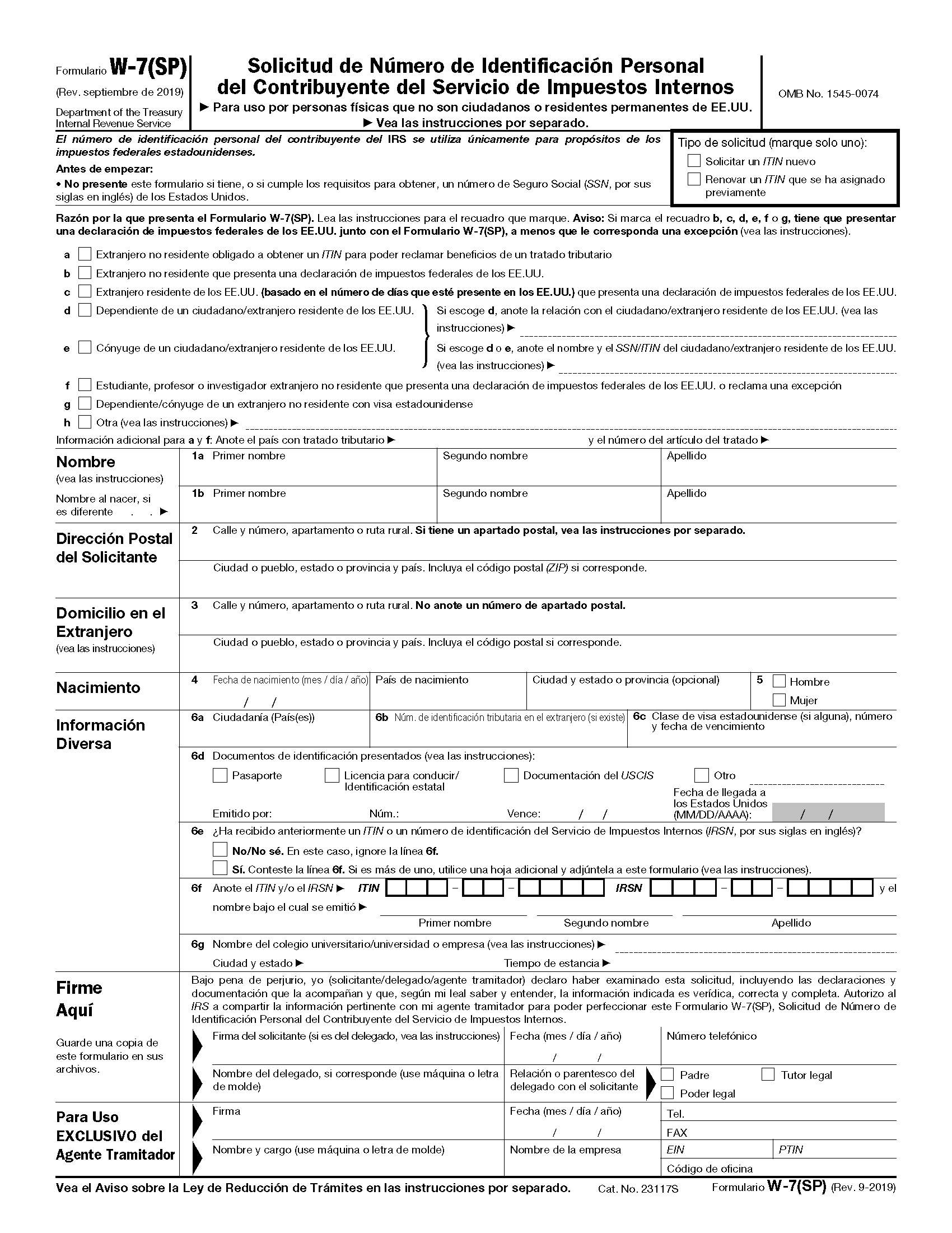

Form W-7, also known as the Application for IRS Individual Taxpayer Identification Number, is a document used by individuals who are not eligible for a Social Security Number but need to file federal taxes in the United States. This form allows individuals to apply for an ITIN, which is a nine-digit number issued by the IRS for tax purposes.

For those who need to obtain an ITIN, the IRS provides a printable version of Form W-7 on their website. This form can be easily downloaded and filled out by individuals who meet the eligibility requirements. It is important to note that Form W-7 must be submitted along with the necessary supporting documentation to verify the applicant’s identity and foreign status.

