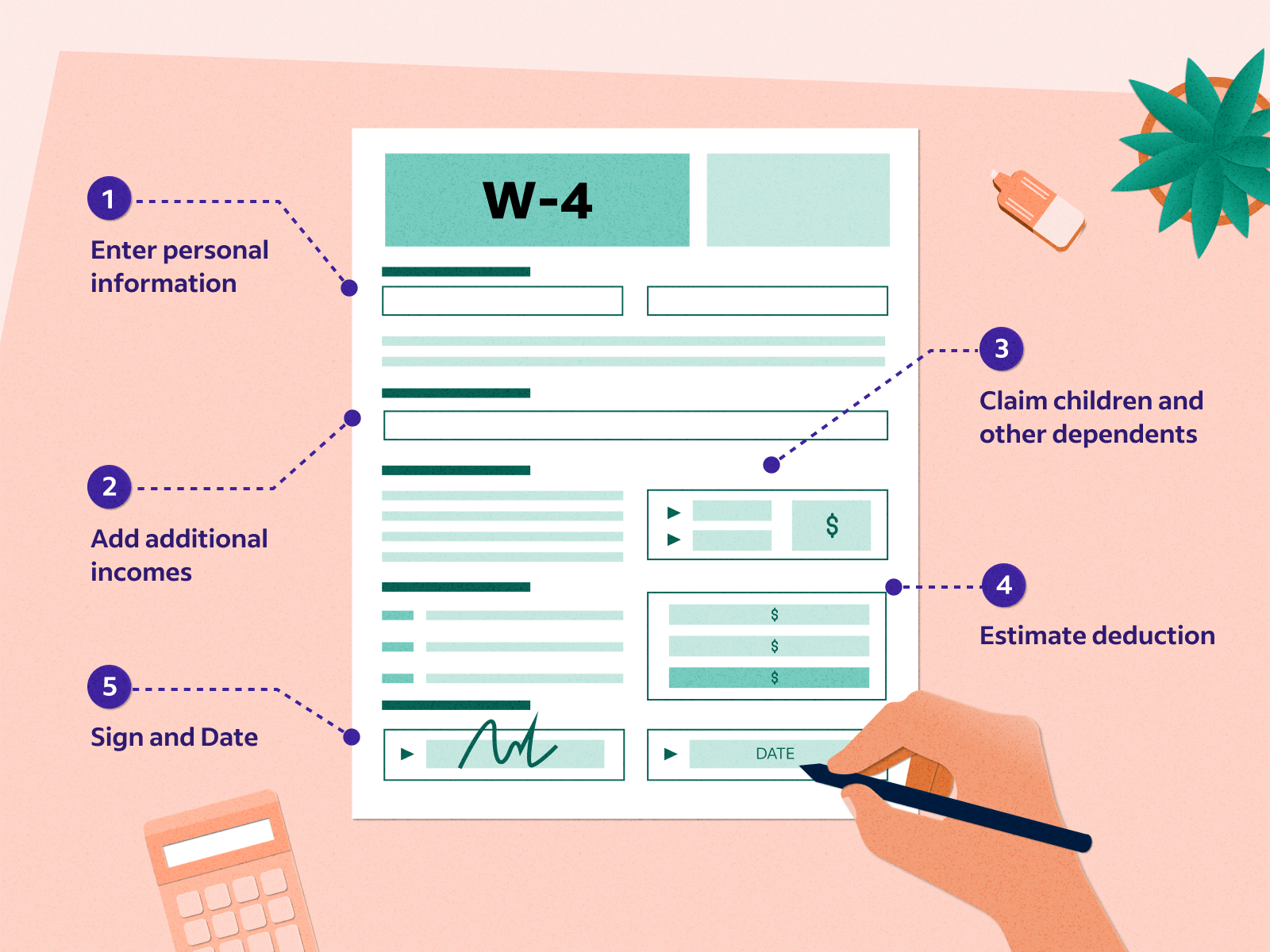

When starting a new job or experiencing a change in your financial situation, it’s important to fill out the IRS Form W-4. This form helps your employer determine how much federal income tax to withhold from your paycheck. By accurately completing this form, you can ensure that you are not overpaying or underpaying your taxes throughout the year.

Form W-4 is a crucial document for both employees and employers. It provides important information about your filing status, number of dependents, and any additional income you expect to receive. By completing this form correctly, you can avoid owing a large sum of money at tax time or missing out on potential refunds.

