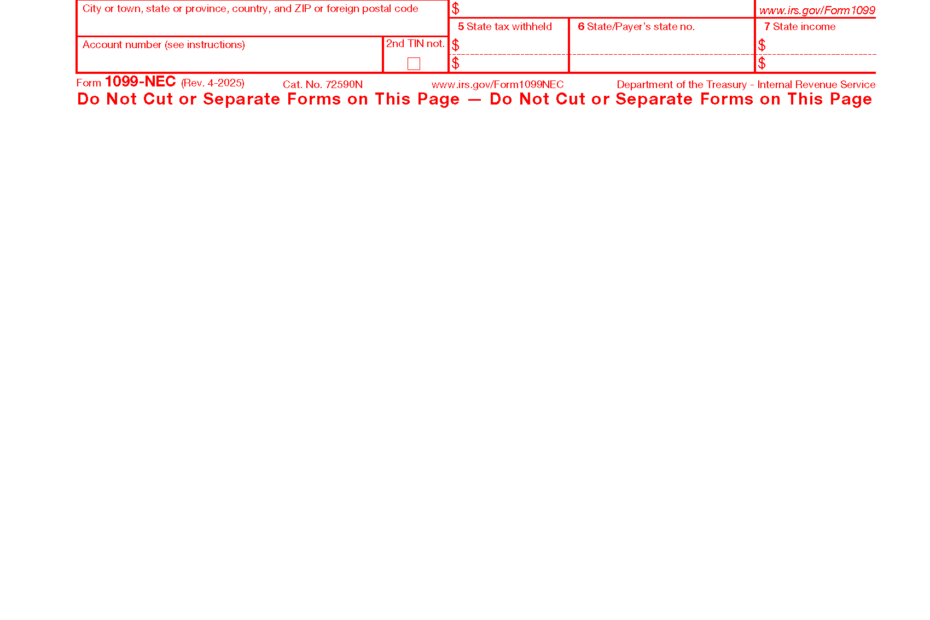

As tax season approaches, it’s important for businesses to be aware of the necessary forms they need to file with the IRS. One such form is the Printable 1099 NEC Form 2025, which is used to report nonemployee compensation.

Nonemployee compensation includes payments made to independent contractors, freelancers, or other non-employee individuals for services rendered. It is important for businesses to accurately report these payments to ensure compliance with IRS regulations.

Irs Printable 1099 Nec Form 2025

Irs Printable 1099 Nec Form 2025

Download and Print Irs Printable 1099 Nec Form 2025

The IRS Printable 1099 NEC Form 2025 is a crucial document that businesses must file to report nonemployee compensation. This form helps the IRS track income earned by individuals who are not considered employees of the business.

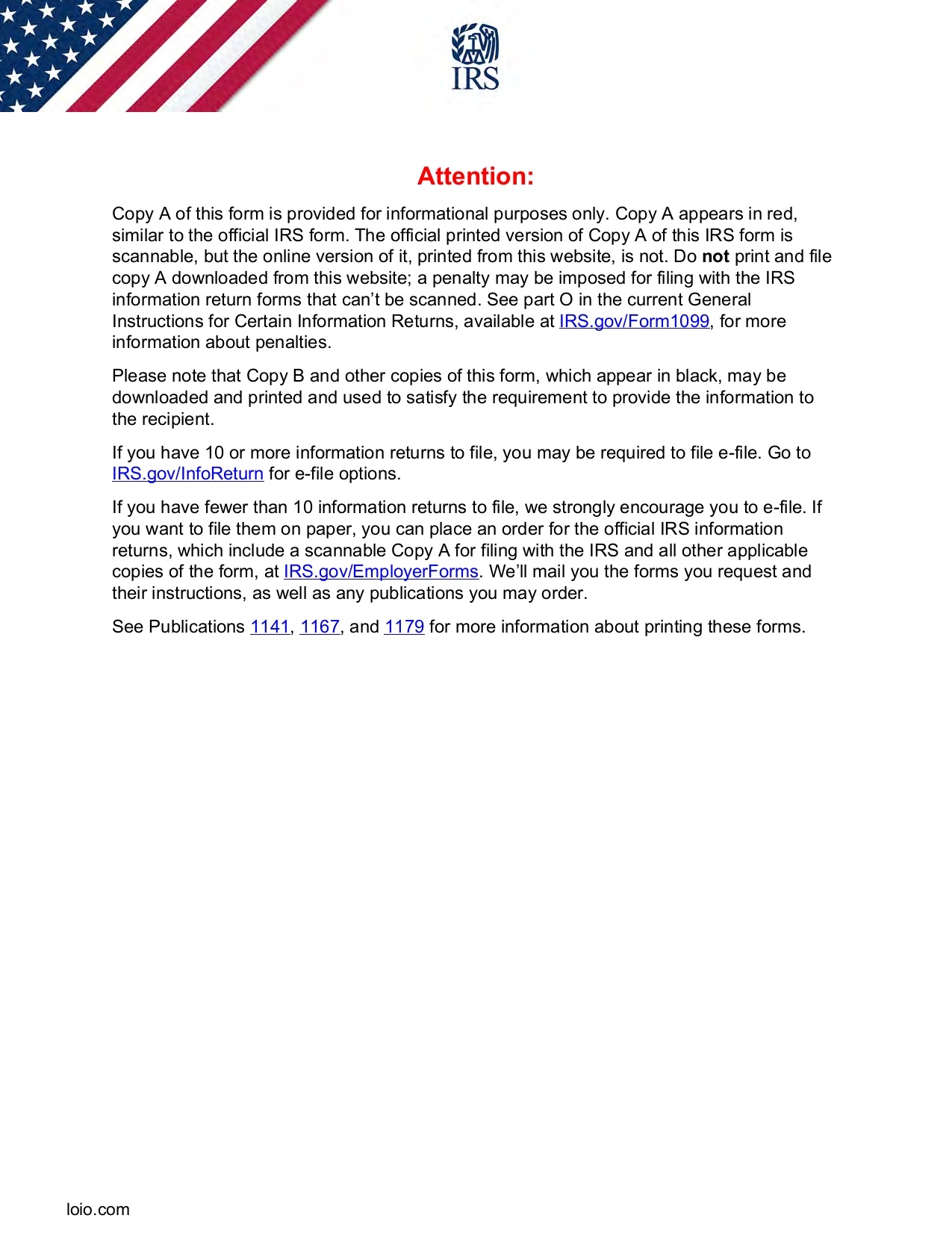

Businesses must provide a copy of the 1099 NEC Form to the recipient by January 31st of the following tax year. They must also submit a copy to the IRS by February 28th if filing by mail, or March 31st if filing electronically.

Failure to file the IRS Printable 1099 NEC Form 2025 or inaccurately reporting nonemployee compensation can result in penalties from the IRS. It is important for businesses to ensure they are accurately reporting these payments to avoid any potential issues.

Overall, the IRS Printable 1099 NEC Form 2025 is a crucial document for businesses to file when reporting nonemployee compensation. By accurately reporting these payments, businesses can ensure compliance with IRS regulations and avoid potential penalties.