As tax season approaches, it’s important for businesses to stay informed about any changes to IRS forms. One important form to be aware of is the IRS Printable 1099 NEC Form 2025. This form is used to report nonemployee compensation, such as payments made to independent contractors, freelancers, or other self-employed individuals.

Businesses are required to provide a copy of the 1099 NEC form to any nonemployee who received $600 or more in compensation during the tax year. This form is crucial for both the IRS and the recipient to accurately report income and pay any necessary taxes.

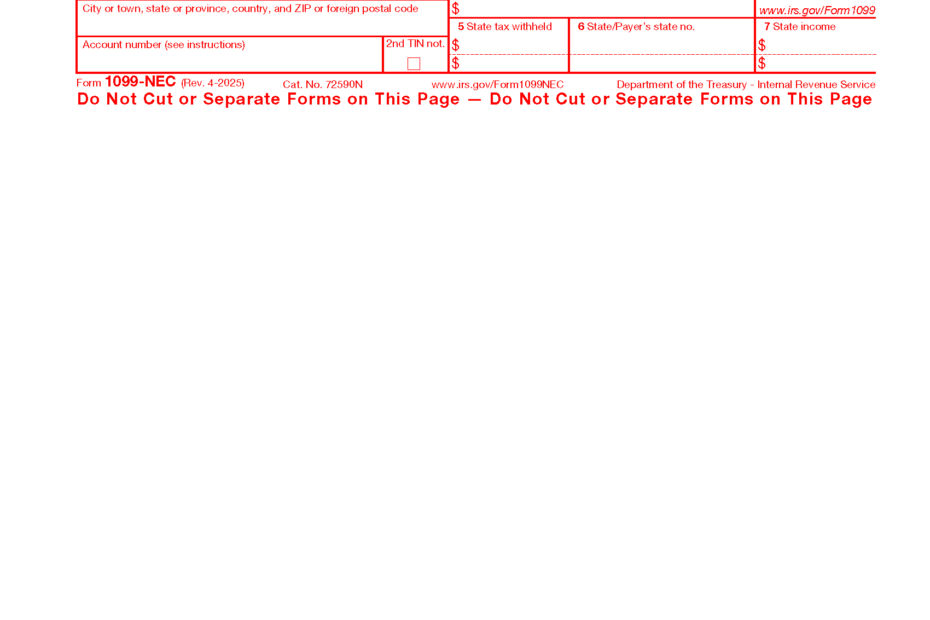

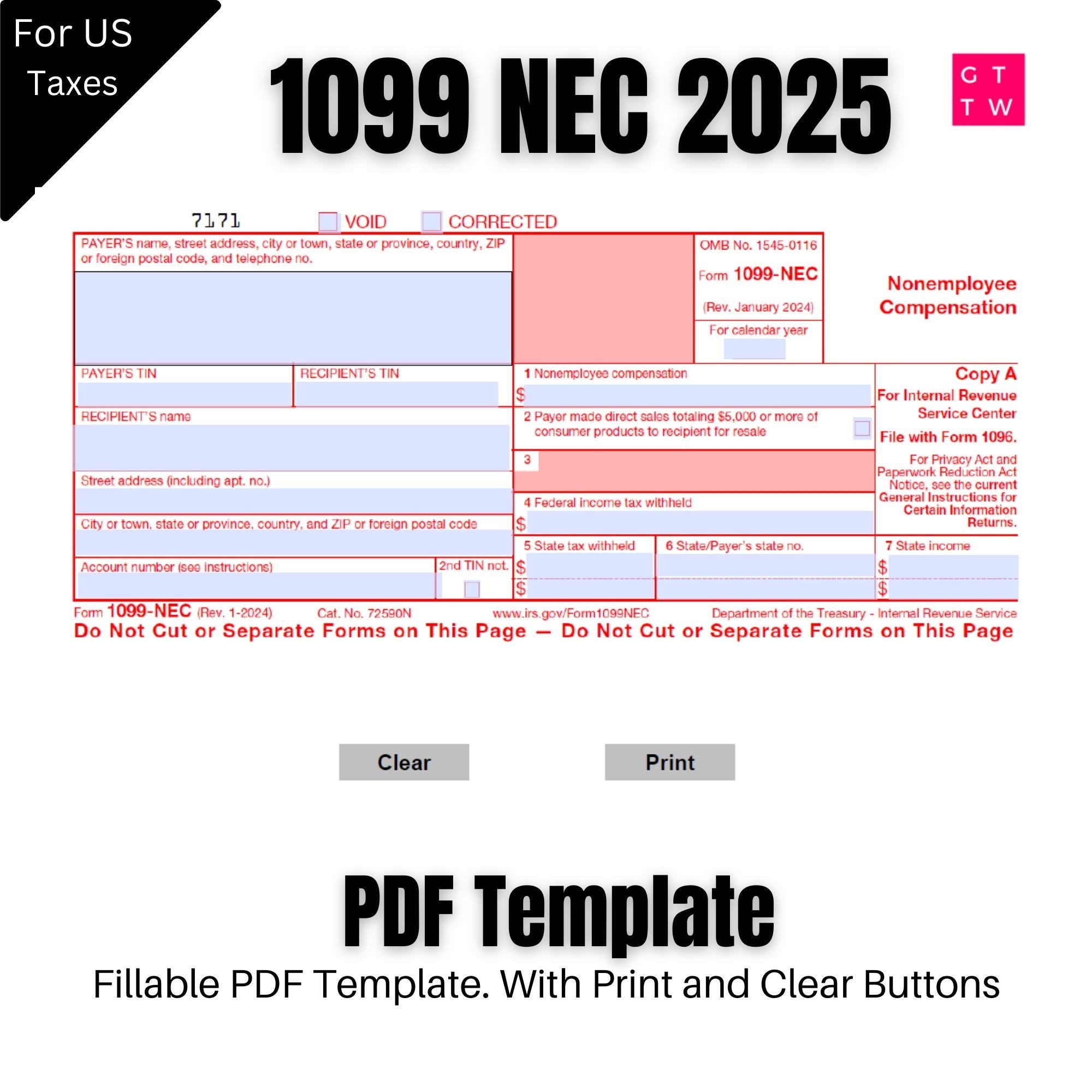

Irs Printable 1099 Nec Form 2025

Irs Printable 1099 Nec Form 2025

Save and Print Irs Printable 1099 Nec Form 2025

