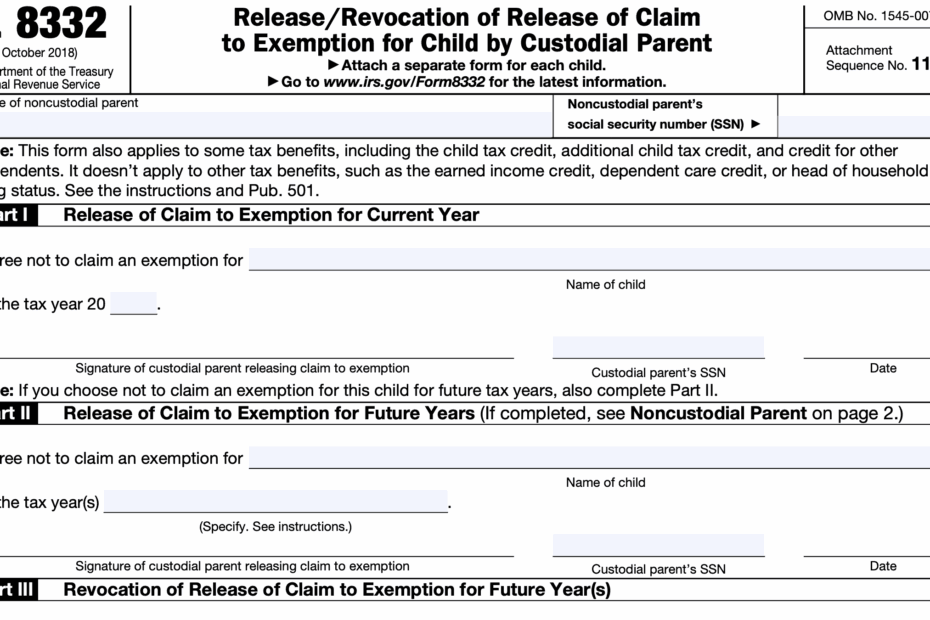

When it comes to claiming a child on your taxes, there are specific forms that need to be filled out in order to do so correctly. One important form is the IRS Tax Form 8332. This form allows a custodial parent to release their claim to a child so that the non-custodial parent can claim them on their taxes.

It is important to note that this form must be filled out and signed by the custodial parent in order for the non-custodial parent to claim the child on their taxes. Without this form, the non-custodial parent will not be able to claim the child as a dependent.

Download and Print Irs Tax Form 8332 Printable

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

IRS Tax Form 8332 is available for download and printing on the IRS website. This form is essential for parents who are co-parenting and need to determine who can claim the child as a dependent for tax purposes. It is important to follow the instructions carefully and ensure that all information is filled out accurately.

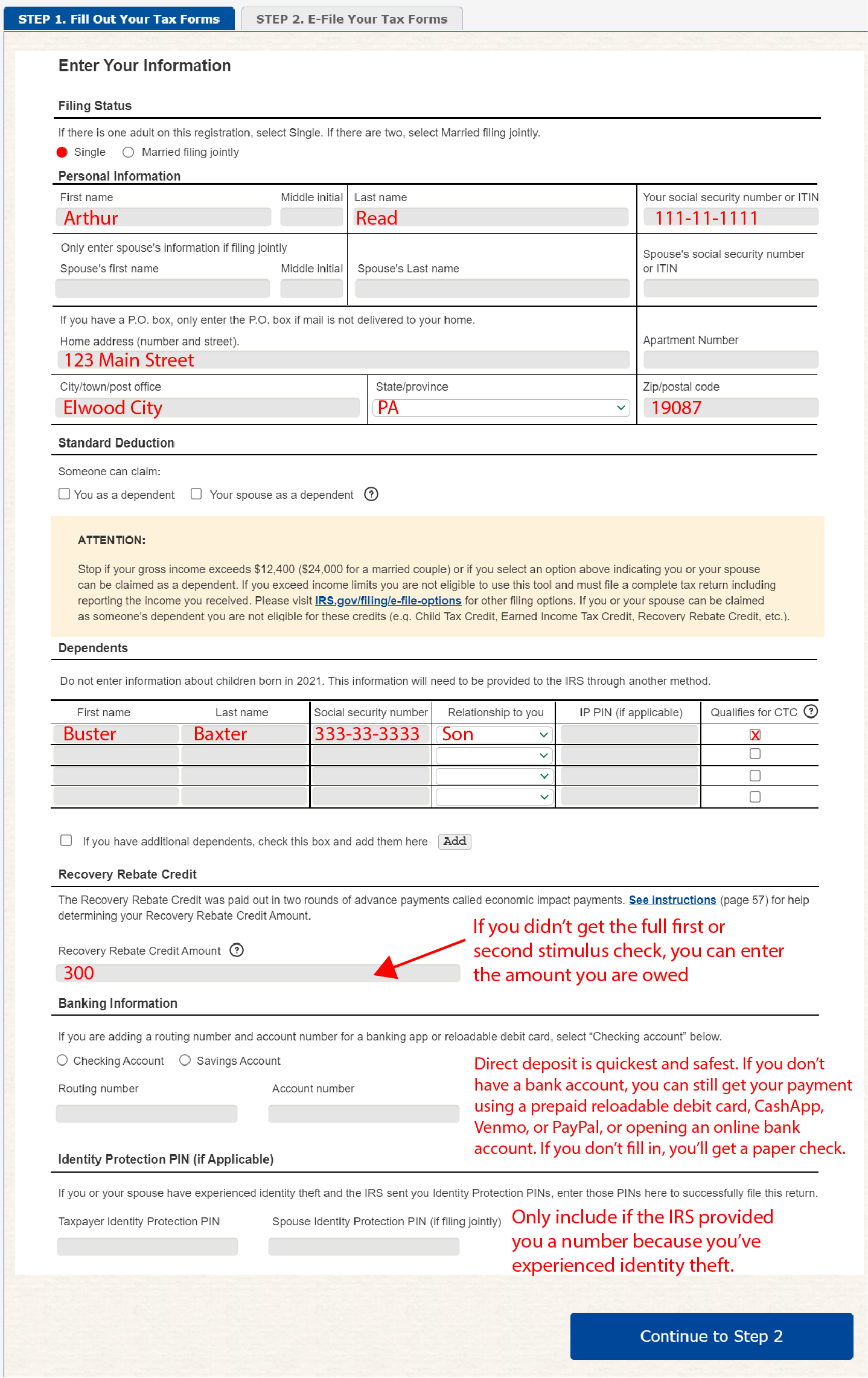

When filling out IRS Tax Form 8332, you will need to provide details about the child in question, as well as information about both the custodial and non-custodial parent. Make sure to double-check all information before submitting the form to avoid any delays or issues with your tax return.

Once the form is filled out and signed by the custodial parent, it should be submitted along with the non-custodial parent’s tax return. This will ensure that the non-custodial parent is able to claim the child as a dependent and receive any tax benefits associated with doing so. It is important to keep a copy of the form for your records.

Overall, IRS Tax Form 8332 is a crucial document for parents who are sharing custody of a child and need to determine who can claim them on their taxes. By following the instructions and filling out the form accurately, you can ensure that both parents are able to receive the tax benefits they are entitled to.