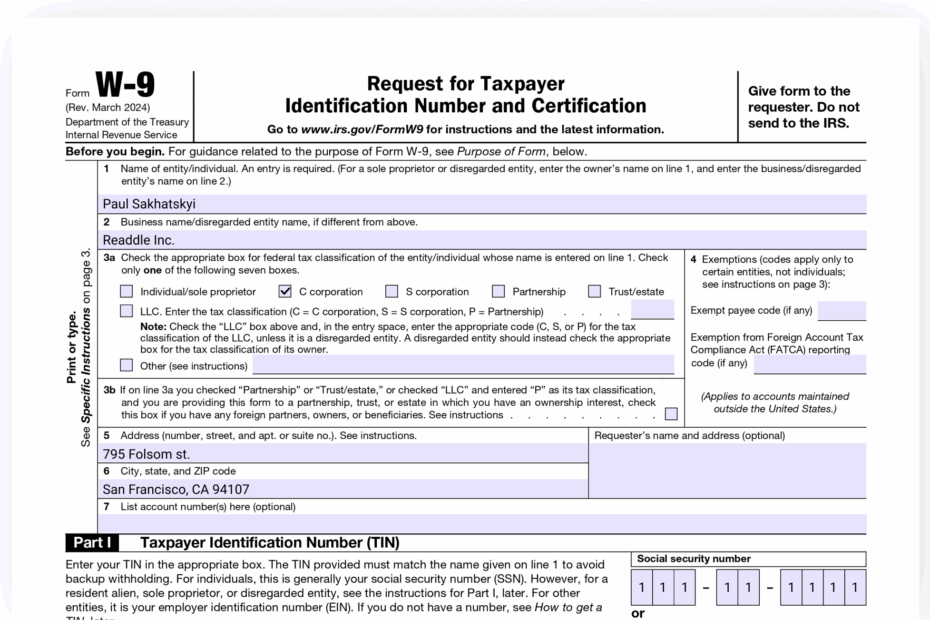

When it comes to tax season, filling out the necessary forms can be a daunting task. One of the most important forms to have on hand is the IRS Form W9. This form is used to collect information from independent contractors, freelancers, and other non-employees who need to be paid for their services. By having this form readily available, you can ensure that you have all the necessary information to report payments accurately to the IRS.

It is crucial to have the most up-to-date version of the IRS Form W9. The 2025 printable version ensures that you are using the correct form with the latest guidelines and requirements. By using the correct form, you can avoid any potential errors or delays in processing your payments to vendors or contractors.

Download and Print Irs Form W9 2025 Printable

W9 Tax Form 2025 Printable Printable W9 Form 2025

W9 Tax Form 2025 Printable Printable W9 Form 2025

When filling out the IRS Form W9, it is important to provide accurate information to avoid any issues with the IRS. This includes your legal name, business name (if applicable), address, and taxpayer identification number. By providing this information correctly, you can ensure that your payments are processed efficiently and accurately.

Having the IRS Form W9 2025 printable version on hand makes it easy to access and fill out whenever needed. Whether you are a business owner or a freelancer, having this form readily available can streamline the process of collecting necessary information from vendors and contractors. By staying organized and up-to-date with the latest forms, you can ensure that your tax reporting is accurate and compliant with IRS regulations.

Overall, the IRS Form W9 is a crucial document for businesses and individuals who work with independent contractors and vendors. By using the 2025 printable version, you can ensure that you have the most up-to-date form with the latest guidelines. This form simplifies the process of collecting necessary information and ensures that your tax reporting is accurate and compliant. Make sure to have this form on hand during tax season to streamline your payments and avoid any potential issues with the IRS.