Quickly Access and Print Irs Form W 7 Printable

28 Form W7 Royalty Free Images Stock Photos U0026 Pictures Shutterstock

28 Form W7 Royalty Free Images Stock Photos U0026 Pictures Shutterstock

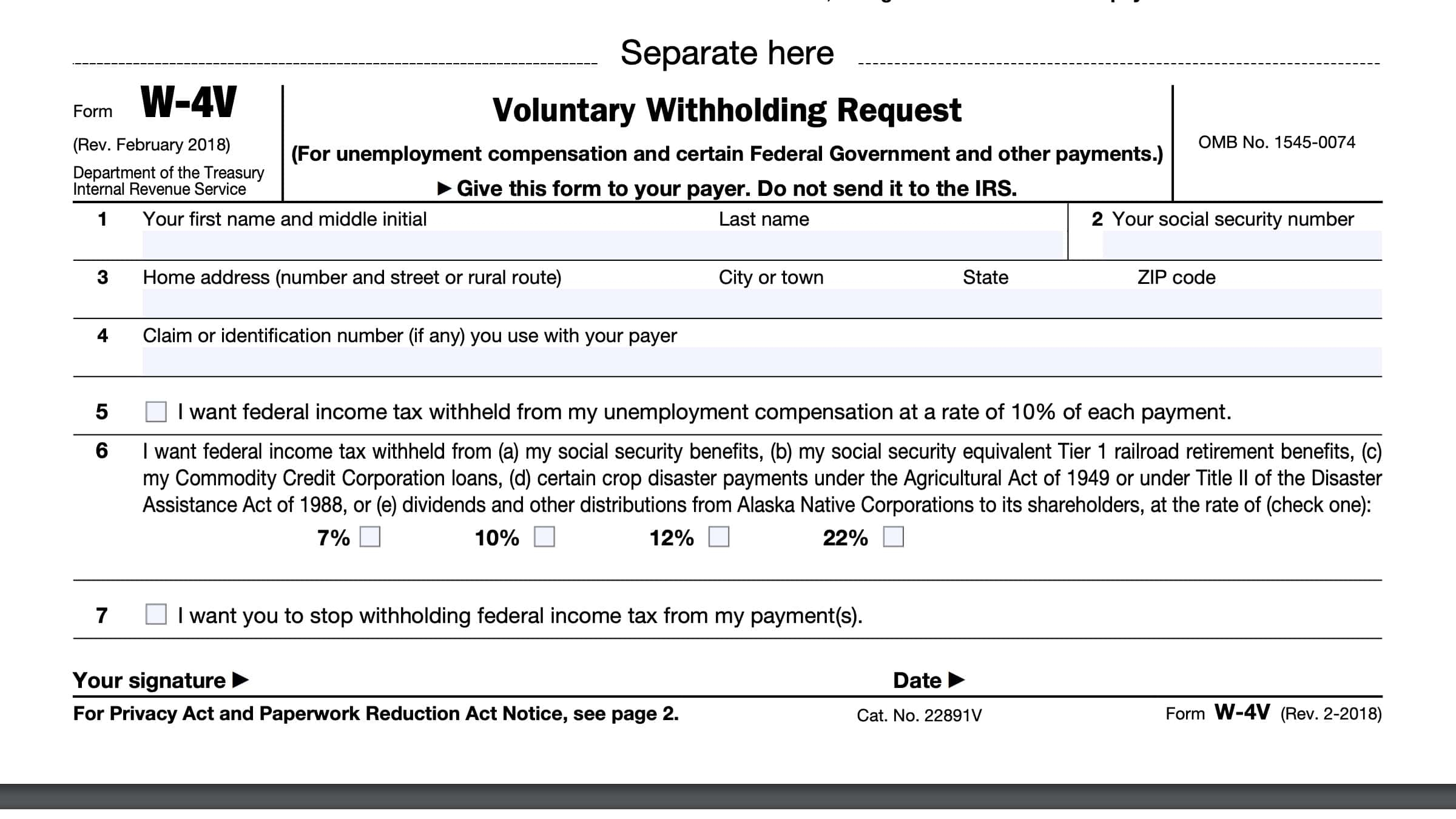

When filling out Form W-7, applicants will need to provide personal information such as their name, date of birth, and foreign address. They will also need to indicate the reason they are applying for an ITIN and provide supporting documentation such as a valid passport or birth certificate. Once the form is completed, it can be mailed to the address provided on the form along with the required documents.

It is important for individuals to ensure that they are using the most up-to-date version of Form W-7 when applying for an ITIN. The IRS periodically updates their forms, so it is recommended to check their website for the latest version of the form before submitting your application. Additionally, it is crucial to carefully review the instructions provided with the form to ensure that all necessary information is included and that the form is filled out correctly.

