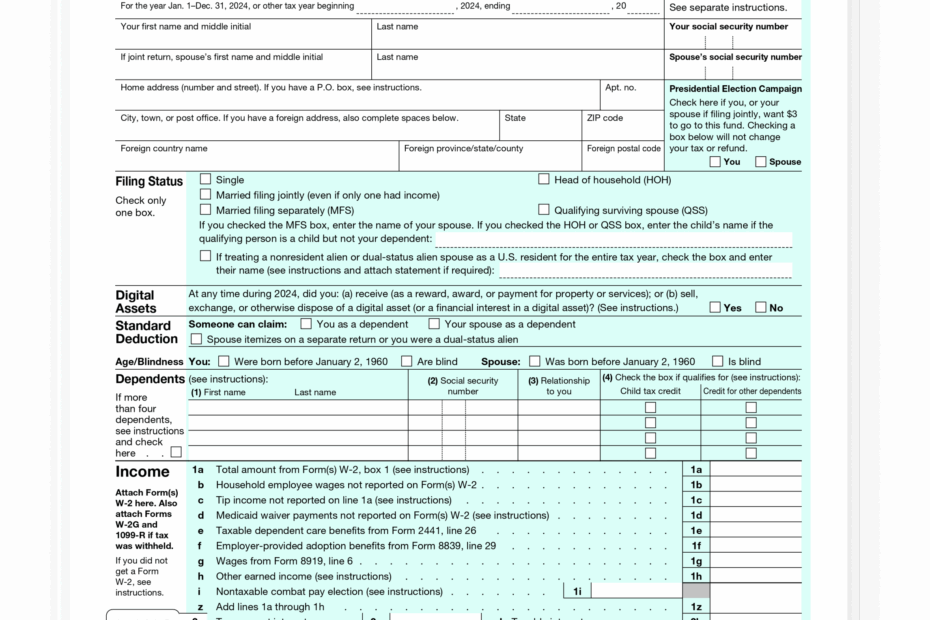

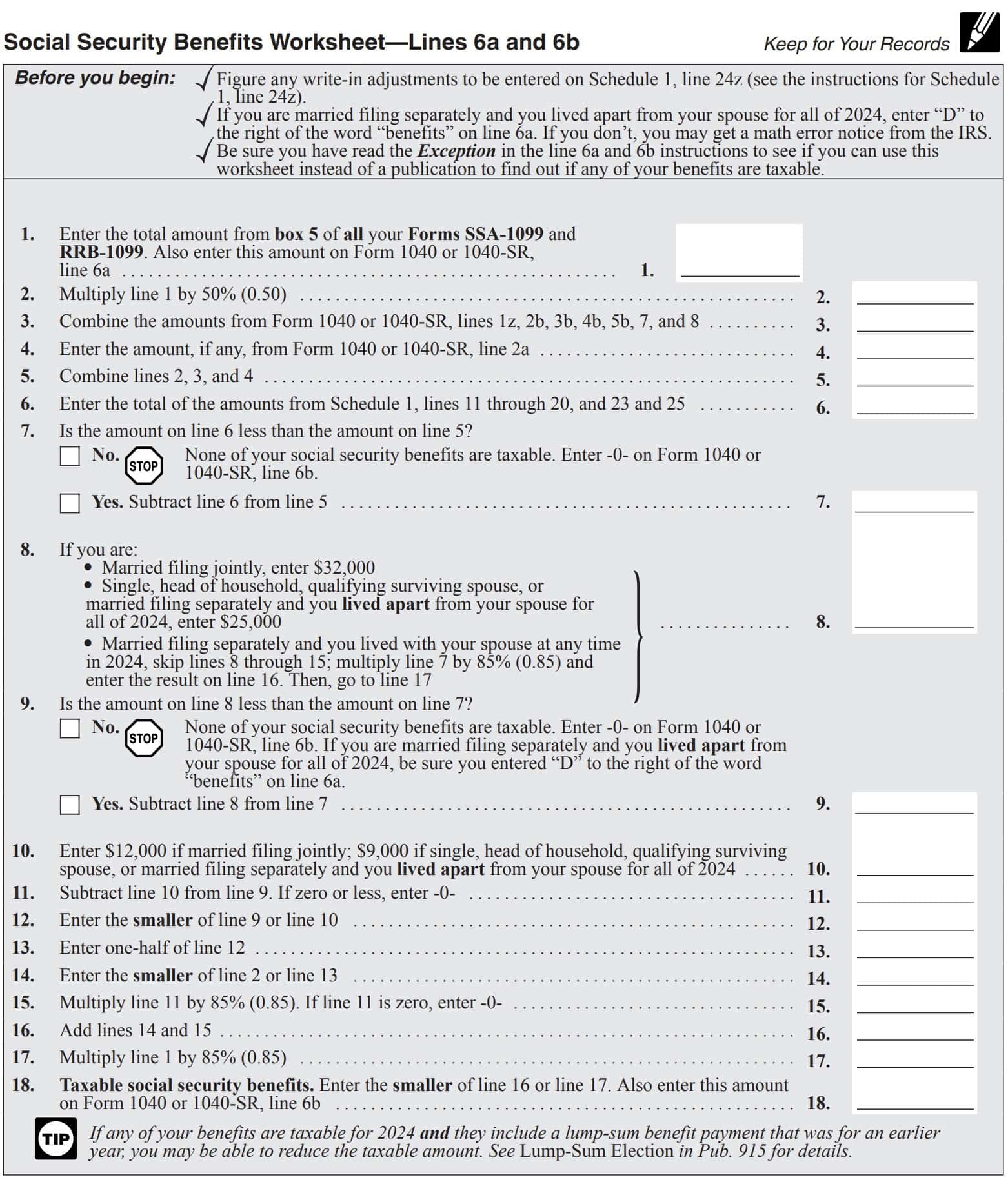

When it comes to filing your taxes, the Irs Printable 1040 Form is a crucial document that you need to have on hand. This form is used by individuals to report their annual income to the Internal Revenue Service (IRS) and determine how much tax they owe. It is essential for accurately calculating your tax liability and ensuring that you are in compliance with federal tax laws.

