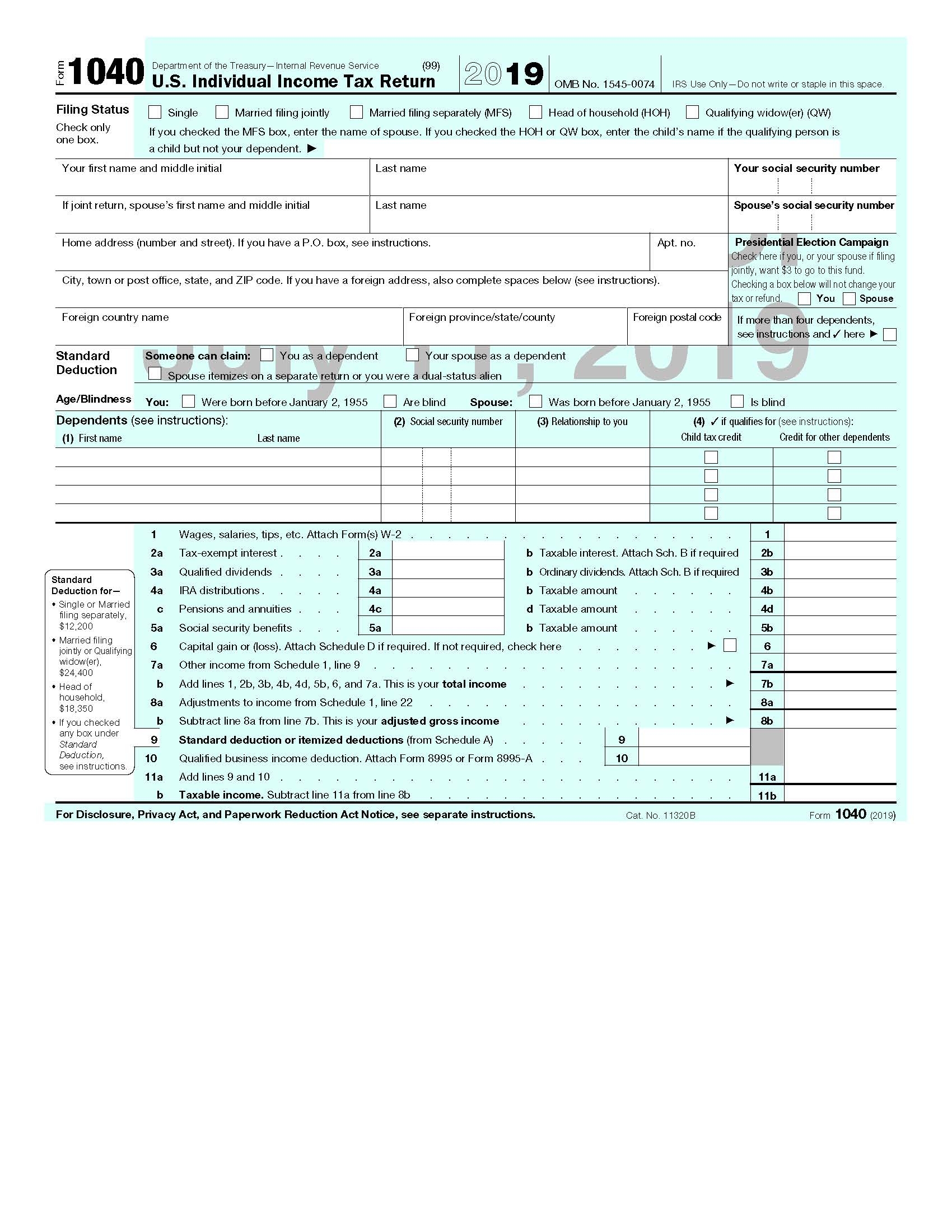

Filing your taxes can be a daunting task, but with the help of the Irs Printable Form 1040, the process becomes much simpler. This form is the standard document that individuals use to report their annual income and calculate their tax liability to the Internal Revenue Service (IRS).

