in case you need to refer back to it in the future. Failing to include Form 8962 with your tax return can result in delays in processing and potential penalties.

Overall, understanding IRS Tax Form 8962 is essential for individuals who have received advance premium tax credits through the Health Insurance Marketplace. By filling out this form accurately and submitting it with your tax return, you can ensure that you are receiving the correct amount of tax credit and avoid any potential issues with your tax return.