When it comes to filing your taxes, the process can often feel overwhelming. However, with the right tools and resources, you can simplify the process and ensure that you are submitting your information accurately and on time. One such tool that can help streamline your tax filing is the IRS Printable 1040EZ Form.

The IRS Printable 1040EZ Form is a simplified version of the standard 1040 form, designed for individuals with straightforward tax situations. This form is typically used by individuals who have no dependents, do not itemize deductions, and have a taxable income of less than $100,000. By using this form, you can easily report your income, claim any deductions or credits you may be eligible for, and calculate your tax liability in a straightforward manner.

Quickly Access and Print Irs Printable 1040ez Form

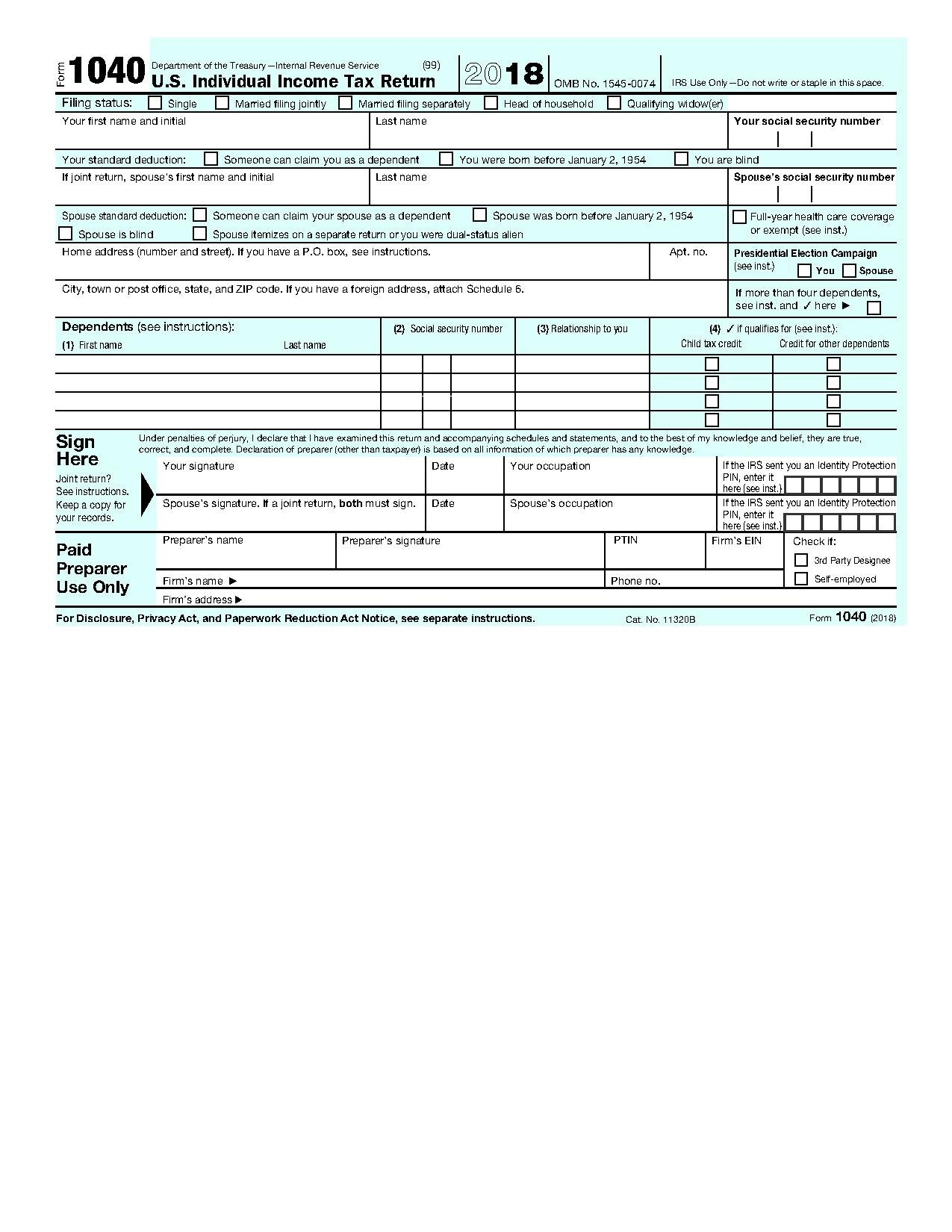

File IRS Form 1040 2018 Pdf Wikimedia Commons

File IRS Form 1040 2018 Pdf Wikimedia Commons

Irs Printable 1040ez Form

One of the key advantages of using the IRS Printable 1040EZ Form is its simplicity. The form is only two pages long and requires minimal calculations, making it easy to fill out and submit. Additionally, the form is available for download on the IRS website, allowing you to access it at any time and from any location.

