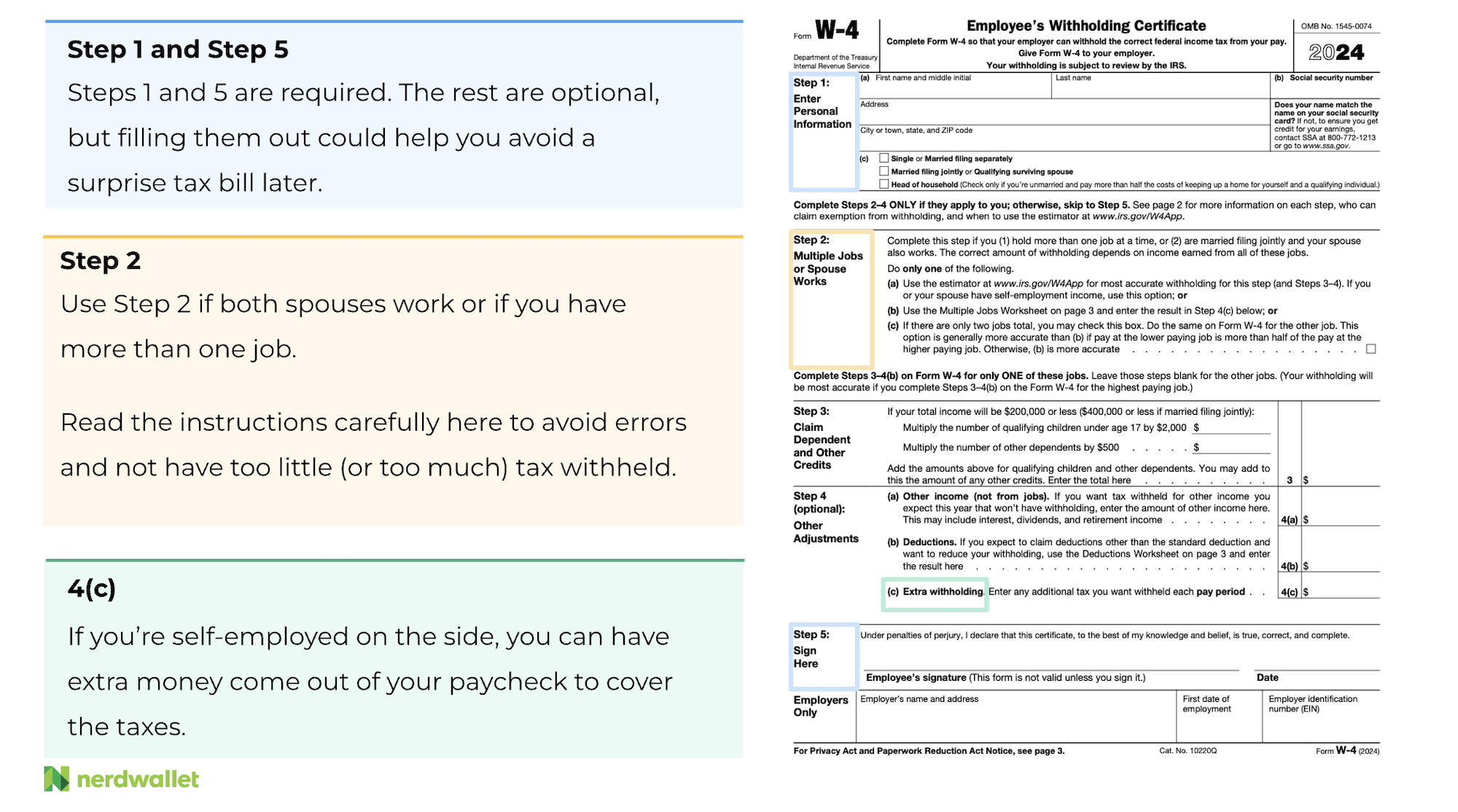

When starting a new job, one of the first forms you’ll be asked to fill out is the IRS Form W-4. This form is used by your employer to determine how much federal income tax to withhold from your paycheck. It’s important to fill out this form accurately to avoid any surprises come tax season.

The IRS Form W-4 can be a bit daunting at first glance, but with a little guidance, it’s actually quite straightforward. The form asks for information about your filing status, dependents, and any additional income you may have. By providing this information, you help your employer calculate the correct amount of tax to withhold from your paycheck.

Save and Print Irs Form W-4 Printable

Form W 4S Request For Federal Income Tax Withholding From Sick Pay

Form W 4S Request For Federal Income Tax Withholding From Sick Pay

Irs Form W-4 Printable

One of the easiest ways to access the IRS Form W-4 is to download and print it from the IRS website. The form is updated annually, so be sure to use the most current version. Once you have the form in hand, take your time to carefully fill it out. If you’re unsure about any of the questions, don’t hesitate to ask your HR department for assistance.

When filling out the IRS Form W-4, it’s important to remember that you can update it at any time. If your financial situation changes, such as getting married or having a child, you may need to adjust your withholding allowances. By keeping your form up to date, you can ensure that you’re not overpaying or underpaying your taxes throughout the year.

It’s also worth noting that the IRS provides a withholding calculator on their website to help you determine the appropriate number of allowances to claim on your Form W-4. This tool can be especially helpful if you have multiple sources of income or if you’re self-employed. By using the calculator, you can avoid any potential tax surprises and ensure that you’re on track with your tax obligations.

In conclusion, the IRS Form W-4 is a crucial document that helps your employer withhold the correct amount of federal income tax from your paycheck. By understanding how to fill out the form and keeping it up to date, you can avoid any unnecessary tax headaches down the road. Be sure to take the time to review your Form W-4 periodically and make any necessary changes to ensure your tax withholding is accurate.