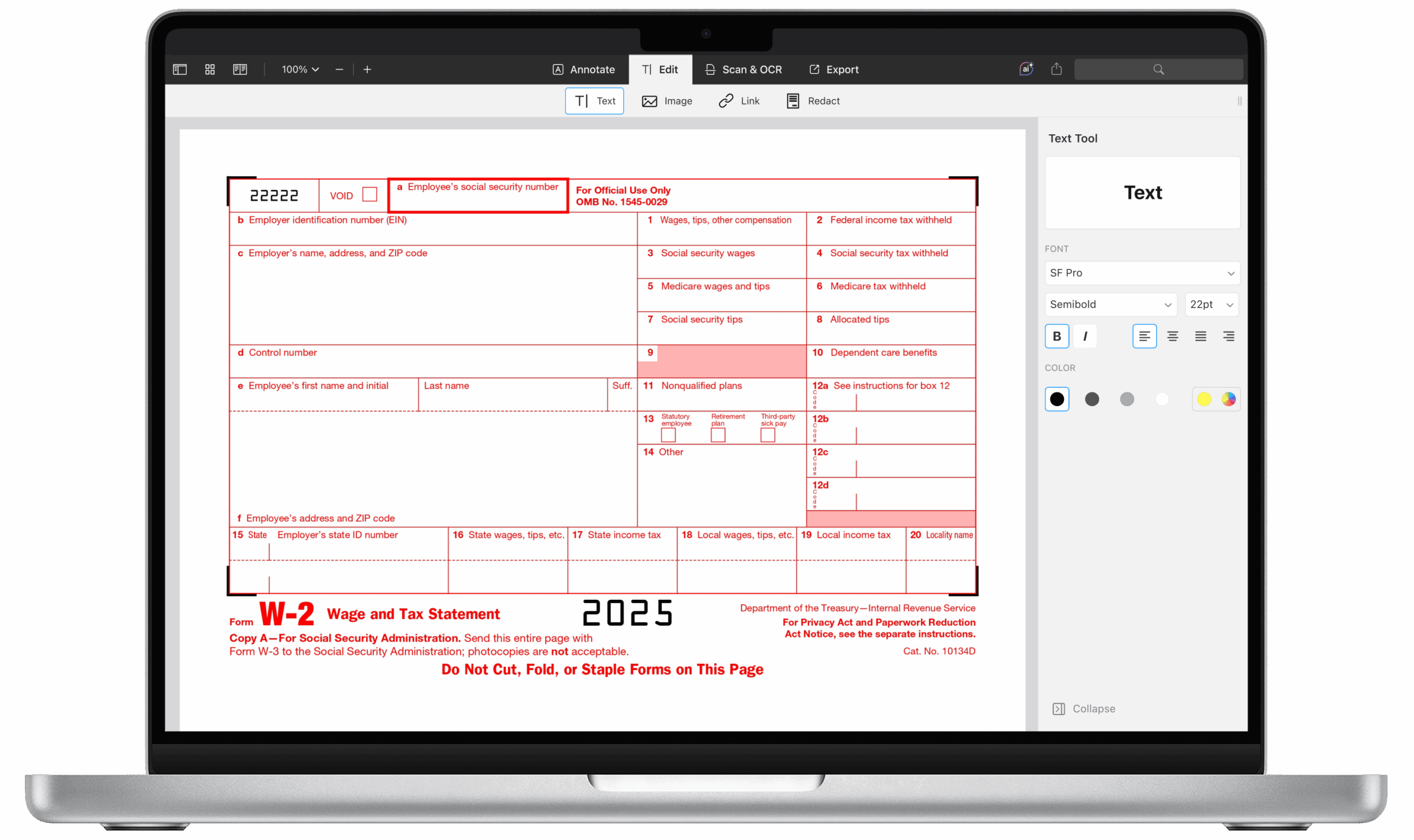

When it comes to managing your finances, it’s important to stay informed about the various forms and documents that are necessary for tax purposes. One such form is the IRS Form W-4p, which is used to withhold federal income tax from certain retirement distributions. It’s essential to understand how to properly fill out this form to ensure that you are withholding the correct amount of tax.

IRS Form W-4p 2025 Printable is a form provided by the Internal Revenue Service for individuals who receive retirement plan distributions. This form allows you to specify how much federal income tax you want withheld from your distribution. By accurately completing this form, you can avoid underpayment of taxes and potential penalties.

