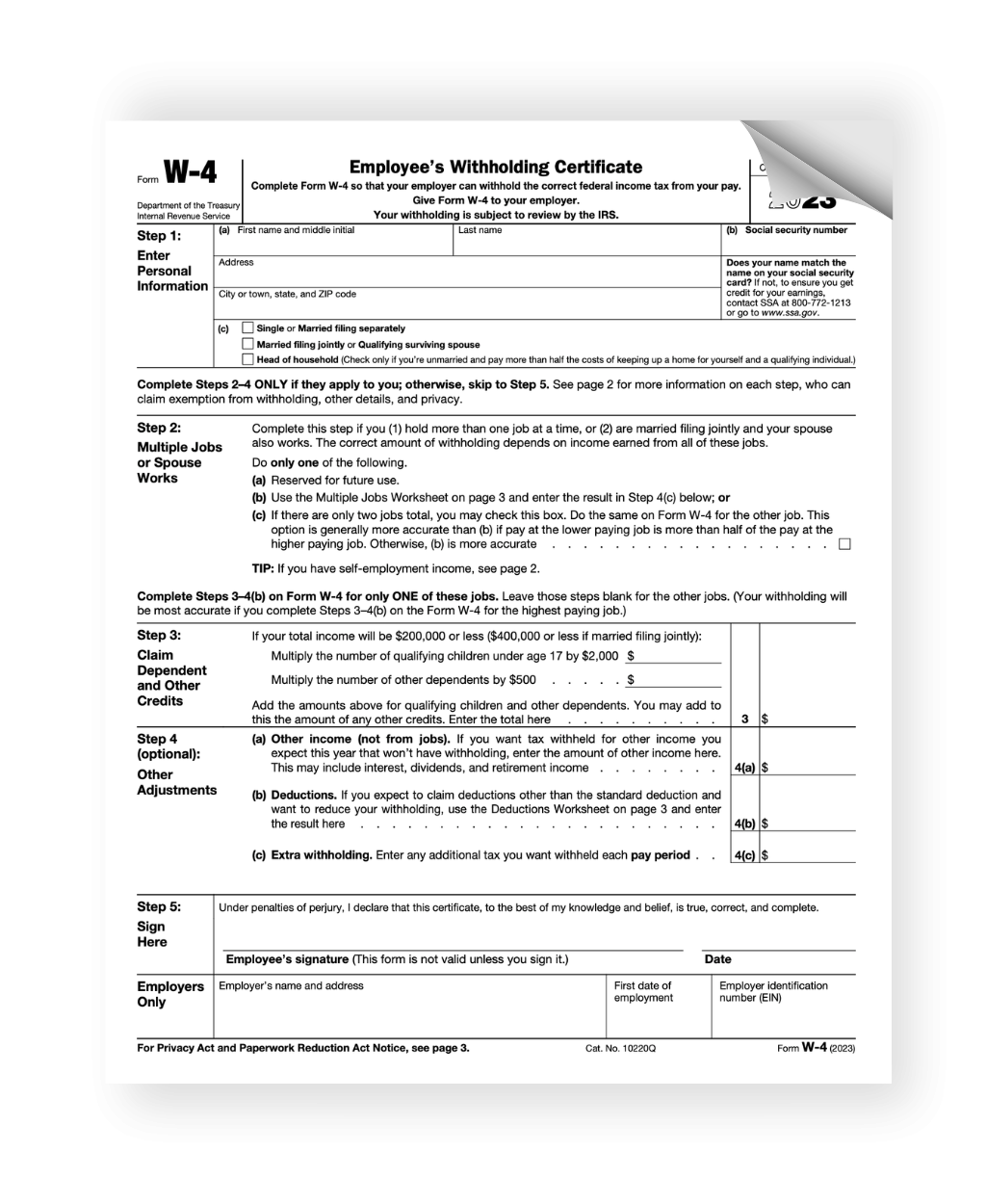

IRS Form W-4T is an important document used by employees to determine the amount of federal income tax to be withheld from their paychecks. This form helps employers calculate the correct amount of taxes to withhold based on the employee’s filing status, number of dependents, and other factors. It is crucial for employees to fill out this form accurately to avoid overpaying or underpaying taxes throughout the year.

Employees can access the printable version of IRS Form W-4T on the IRS website or through their employer’s HR department. It is essential to review the form carefully and provide accurate information to ensure the correct withholding amount. Any changes in personal or financial circumstances should prompt employees to update their W-4T form to reflect these changes.

