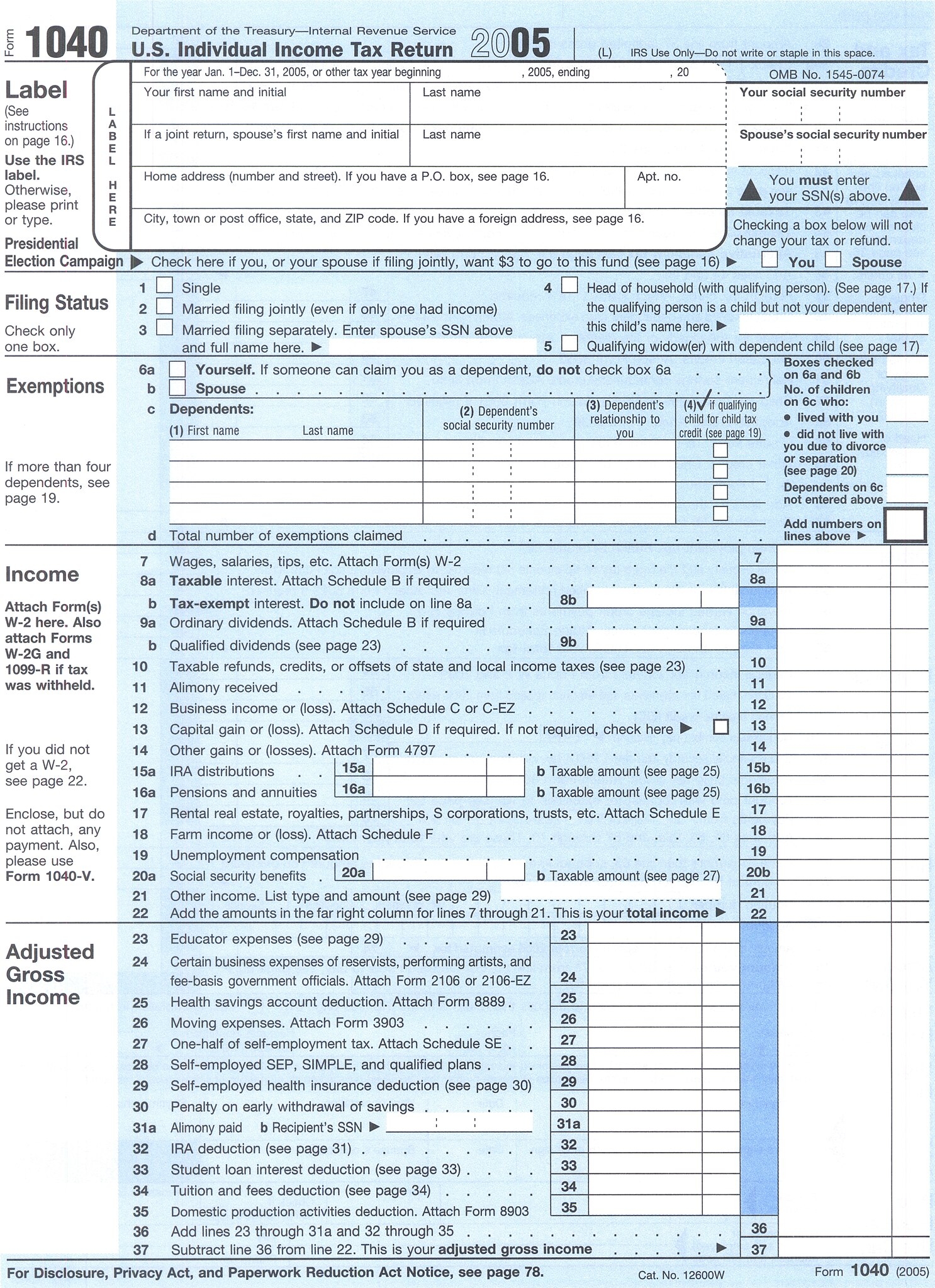

As tax season approaches, many Americans are gearing up to file their tax returns and ensure they are in compliance with the IRS. One of the most commonly used forms for individuals is the IRS Form 1040a, which is a simplified version of the more comprehensive Form 1040. This form is designed for taxpayers who have relatively simple tax situations and do not need to itemize deductions.