Get and Print Irs Form W-4p 2025 Printable

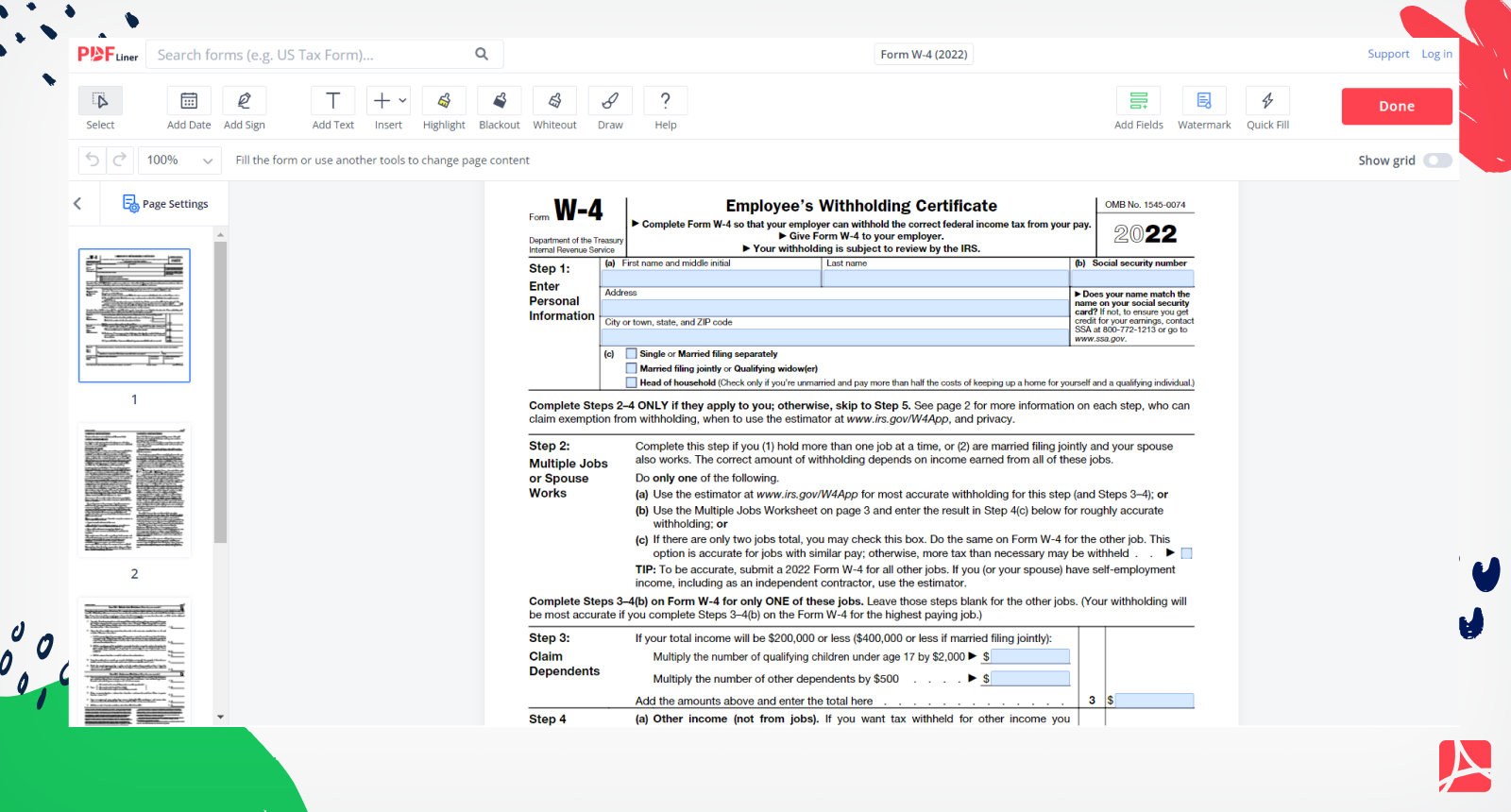

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

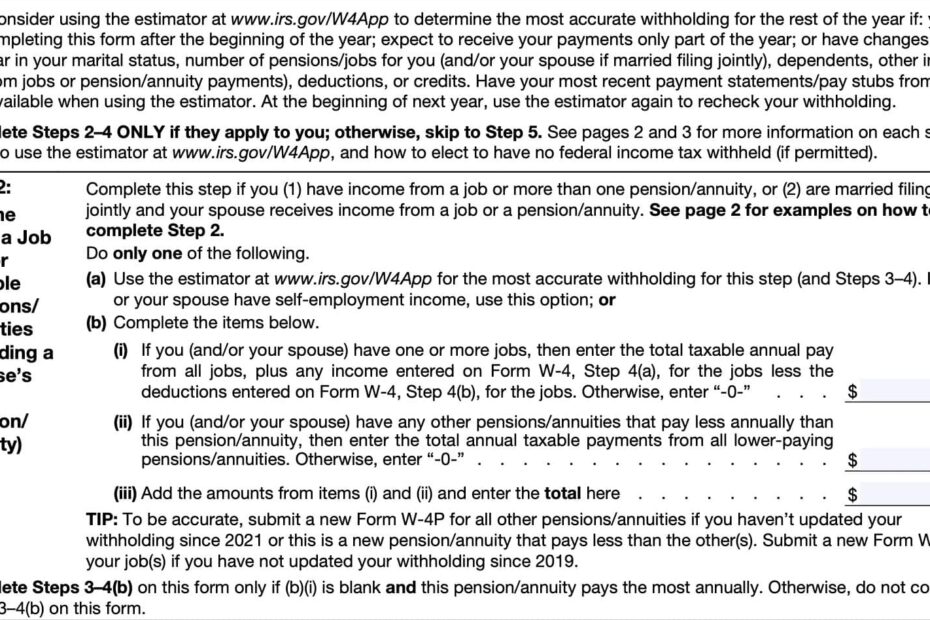

When filling out IRS Form W-4p, you will need to provide information such as your name, address, Social Security number, and the amount you wish to have withheld for federal income tax. It’s important to carefully review the form and follow the instructions to ensure that you are completing it correctly. If you have any questions or are unsure about how to fill out the form, it’s recommended to seek assistance from a tax professional.

Additionally, it’s important to review and update your Form W-4p regularly, especially if there are any changes to your financial situation or tax laws. By staying informed and proactive in managing your tax withholdings, you can avoid any surprises come tax time and ensure that you are compliant with IRS regulations.

Overall, IRS Form W-4p 2025 Printable is a crucial document for individuals receiving retirement plan distributions. By taking the time to properly fill out this form and stay informed about tax regulations, you can effectively manage your tax withholdings and avoid any potential issues with the IRS.

Remember to keep a copy of your completed Form W-4p for your records and consult with a tax professional if you have any questions or concerns. By staying proactive and informed, you can ensure that you are on the right track when it comes to managing your finances and taxes.