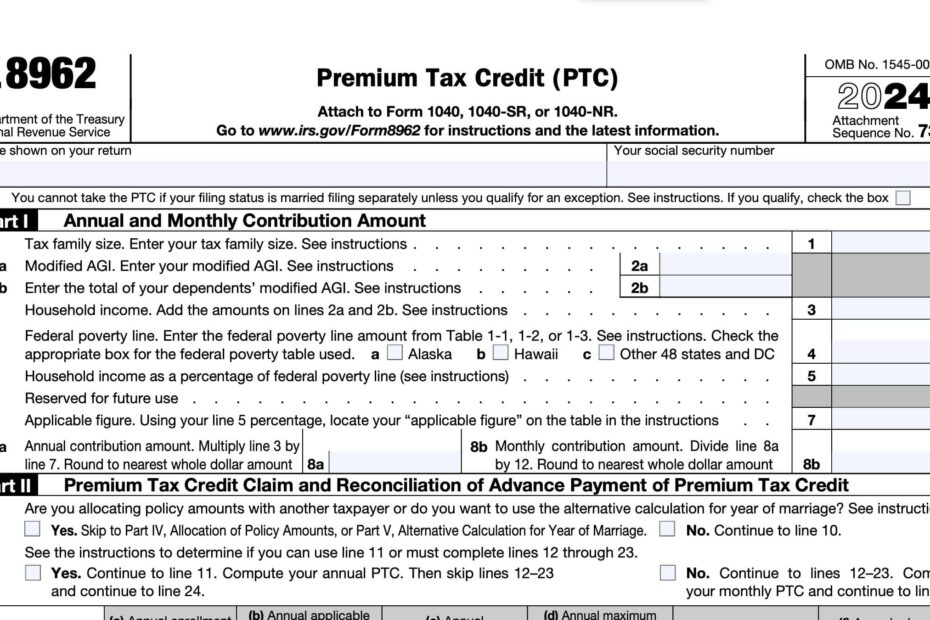

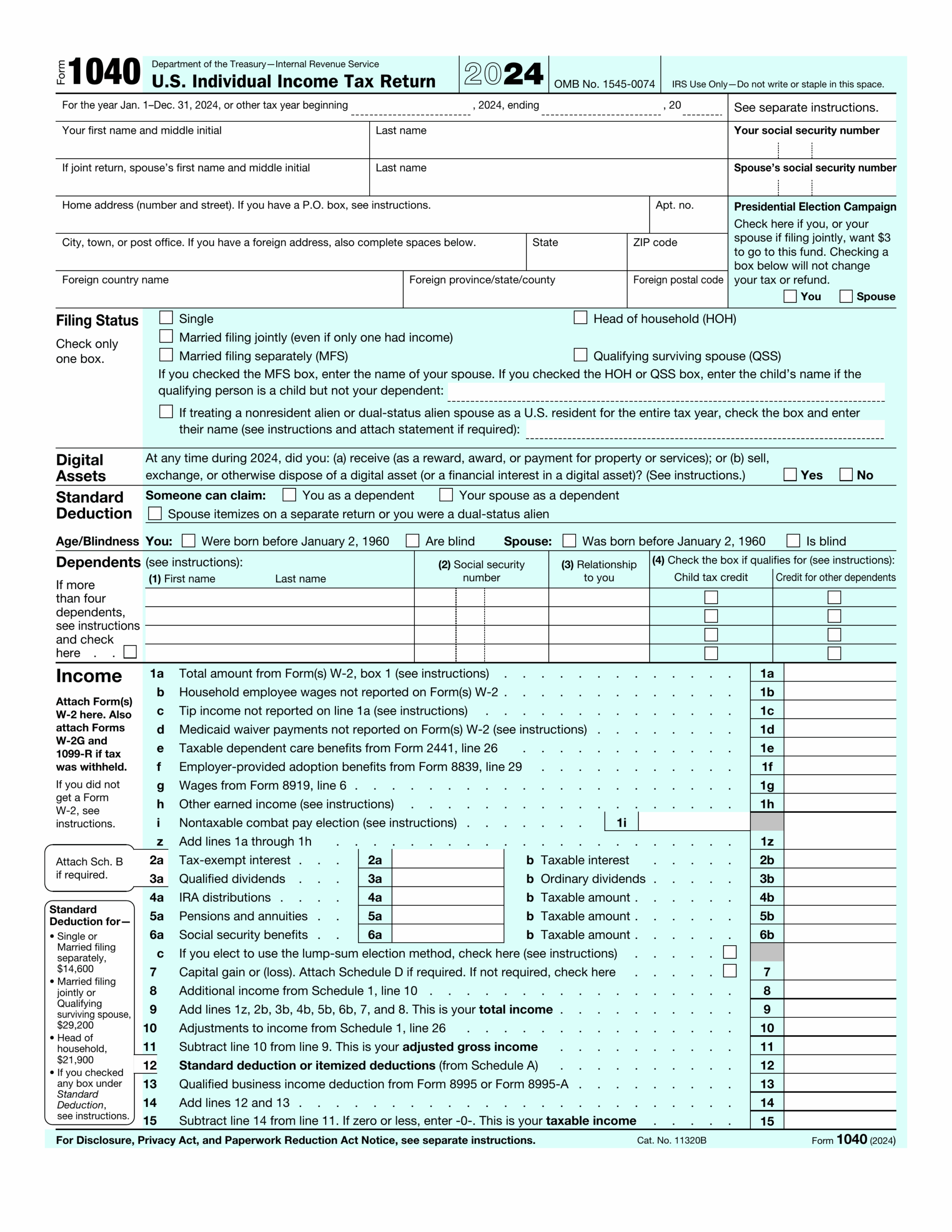

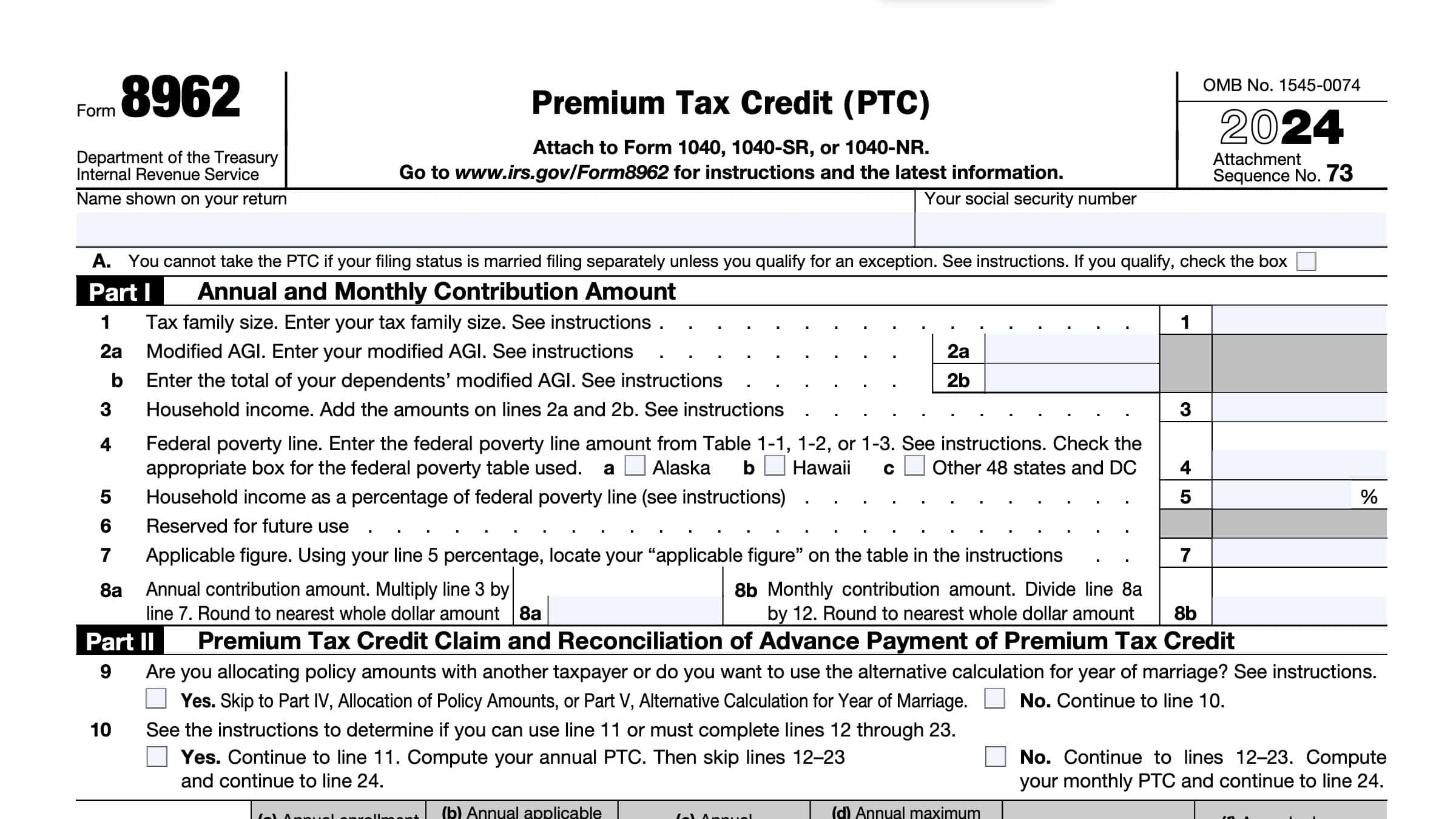

Filing taxes can be a daunting task for many individuals, especially when it comes to understanding and completing the necessary forms. One important form that taxpayers may need to fill out is IRS Form 8962. This form is used to reconcile advance payments of the Premium Tax Credit and to claim the credit if you are eligible.

Form 8962 is essential for individuals who have received advance payments of the Premium Tax Credit to help pay for their health insurance premiums through the Health Insurance Marketplace. By completing this form, taxpayers can ensure that they are receiving the correct amount of credit and avoid any potential issues with their tax return.