Overall, Form W-7 is a valuable resource for individuals who need to obtain an ITIN for tax purposes. By utilizing the printable version of the form provided by the IRS, individuals can easily apply for an ITIN and ensure that they are compliant with federal tax regulations. Whether you are a non-resident alien, a spouse or dependent of a non-resident alien, or a foreign student or exchange visitor, Form W-7 can help you obtain the necessary identification number to fulfill your tax obligations in the United States.

In conclusion, Form W-7 is an essential document for individuals who need to obtain an ITIN for tax purposes. By utilizing the printable version of the form provided by the IRS and following the instructions carefully, applicants can successfully apply for an ITIN and ensure compliance with federal tax regulations.

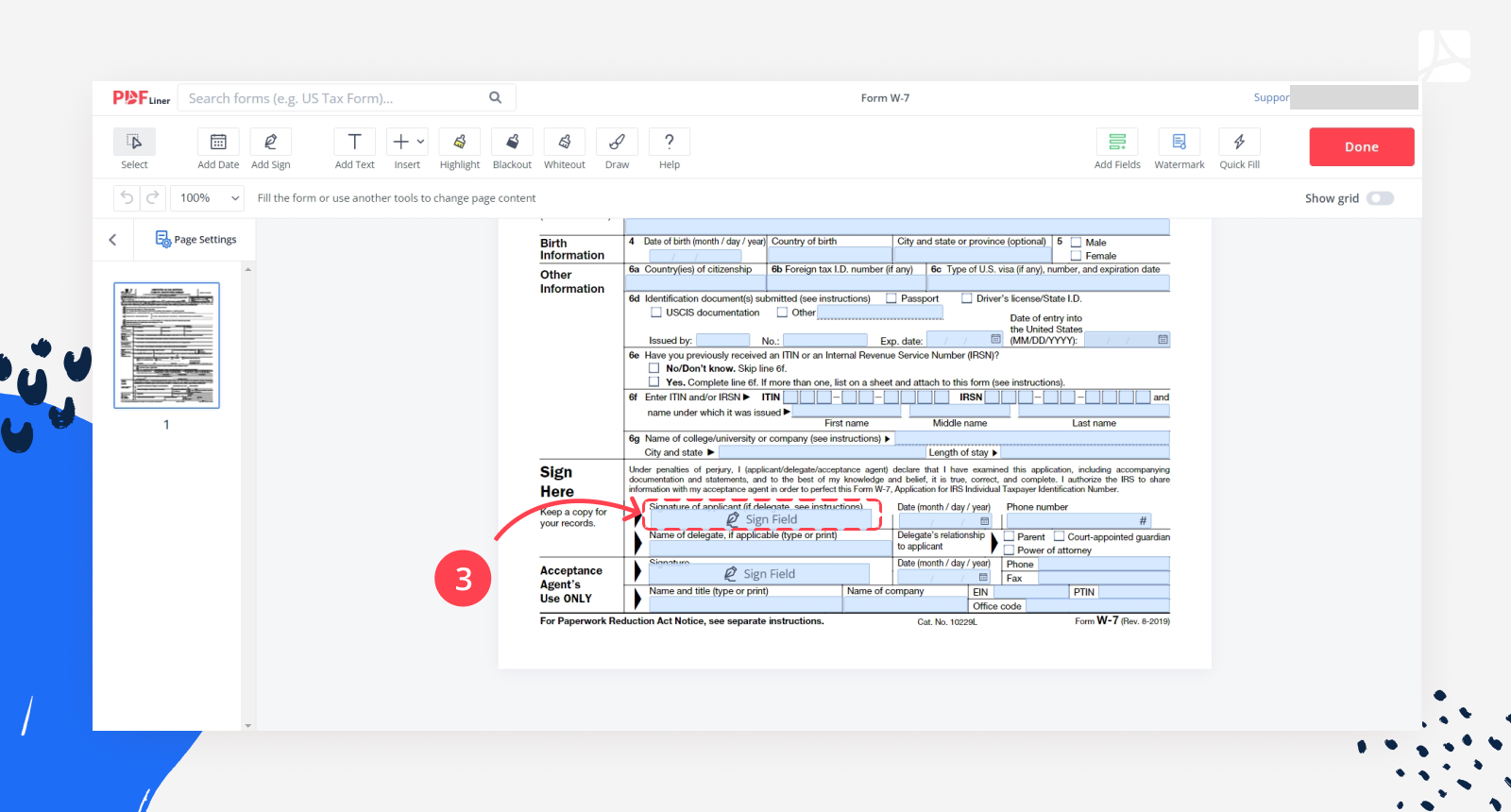

Form W 7 Printable Form W 7 Blank Sign Online PDFliner

Form W 7 Printable Form W 7 Blank Sign Online PDFliner