By filling out the Irs Printable 1040 Form, you can report various sources of income, such as wages, salaries, tips, and self-employment earnings. You can also claim deductions and credits that you are eligible for, which can help reduce your overall tax bill. This form is designed to be user-friendly and straightforward, making it easy for individuals to navigate and complete.

Get and Print Irs Printable 1040 Form

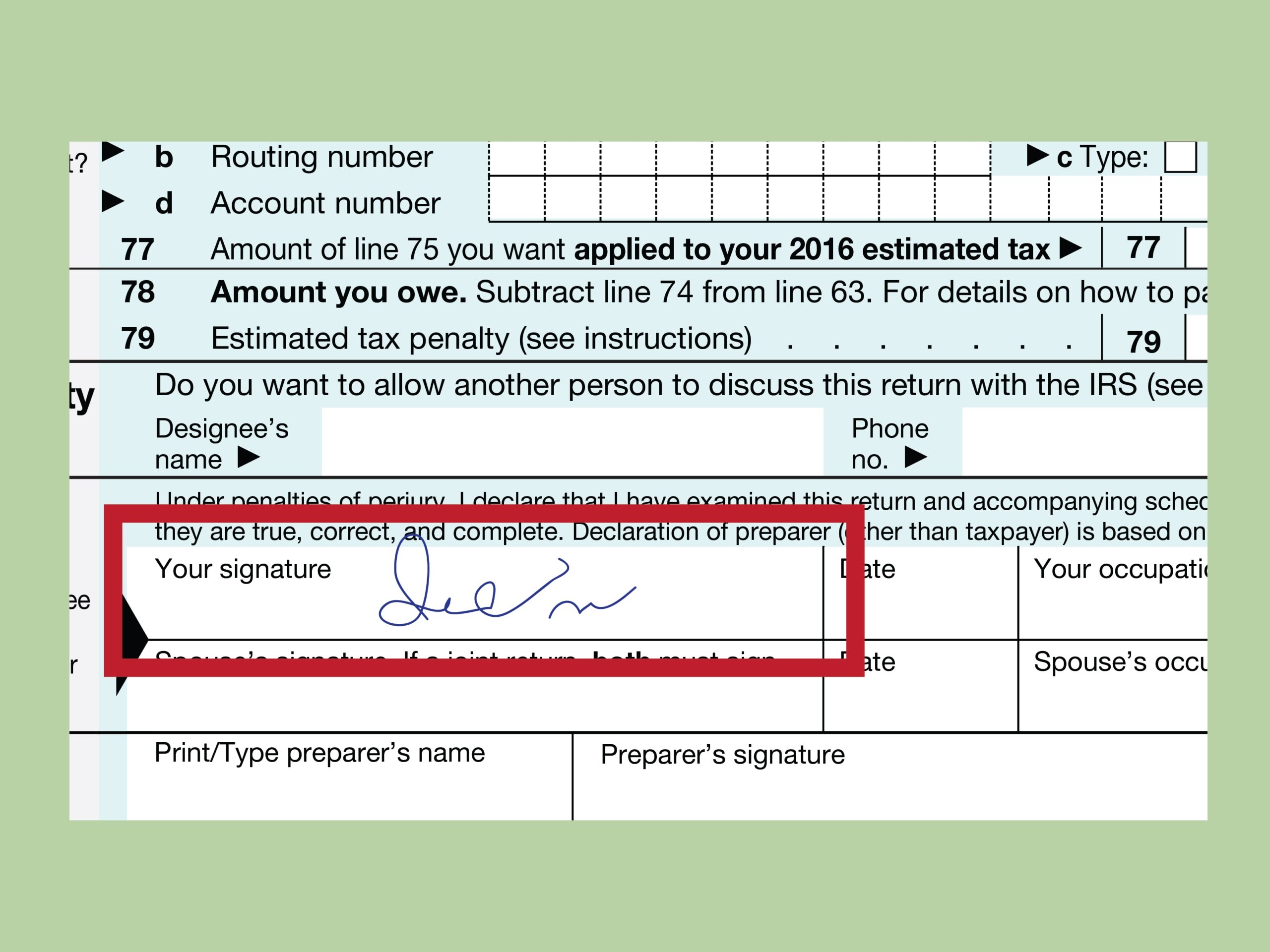

How To Fill Out IRS Form 1040 With Pictures WikiHow

How To Fill Out IRS Form 1040 With Pictures WikiHow

One of the key benefits of the Irs Printable 1040 Form is that it allows you to file your taxes electronically, which can help expedite the processing of your return and ensure that you receive any refunds in a timely manner. Additionally, having a printable version of the form allows you to keep a record of your tax information for future reference.

It is important to note that the Irs Printable 1040 Form may undergo changes from year to year, so it is essential to download the most up-to-date version from the IRS website. This ensures that you are using the correct form and are in compliance with any new tax laws or regulations that may have been implemented.

In conclusion, the Irs Printable 1040 Form is a vital tool for individuals to accurately report their income and calculate their tax liability. By using this form, you can ensure that you are in compliance with federal tax laws and avoid any potential penalties or fines. Make sure to download the latest version of the form each year and keep a record of your tax information for future reference.