Are you running out of time to file your taxes? Don’t worry, the IRS offers a solution in the form of a printable extension form. This form allows you to request additional time to file your taxes, giving you some breathing room to gather all necessary documents and information.

It’s important to note that an extension to file does not grant an extension to pay any taxes owed. You are still required to estimate and pay any taxes due by the original deadline to avoid penalties and interest. However, the extension form can help alleviate some of the stress associated with meeting the tax deadline.

Get and Print Irs Printable Extension Form

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

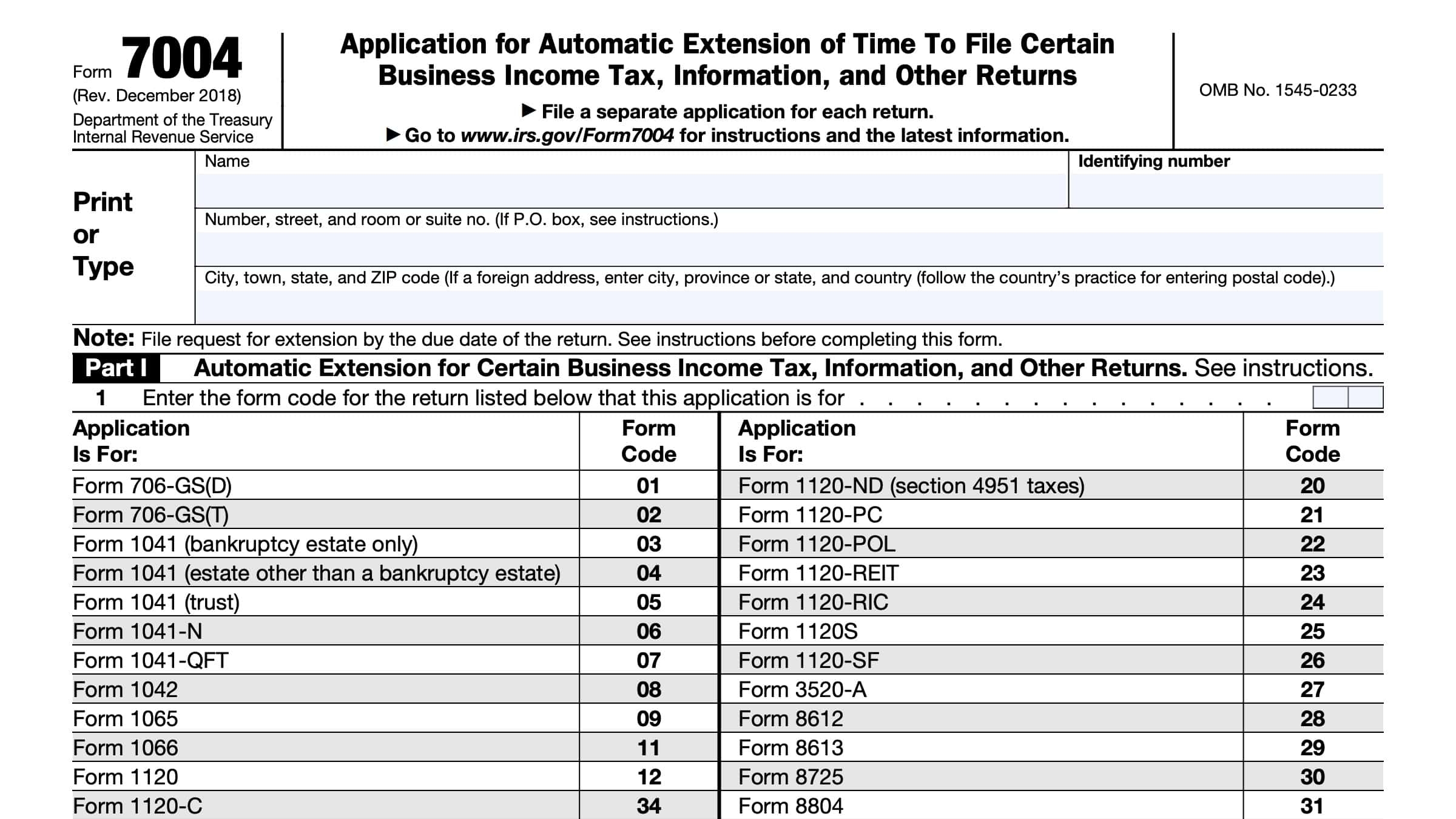

When filling out the IRS printable extension form, you will need to provide basic information such as your name, address, Social Security number, and the tax year for which you are requesting an extension. You can submit the form electronically or mail it to the IRS, depending on your preference.

It’s essential to submit the extension form before the original tax deadline to avoid any penalties for late filing. The IRS typically grants an additional six months to file your taxes, giving you until October to submit your completed return. This extension can be a lifesaver for those who need extra time to gather all necessary paperwork.

Remember, while the extension form gives you more time to file your taxes, it does not extend the deadline for paying any taxes owed. It’s crucial to estimate your tax liability and make a payment by the original deadline to avoid penalties and interest. The extension form is a helpful tool for those who need a little extra time to meet their tax obligations.

In conclusion, the IRS printable extension form is a valuable resource for individuals who need more time to file their taxes. By submitting this form, you can avoid late filing penalties and give yourself extra time to gather all necessary documentation. Remember to estimate and pay any taxes owed by the original deadline to avoid additional fees. Take advantage of the extension form to relieve some of the stress associated with tax season.