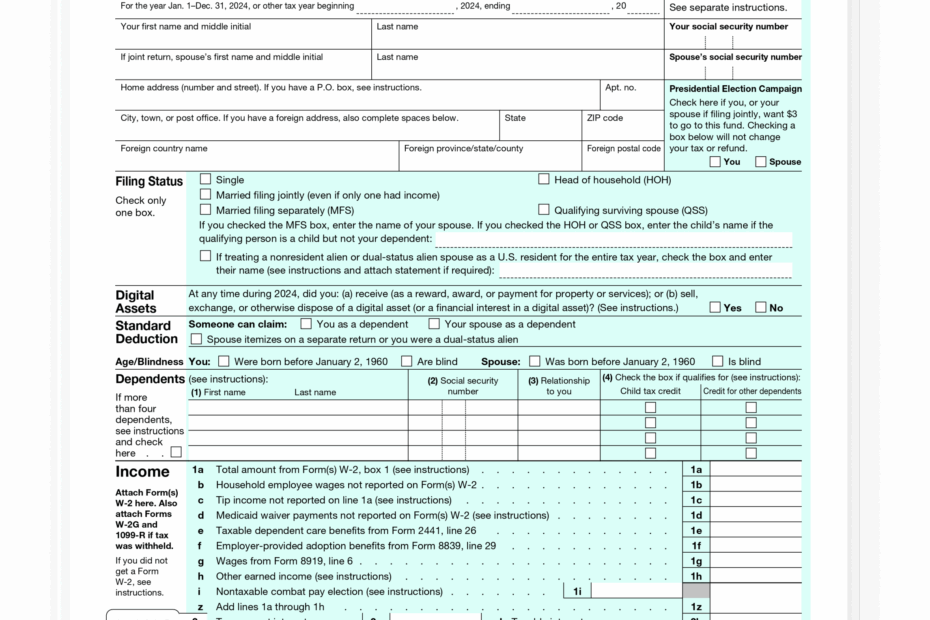

Filing taxes can be a stressful process for many individuals, but the IRS has made it easier with the printable Form 1040. This form is the standard tax form used by individuals to file their annual income tax return with the IRS. It is important to accurately fill out this form to ensure compliance with tax laws and to avoid any penalties or fines.

One of the benefits of the IRS Gov printable Form 1040 is that it can be easily accessed and downloaded from the IRS website. This allows individuals to fill out the form at their own convenience and in the comfort of their own home. The form is available in a printable format, making it easy to complete and submit to the IRS.

