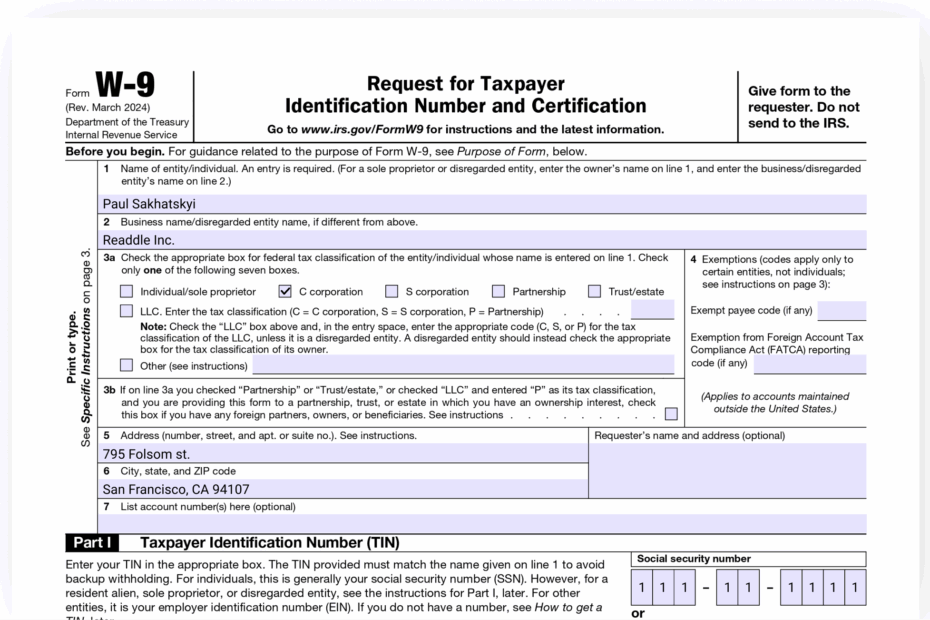

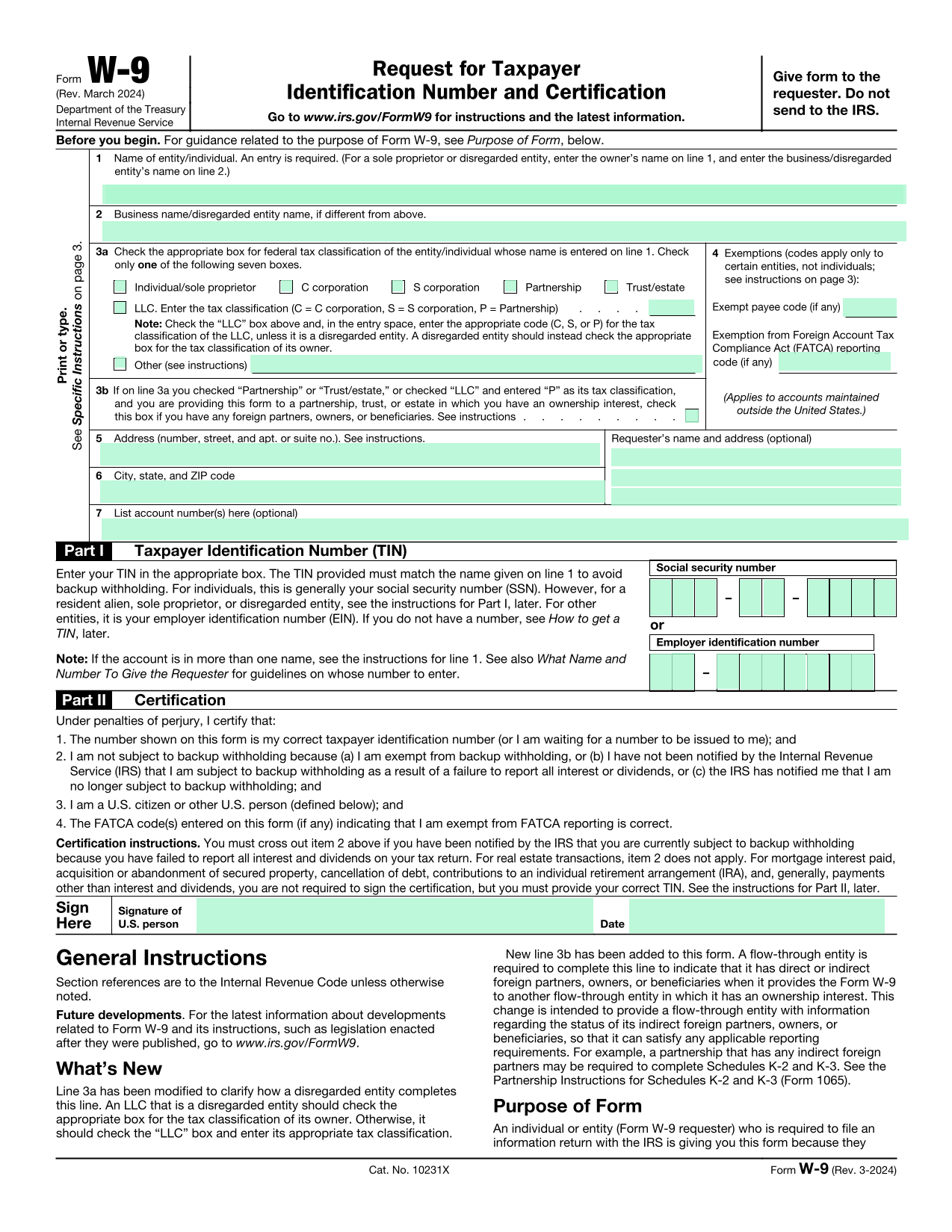

When it comes to tax compliance, filling out the necessary forms is crucial. One such form that is commonly used is the IRS W-9 form. This form is used to collect the taxpayer identification number (TIN) of individuals or entities who are paid by a business. It is important for businesses to have this information on file in order to report payments accurately to the IRS.

By having the IRS W-9 form readily available in a printable format, businesses can easily collect the necessary information from vendors, contractors, or other payees. This form streamlines the process of obtaining TINs and ensures that businesses are in compliance with tax regulations.

Irs Gov W 9 Form 2025 Printable

Irs Gov W 9 Form 2025 Printable

Get and Print Irs Gov W 9 Form 2025 Printable

IRS Gov W 9 Form 2025 Printable

The IRS W-9 form for the year 2025 is an updated version of the form that includes any changes to tax laws or regulations. By using the most current version of the form, businesses can be sure that they are collecting the correct information and staying compliant with the IRS.

When filling out the IRS W-9 form, payees must provide their name, address, and TIN. This information is used by businesses to report payments to the IRS and issue any necessary tax documents, such as 1099 forms. Having a printable version of the form makes it easy for businesses to distribute to their payees and collect the required information.

Businesses can easily access the IRS W-9 form 2025 printable version online through the IRS website or other trusted sources. By keeping this form on hand, businesses can ensure that they are prepared to collect the necessary information from their payees and comply with tax regulations.

In conclusion, the IRS W-9 form is a vital tool for businesses to collect TIN information from payees and ensure compliance with tax laws. Having a printable version of the form for the year 2025 makes it easy for businesses to collect this information and stay up to date with any changes to tax regulations. By utilizing the IRS W-9 form, businesses can streamline their payment reporting processes and avoid any potential penalties for non-compliance.