Download and Print Irs Printable Form 8962

Form 8962 For 2024 2025 Fill Edit And Download PDF Guru

Form 8962 For 2024 2025 Fill Edit And Download PDF Guru

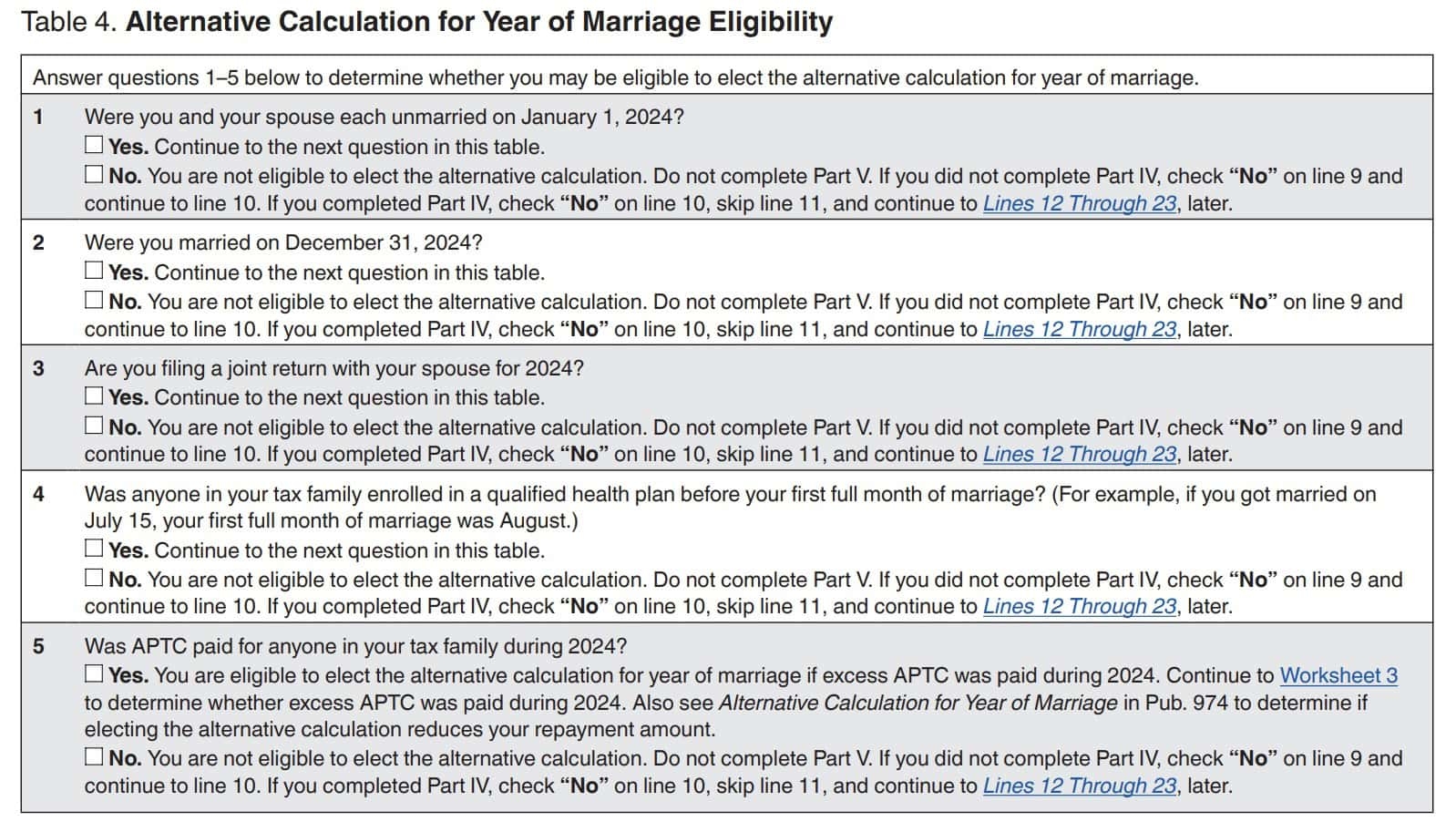

When filling out Form 8962, taxpayers will need to provide information about their household income, the cost of their health insurance premiums, and any advance payments they received. It is important to carefully review all the instructions and guidelines provided by the IRS to ensure accurate completion of the form.

Additionally, taxpayers should be aware of the eligibility requirements for the Premium Tax Credit, as not everyone may qualify for this credit. Factors such as income, family size, and the specific health insurance plan chosen can all impact eligibility for the credit.

Once Form 8962 has been completed and submitted along with the tax return, the IRS will review the information provided and determine the final amount of the Premium Tax Credit. Taxpayers may receive a refund if they are owed additional credit, or they may be required to repay any excess advance payments they received throughout the year.

In conclusion, IRS Form 8962 is an important document for individuals who have received advance payments of the Premium Tax Credit. By carefully completing this form and ensuring eligibility for the credit, taxpayers can accurately reconcile their payments and avoid any potential issues with their tax return. It is crucial to follow all instructions provided by the IRS and seek assistance from a tax professional if needed to ensure compliance with tax laws and regulations.

