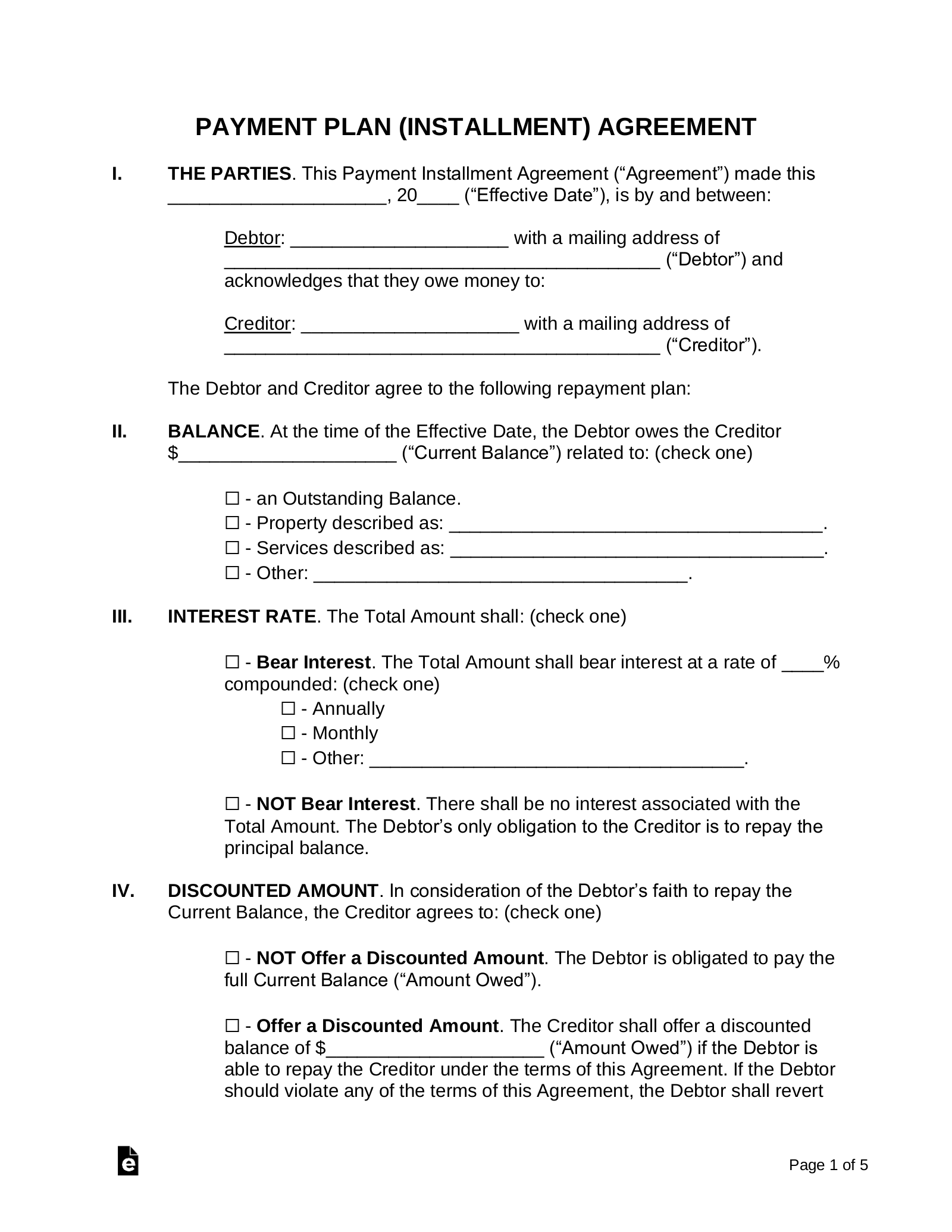

Dealing with tax debt can be overwhelming, but the IRS offers payment plans to help individuals and businesses manage their tax obligations. If you owe money to the IRS and are unable to pay it all at once, you may be eligible for an installment agreement. This allows you to make monthly payments over time until the debt is fully paid off.

