As tax season approaches, many people are gearing up to file their taxes. IRS printable tax forms for 2016 are essential for those who prefer to file their taxes manually. These forms can be easily accessed online and printed out for convenience. Whether you’re self-employed, a small business owner, or an individual taxpayer, having the right forms is crucial for accurate tax filing.

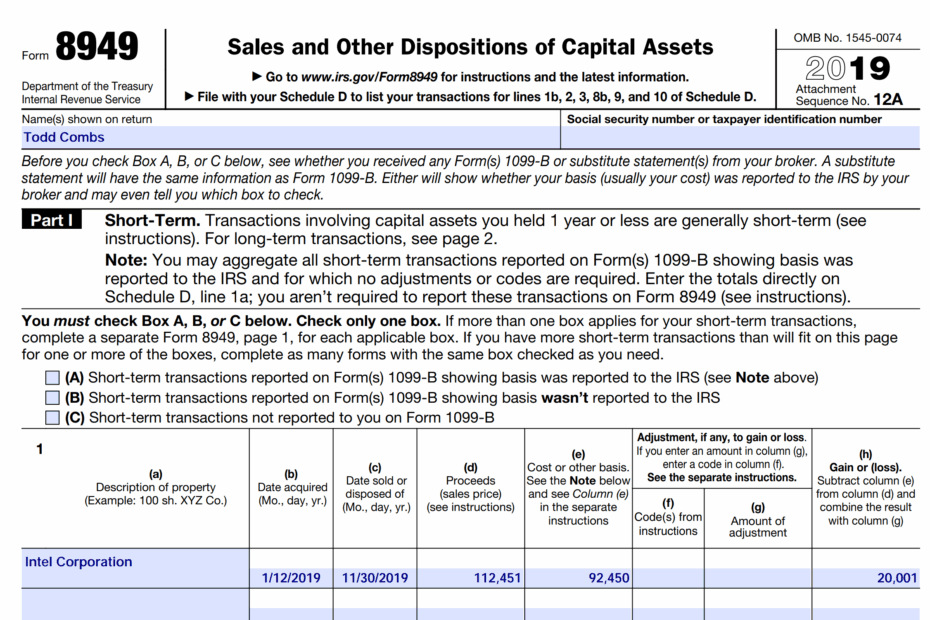

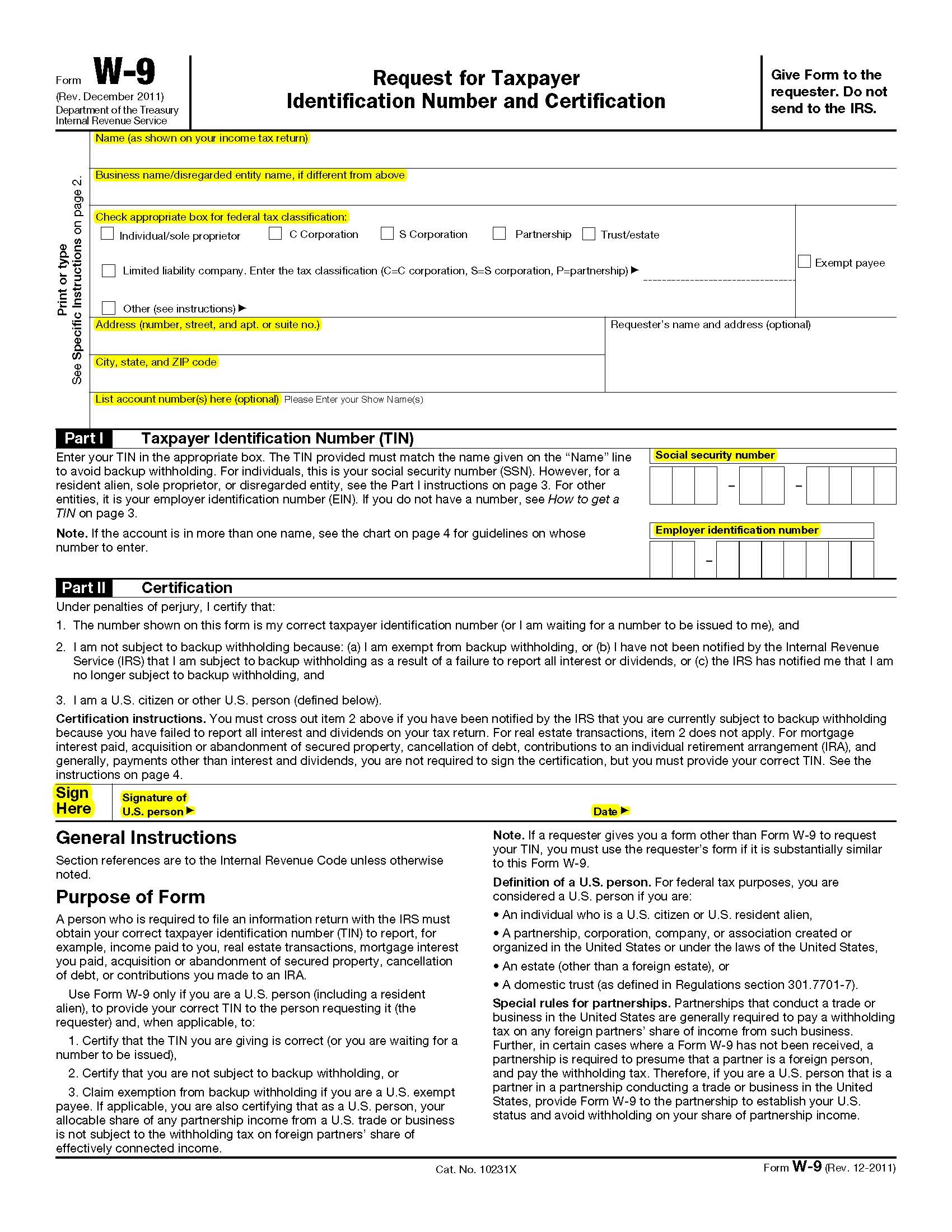

IRS printable tax forms for 2016 include various forms such as Form 1040, Form 1040A, and Form 1040EZ. These forms cater to different types of taxpayers based on their income level and filing status. Additionally, there are schedules and worksheets that may need to be filled out depending on your specific tax situation.

