The Internal Revenue Service (IRS) provides taxpayers with a variety of forms to help them report their income, claim deductions, and fulfill their tax obligations. These forms are essential for individuals and businesses to accurately file their taxes and avoid penalties. In 2024, the IRS will continue to offer printable forms that can be easily accessed online or at local IRS offices.

Whether you are a small business owner, a freelancer, or a salaried employee, you will likely need to use IRS forms to file your taxes. These forms cover a wide range of tax-related activities, including reporting income, claiming deductions, and calculating tax liabilities. By using the correct forms and filling them out accurately, you can ensure that your taxes are filed correctly and on time.

Save and Print Irs Printable Forms 2024

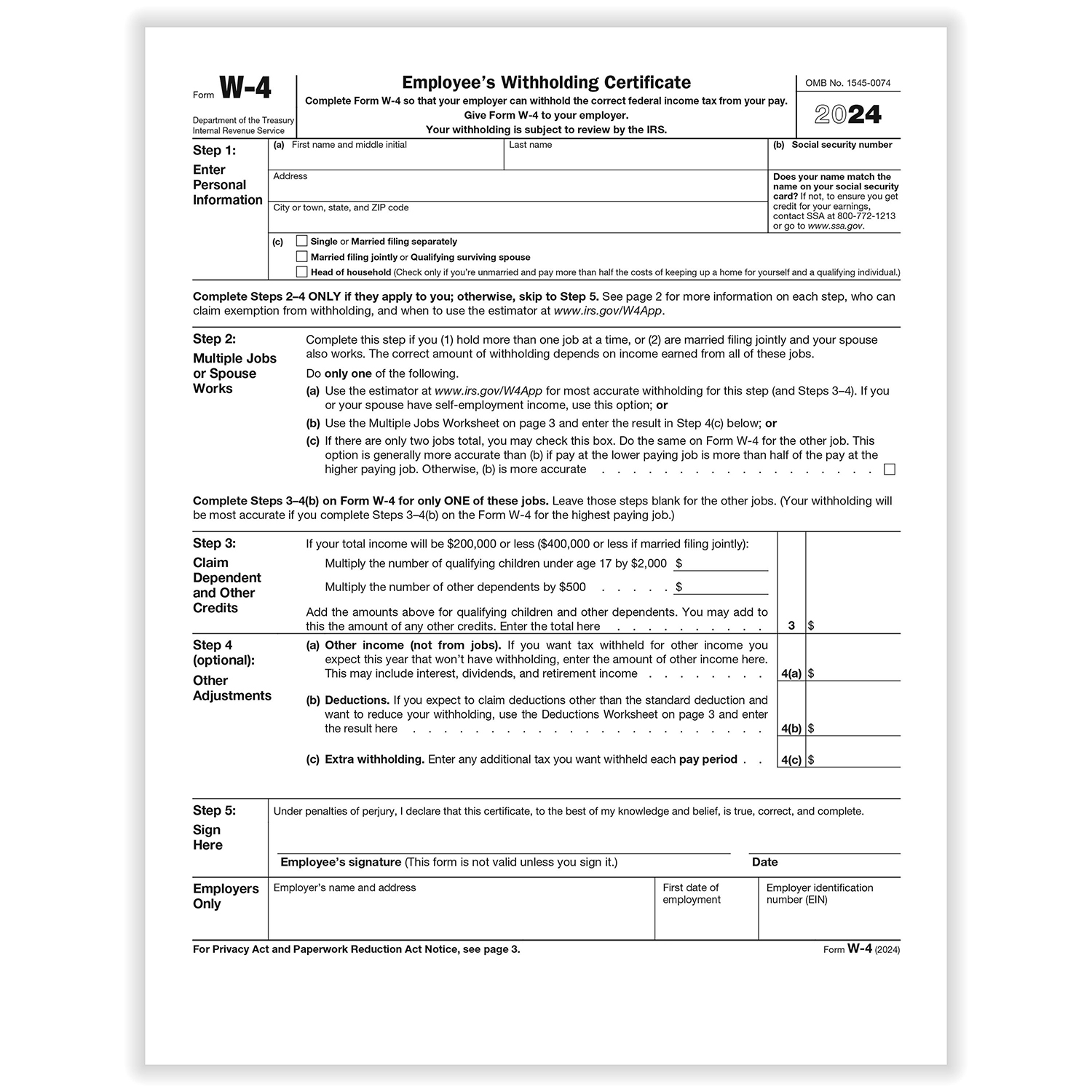

2024 IRS W 4 Form HRdirect Worksheets Library

2024 IRS W 4 Form HRdirect Worksheets Library

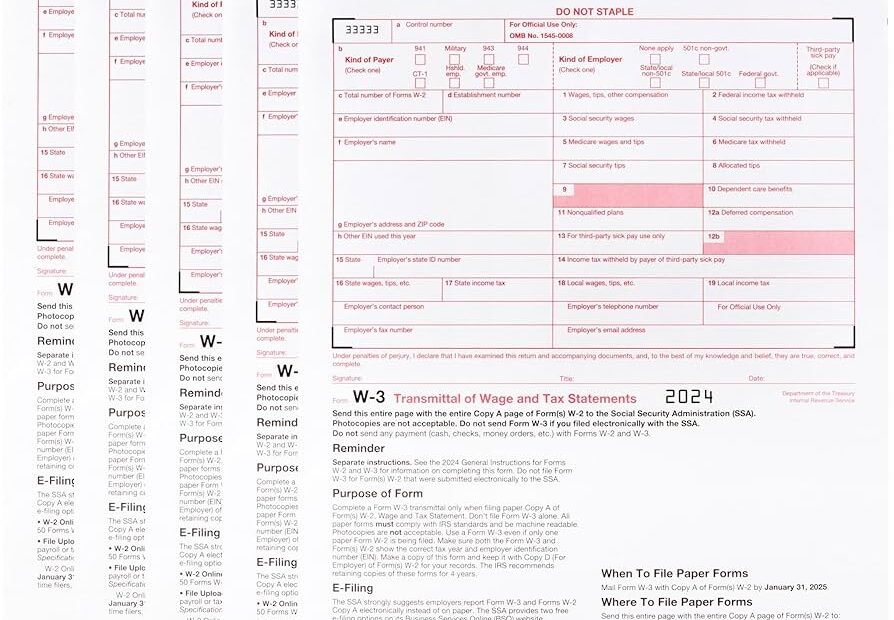

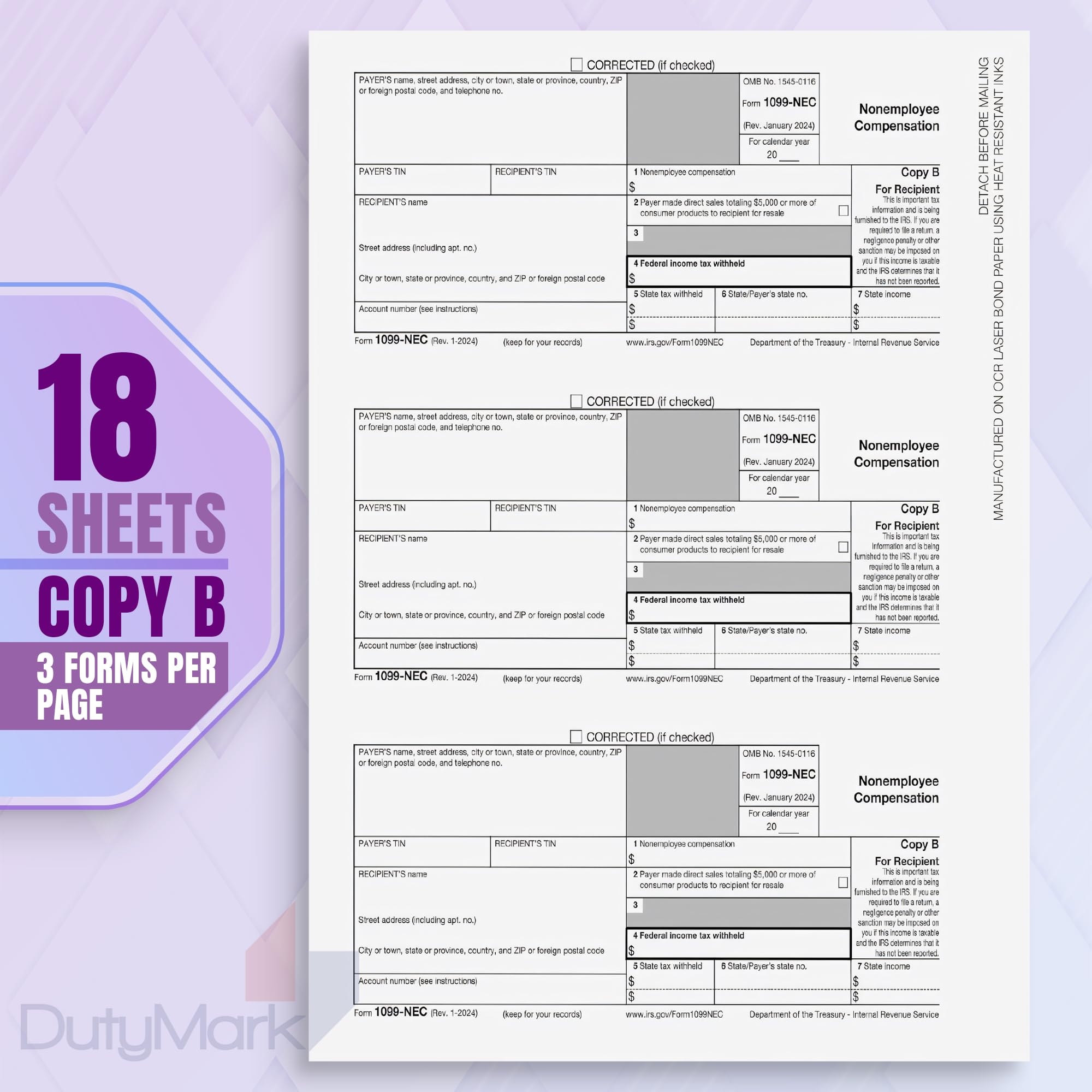

Some of the most commonly used IRS forms include the 1040 series for individual income tax returns, the 1099 series for reporting various types of income, and the W-2 form for reporting wages and salaries. In addition, there are specific forms for claiming deductions, credits, and exemptions, as well as forms for reporting investment income, self-employment income, and foreign income.

When it comes to IRS printable forms for 2024, taxpayers can expect to find updated versions of existing forms as well as new forms that reflect changes in tax laws and regulations. It is important to download the most recent versions of IRS forms from the official IRS website to ensure that you are using the correct forms and complying with current tax laws.

In conclusion, IRS printable forms for 2024 play a crucial role in helping taxpayers fulfill their tax obligations and avoid costly mistakes. By using the correct forms and filling them out accurately, you can ensure that your taxes are filed correctly and on time. Make sure to stay informed about any updates to IRS forms and regulations to ensure compliance with current tax laws.