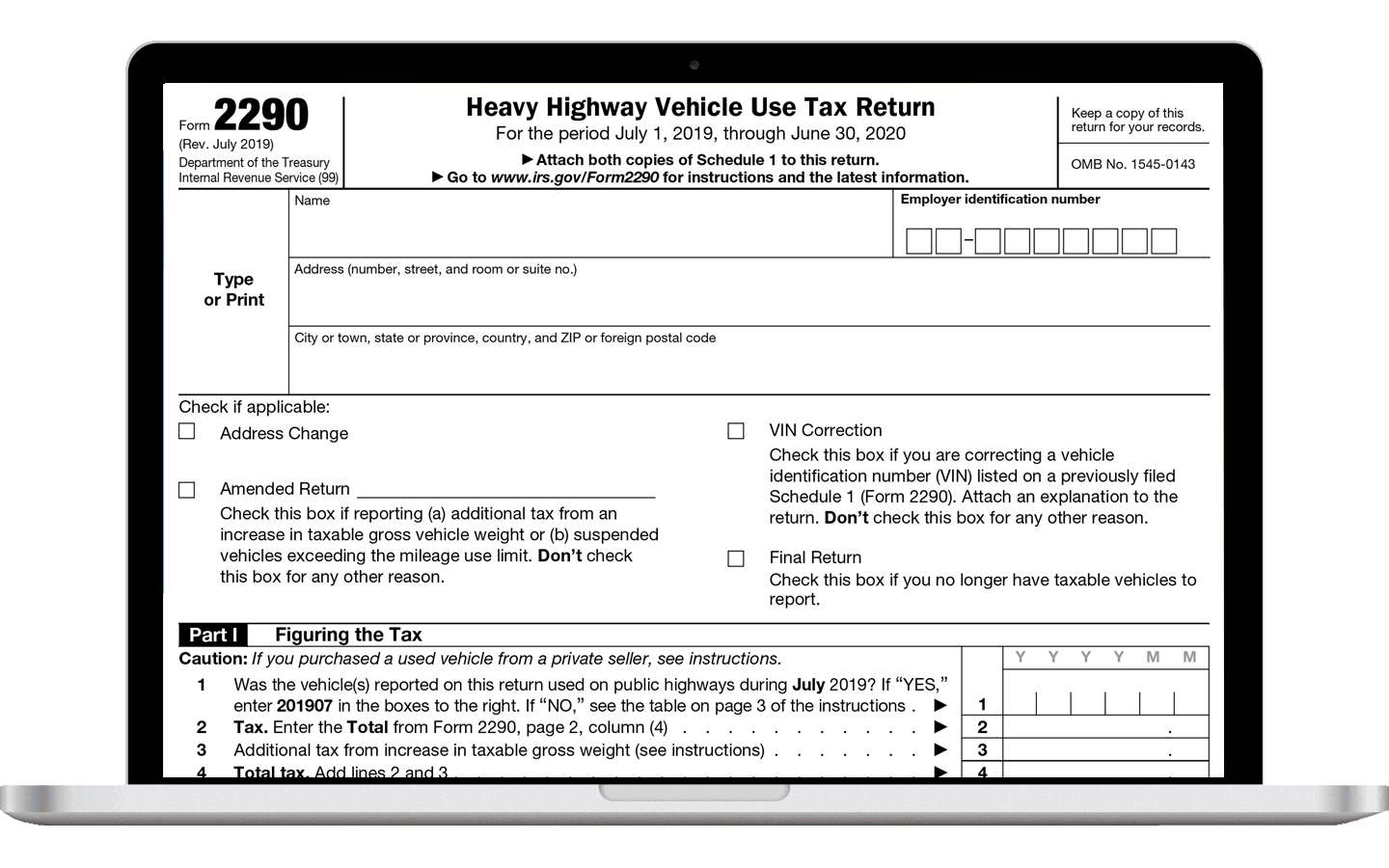

When it comes to filing taxes for your heavy vehicle, IRS Form 2290 is a crucial document that you need to be familiar with. This form is used to report and pay the Heavy Highway Vehicle Use Tax, which is required for vehicles with a gross weight of 55,000 pounds or more. Understanding how to properly fill out and submit Form 2290 is essential to staying compliant with IRS regulations.

One of the important things to note about Form 2290 is that it can be easily accessed and printed from the IRS website. This printable form allows you to fill out the necessary information offline and submit it by mail or in person. Having a physical copy of the form on hand can be helpful for those who prefer to file their taxes manually or need to keep records for their business.

