As tax season approaches, many individuals and businesses are gearing up to file their taxes. One important form that is often required for reporting income is the IRS Printable 1099 Tax Form. This form is used to report various types of income, such as freelance earnings, rental income, and interest earned on investments.

It is crucial to accurately report all sources of income to avoid potential penalties from the IRS. The 1099 form is essential for both the recipient of the income and the entity that paid it. By providing accurate information on this form, individuals and businesses can ensure compliance with tax laws and regulations.

Get and Print Irs Printable 1099 Tax Form

2024 1099 MISC Form Fillable Printable Download 2024 Instructions

2024 1099 MISC Form Fillable Printable Download 2024 Instructions

Irs Printable 1099 Tax Form

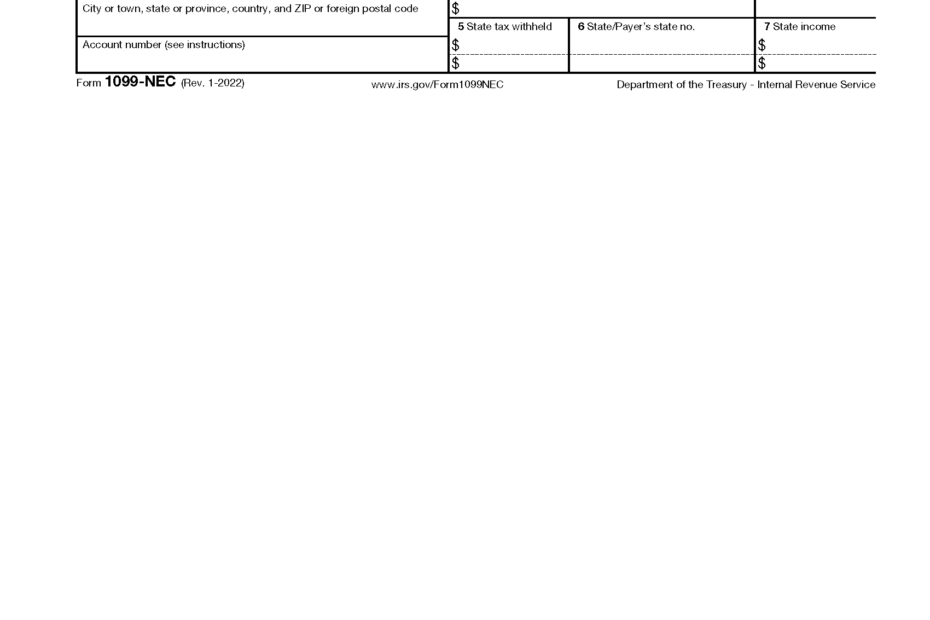

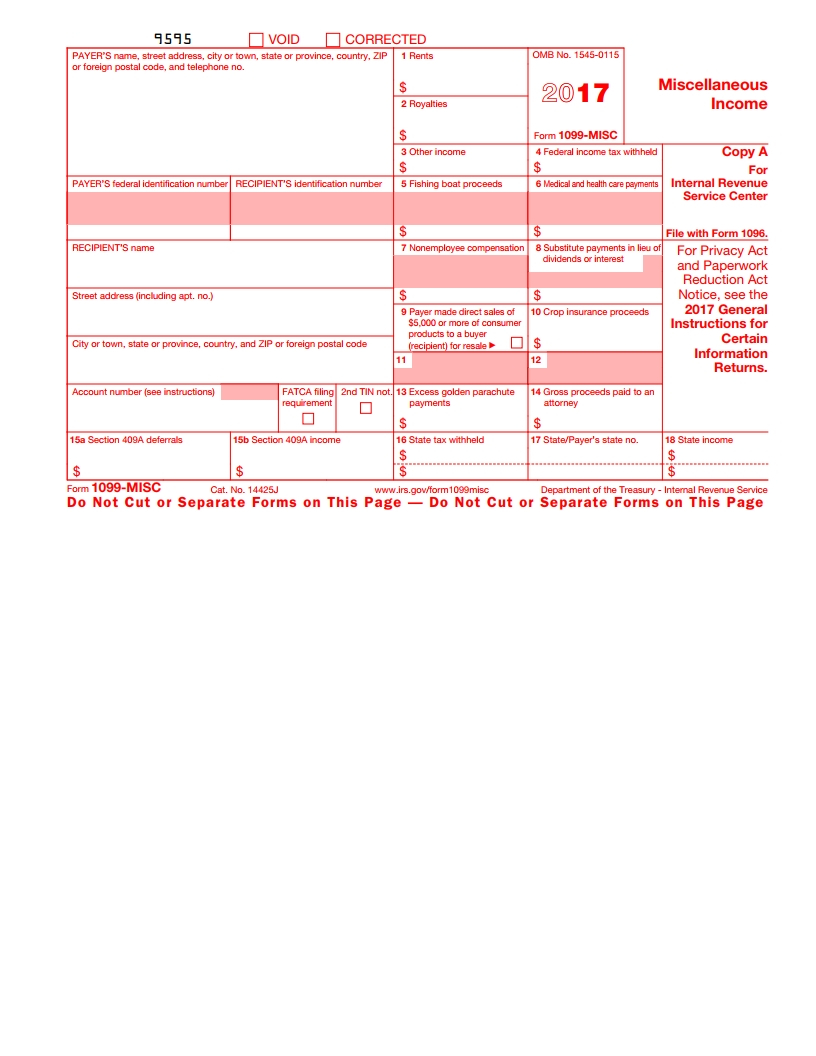

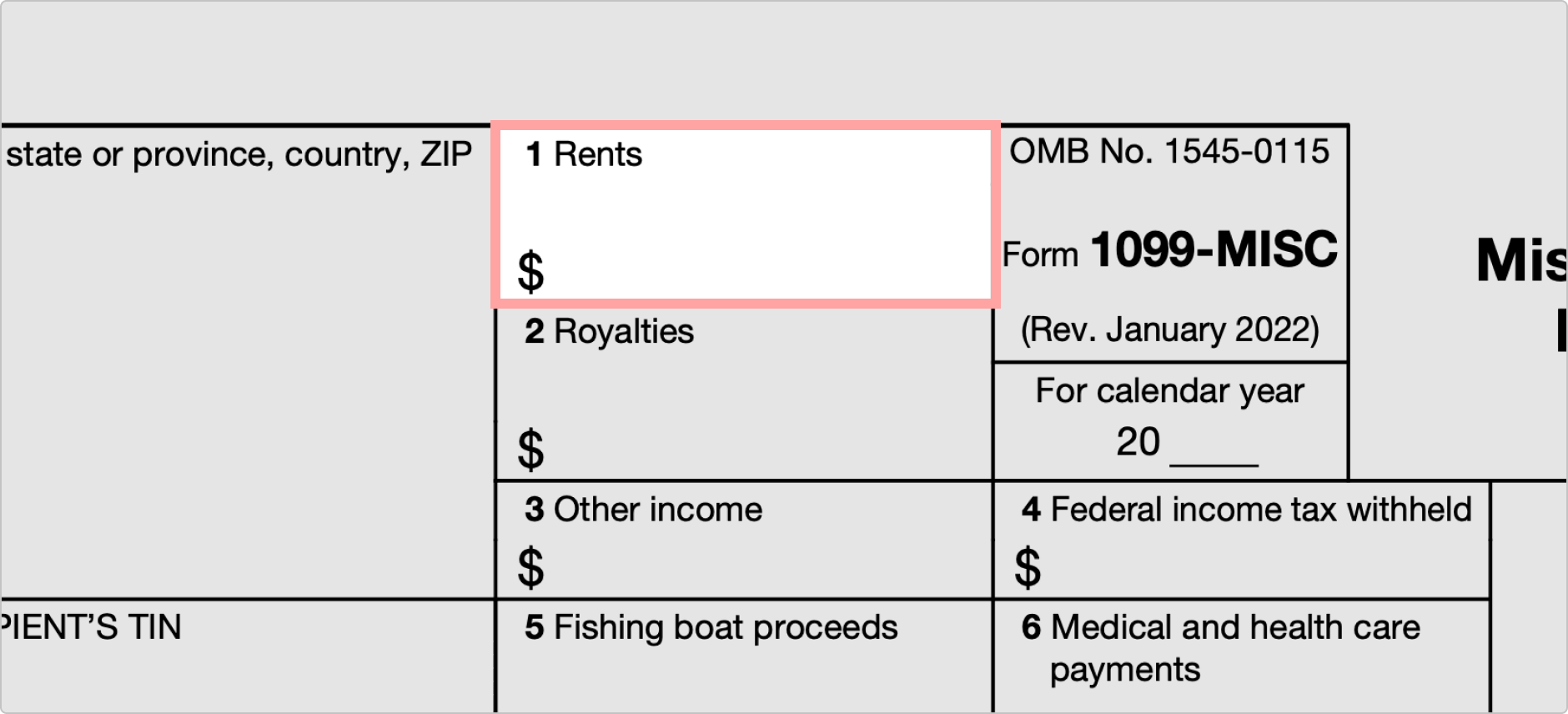

The IRS Printable 1099 Tax Form is available on the IRS website for download. This form comes in various versions, depending on the type of income being reported. For example, there are different forms for reporting income from self-employment, interest and dividends, and rental income. It is important to use the correct form to accurately report income and avoid any discrepancies.

When filling out the 1099 form, individuals and businesses must provide detailed information about the income received, including the amount, date of payment, and recipient’s information. This information is used by the IRS to verify income reported on tax returns and ensure that all taxes owed are paid in full.

Once the 1099 form is completed, it must be sent to both the recipient of the income and the IRS. The recipient will use this information to report the income on their tax return, while the IRS will use it to cross-reference with tax returns filed by the payer. Failure to report income accurately can result in penalties and fines from the IRS.

In conclusion, the IRS Printable 1099 Tax Form is a crucial document for reporting various types of income. It is essential to accurately fill out this form to comply with tax laws and regulations. By providing detailed and accurate information, individuals and businesses can avoid potential penalties and ensure smooth tax filing process.