Form 1040a is a two-page form that allows taxpayers to report their income, claim certain deductions and credits, and calculate their tax liability. It is a straightforward form that is easy to understand and complete, making it a popular choice for many individuals.

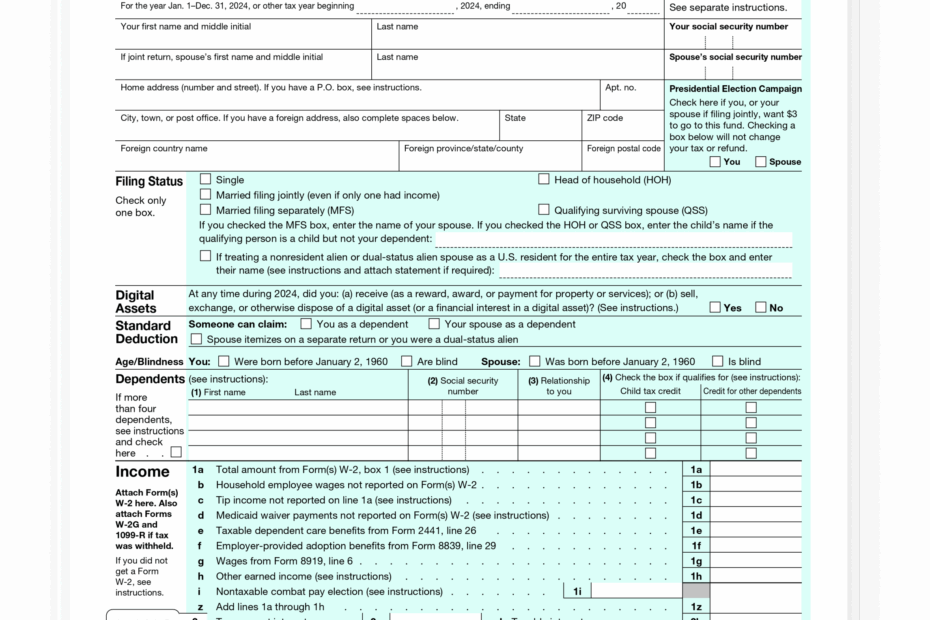

Get and Print Irs Printable Tax Form 1040a

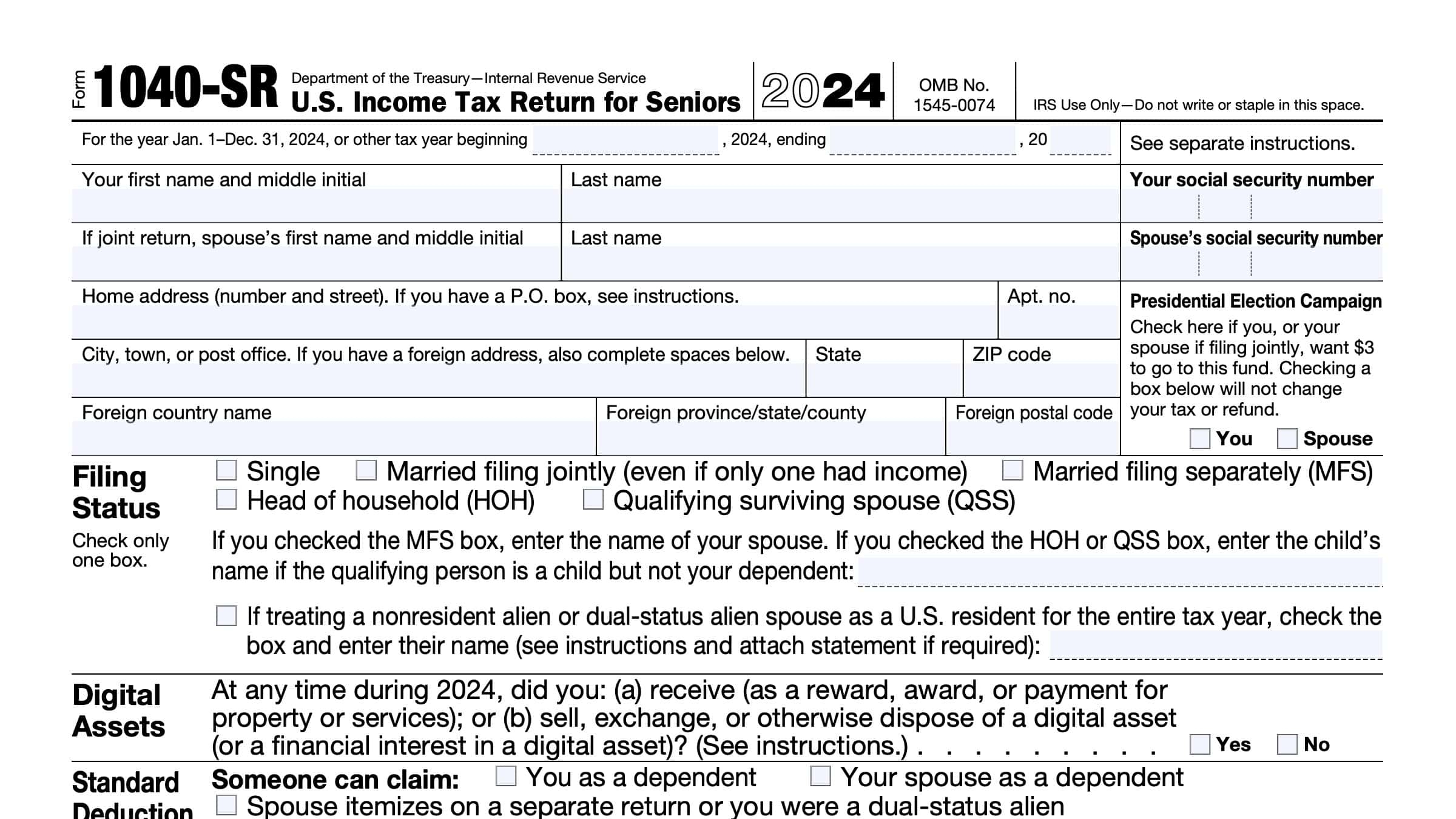

IRS Form 1040 SR Instructions Tax Return For Seniors

IRS Form 1040 SR Instructions Tax Return For Seniors

When filling out Form 1040a, taxpayers will need to provide information about their income, such as wages, salaries, tips, and interest. They will also need to report any deductions they are eligible for, such as the standard deduction, and any tax credits they may qualify for, such as the Earned Income Tax Credit.

Once all the necessary information has been entered on Form 1040a, taxpayers can calculate their total tax liability and determine whether they owe additional taxes or are entitled to a refund. If a refund is due, taxpayers can choose to have it deposited directly into their bank account or receive a paper check in the mail.

It is important for taxpayers to carefully review their completed Form 1040a before submitting it to the IRS to ensure that all information is accurate and complete. Any errors or omissions could result in delays in processing or even penalties from the IRS. By taking the time to double-check their form, taxpayers can avoid potential issues and ensure a smooth tax filing process.

In conclusion, IRS Form 1040a is a simple and straightforward tax form that is ideal for individuals with uncomplicated tax situations. By providing all the necessary information and carefully reviewing the form before submission, taxpayers can accurately report their income, claim deductions and credits, and calculate their tax liability. With the help of Form 1040a, taxpayers can navigate the tax filing process with ease and ensure they are in compliance with the IRS.