Are you a freelancer or independent contractor who received income from a client or business? If so, you may need to file a 1099-MISC form with the IRS. This form is used to report miscellaneous income, such as payments for services rendered, rent, royalties, and prizes or awards. Filing this form accurately and on time is crucial to avoid penalties from the IRS.

Failure to report income on a 1099-MISC form can lead to hefty fines and penalties. It is important to understand the requirements and deadlines for filing this form to stay compliant with IRS regulations. Luckily, the IRS provides printable 1099-MISC forms that make it easy for freelancers and contractors to report their income.

Download and Print Irs Printable 1099 Misc Form

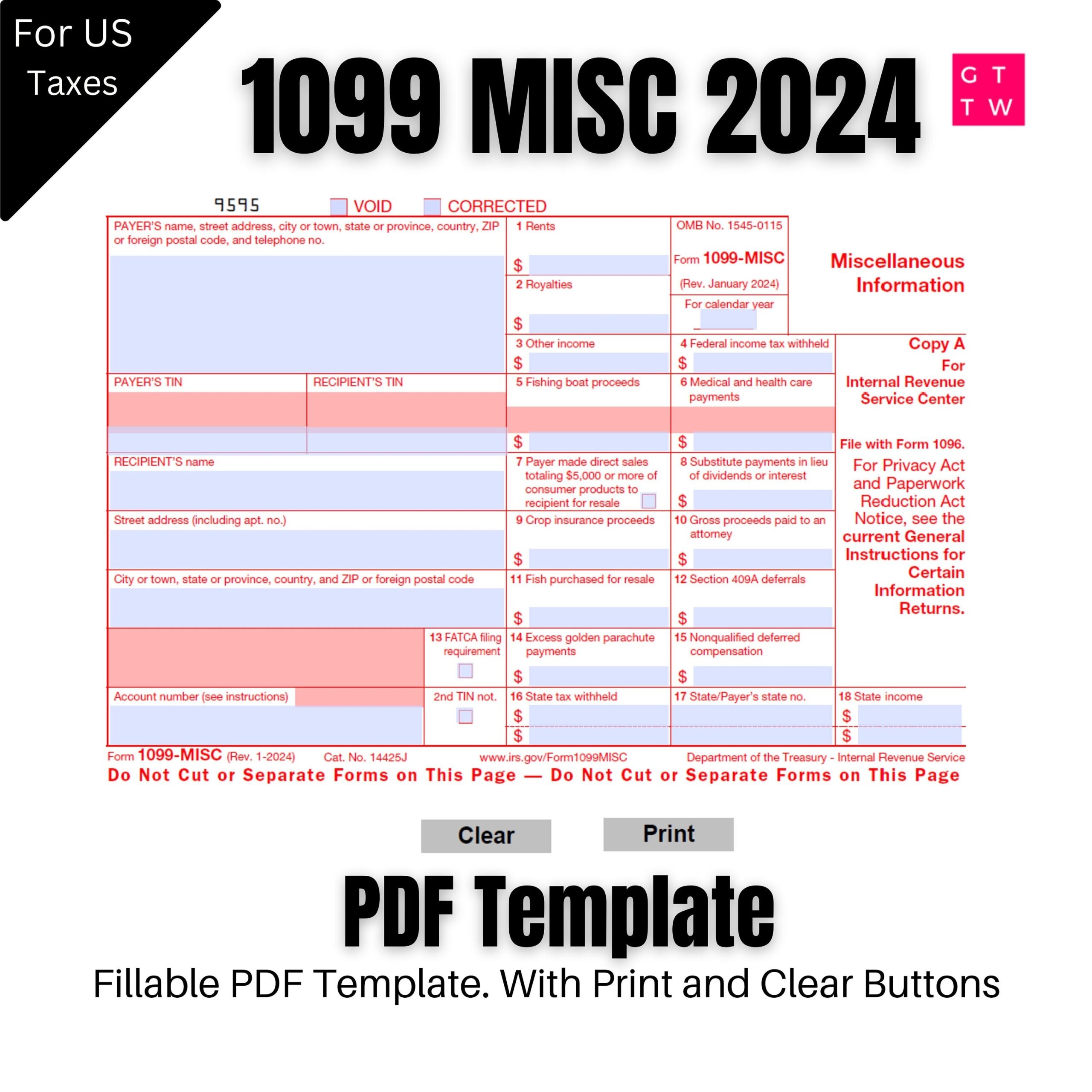

2024 1099 MISC Form Fillable Print Template Digital Download Etsy

2024 1099 MISC Form Fillable Print Template Digital Download Etsy

Irs Printable 1099 Misc Form

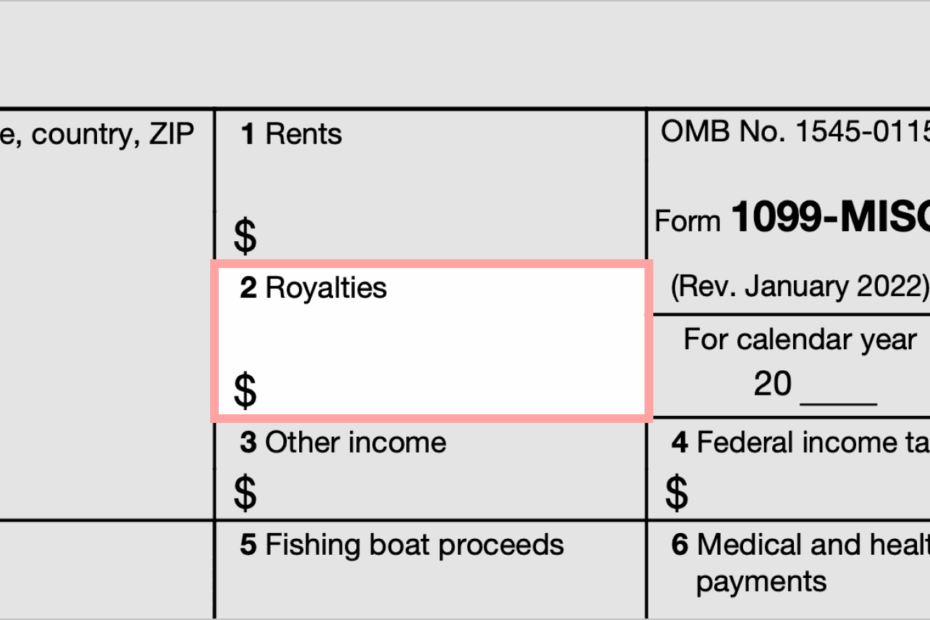

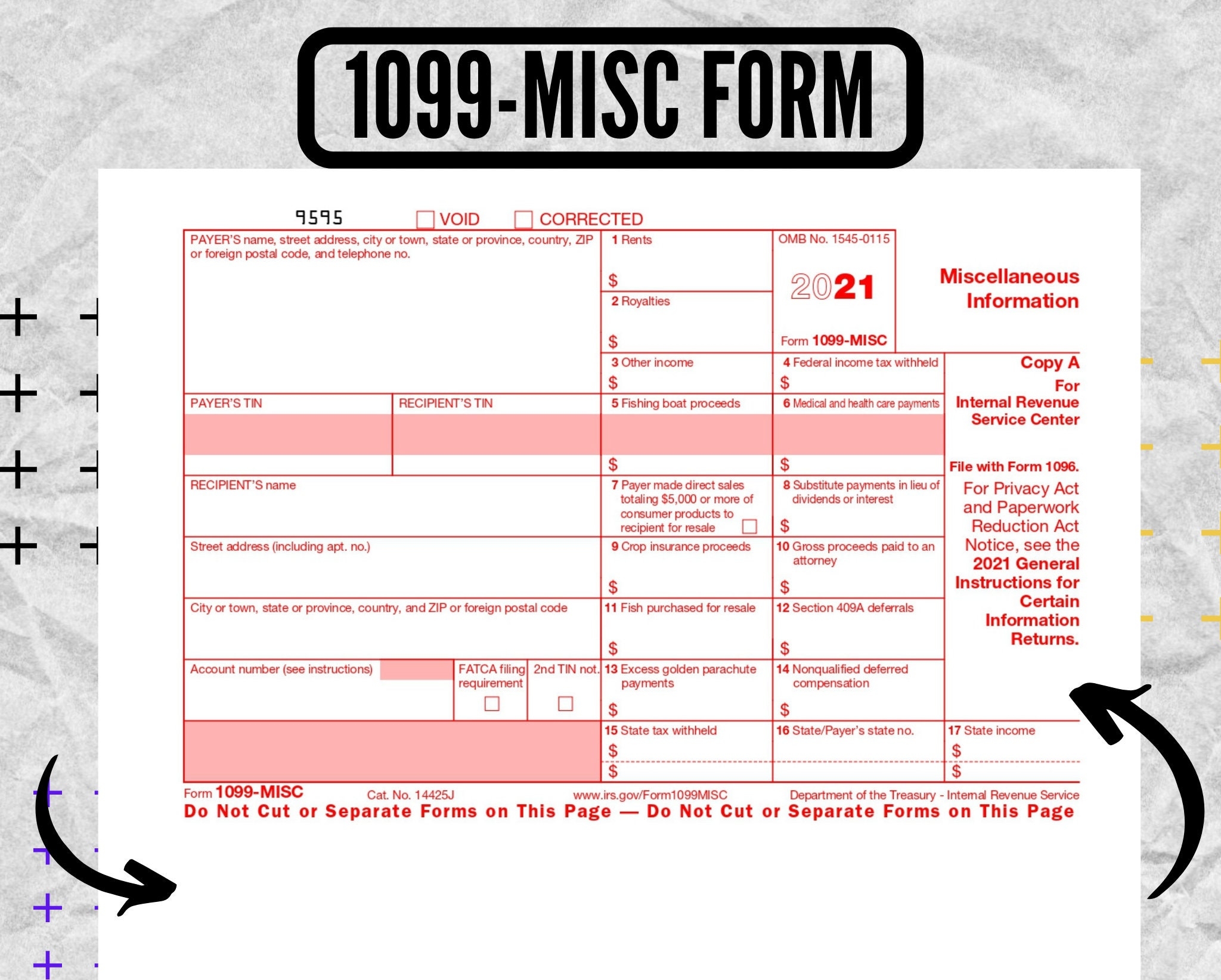

The IRS printable 1099-MISC form is a simple and straightforward document that allows individuals to report their miscellaneous income accurately. The form includes sections for the payer’s information, recipient’s information, and details about the income received. It is crucial to fill out this form correctly to avoid any discrepancies or issues with the IRS.

When filling out the 1099-MISC form, make sure to include all sources of income, even if they are small amounts. Any income over $600 must be reported on this form. It is also important to double-check all information before submitting the form to ensure accuracy.

Once the form is completed, it can be filed electronically or mailed to the IRS. The deadline for filing 1099-MISC forms is typically January 31st, so it is essential to submit the form on time to avoid any penalties. Keep in mind that failure to file this form or submitting inaccurate information can result in fines from the IRS.

In conclusion, the IRS printable 1099-MISC form is a valuable tool for freelancers and independent contractors to report their miscellaneous income accurately. By understanding the requirements and deadlines for filing this form, individuals can avoid penalties and stay compliant with IRS regulations. Make sure to fill out the form correctly and submit it on time to ensure a smooth tax season.