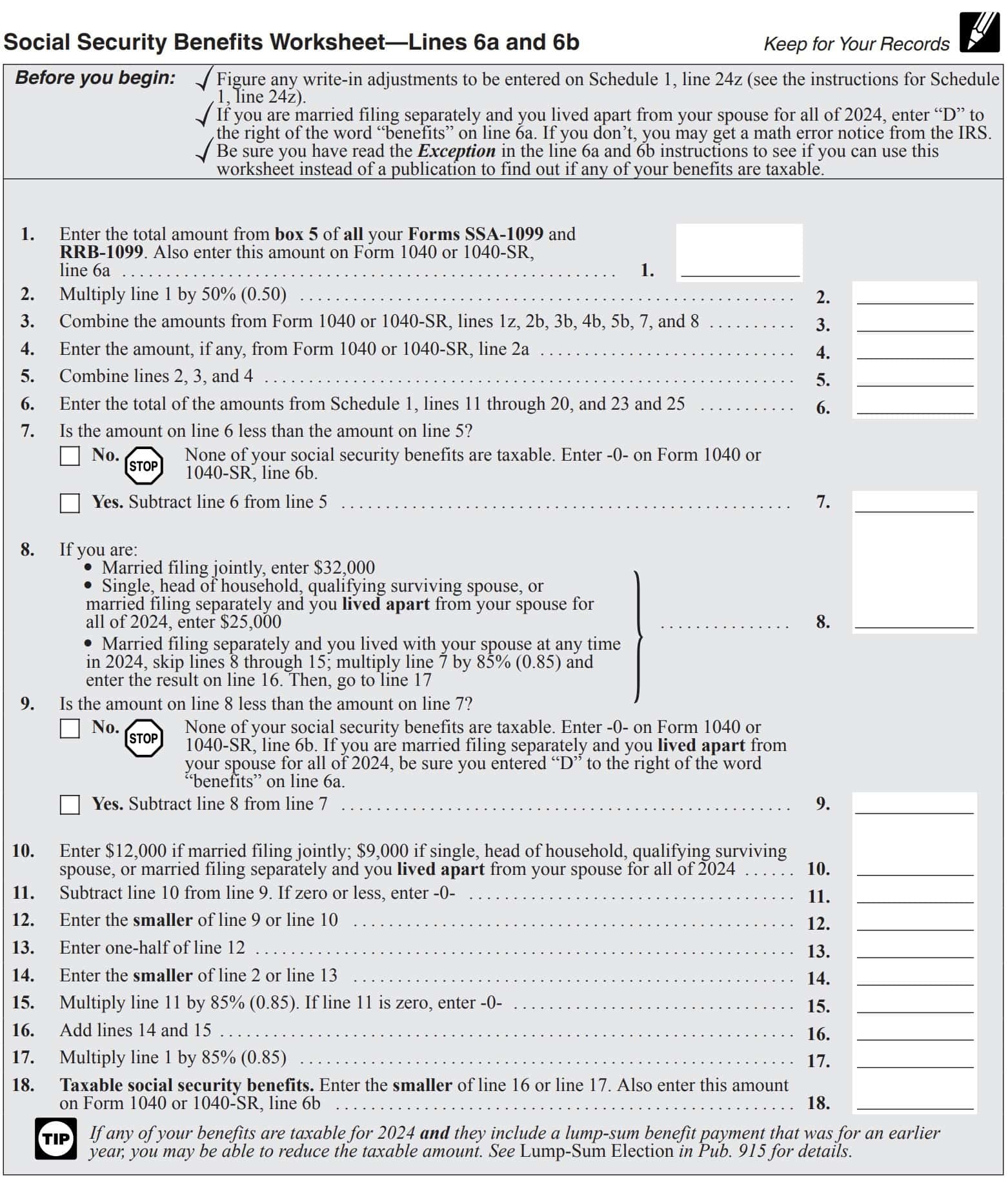

When filling out the IRS Printable 1040EZ Form, it is important to ensure that you provide accurate and up-to-date information. This includes reporting all sources of income, claiming any deductions or credits you may be eligible for, and double-checking your calculations before submitting the form. By taking the time to carefully review your information, you can avoid any errors or discrepancies that may delay the processing of your tax return.

Once you have completed the IRS Printable 1040EZ Form, you can either file it electronically or mail it to the IRS. If you choose to file electronically, you can use IRS-approved software or online platforms to submit your form quickly and securely. If you prefer to mail your form, be sure to send it to the appropriate IRS address based on your location and follow any additional instructions provided by the IRS.

In conclusion, the IRS Printable 1040EZ Form is a valuable resource for individuals with simple tax situations who want to streamline the filing process. By using this form, you can accurately report your income, claim any deductions or credits you may be eligible for, and calculate your tax liability efficiently. Be sure to take advantage of this tool when filing your taxes to ensure a smooth and stress-free experience.