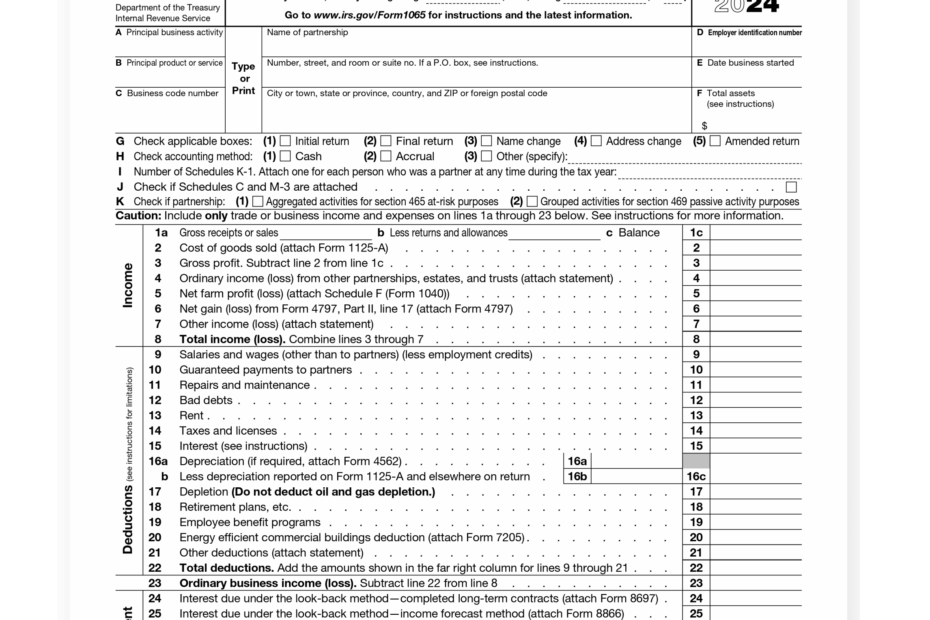

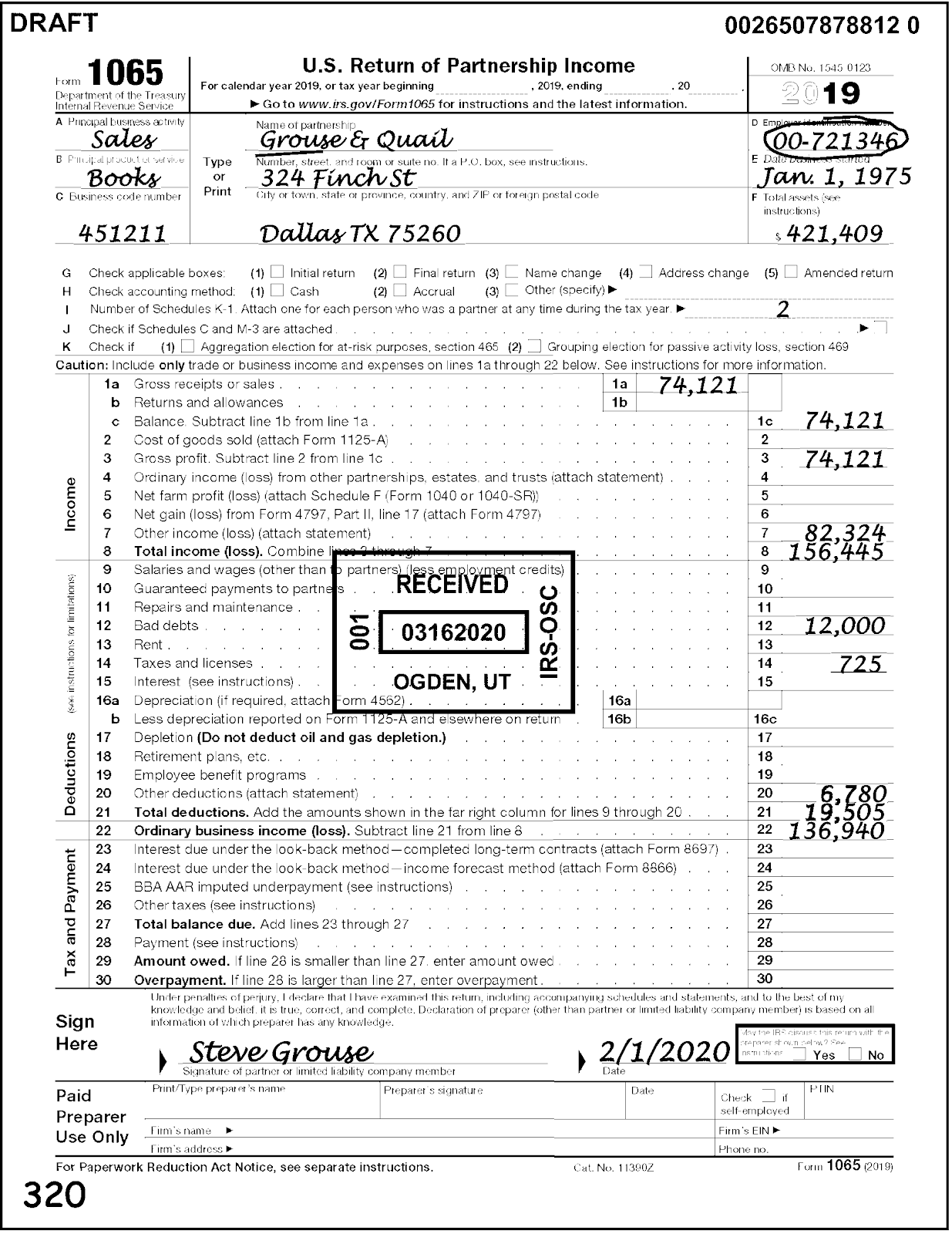

When it comes to filing taxes for a partnership, Form 1065 is essential. This form is used to report the income, deductions, and credits of a partnership. Partnerships must file Form 1065 annually to report their financial information to the IRS. This form is crucial for ensuring that the partnership is in compliance with tax laws and regulations.

Partnerships are required to provide each partner with a Schedule K-1, which outlines their share of the partnership’s income, deductions, and credits. Partners then use this information to report their individual tax liability on their personal tax returns. Filing Form 1065 accurately and on time is crucial for avoiding penalties and ensuring that the partnership remains in good standing with the IRS.