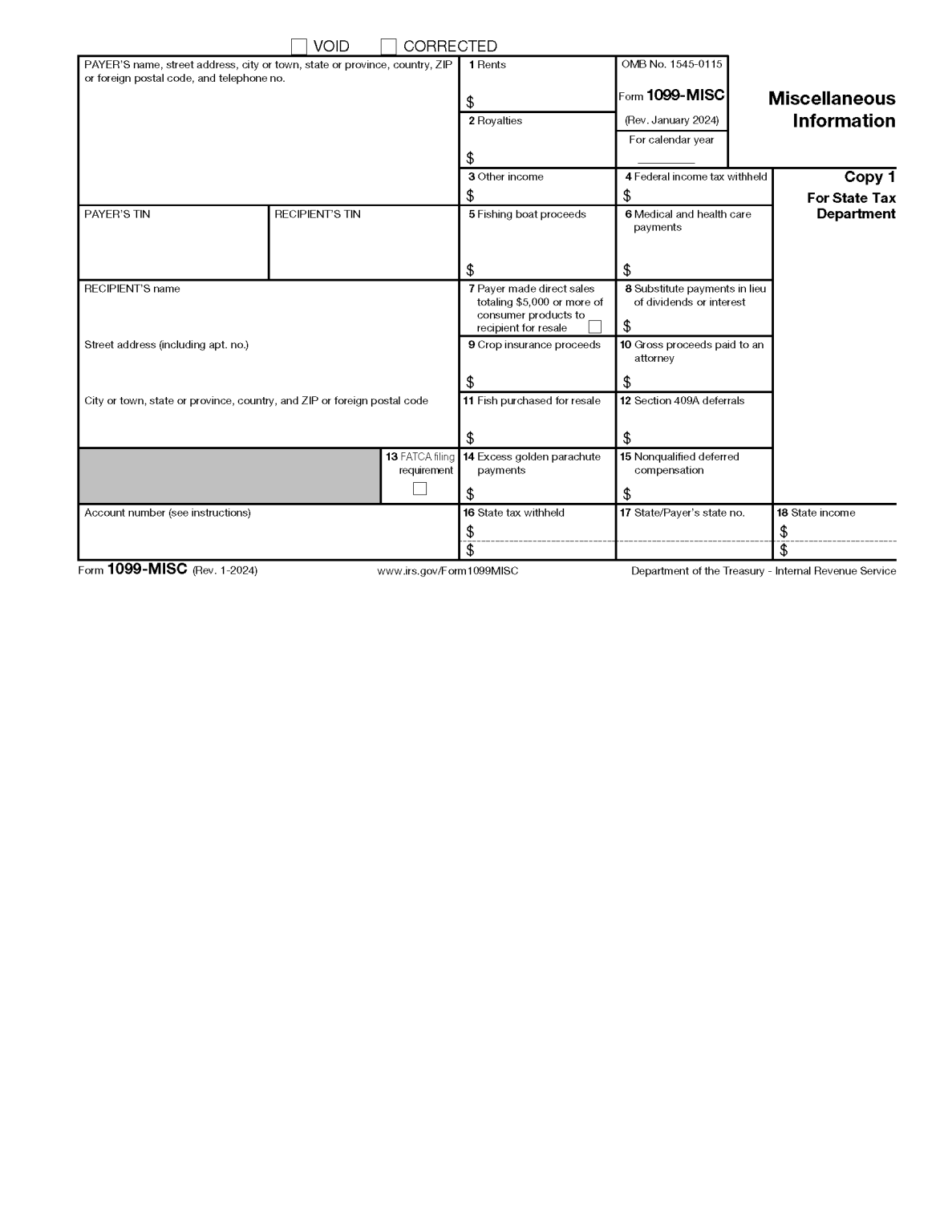

When filling out the IRS Printable 1099 NEC Form 2025, businesses will need to provide information such as the recipient’s name, address, and taxpayer identification number. They will also need to report the total amount of nonemployee compensation paid during the year. It’s important to ensure that all information is accurate and up-to-date to avoid any potential penalties or fines.

Businesses can easily access and download the IRS Printable 1099 NEC Form 2025 from the IRS website. The form can then be filled out electronically or printed and filled out by hand. Once completed, businesses will need to send a copy of the form to both the IRS and the recipient by the required deadline.

Overall, staying compliant with IRS regulations is essential for businesses of all sizes. By understanding and correctly filling out forms such as the IRS Printable 1099 NEC Form 2025, businesses can avoid costly mistakes and ensure that they are meeting their tax obligations. It’s always a good idea to consult with a tax professional if you have any questions or concerns about your tax reporting requirements.

In conclusion, the IRS Printable 1099 NEC Form 2025 is a vital tool for businesses to report nonemployee compensation accurately. By being aware of the requirements and filling out the form correctly, businesses can stay in compliance with IRS regulations and avoid potential penalties. Make sure to download the form from the IRS website and submit it by the deadline to ensure a smooth tax season.