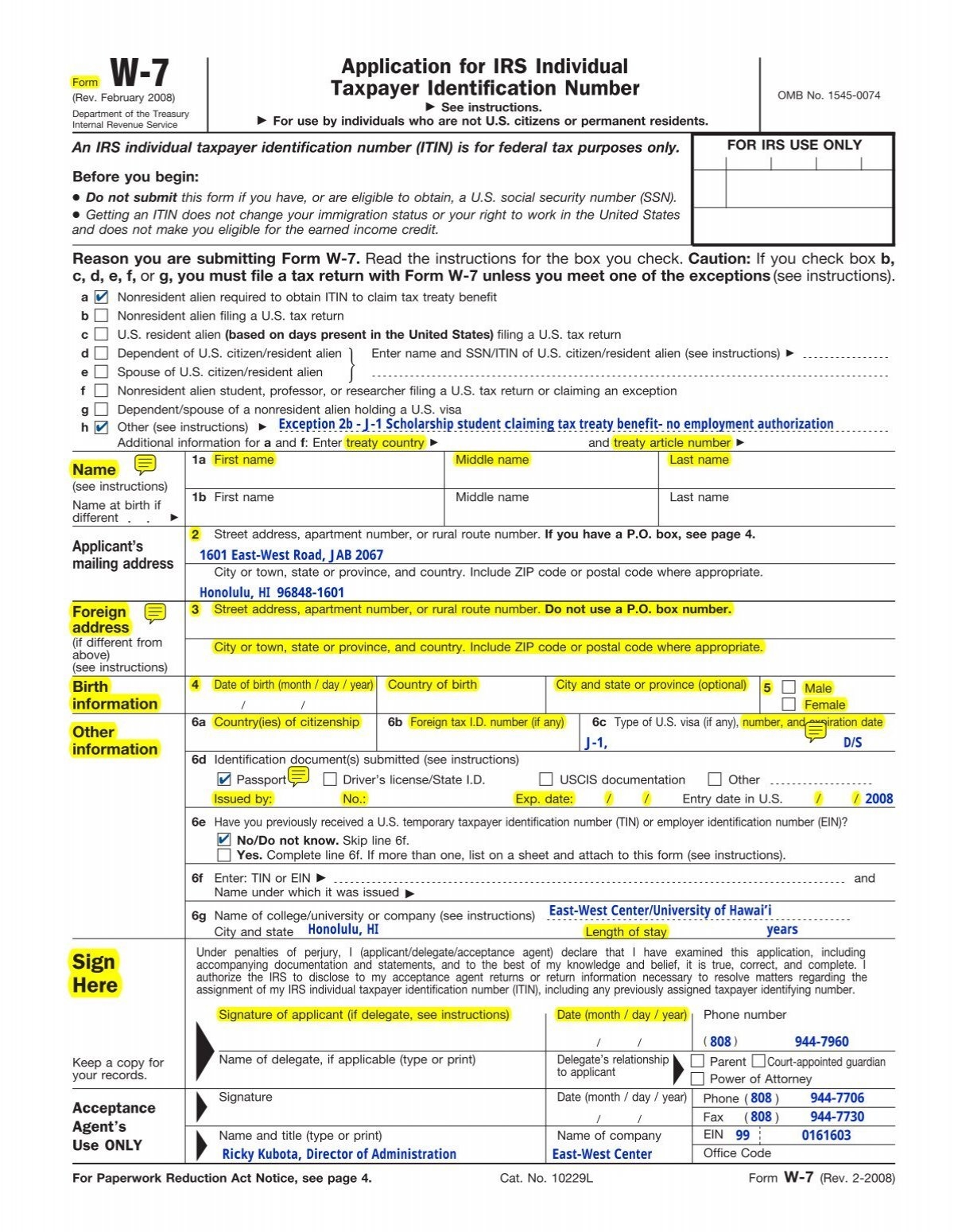

Form W 7 Rev February 2008 East West Center

Form W 7 Rev February 2008 East West Center

Free IRS Form W7 ITIN Application PDF EForms

Free IRS Form W7 ITIN Application PDF EForms

Searching for a stress-free method to manage your finances? Our Irs Form W 7 Printable give you a simple, reliable, and personalizable solution from the comfort of your home. Perfect for individual purposes, small enterprises, or financial planning, printable checks save both time and cash without compromising professionalism. Supports common finance software and designed for easy printing, they’re a wise option to bank-ordered checks. Start printing today and gain full control over your financial transactions—instant access, completely free. Check out our collection of templates and select the one that fits your needs. With our easy-to-use interface, handling your money has never been this easy. Access your Irs Form W 7 Printable and simplify your check-writing process with security!.