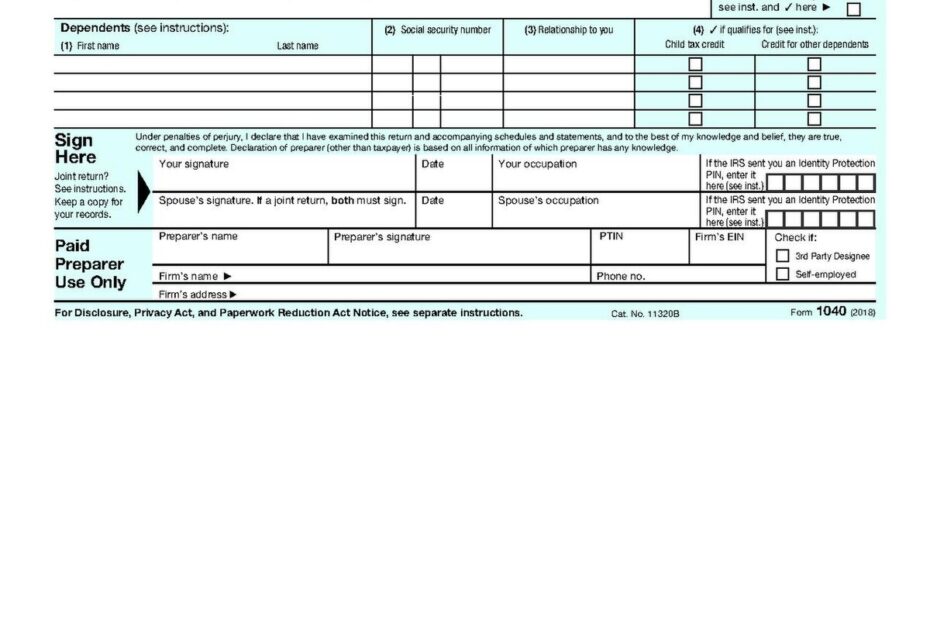

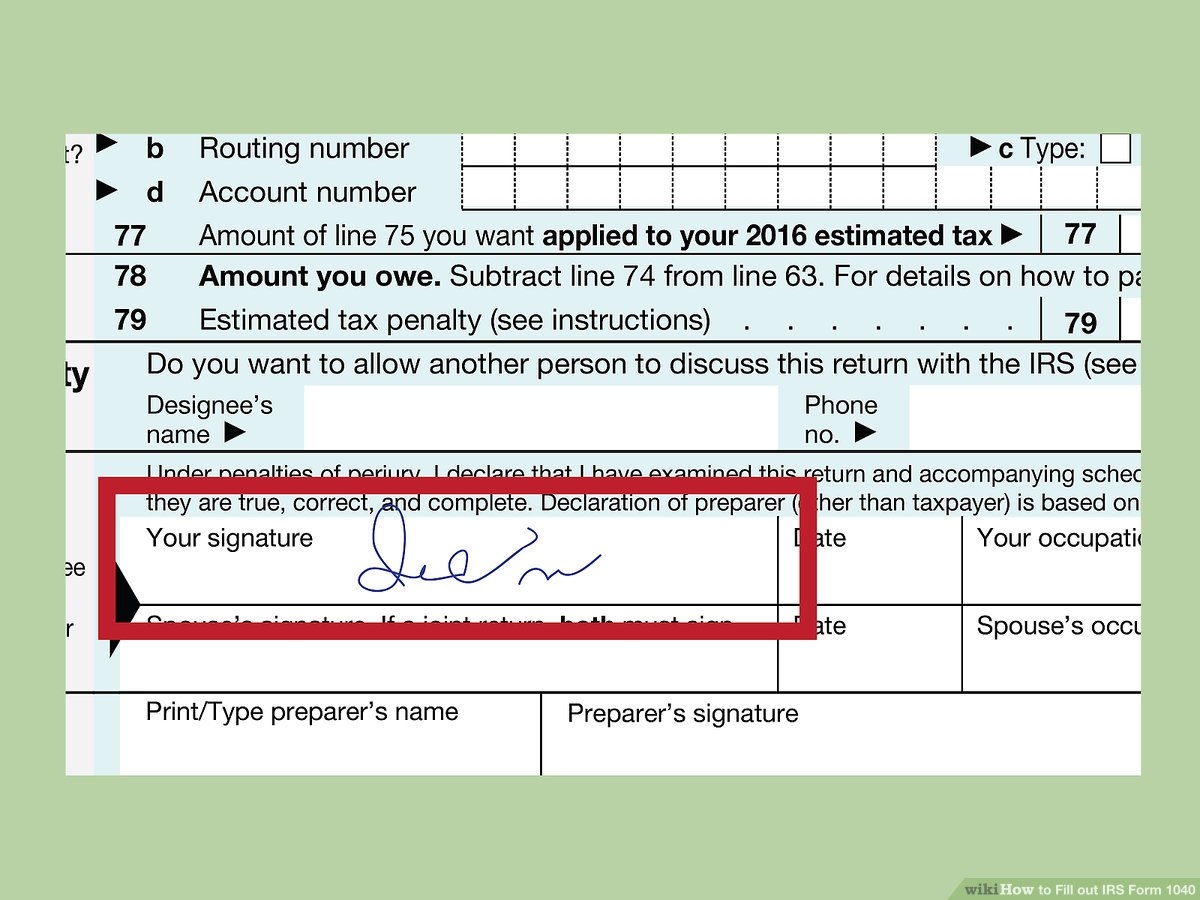

When it comes to filing your taxes, the IRS Printable 1040 Tax Form is an essential document that you need to have. This form is used by individuals to report their income, deductions, and credits to determine the amount of tax they owe or the refund they can expect. It is important to ensure that you fill out this form accurately and submit it on time to avoid any penalties or interest charges.