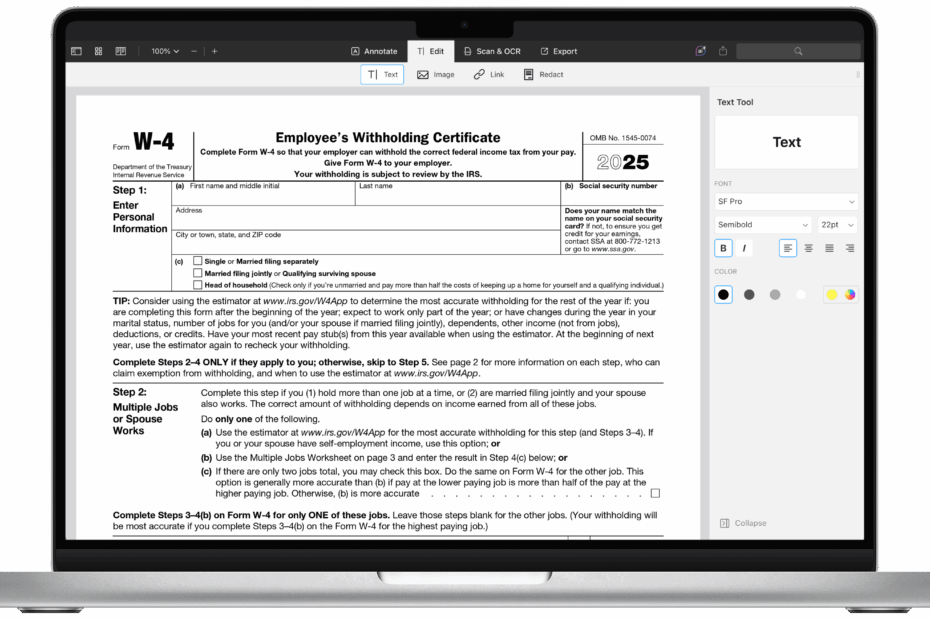

Get and Print Irs Printable Form W 4

Guide To Additional Amount Withheld And Form W 4 Indeed

Guide To Additional Amount Withheld And Form W 4 Indeed

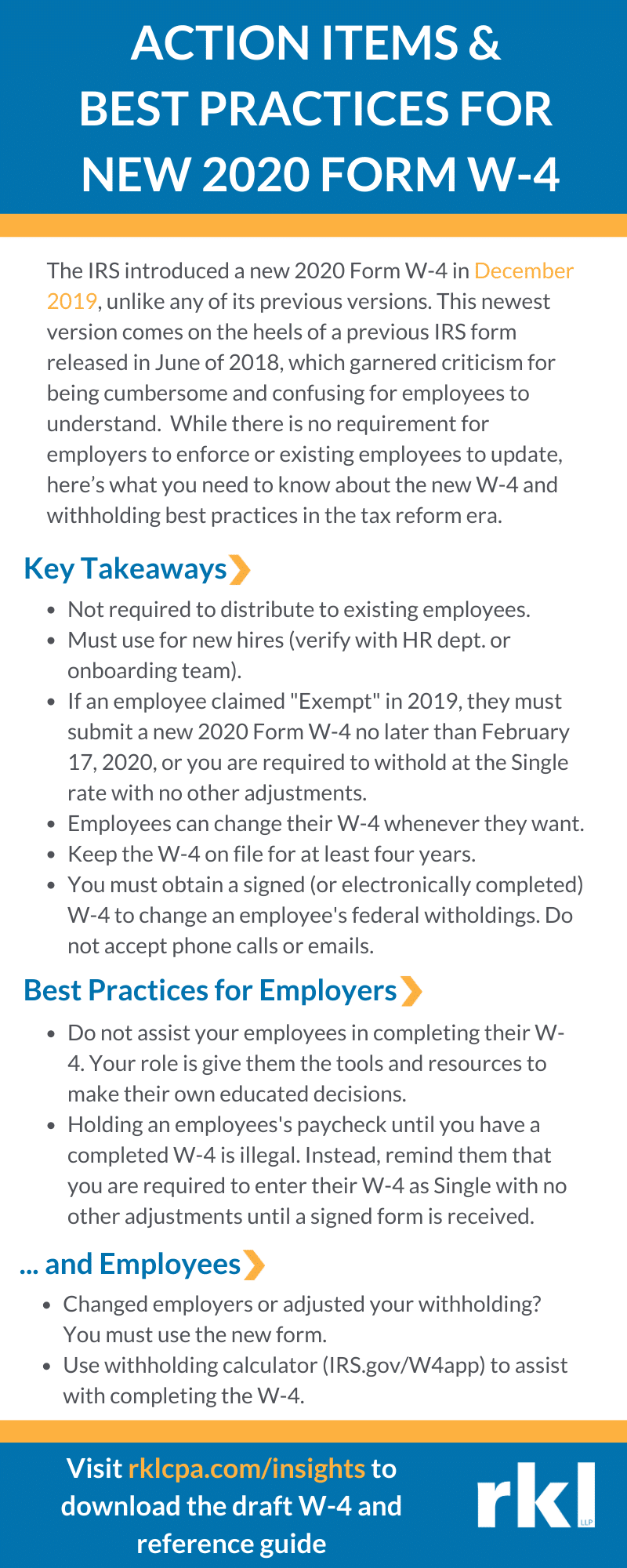

It is essential to update your Form W-4 whenever your financial situation changes. This includes getting married, having children, or taking on a second job. By keeping this form up to date, you can ensure that the correct amount of taxes is withheld from your paycheck each pay period.

When filling out Form W-4, be sure to carefully follow the instructions provided by the IRS. This form can be confusing for some individuals, but taking the time to accurately complete it can save you from potential headaches in the future. If you have any questions about how to fill out this form, don’t hesitate to seek guidance from a tax professional or your employer.

Once you have completed Form W-4, be sure to submit it to your employer as soon as possible. This will ensure that the correct amount of taxes is withheld from your paycheck starting with your next pay period. By staying on top of your tax withholding, you can avoid any surprises when it comes time to file your tax return.

Overall, Form W-4 is a crucial document for anyone who receives a paycheck. By accurately completing this form and keeping it up to date, you can ensure that you are paying the correct amount of taxes throughout the year. Be sure to take the time to fill out this form correctly to avoid any potential issues with your taxes in the future.