Quickly Access and Print Irs Printable Form 2290

IRS Form 2290 Due Date For 2023 2024 Tax Period

IRS Form 2290 Due Date For 2023 2024 Tax Period

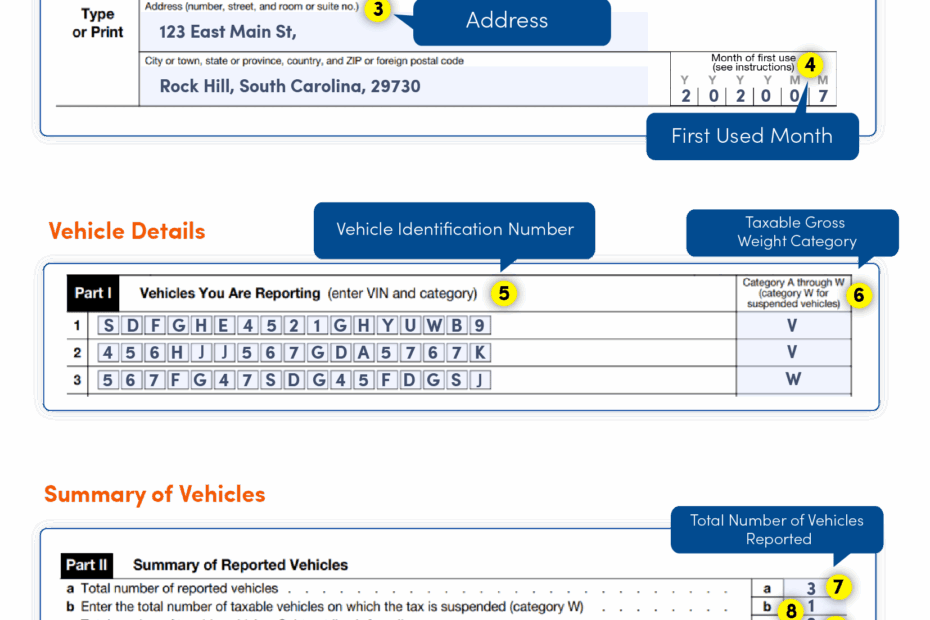

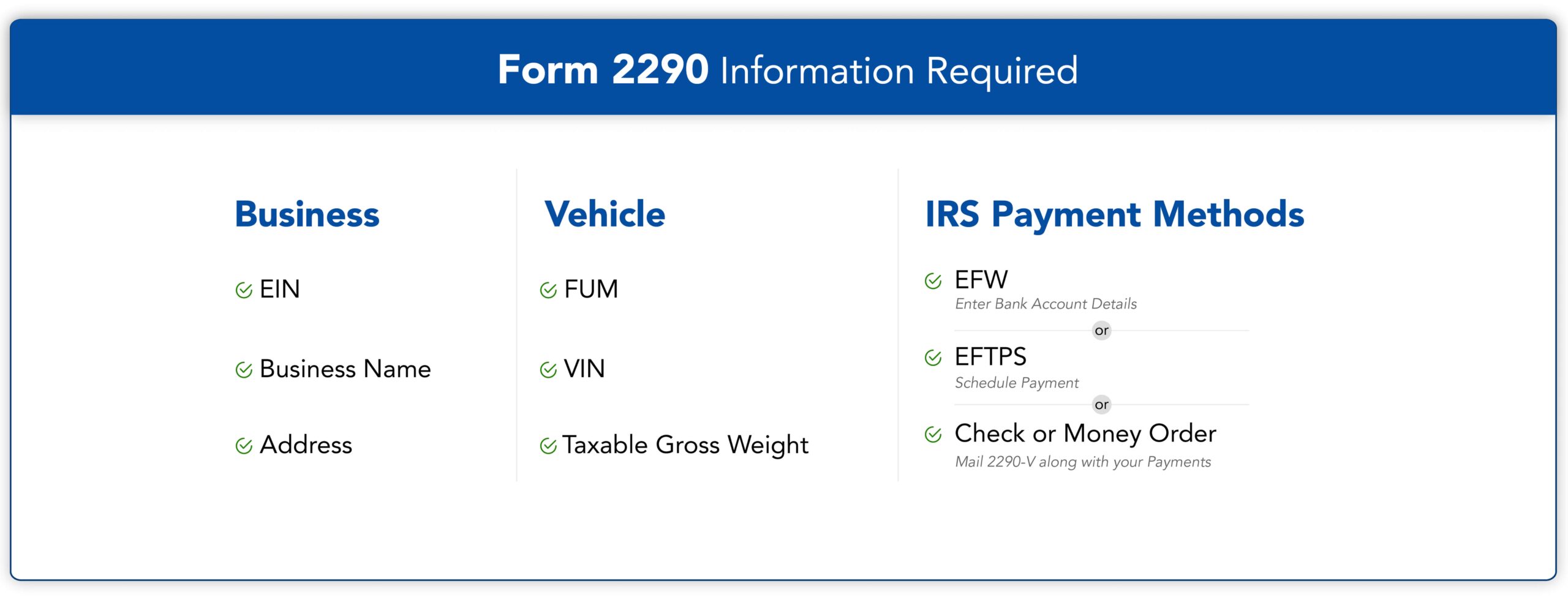

When filling out Form 2290, you will need to provide details about your vehicle, including its identification number, taxable gross weight, and mileage use limit. You will also need to calculate the tax amount based on the weight category of your vehicle. Once you have completed the form, you can then submit it along with the payment to the IRS before the deadline to avoid any penalties or fines.

It is important to keep in mind that Form 2290 must be filed annually, with the deadline falling on August 31st each year. Failure to file the form by the due date can result in hefty penalties, so it is crucial to make sure you submit it on time. By utilizing the printable form provided by the IRS, you can ensure that you have all the necessary information at your fingertips to complete the process efficiently.

In conclusion, IRS Form 2290 is a vital document for heavy vehicle owners to report and pay the Heavy Highway Vehicle Use Tax. By utilizing the printable form available on the IRS website, you can easily fill out the required information and submit it in a timely manner. Staying compliant with IRS regulations is essential for avoiding penalties and keeping your business operations running smoothly.