When it comes to tax season, one of the most important forms that individuals and businesses need to be aware of is the 1099-MISC form. This form is used to report miscellaneous income, such as payments made to independent contractors or rental income. It is crucial to accurately report this income to the IRS to avoid any penalties or audits.

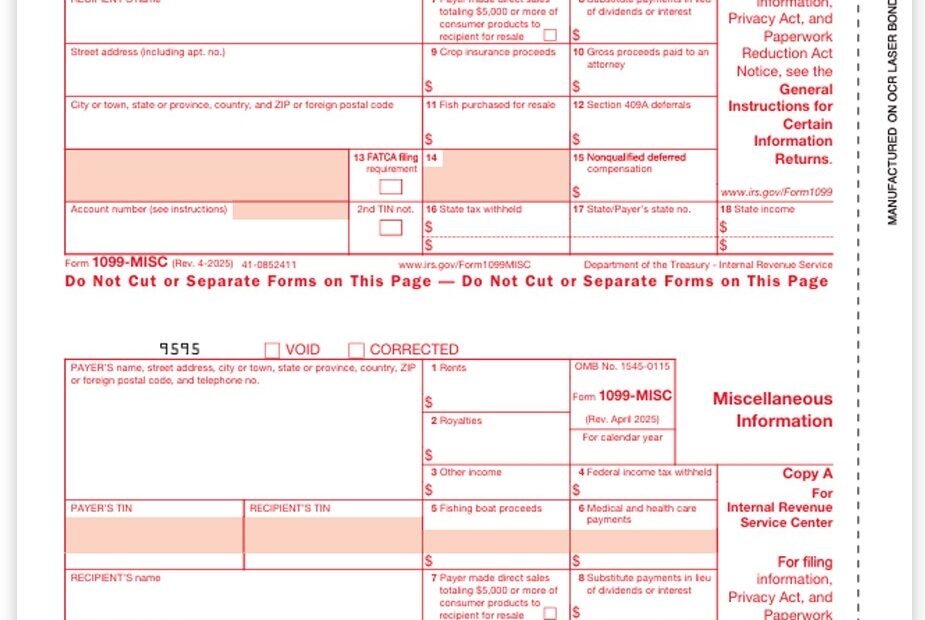

For those who need to file a 1099-MISC form, the IRS provides printable forms that can be easily accessed and filled out. These forms can be found on the IRS website or at various tax preparation websites. Having access to printable forms makes it convenient for individuals and businesses to report their income accurately and in a timely manner.

