When it comes to filing your taxes, having the right forms is essential. One of the most commonly used forms is the IRS Printable Forms 1040ez. This form is designed for taxpayers with simple tax situations and allows them to easily report their income, claim deductions, and calculate their tax liability.

IRS Printable Forms 1040ez is a simplified version of the standard Form 1040 and is perfect for those who have no dependents, do not itemize deductions, and have a taxable income of less than $100,000. It is a straightforward form that makes the tax filing process quick and easy for eligible taxpayers.

Get and Print Irs Printable Forms 1040ez

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

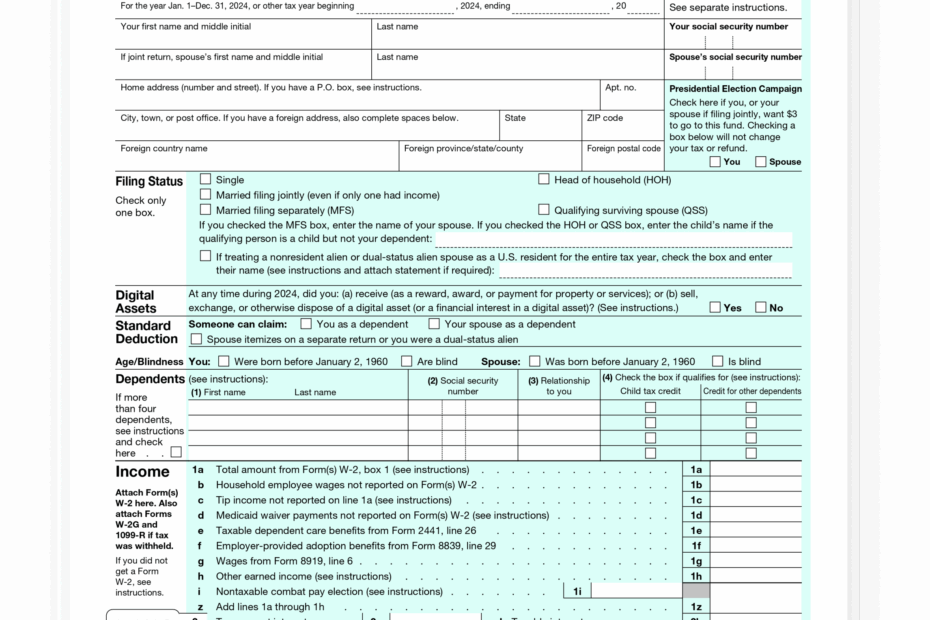

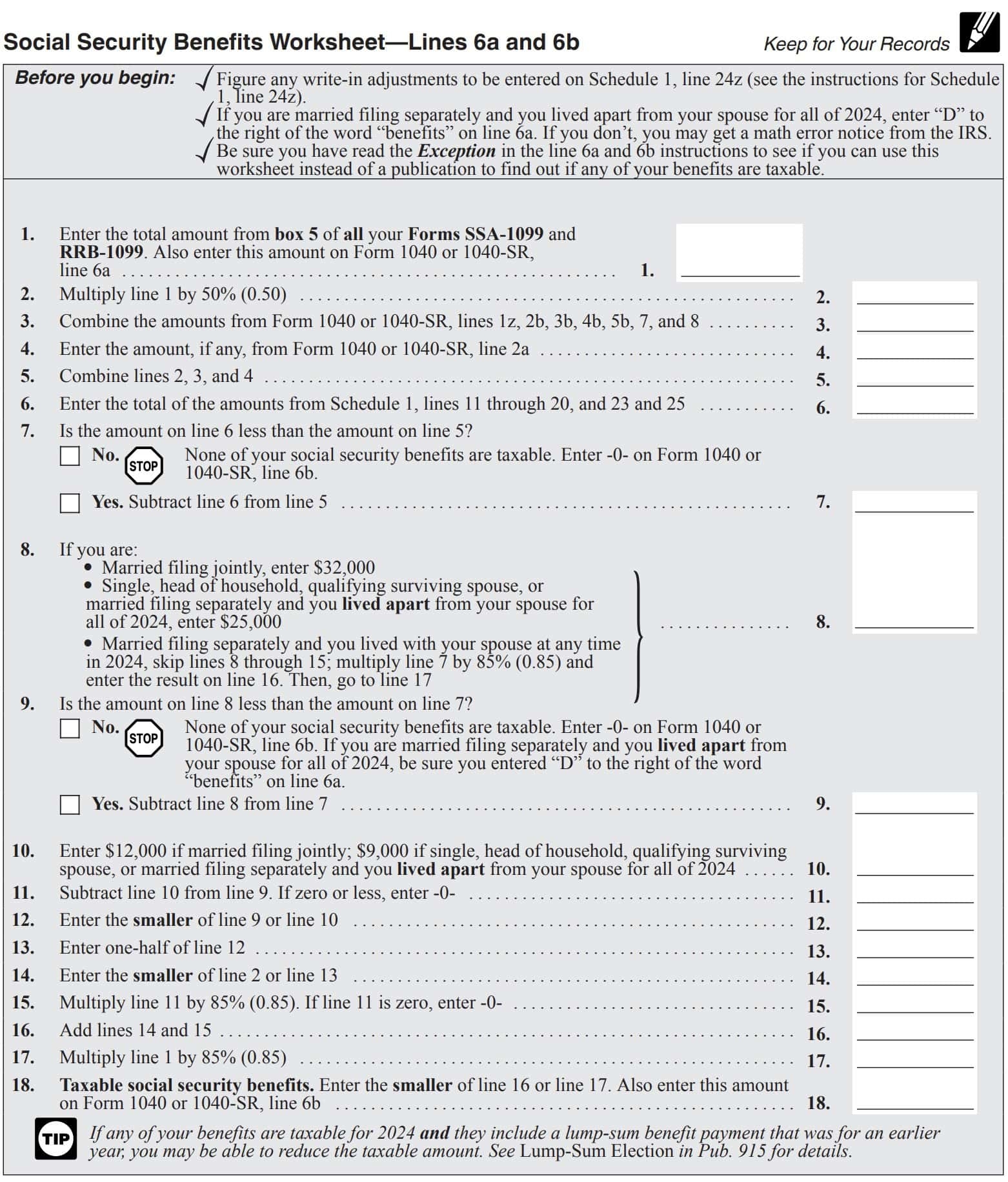

When filling out the IRS Printable Forms 1040ez, taxpayers will need to provide basic information such as their name, address, Social Security number, and filing status. They will also need to report their income, claim any deductions or credits they are eligible for, and calculate their tax liability using the provided instructions.

Once the form is completed, taxpayers can either file it electronically or mail it to the IRS. Filing electronically is the fastest and most secure way to submit your taxes, but if you prefer to mail in your forms, be sure to double-check that you have included all necessary documentation and have signed the form before sending it off.

Overall, IRS Printable Forms 1040ez is a convenient option for taxpayers with simple tax situations who want to file their taxes quickly and accurately. By using this form, you can streamline the tax filing process and ensure that you are meeting your obligations to the IRS.

So, if you qualify for the IRS Printable Forms 1040ez, be sure to download the form from the IRS website or pick up a copy at your local post office. With this form in hand, you can easily navigate the tax filing process and stay on top of your financial responsibilities.