When it comes to tax season, one of the most important forms that individuals and businesses need to be familiar with is the IRS Gov 1099 Printable Form. This form is used to report various types of income, including freelance earnings, rental income, and investment income. It is crucial to accurately report this information to the IRS to avoid any potential penalties or audits.

For individuals and businesses who need to report income that falls under the 1099 category, the IRS Gov 1099 Printable Form is a convenient and easy-to-use tool. By filling out this form correctly, taxpayers can ensure that they are in compliance with IRS regulations and avoid any unnecessary complications during tax season.

Download and Print Irs Gov 1099 Printable Form

2024 1099 MISC Form Fillable Printable Download 2024 Instructions

2024 1099 MISC Form Fillable Printable Download 2024 Instructions

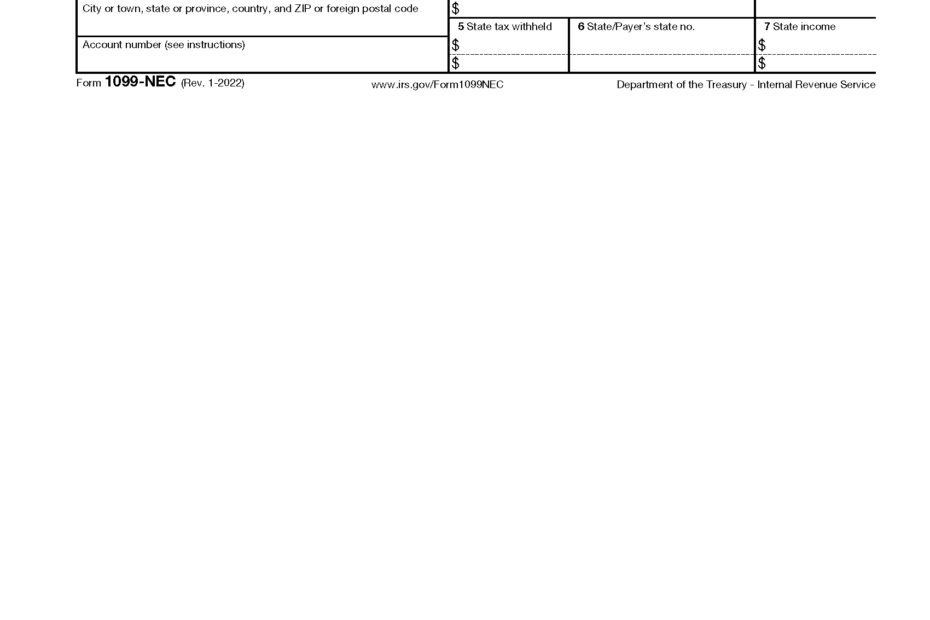

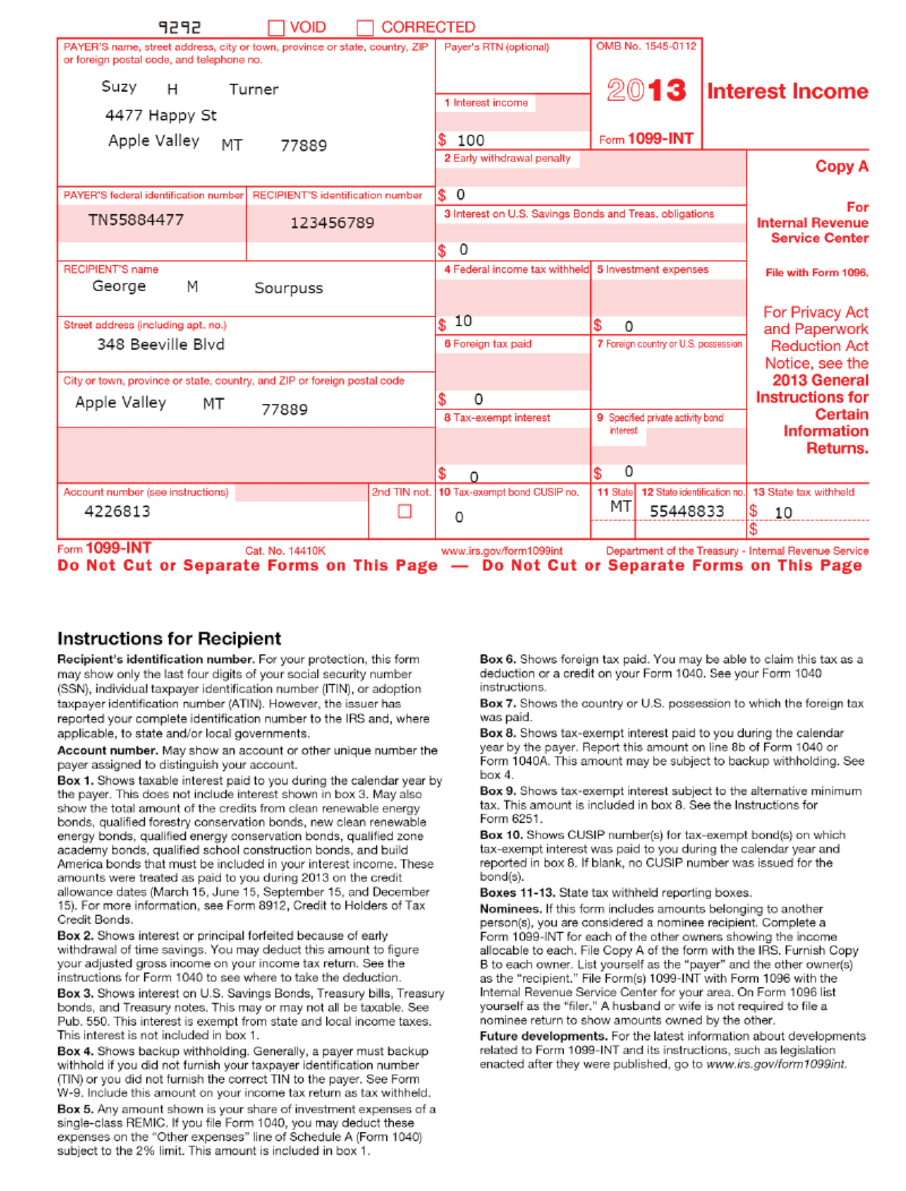

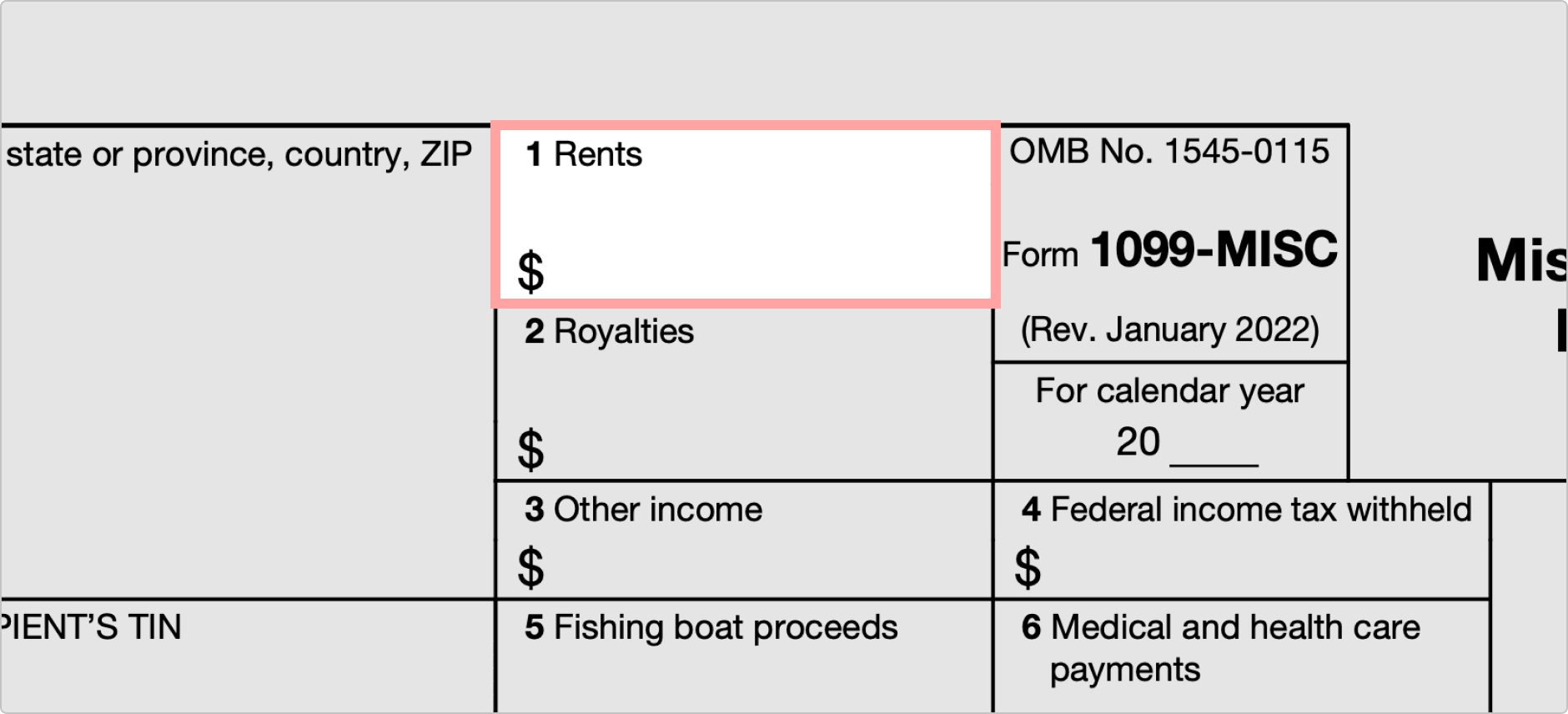

There are several different types of 1099 forms, each corresponding to a specific type of income. Some of the most common include the 1099-MISC for miscellaneous income, the 1099-INT for interest income, and the 1099-DIV for dividend income. By using the appropriate form for the type of income being reported, taxpayers can streamline the reporting process and minimize the risk of errors.

One of the key benefits of the IRS Gov 1099 Printable Form is its accessibility and user-friendly format. Taxpayers can easily download the form from the IRS website, fill it out electronically or by hand, and submit it to the IRS by mail or electronically. This makes it simple for individuals and businesses to report their income accurately and in a timely manner.

Overall, the IRS Gov 1099 Printable Form is an essential tool for individuals and businesses who need to report various types of income to the IRS. By understanding how to use this form correctly and making sure to report income accurately, taxpayers can avoid potential penalties and ensure a smooth tax filing process.

As tax season approaches, it is important for individuals and businesses to familiarize themselves with the IRS Gov 1099 Printable Form and ensure that they are using it correctly. By taking the time to understand the form and accurately report income, taxpayers can minimize the risk of errors and ensure compliance with IRS regulations.