When tax season rolls around, one of the most important tasks for individuals and businesses alike is filing their taxes. The Internal Revenue Service (IRS) provides a variety of forms to help taxpayers report their income, deductions, and credits accurately. While many people choose to file their taxes electronically, some still prefer to fill out and mail in paper forms. For those who prefer the traditional route, IRS printable tax forms are essential.

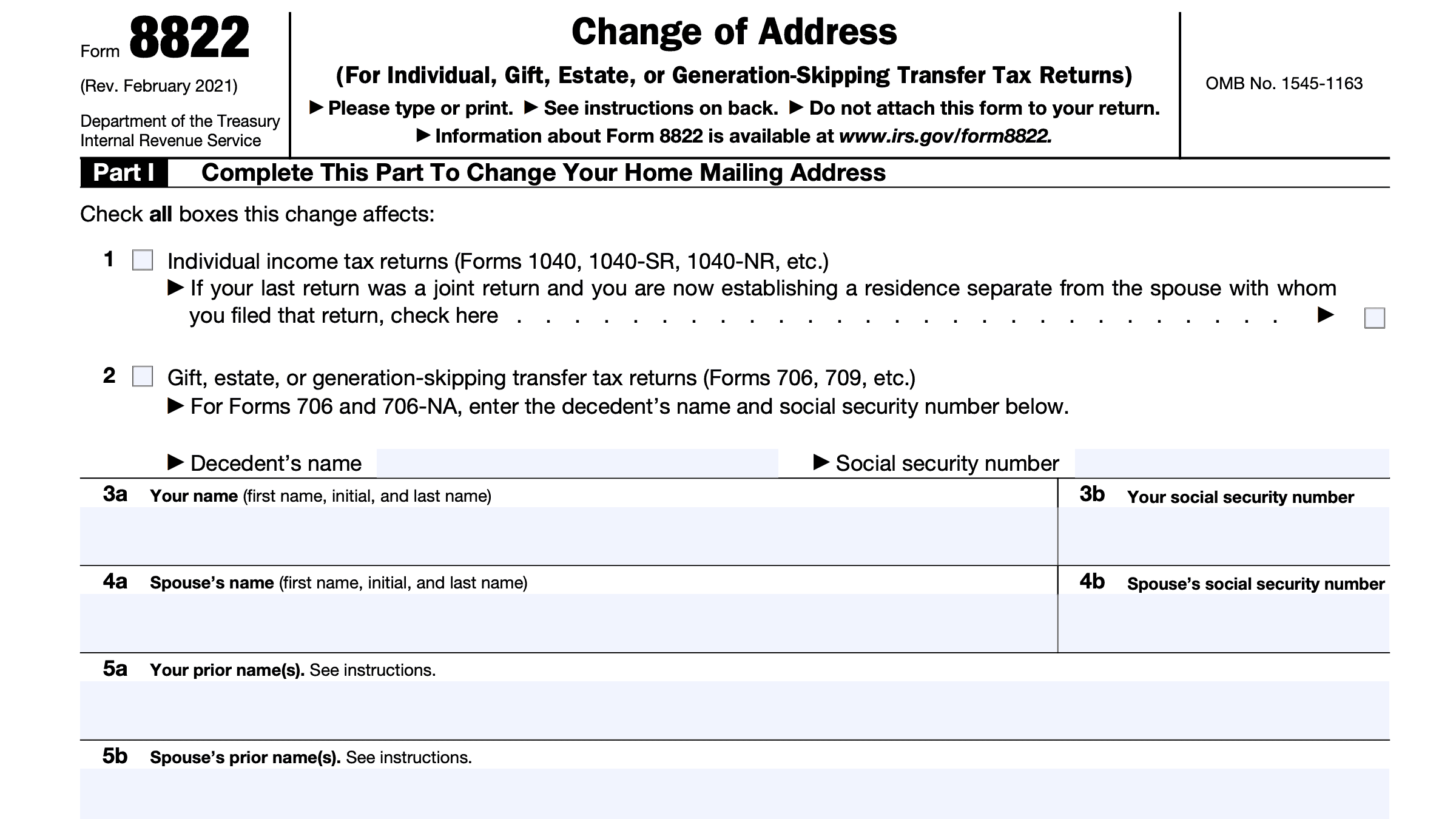

IRS printable tax forms are easily accessible on the IRS website, making it convenient for taxpayers to download and print the forms they need. Whether you need to file a simple individual tax return or a more complex business tax return, there are printable forms available for every situation. These forms are updated annually to reflect any changes in tax laws, so it’s important to use the most recent version when filing your taxes.