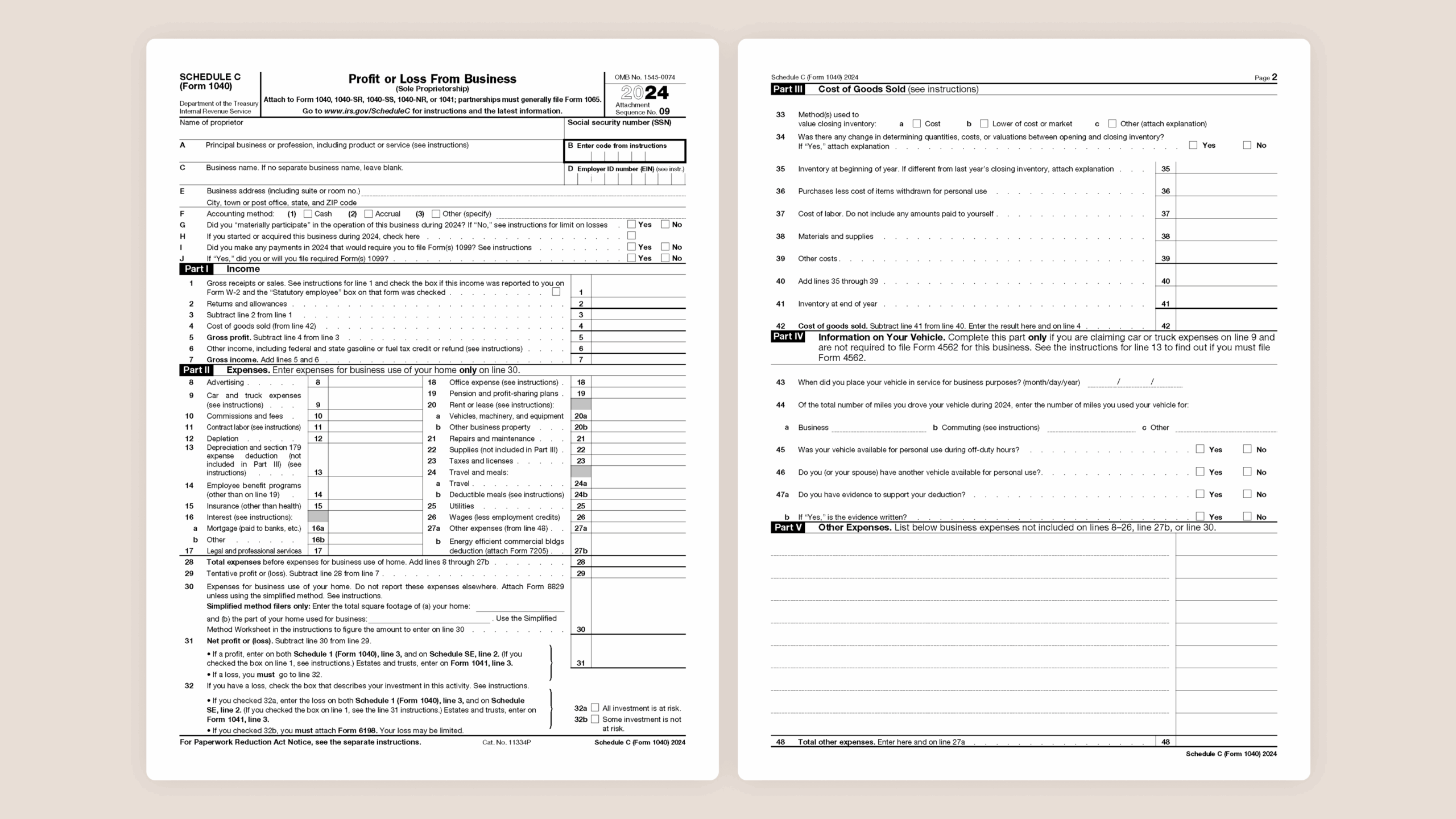

Whether you are a salaried employee, a freelancer, or a business owner, Form 1040 is essential for accurately reporting your income and ensuring compliance with federal tax laws. It is important to understand the various sections of the form and provide accurate information to avoid any penalties or audits.

Get and Print Irs Printable Form 1040

Farewell 1040 Postcard We Hardly Knew Ye Current Federal Tax Developments

Farewell 1040 Postcard We Hardly Knew Ye Current Federal Tax Developments

Irs Printable Form 1040

The Irs Printable Form 1040 consists of several sections, including personal information, income, deductions, and credits. You will need to fill out each section carefully, ensuring that all information is accurate and up to date. The form also includes instructions to help you complete it correctly.

One of the key sections of Form 1040 is the income section, where you will report your earnings from various sources, such as wages, dividends, and rental income. You will also need to report any deductions you are eligible for, such as student loan interest, mortgage interest, and charitable contributions.

Another important section of the form is the credits section, where you can claim tax credits for certain expenses, such as education expenses, child and dependent care expenses, and retirement savings contributions. These credits can help reduce your tax liability and increase your refund.

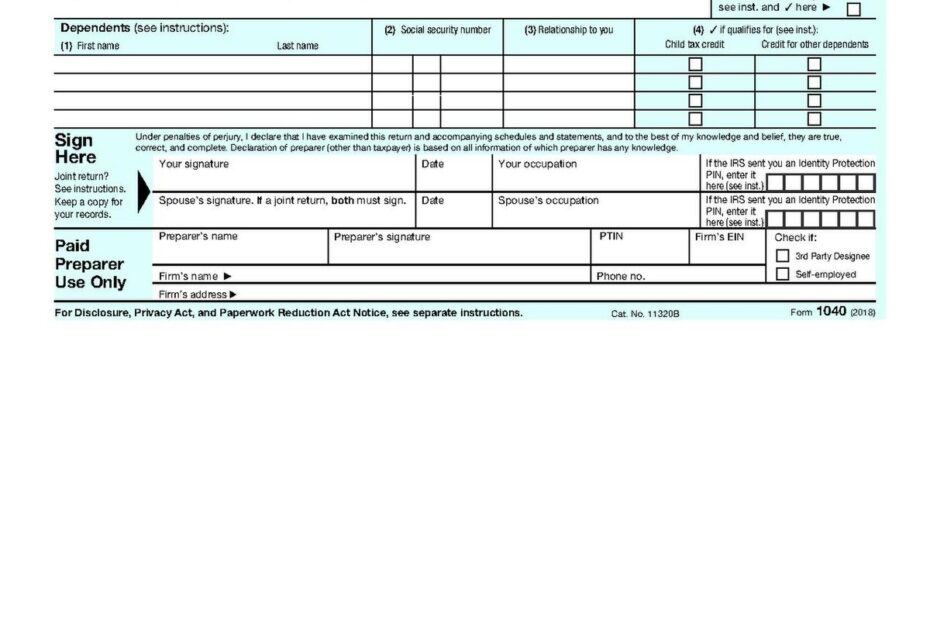

Once you have completed all the sections of the form, you will need to sign and date it before submitting it to the IRS. You can file your Form 1040 electronically or mail it to the IRS, depending on your preference. Be sure to keep a copy of the form for your records.

In conclusion, the Irs Printable Form 1040 is an essential document for filing your taxes and ensuring compliance with federal tax laws. By understanding how to complete the form correctly and accurately, you can avoid any potential issues and ensure a smooth tax filing process.