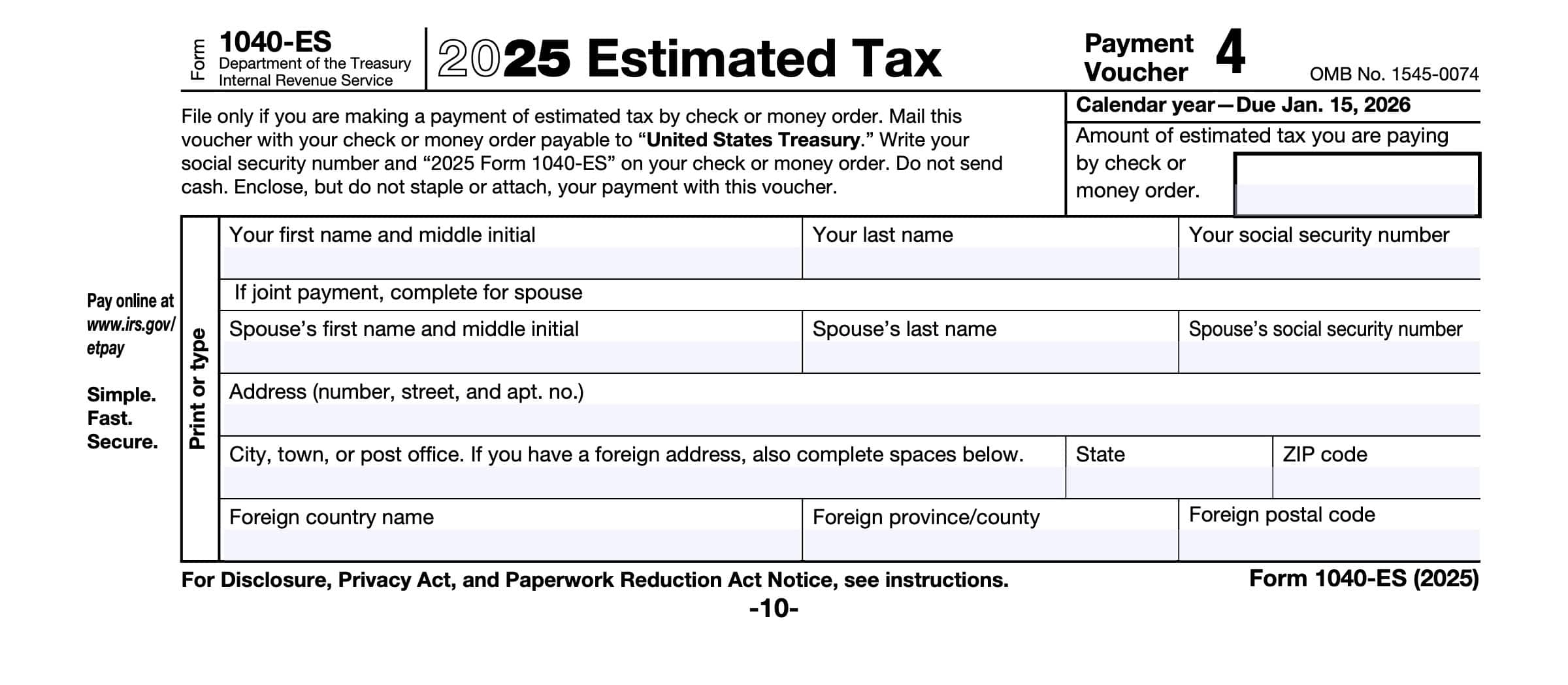

One of the first steps in setting up an IRS payment plan is filling out the necessary forms. The IRS provides a printable form, Form 9465, which is used to request an installment agreement. This form collects information about your financial situation and proposes a payment plan based on your ability to pay.

Irs Payment Plan Form Printable

Irs Payment Plan Form Printable

Quickly Access and Print Irs Payment Plan Form Printable

Free Payment Plan Agreement Template PDF Word EForms

Free Payment Plan Agreement Template PDF Word EForms

When completing Form 9465, you will need to provide details such as your name, address, Social Security number, the amount you owe, and how much you can afford to pay each month. It is important to be honest and accurate when filling out this form, as providing false information can result in penalties or the rejection of your payment plan request.

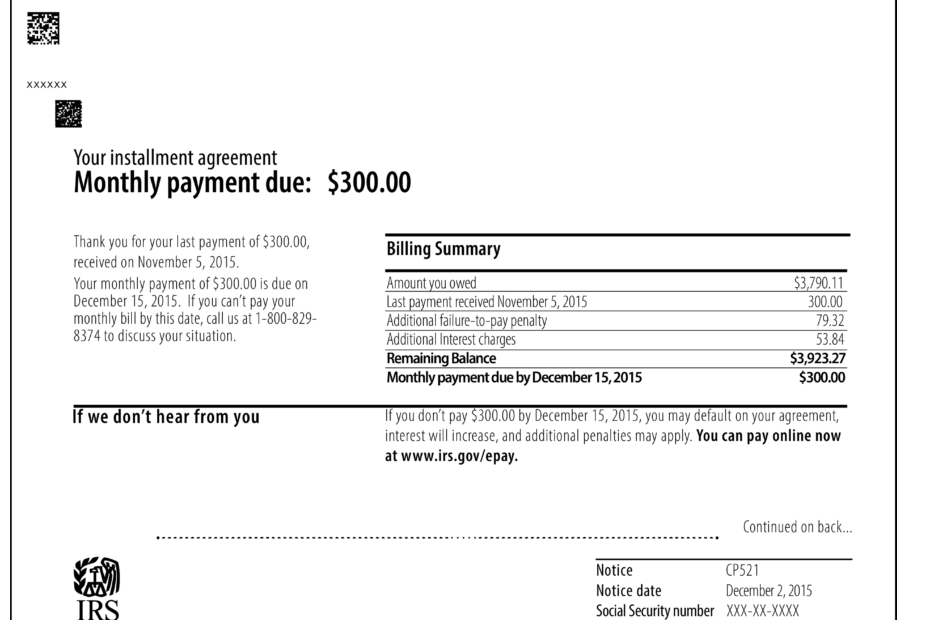

After submitting Form 9465, the IRS will review your financial information and determine if you qualify for an installment agreement. If approved, they will send you a confirmation letter outlining the terms of the payment plan. It is crucial to make timely payments and adhere to the agreed-upon terms to avoid any further complications with the IRS.

Keep in mind that there may be fees associated with setting up an installment agreement, depending on your income level and the length of the payment plan. Additionally, interest and penalties may continue to accrue on the remaining balance until it is fully paid off. It is essential to stay on top of your payments and make adjustments to your plan if your financial situation changes.

In conclusion, if you are struggling to pay your tax debt, an IRS payment plan can provide a manageable solution. By filling out Form 9465 and submitting it to the IRS, you can work towards paying off your debt in a structured and affordable way. Remember to stay in communication with the IRS and fulfill your obligations to successfully resolve your tax debt.