Get and Print Irs Gov Printable Form 1040

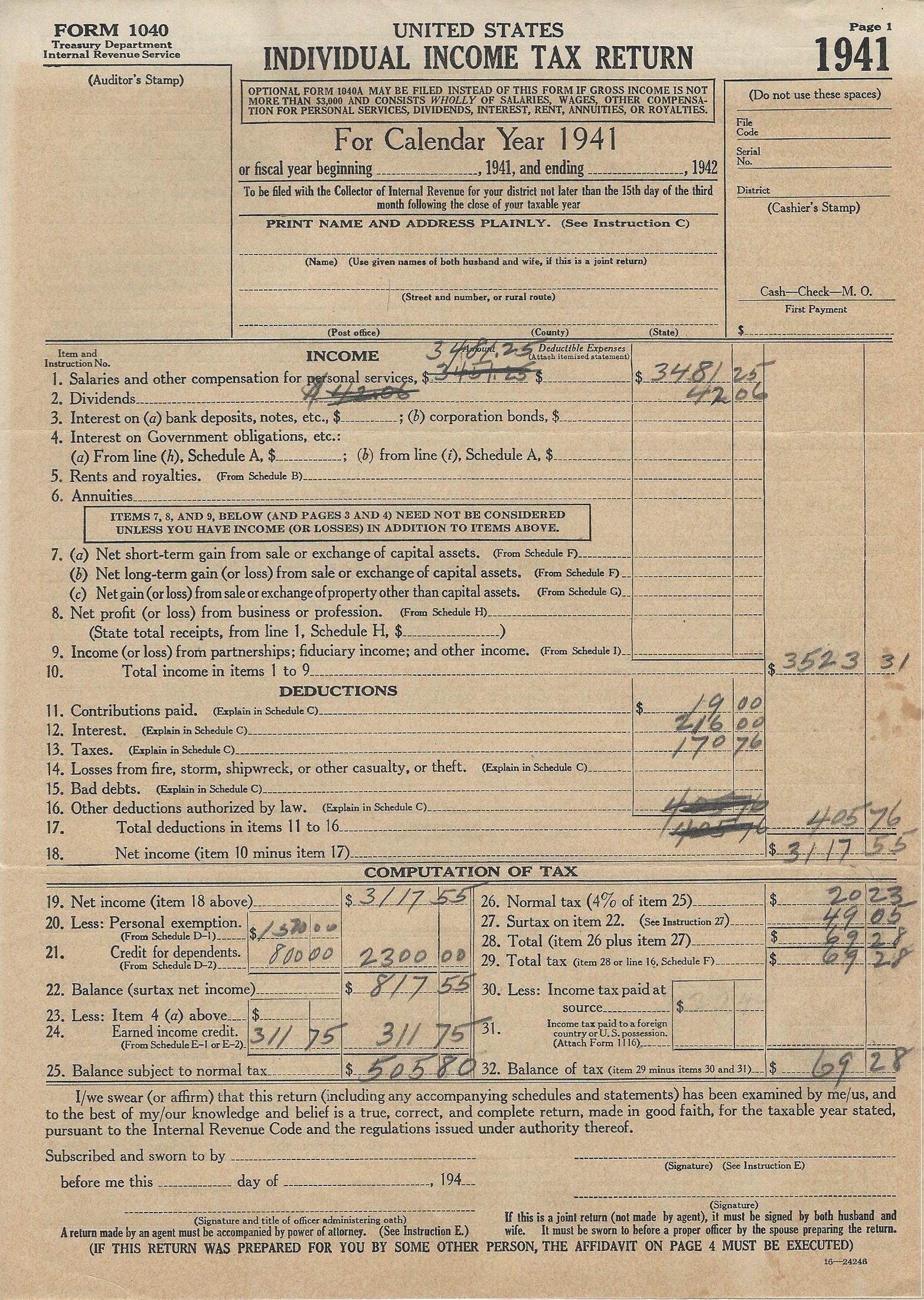

File Form 1040 1941 Jpg Wikimedia Commons

File Form 1040 1941 Jpg Wikimedia Commons

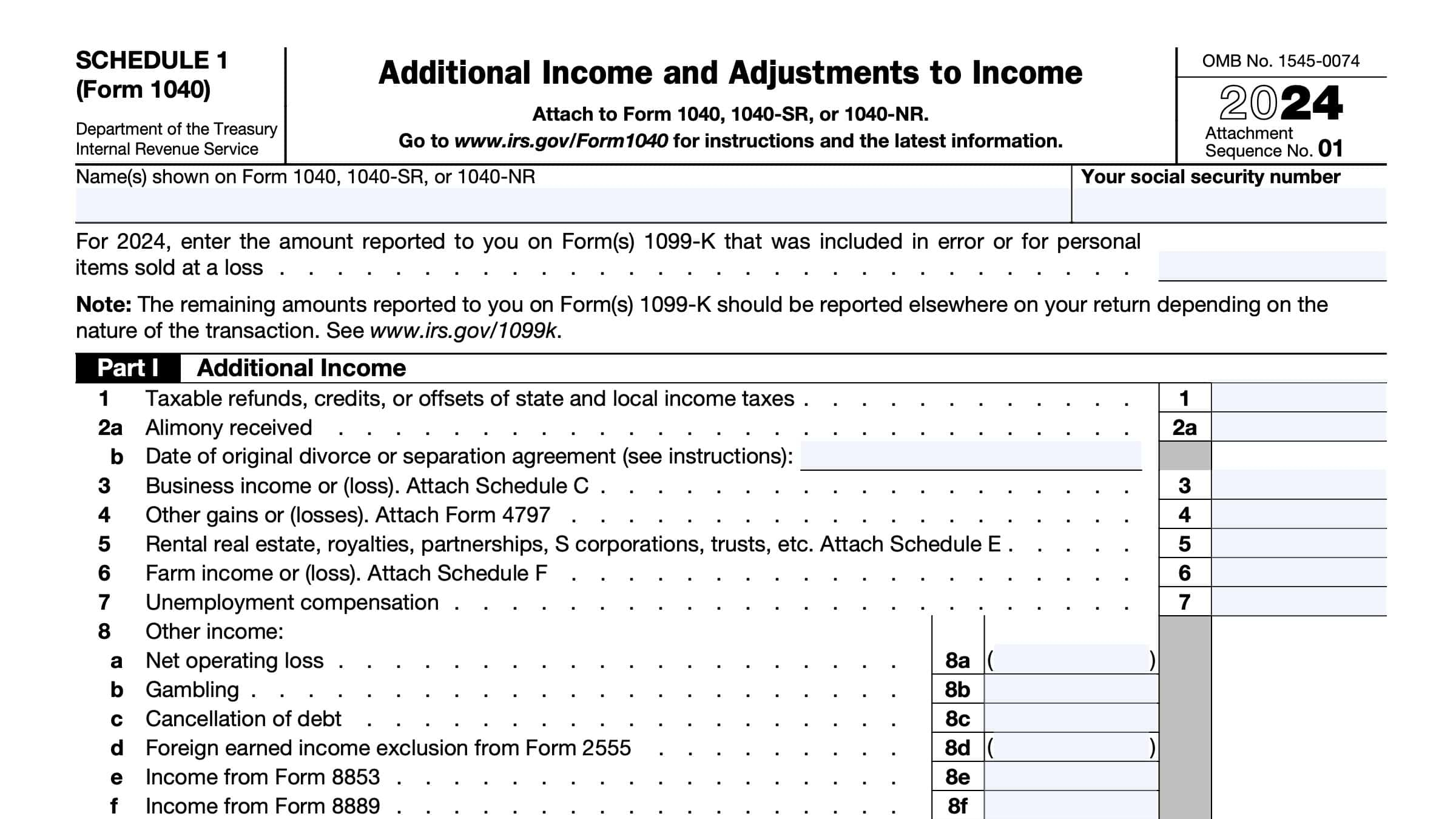

When filling out the Form 1040, individuals will need to provide information about their income, deductions, and credits. This includes details about wages, salaries, tips, and other income sources, as well as any deductions or credits that may apply to their tax situation. It is important to carefully review the instructions for the form to ensure all necessary information is included.

Once the Form 1040 is completed, individuals can either file it electronically through the IRS e-file system or mail it to the IRS. Filing electronically is the quickest and most secure way to submit your tax return, but mailing in a paper form is also an option. Whichever method you choose, it is important to keep a copy of your completed form for your records.

Overall, the IRS Gov printable Form 1040 is a valuable tool for individuals to accurately report their income and taxes owed to the IRS. By carefully filling out this form and submitting it on time, individuals can ensure compliance with tax laws and avoid any potential penalties or fines. Remember to always consult with a tax professional if you have any questions or concerns about your tax return.

In conclusion, the IRS Gov printable Form 1040 is a vital document for individuals to accurately report their income and taxes to the IRS. By following the instructions and filling out the form correctly, individuals can ensure compliance with tax laws and avoid any potential issues with the IRS. Take advantage of this printable form to make the tax filing process as smooth and efficient as possible.