Quickly Access and Print Irs Printable Form 1065

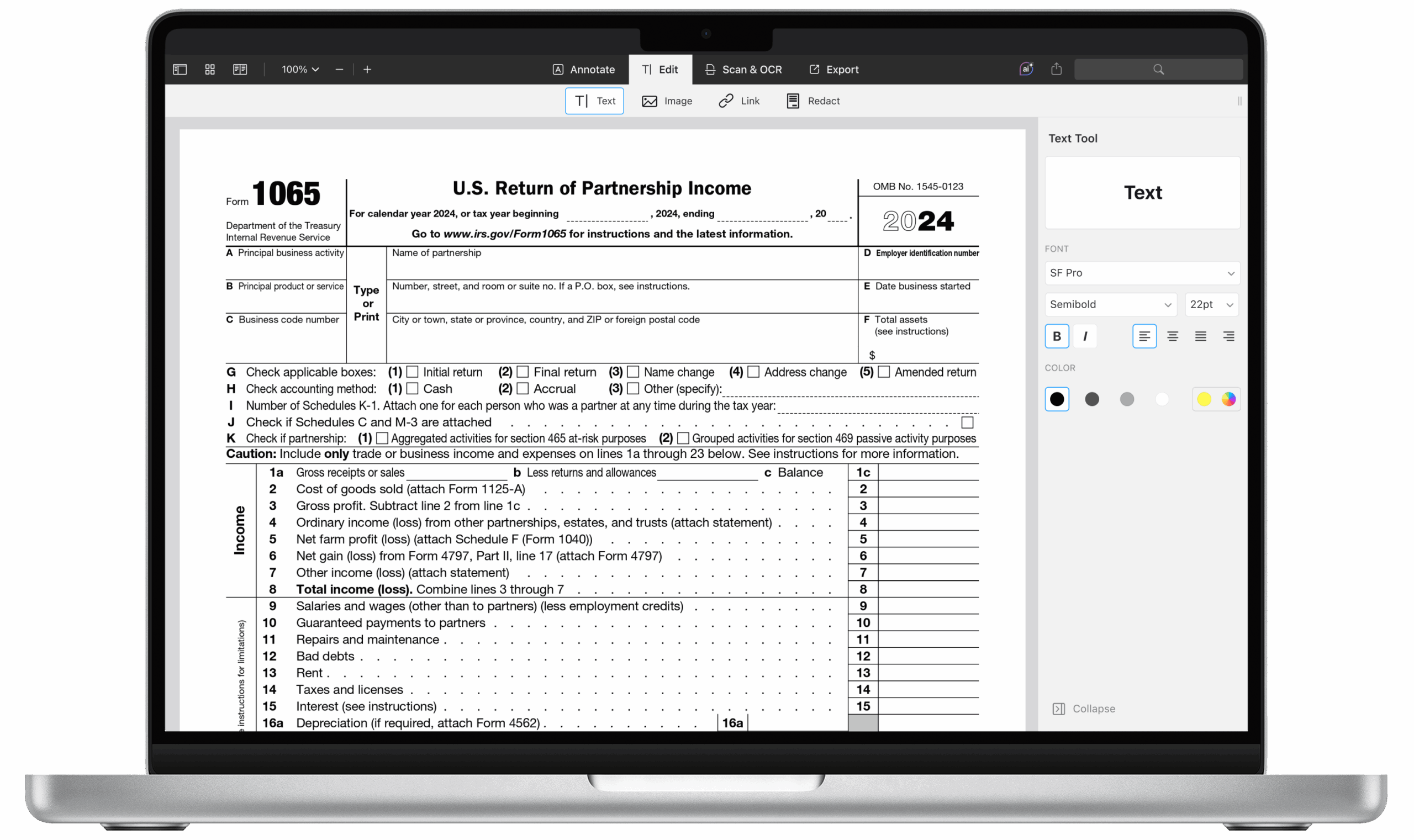

How To Fill Out IRS 1065 Form PDF 2024 2025 PDF Expert

How To Fill Out IRS 1065 Form PDF 2024 2025 PDF Expert

Form 1065 consists of several sections, including information about the partnership, income, deductions, credits, and more. Partnerships must provide detailed information about their financial activities throughout the tax year, including any income earned, expenses incurred, and any tax credits they may be eligible for. This information is used by the IRS to assess the partnership’s tax liability and ensure that all taxes are paid in full.

Partnerships can download and print Form 1065 from the IRS website. The form is available in a printable format, making it easy for partnerships to fill out and submit their financial information to the IRS. Partnerships should ensure that they carefully review the instructions for Form 1065 to ensure that they are providing accurate and complete information on their tax return.

Overall, Form 1065 is a crucial document for partnerships to file their taxes accurately and in compliance with IRS regulations. By providing detailed information about their financial activities, partnerships can ensure that they are meeting their tax obligations and avoiding penalties. Partnerships should make sure to file Form 1065 on time each year to maintain good standing with the IRS and avoid any potential issues with their tax return.

In conclusion, Form 1065 is an essential document for partnerships to report their income, deductions, and credits to the IRS. By accurately completing and submitting this form, partnerships can ensure that they are in compliance with tax laws and regulations. Partnerships should take the time to carefully review and complete Form 1065 to avoid any potential issues with their tax return and maintain good standing with the IRS.