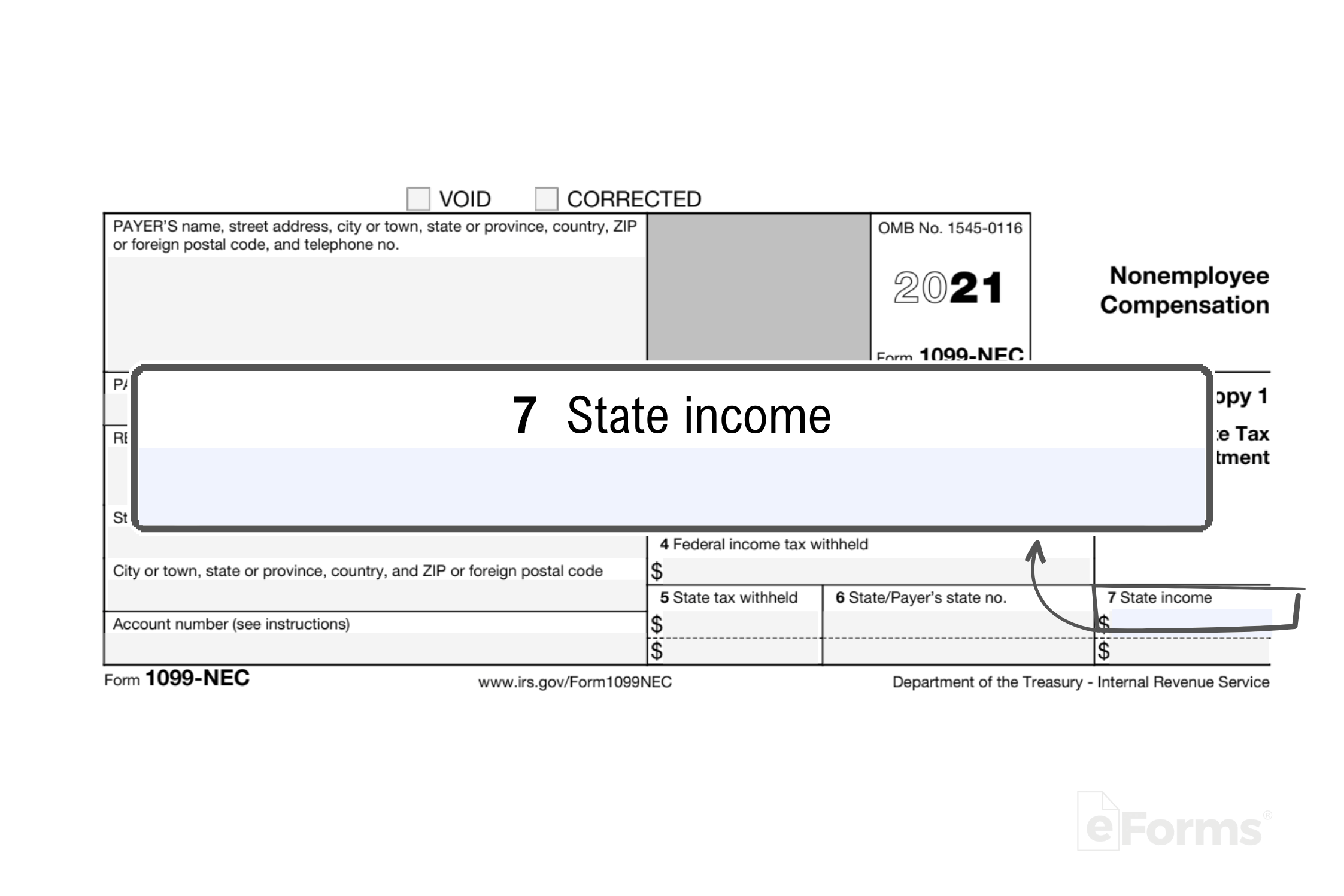

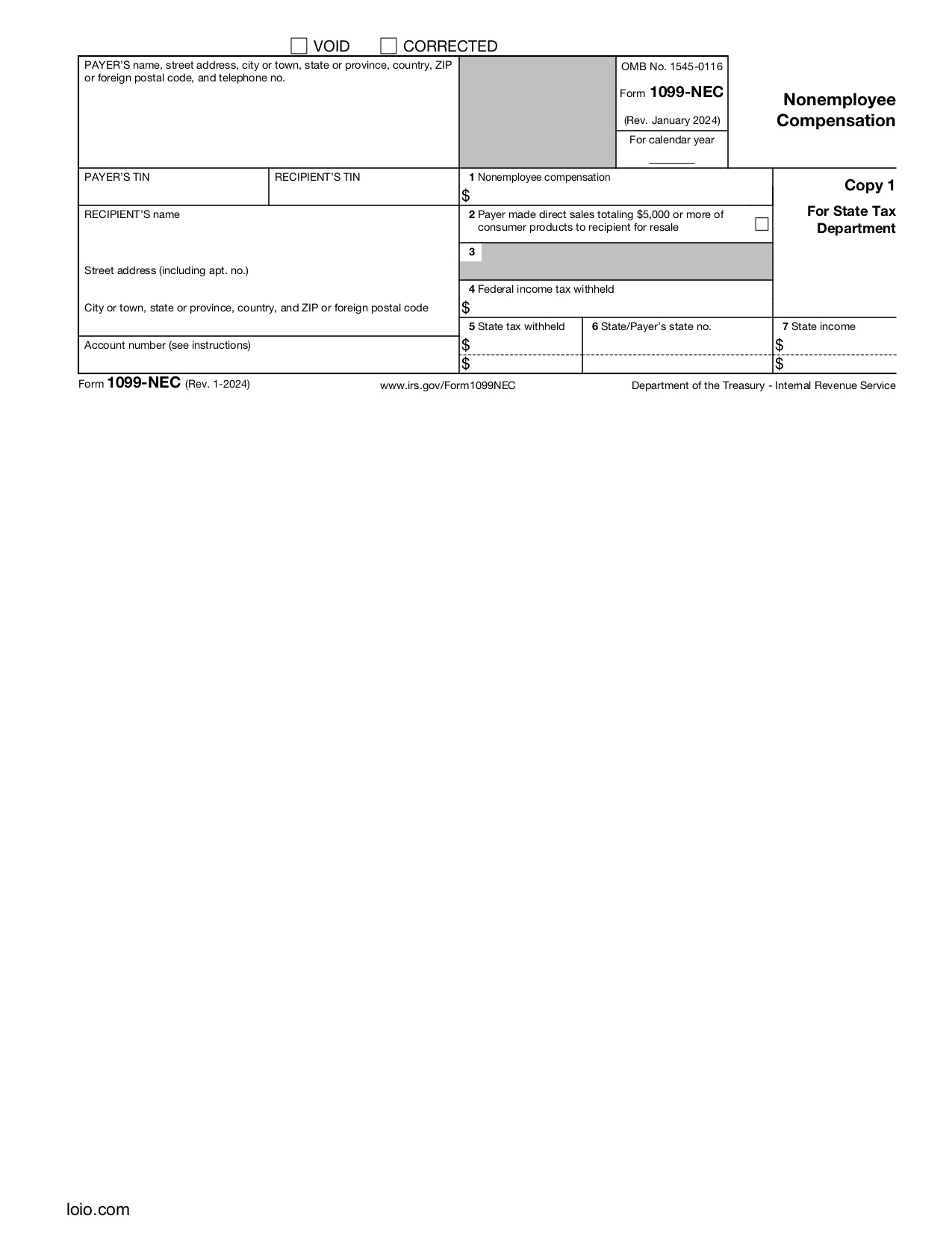

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

1099 NEC Editable PDF Fillable Template 2025 With Print And Clear Buttons Courier Font Etsy

1099 NEC Editable PDF Fillable Template 2025 With Print And Clear Buttons Courier Font Etsy

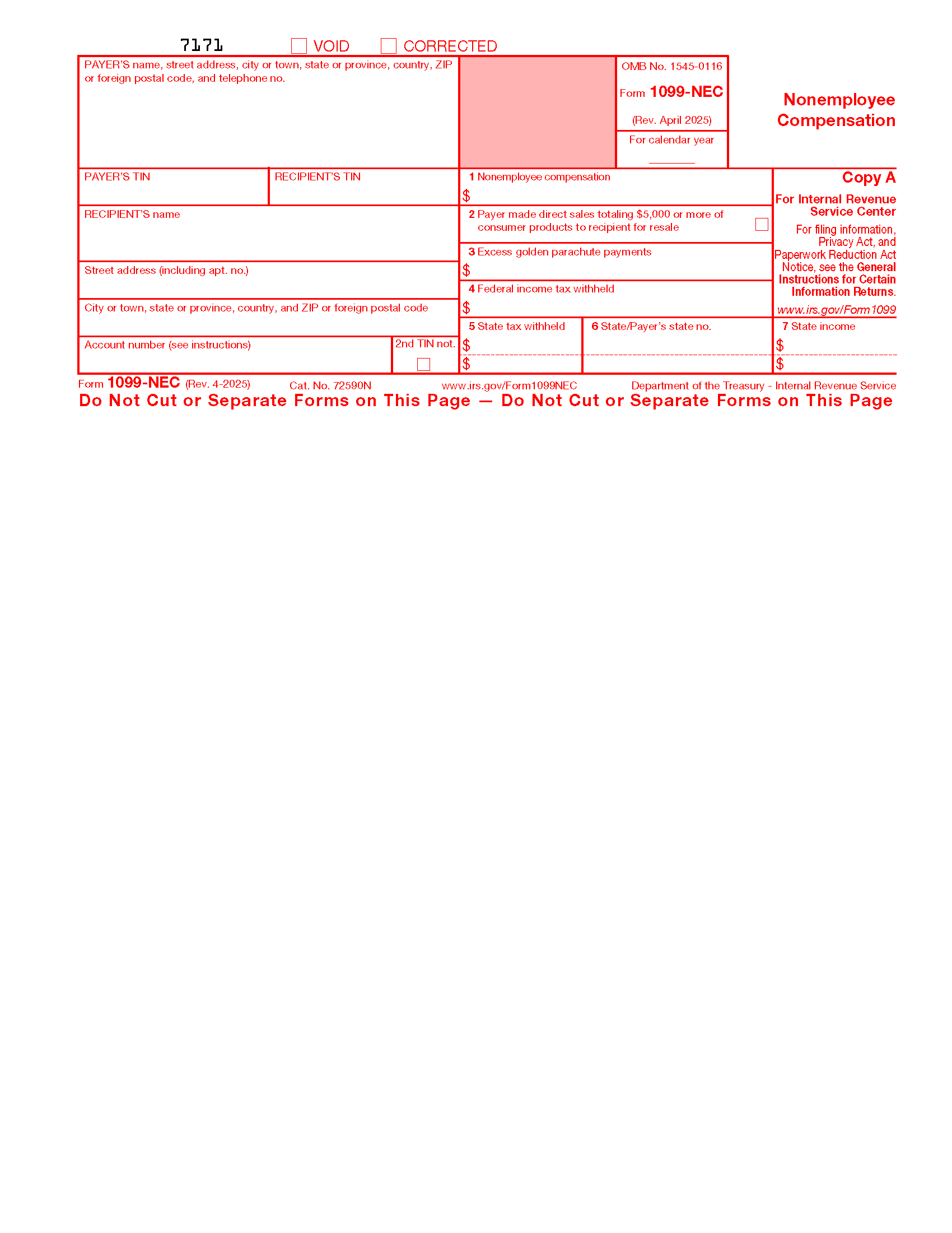

2025 IRS Form 1099 NEC Easy Filing For Contractors

2025 IRS Form 1099 NEC Easy Filing For Contractors

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Looking for a hassle-free way to handle your money matters? The Irs Printable 1099 Nec Form 2025 offer a simple, secure, and customizable alternative right from home. Whether for individual purposes, small enterprises, or keeping track of expenses, Irs Printable 1099 Nec Form 2025 save money and effort without compromising quality. Supports common finance software and designed for easy printing, they’re a smart choice to store-bought checks. Begin printing now and gain full control over your payments—no waiting, no fees. Check out our free templates and select the one that matches your purpose. With our intuitive tools, financial management has never been this streamlined. Access your free printable checks and simplify your check-writing process with ease!.