Quickly Access and Print Irs Printable Tax Forms

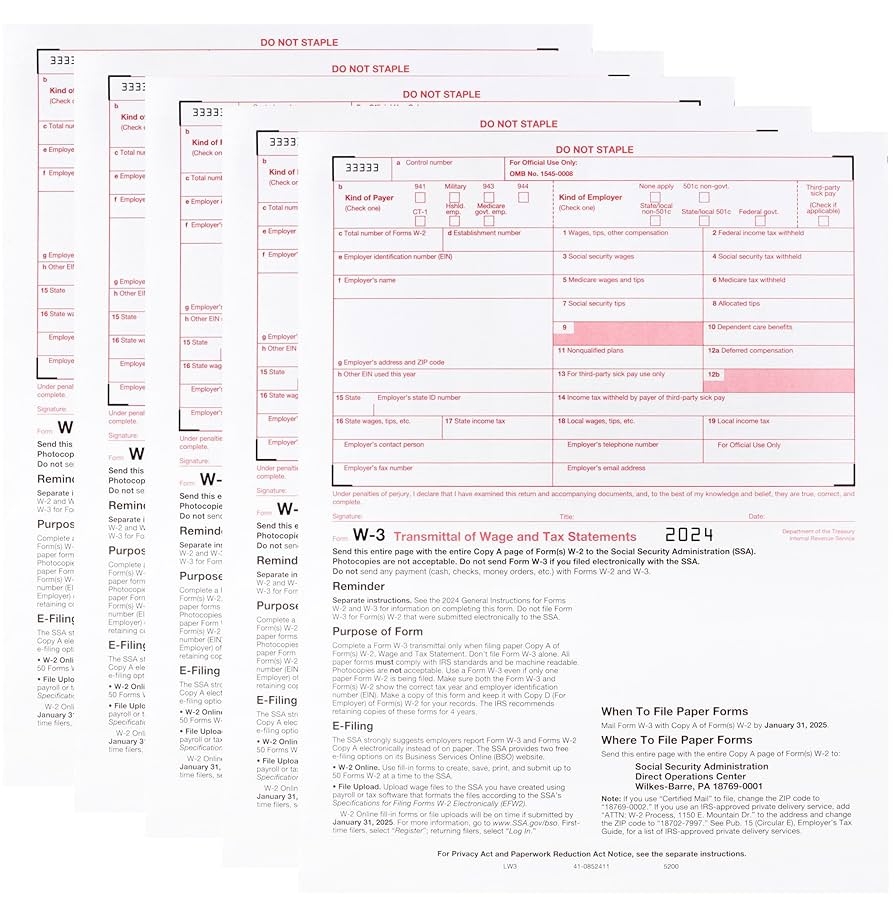

Free Printable 2024 W 3 Transmittal Forms Pack Of 10 IRS Approved Laser Forms For W 2 Submission Irs Forms 2024

Free Printable 2024 W 3 Transmittal Forms Pack Of 10 IRS Approved Laser Forms For W 2 Submission Irs Forms 2024

IRS Printable Tax Forms

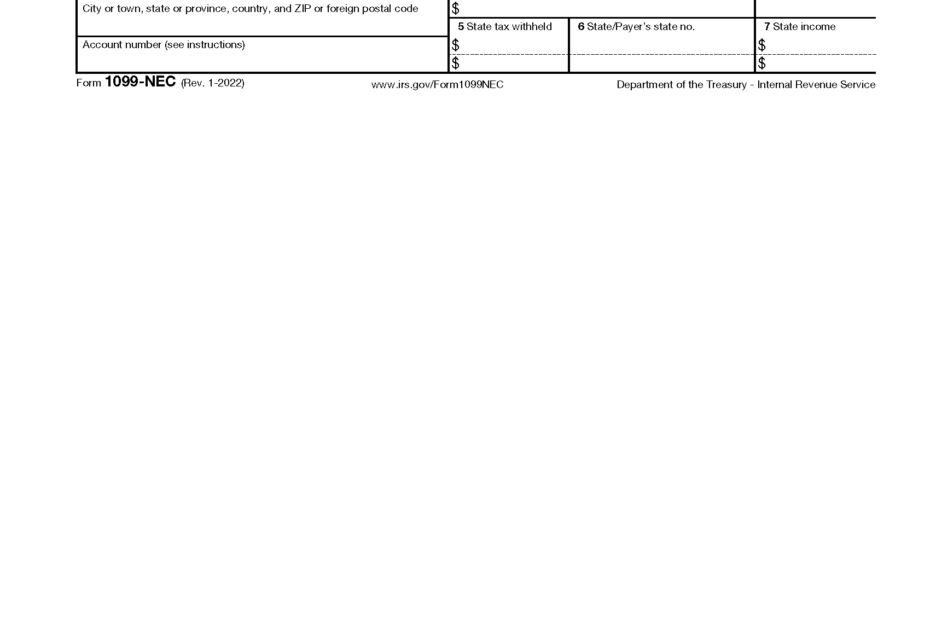

One of the most commonly used IRS printable tax forms is Form 1040, which is used by individuals to report their income, deductions, and credits. This form is available in several variations, depending on the taxpayer’s filing status and income level. Other popular forms include Form 1099 for reporting miscellaneous income, Form W-2 for reporting wages and salaries, and Form 941 for reporting employment taxes.

When filling out IRS printable tax forms, it’s important to double-check all information to ensure accuracy. Any errors or omissions could result in delays in processing your return or even penalties from the IRS. If you’re unsure about how to fill out a particular form, the IRS website provides instructions and resources to help you navigate the process.

Once you’ve completed your IRS printable tax forms, you can either mail them to the IRS or submit them electronically through an authorized e-file provider. Mailing in paper forms can take longer to process, so electronic filing is often the faster option. Whichever method you choose, be sure to keep a copy of your tax return for your records.

In conclusion, IRS printable tax forms are a valuable resource for taxpayers who prefer to file their taxes on paper. By using the correct forms and following the instructions carefully, you can ensure that your tax return is accurate and compliant with IRS regulations. Whether you’re an individual taxpayer or a business owner, these forms are essential for meeting your tax obligations each year.