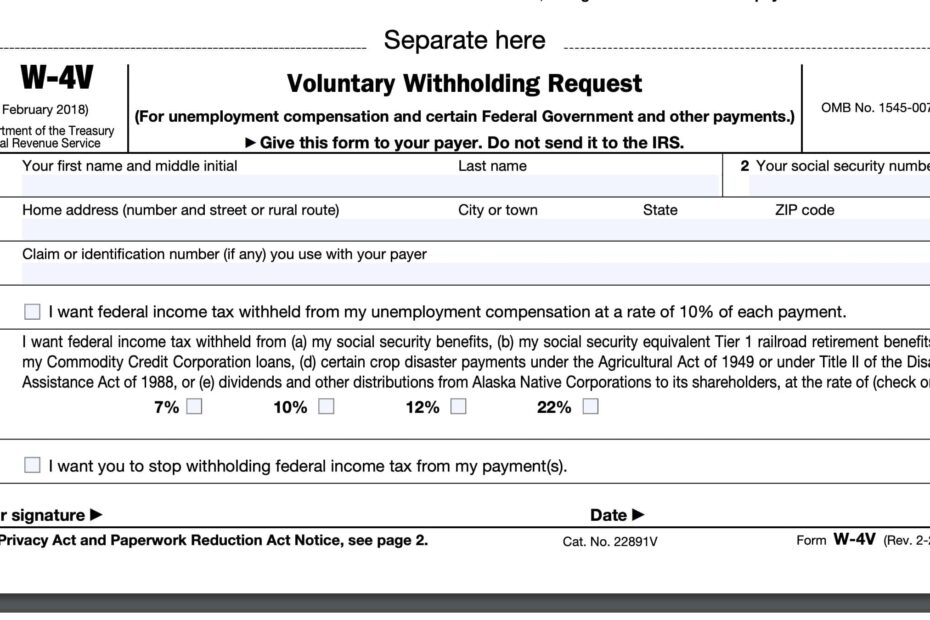

IRS Form W-4v is a document that allows individuals to voluntarily withhold a specific amount from their Social Security benefits for federal income tax purposes. This form is used by retirees or beneficiaries who want to ensure that enough taxes are withheld from their benefits to avoid owing taxes at the end of the year. It’s important to understand how to properly fill out this form to avoid any tax-related issues.

When filling out IRS Form W-4v, you will need to provide your personal information, including your name, Social Security number, and address. You will also need to indicate the amount you want to withhold from your benefits each month. This amount can be a flat dollar amount or a percentage of your benefits. Once you have completed the form, you can submit it to the Social Security Administration either online or by mail.

Download and Print Irs Form W-4v Printable

Fillable Form W 4V Edit Sign U0026 Download In PDF PDFRun

Fillable Form W 4V Edit Sign U0026 Download In PDF PDFRun

It’s important to note that the amount you choose to withhold from your benefits may have an impact on your overall tax liability. If you withhold too little, you may end up owing taxes when you file your return. On the other hand, if you withhold too much, you may receive a refund at the end of the year. It’s a good idea to consult with a tax professional before making any decisions about how much to withhold from your benefits.

IRS Form W-4v is typically used by individuals who receive Social Security benefits and have other sources of income that may affect their tax liability. By voluntarily withholding taxes from your benefits, you can avoid having to pay a large tax bill at the end of the year. It’s a simple way to ensure that you are meeting your tax obligations and avoiding any potential penalties or interest charges.

In conclusion, IRS Form W-4v is an important document for individuals who receive Social Security benefits and want to ensure that enough taxes are withheld from their payments. By properly filling out this form and submitting it to the Social Security Administration, you can avoid any tax-related issues and ensure that you are meeting your tax obligations. If you have any questions about how to fill out this form, don’t hesitate to seek advice from a tax professional.