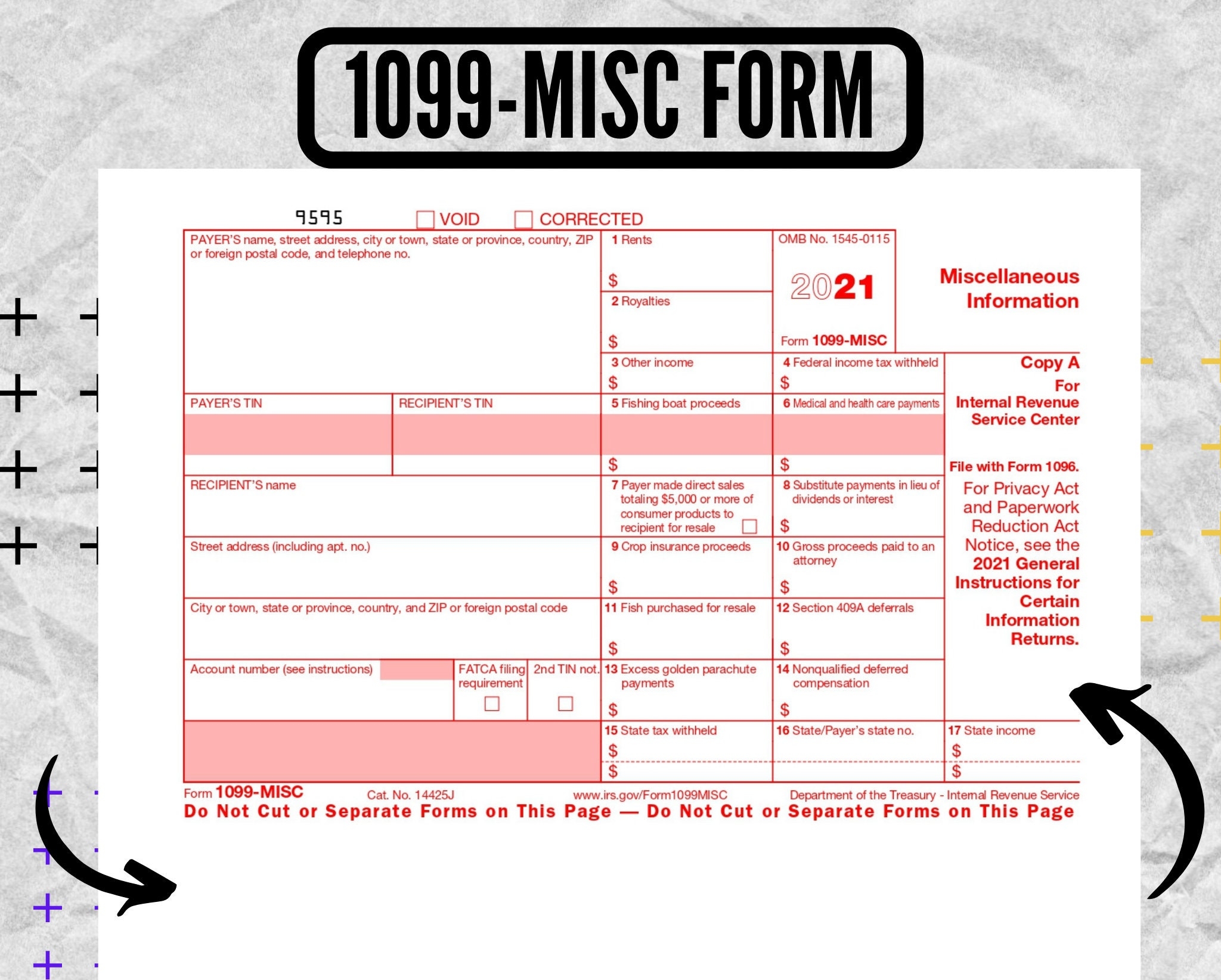

Save and Print Irs Printable 1099 Misc Forms

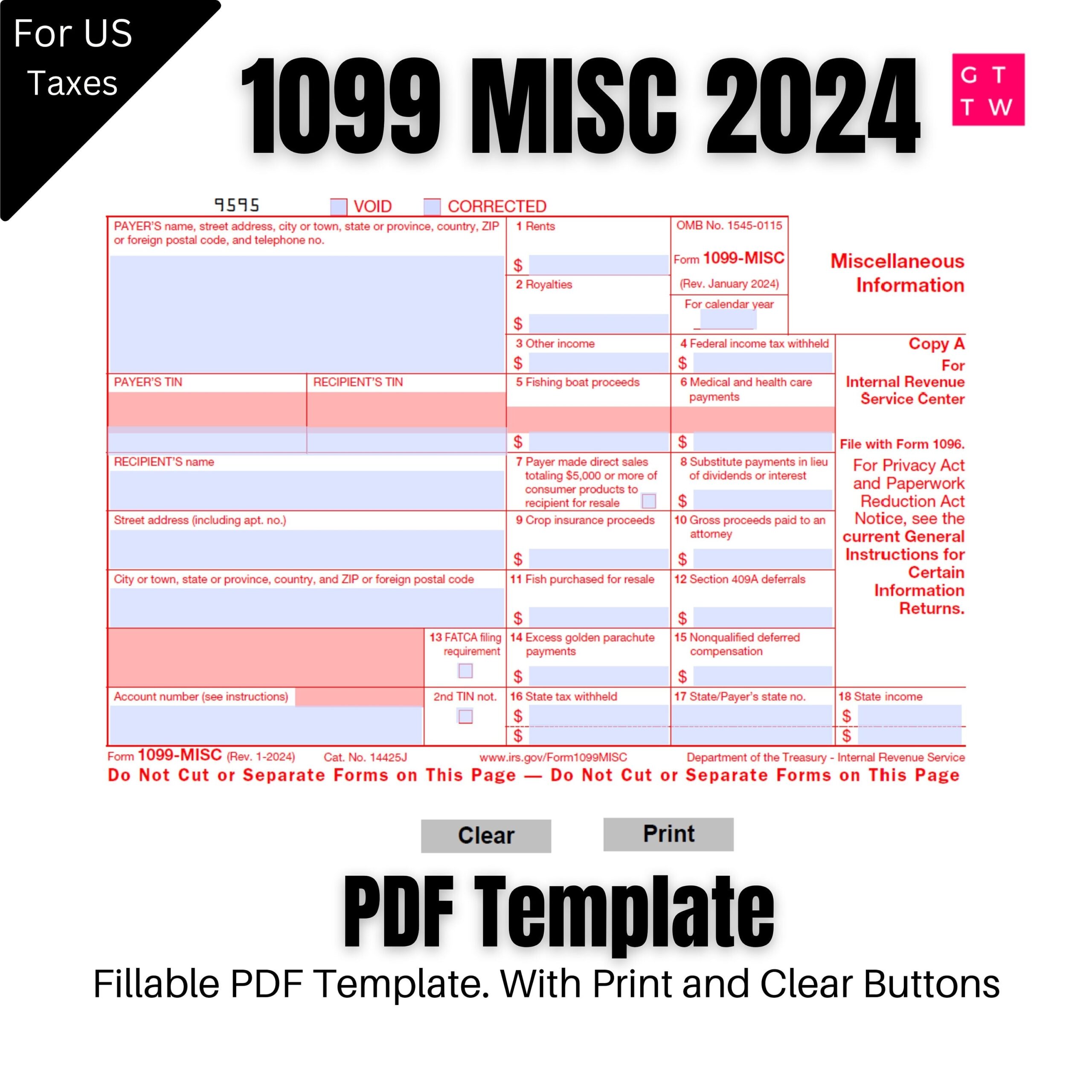

2024 1099 MISC Form Fillable Print Template Digital Download

2024 1099 MISC Form Fillable Print Template Digital Download

There are several important sections on the 1099-MISC form that need to be filled out, including the recipient’s name, address, and taxpayer identification number. Additionally, the form requires information about the type of income being reported and the total amount paid to the recipient. It is important to carefully review the form and ensure that all information is accurate before submitting it to the IRS.

One of the benefits of using printable 1099-MISC forms is that they can be filled out electronically, making it easier to submit them online. This saves time and reduces the chances of errors that can occur when filling out forms by hand. Additionally, printable forms can be saved and accessed for future reference, making it easier to keep track of income and expenses throughout the year.

Overall, having access to IRS printable 1099-MISC forms is essential for individuals and businesses who need to report miscellaneous income. By accurately completing and submitting these forms, taxpayers can ensure compliance with IRS regulations and avoid any potential penalties. It is important to stay organized and keep accurate records of income and expenses to make the tax filing process as smooth as possible.

In conclusion, utilizing IRS printable 1099-MISC forms is a convenient and efficient way to report miscellaneous income to the IRS. By carefully filling out these forms and submitting them on time, individuals and businesses can stay in compliance with tax regulations and avoid any potential issues with the IRS. Make sure to take advantage of these printable forms to make the tax filing process as seamless as possible.