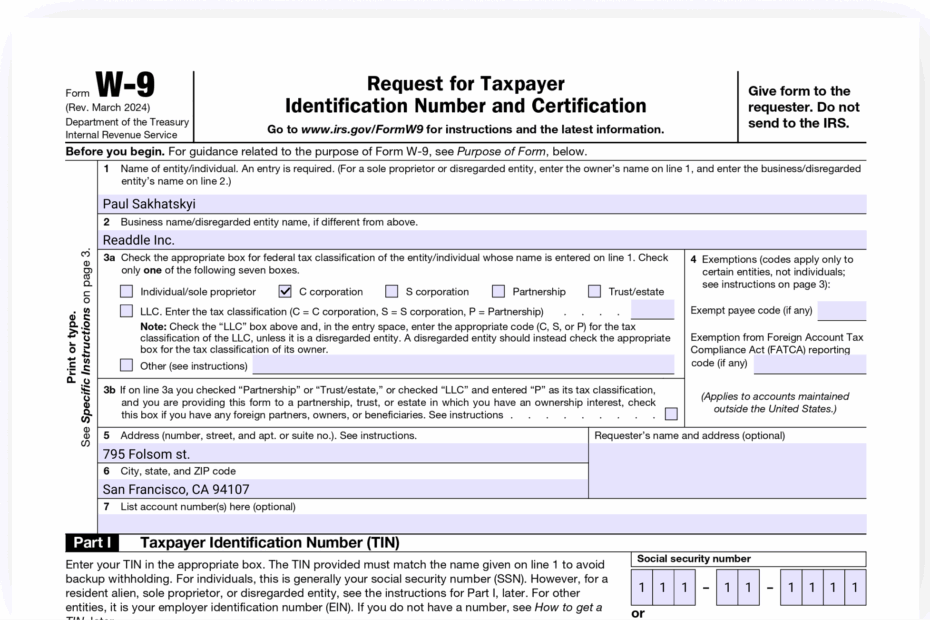

When it comes to tax forms, the W-9 is one of the most common ones you’ll come across. The W-9 form is used by businesses to request information from vendors they work with. It includes details such as the vendor’s name, address, and taxpayer identification number. The IRS has recently released the updated version of the W-9 form for the year 2025, and it’s important for both businesses and vendors to be aware of the changes.

Whether you’re a freelancer, independent contractor, or business owner, you may be required to fill out a W-9 form at some point. The form is used to collect information for tax purposes, such as reporting payments made to vendors. It’s important to ensure that the information provided on the form is accurate to avoid any issues with the IRS down the line.

Easily Download and Print Irs Printable W-9 Form 2025

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

Irs Printable W-9 Form 2025

The IRS Printable W-9 Form 2025 is now available on the IRS website for download. The updated form includes minor changes to the layout and instructions, but the core information required remains the same. It’s crucial to use the most recent version of the form to ensure compliance with IRS regulations.

When filling out the W-9 form, vendors should pay close attention to the instructions provided. It’s essential to provide accurate information, including your legal name, business name (if applicable), address, and taxpayer identification number. Failure to provide correct information could result in penalties from the IRS.

Businesses should also be diligent in collecting W-9 forms from their vendors. By ensuring that all necessary information is collected and reported accurately, businesses can avoid potential issues with the IRS during tax season. It’s a good practice to request a W-9 form from new vendors before any payments are made to establish the necessary records.

In conclusion, the IRS Printable W-9 Form 2025 is an essential document for businesses and vendors to ensure compliance with tax regulations. By accurately completing and collecting W-9 forms, both parties can avoid potential penalties and ensure smooth operations. Make sure to download the latest version of the form from the IRS website and follow the instructions carefully when filling it out.