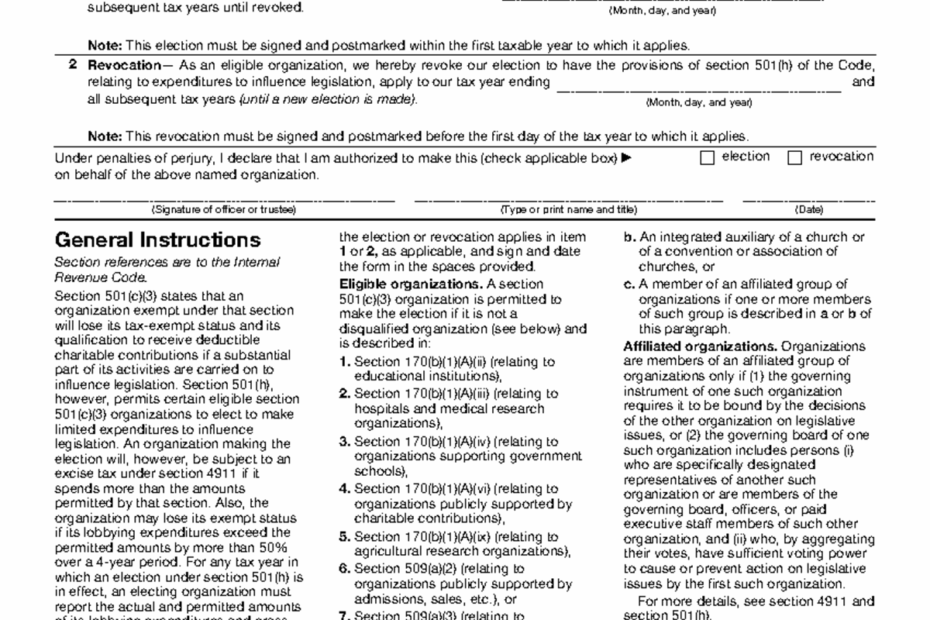

Download and Print Irs Form W 4t Printable

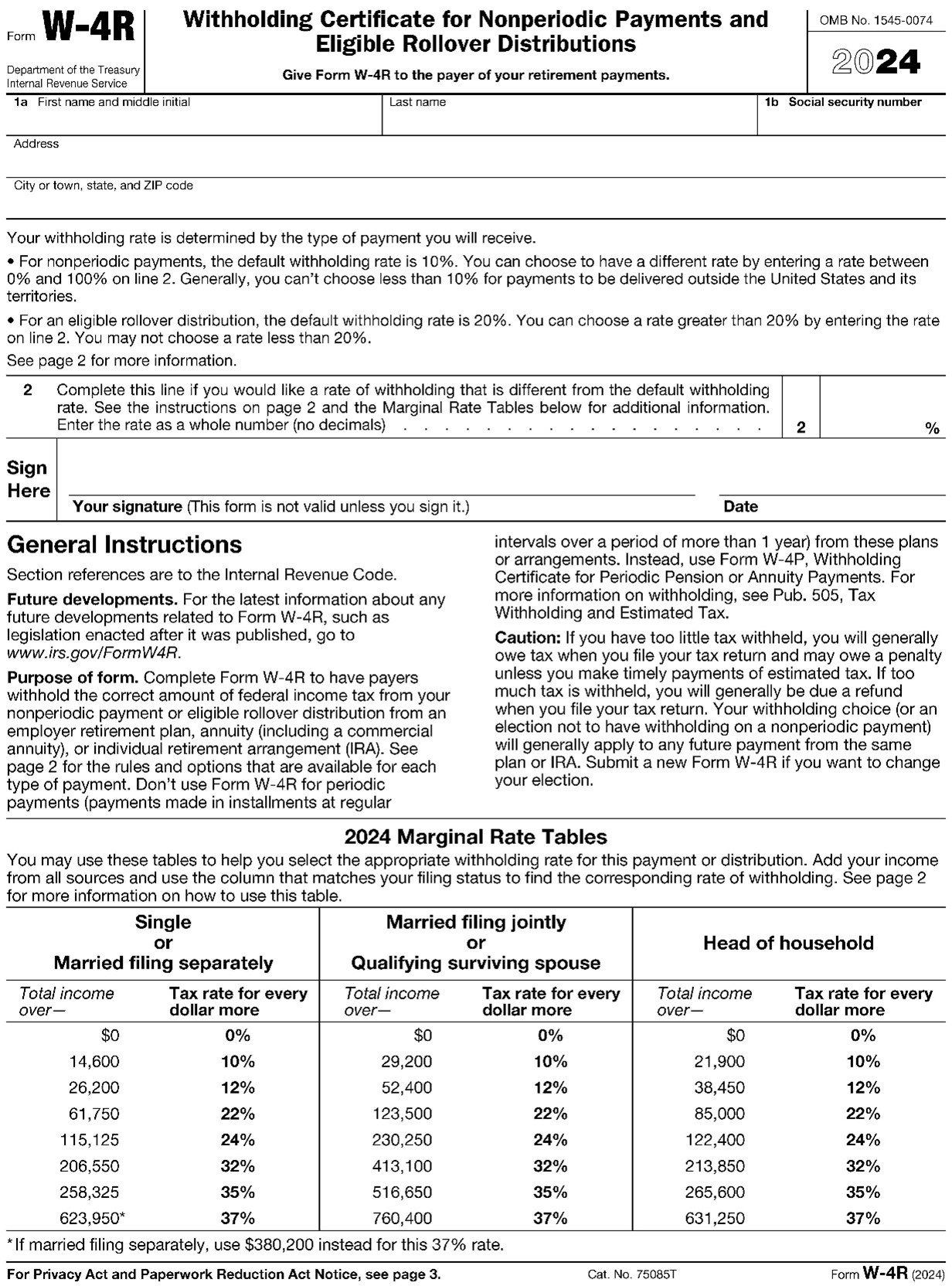

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Form W-4T Printable

When filling out IRS Form W-4T, employees need to provide information such as their name, address, social security number, filing status, and the number of allowances they are claiming. The form also includes additional worksheets for employees with multiple jobs or those claiming dependents.

Employees can use the IRS withholding calculator to help determine the appropriate withholding amount based on their individual circumstances. This tool can provide a more accurate estimate of the taxes to be withheld and help employees avoid owing taxes or receiving a large refund at tax time.

It is important to review and update IRS Form W-4T annually or whenever there are significant changes in personal or financial circumstances. Failing to update this form can result in incorrect withholding amounts and potential tax penalties. Employees should consult with a tax professional if they are unsure about how to accurately complete the form.

In conclusion, IRS Form W-4T is a crucial document for employees to ensure the correct amount of federal income tax is withheld from their paychecks. By accurately completing this form and updating it as needed, employees can avoid tax-related issues and ensure they are paying the appropriate amount of taxes throughout the year.