As we approach the tax season for the year 2025, it is important to be prepared with all the necessary forms and documents to file your taxes accurately and on time. The Internal Revenue Service (IRS) provides printable tax forms that can be easily accessed and filled out at your convenience.

Whether you are an individual taxpayer or a business owner, having the right forms on hand is essential for a smooth tax filing process. The IRS offers a variety of printable forms for different types of income, deductions, and credits, making it easier for taxpayers to report their financial information accurately.

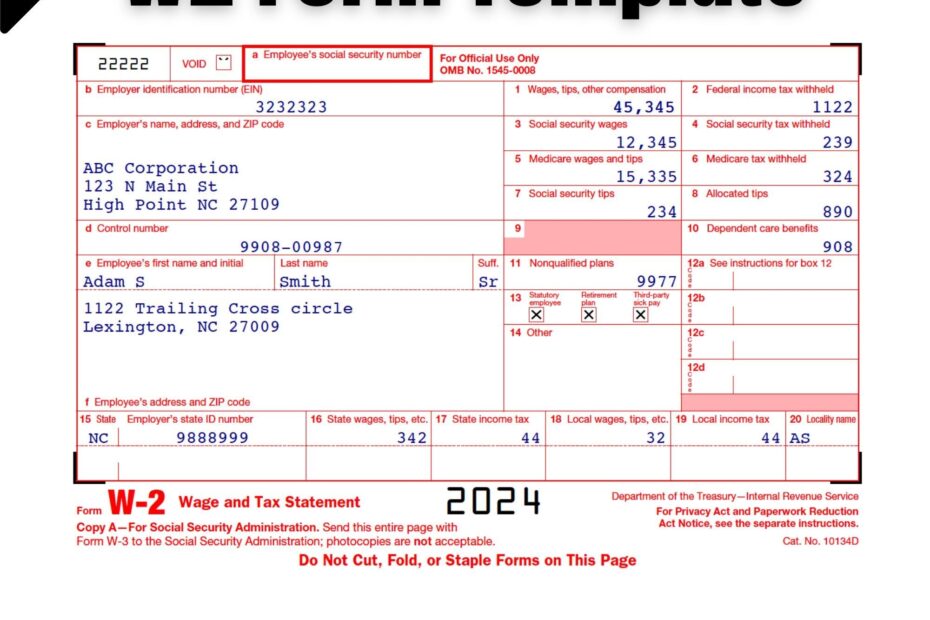

Save and Print Irs Printable Tax Forms 2025

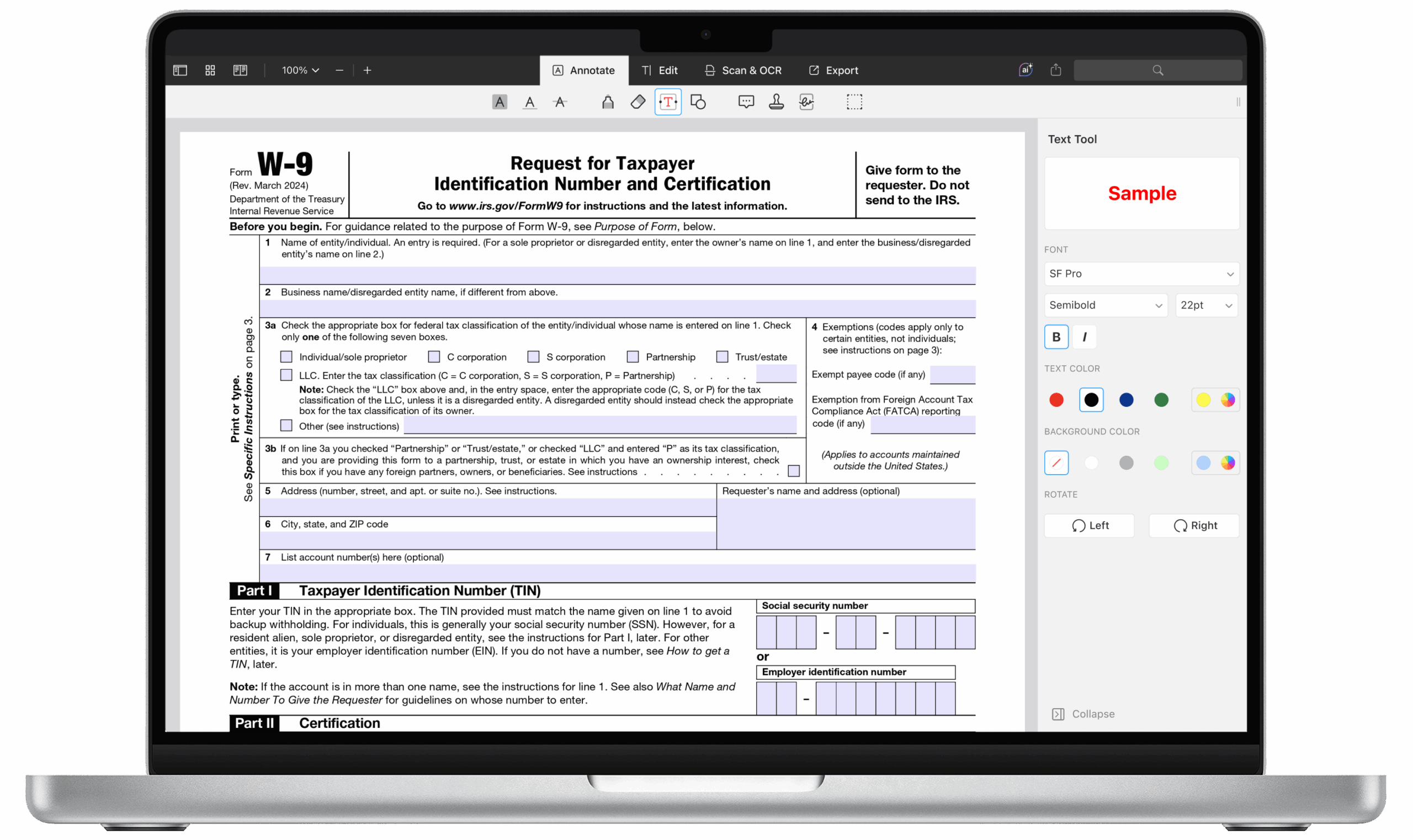

W9 Tax Form 2025 Printable Printable W9 Form 2025

W9 Tax Form 2025 Printable Printable W9 Form 2025

Irs Printable Tax Forms 2025

One of the most commonly used forms for individual taxpayers is the Form 1040, which is used to report your annual income and calculate your tax liability. In addition to the Form 1040, there are also schedules and worksheets that may need to be filled out depending on your specific tax situation.

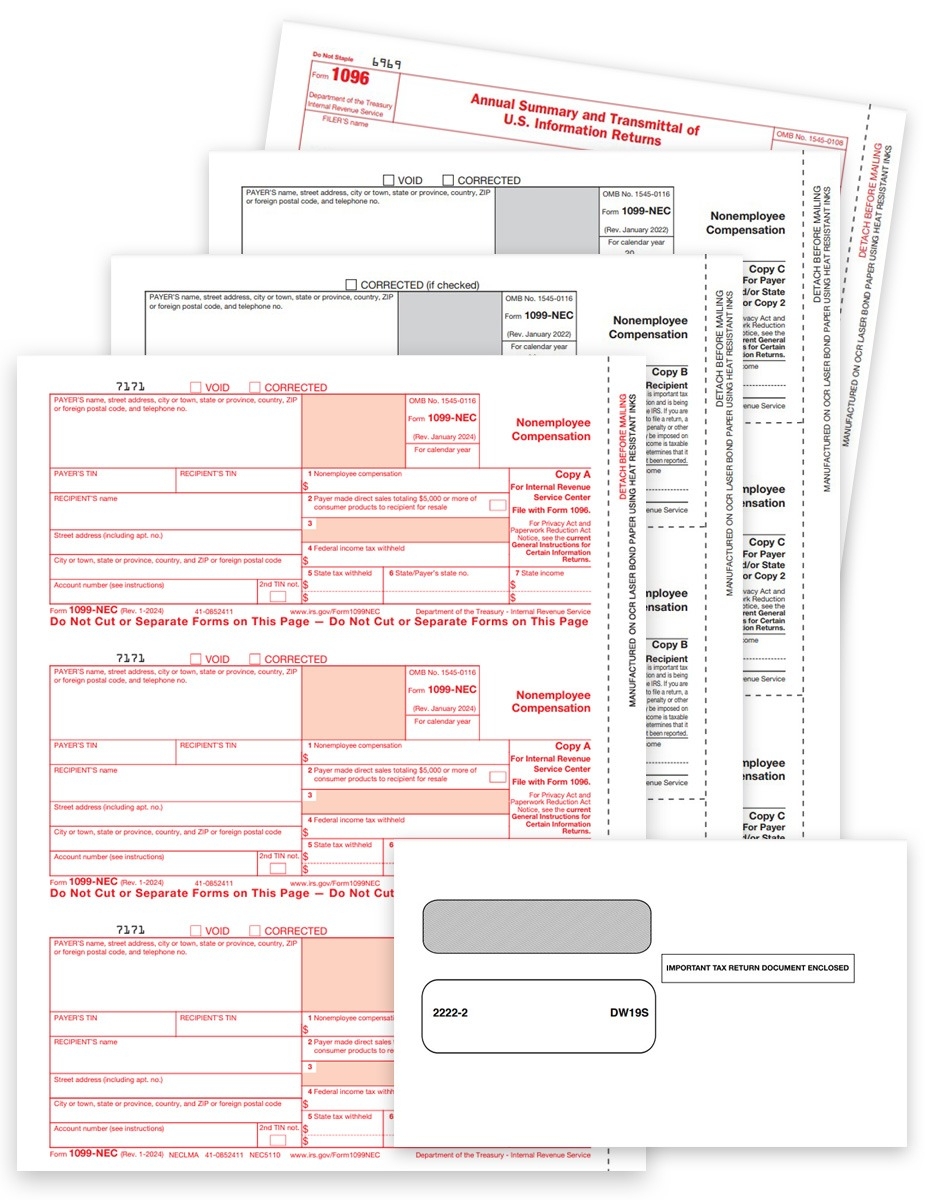

For business owners, the IRS provides printable forms such as the Form 1120 for corporations, Form 1065 for partnerships, and Form 1040-Schedule C for sole proprietors. These forms are essential for reporting business income, expenses, and deductions to determine the correct amount of tax owed.

It is important to note that the IRS updates its forms and instructions each year to reflect changes in tax laws and regulations. Therefore, it is crucial to use the most current versions of the forms when filing your taxes for the year 2025. The IRS website offers a comprehensive list of printable forms and instructions that can be easily downloaded and printed for your convenience.

By staying organized and having the right forms on hand, you can ensure a smooth and efficient tax filing process for the year 2025. Remember to review the instructions carefully and seek assistance from a tax professional if needed to avoid any errors or delays in processing your tax return.

Overall, the IRS printable tax forms for 2025 are a valuable resource for taxpayers to accurately report their financial information and comply with tax laws. By utilizing these forms and following the guidelines provided, you can fulfill your tax obligations effectively and avoid any potential penalties or audits from the IRS.