As tax season approaches, it’s important to start gathering all the necessary documents and forms to ensure a smooth filing process. The IRS provides printable tax forms for individuals to easily access and fill out for the upcoming year. These forms are essential for reporting income, deductions, and credits accurately.

By utilizing IRS printable 2025 tax forms, taxpayers can stay organized and avoid any potential errors that may lead to delays or penalties. Whether you’re filing as an individual, business, or organization, having the correct forms on hand is crucial for complying with tax laws and regulations.

Easily Download and Print Irs Printable 2025 Tax Forms

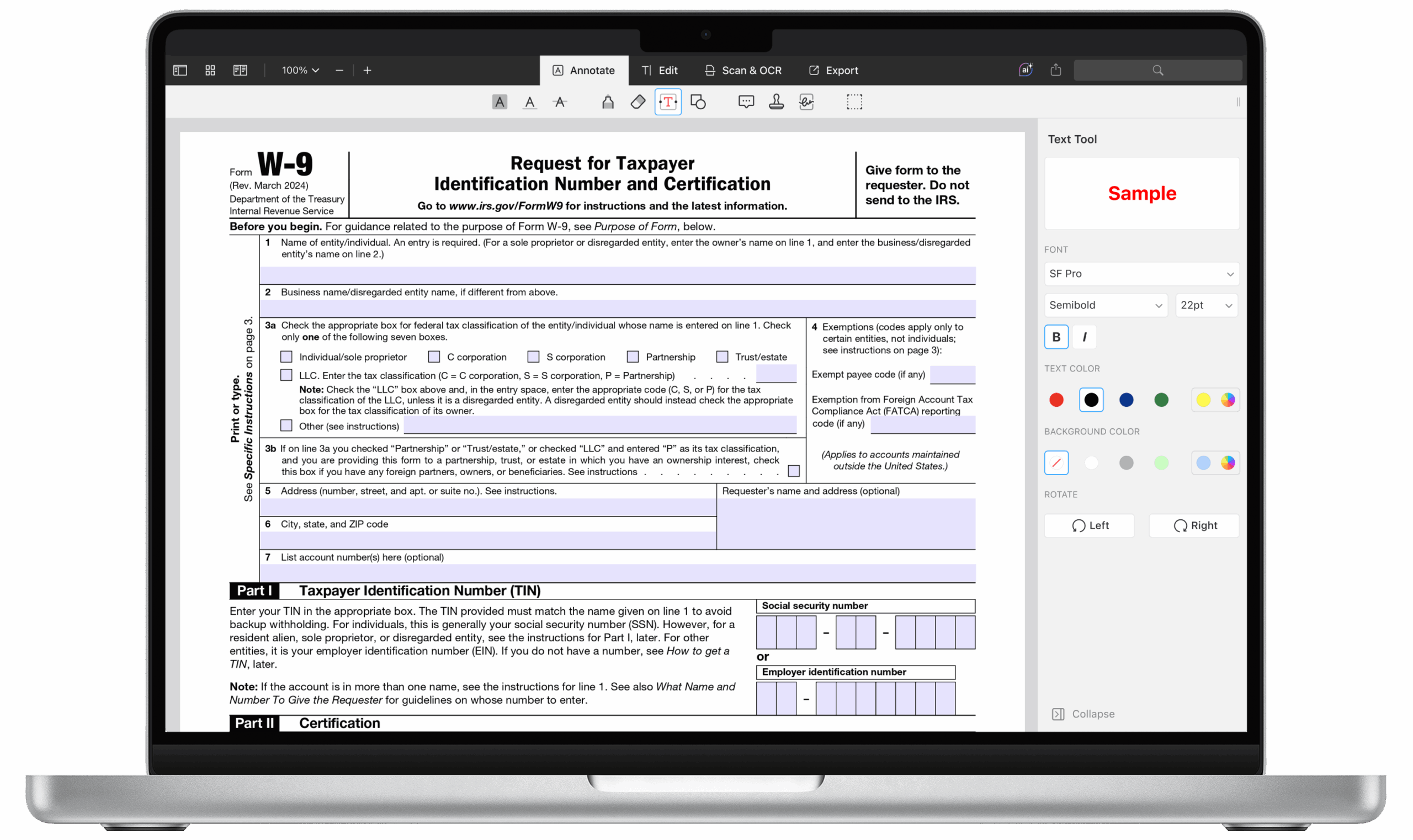

W9 Tax Form 2025 Printable Printable W9 Form 2025

W9 Tax Form 2025 Printable Printable W9 Form 2025

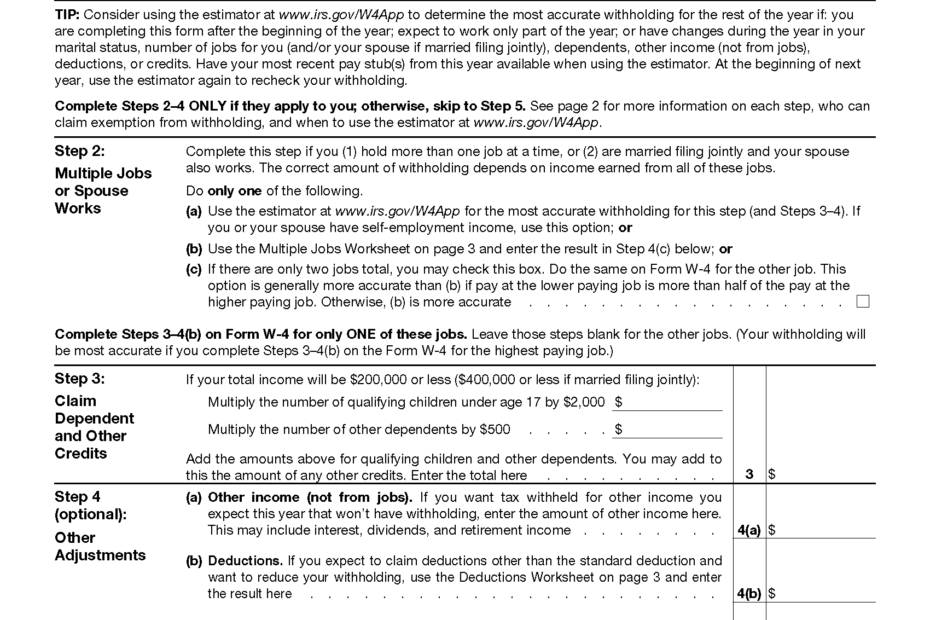

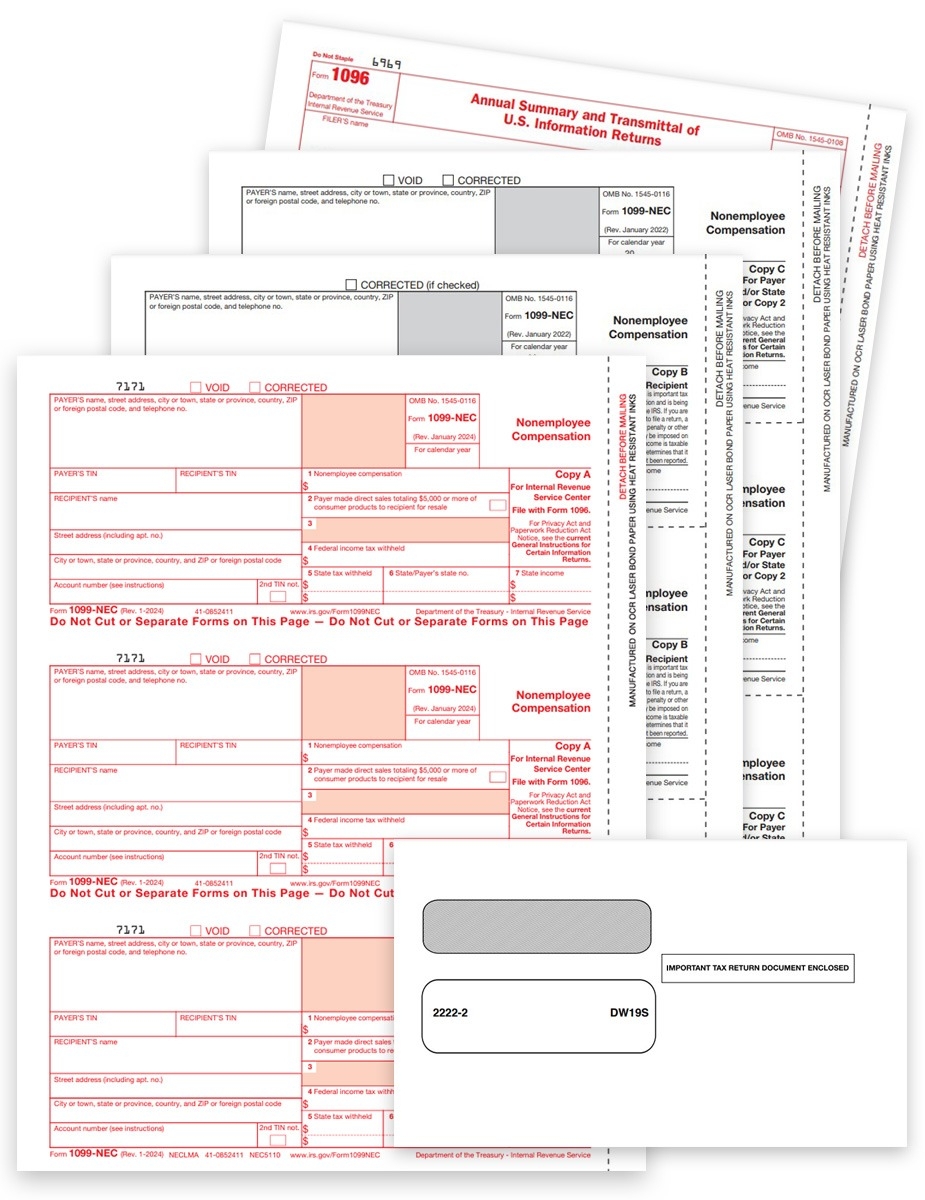

When it comes to preparing your taxes, the IRS offers a variety of printable forms to suit different filing needs. From the standard Form 1040 for individual income tax returns to Form 1099 for reporting various types of income, there is a form for every situation. Additionally, the IRS website provides instructions and guidance on how to fill out each form correctly.

For those who prefer to file their taxes manually rather than electronically, printable IRS tax forms are a convenient option. These forms can be easily downloaded and printed from the IRS website, allowing taxpayers to complete them at their own pace. It’s important to double-check that you are using the correct form for your specific tax situation to avoid any discrepancies.

As the tax deadline approaches, it’s essential to gather all necessary paperwork and ensure that you have all the required forms to accurately report your income and expenses. By utilizing IRS printable 2025 tax forms, you can streamline the filing process and minimize the risk of errors. Remember to keep a copy of your completed forms for your records and submit them to the IRS by the designated deadline.

In conclusion, IRS printable 2025 tax forms are a valuable resource for taxpayers to report their income and deductions accurately. By utilizing these forms, individuals can ensure compliance with tax laws and avoid potential penalties. Make sure to download the necessary forms from the IRS website and carefully follow the instructions provided to complete your tax return successfully.