Using the IRS Printable 1040 Tax Form is a straightforward process that can be done either online or by mail. This form allows you to report all sources of income, including wages, self-employment income, and investment income. It also provides a way for you to claim deductions and credits that you may be eligible for, such as the Earned Income Tax Credit or the Child Tax Credit.

Get and Print Irs Printable 1040 Tax Form

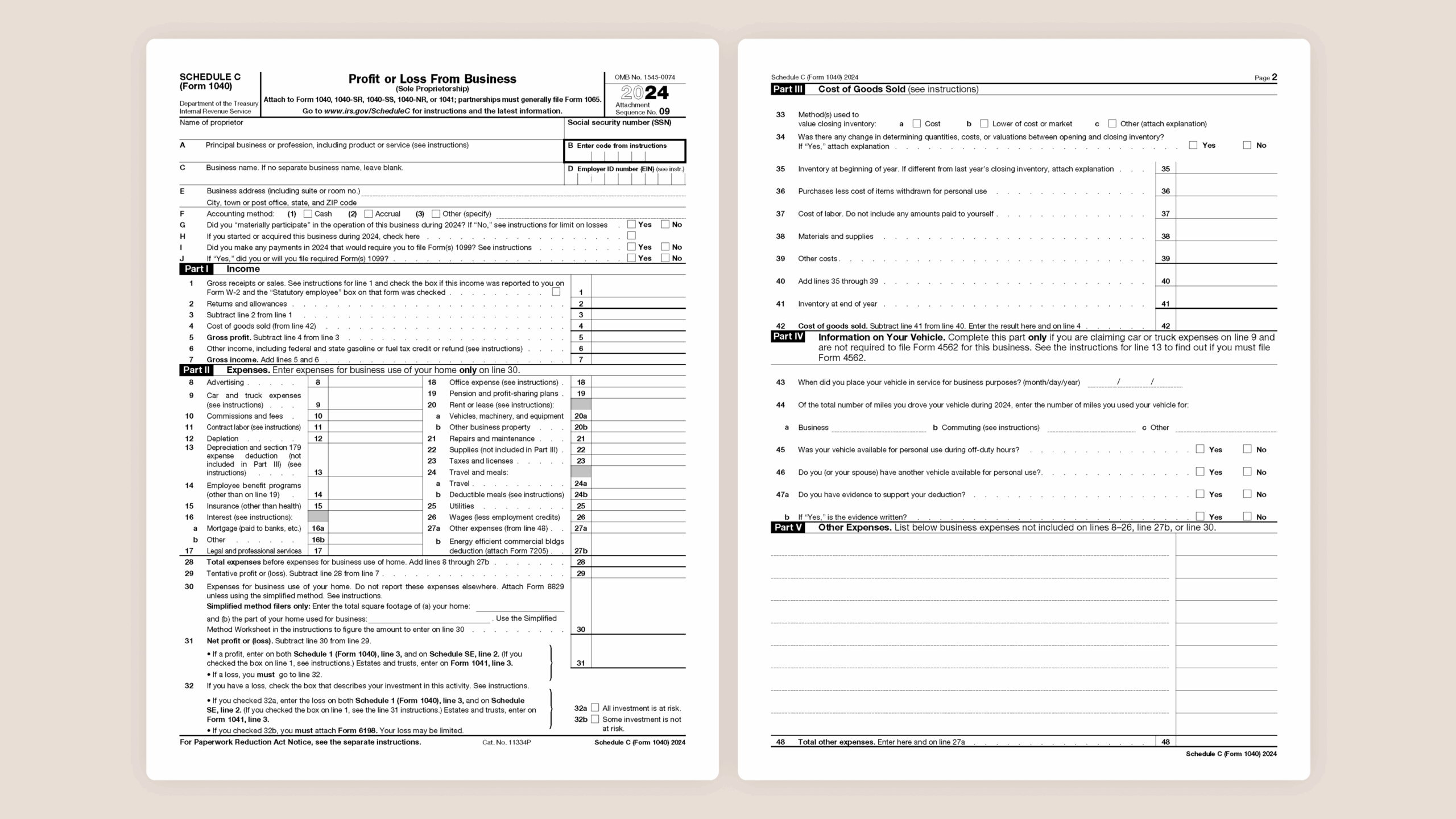

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

Irs Printable 1040 Tax Form

One of the key benefits of using the IRS Printable 1040 Tax Form is that it helps you organize your financial information in a systematic way. By filling out this form, you can track your income and expenses throughout the year, making it easier to file your taxes accurately. Additionally, the 1040 form provides instructions and guidance on how to complete each section, ensuring that you do not miss any important details.

Another advantage of using the IRS Printable 1040 Tax Form is that it allows you to take advantage of various tax breaks and deductions that can lower your tax liability. By carefully reviewing the instructions and requirements for each deduction or credit, you can maximize your tax savings and potentially receive a larger refund. This form also provides a summary of your tax return, making it easier to review and verify the information before submitting it to the IRS.

In conclusion, the IRS Printable 1040 Tax Form is an essential tool for individuals to report their income and taxes accurately. By using this form, you can ensure that you are fulfilling your tax obligations and taking advantage of any available deductions or credits. Make sure to file your taxes on time and avoid any penalties by using the IRS Printable 1040 Tax Form.