IRS Form 8962 Instructions Premium Tax Credit

IRS Form 8962 Instructions Premium Tax Credit

Form 8962 For 2024 2025 Fill Edit And Download PDF Guru

Form 8962 For 2024 2025 Fill Edit And Download PDF Guru

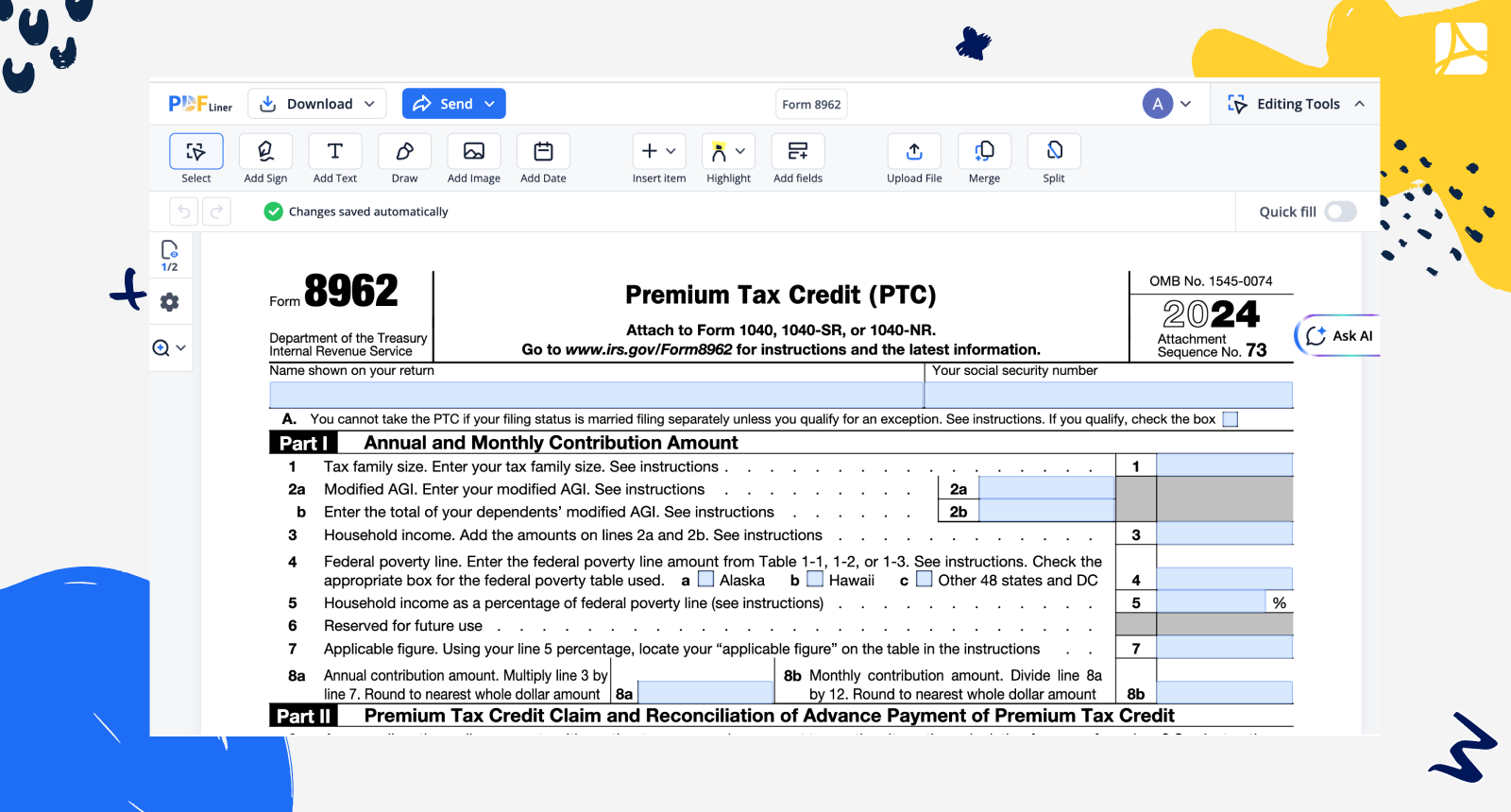

Form 8962 2024 Fillable Printable 8962 Form PDFliner

Form 8962 2024 Fillable Printable 8962 Form PDFliner

IRS Form 8962 Instructions Premium Tax Credit

IRS Form 8962 Instructions Premium Tax Credit

Looking for a simple way to take care of your financial needs? The Irs Printable Form 8962 provide a straightforward, safe, and personalizable alternative you can use at home. Perfect for individual purposes, home businesses, or budgeting, Irs Printable Form 8962 save time and money without lowering security. Compatible with popular bookkeeping tools and easy to print, they’re a wise alternative to bank-ordered checks. Start printing today and gain full control over your check issuing—no waiting, zero charges. Check out our collection of templates and pick the one that suits your style. With our easy-to-use interface, financial management has never been this easy. Download your Irs Printable Form 8962 and streamline your check-writing process with confidence!.