Save and Print Irs Printable Tax Forms 2016

Form 1040 is the standard form used by most taxpayers to report their income, deductions, and credits. Form 1040A is a shorter version of Form 1040 and is typically used by individuals with less complex tax situations. Form 1040EZ is the simplest form and is designed for taxpayers with no dependents and no itemized deductions.

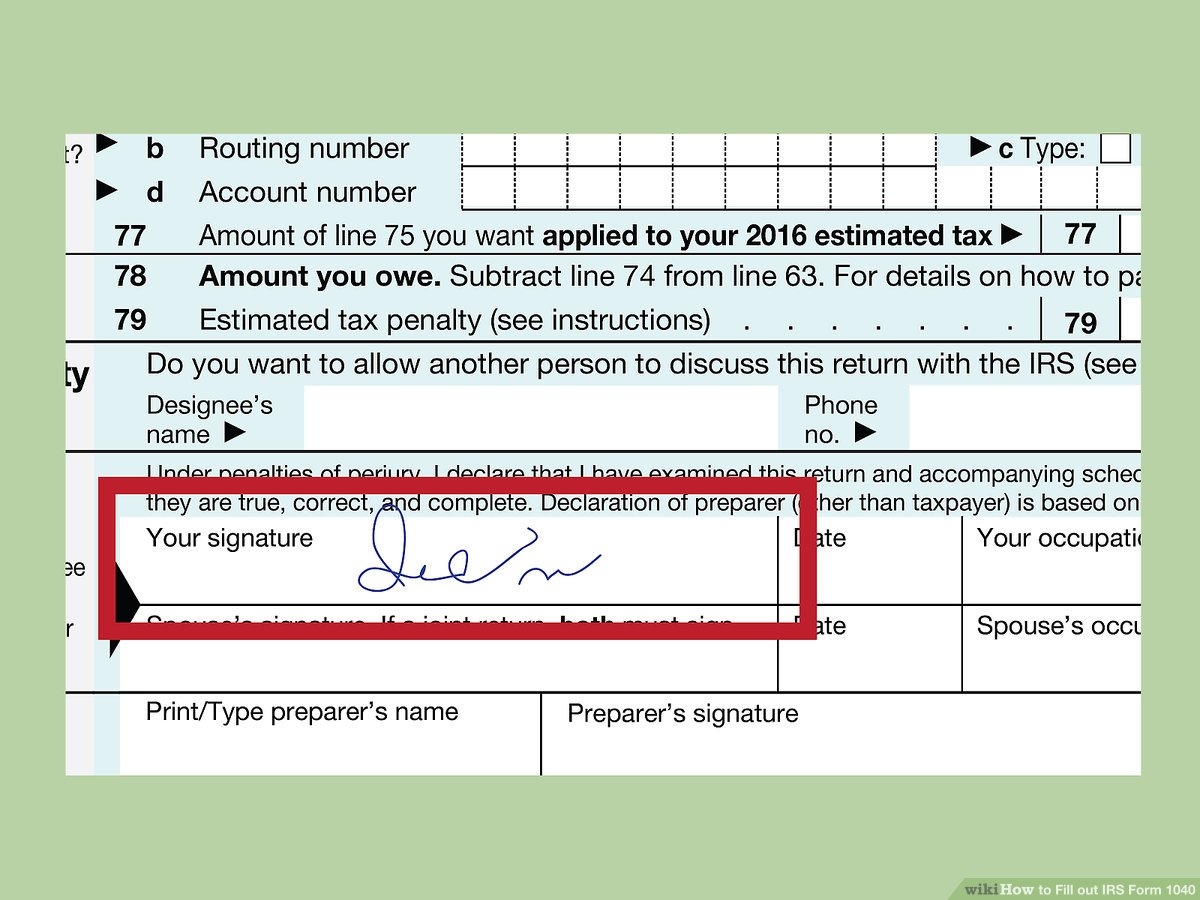

When using IRS printable tax forms for 2016, it’s important to carefully read the instructions provided with each form to ensure accurate completion. Failing to fill out the forms correctly can result in processing delays and potential errors on your tax return. It’s also essential to double-check your information before submitting your forms to the IRS to avoid any discrepancies.

For those who prefer to file their taxes electronically, the IRS offers e-file options that can streamline the tax filing process. However, if you prefer to file a paper return, having access to IRS printable tax forms for 2016 is key. These forms can be downloaded from the IRS website or picked up at local libraries and post offices.

In conclusion, IRS printable tax forms for 2016 are a valuable resource for taxpayers who prefer to file their taxes manually. Whether you’re a seasoned taxpayer or a first-time filer, having the right forms at your disposal can make the tax filing process much smoother. By utilizing these forms and following the instructions provided, you can ensure a successful and accurate tax filing experience.