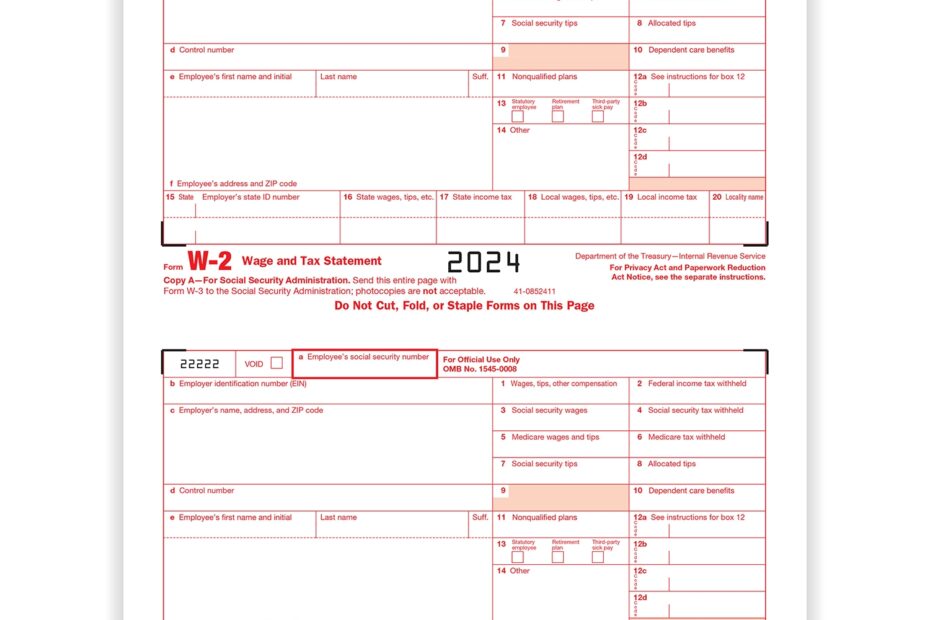

Completing your taxes can be a daunting task, but having the right forms can make the process much easier. One important form that you will need is the IRS Form W-2, which outlines your wages and taxes withheld by your employer. This form is essential for accurately reporting your income and ensuring that you are in compliance with tax laws.

For the year 2024, the IRS has updated the Form W-2 to reflect any changes in tax laws or regulations. It is important to ensure that you have the most current version of the form to avoid any discrepancies in your tax return. Luckily, the IRS provides a printable version of the Form W-2 on their website for easy access.

Get and Print Irs Form W 2 2024 Printable

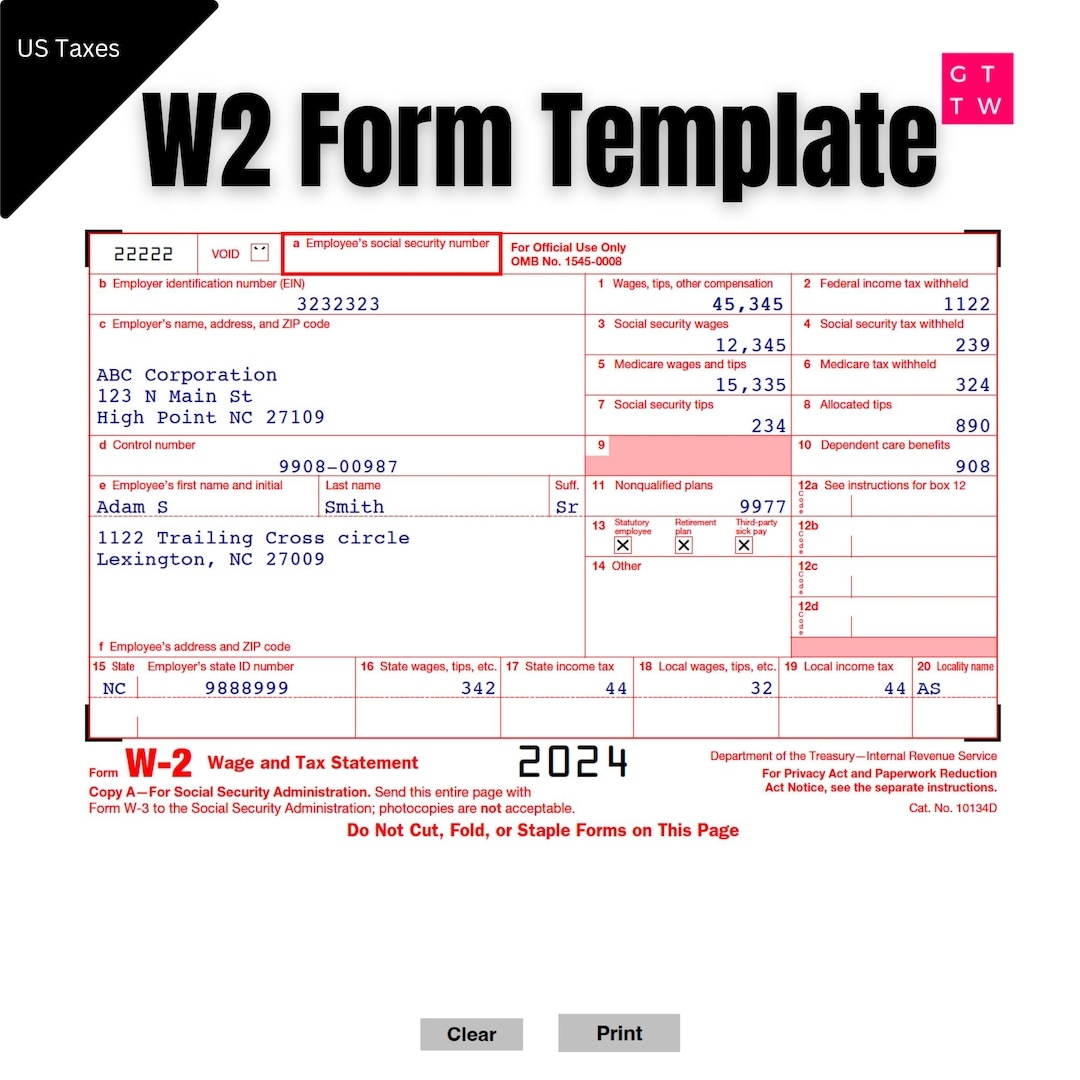

W2 Form IRS 2024 2023 Fillable PDF With Print And Clear Buttons

W2 Form IRS 2024 2023 Fillable PDF With Print And Clear Buttons

When filling out the Form W-2, you will need to provide information such as your employer’s identification number, your social security number, and details about your wages and taxes withheld. It is crucial to double-check all the information before submitting the form to ensure accuracy and avoid any potential issues with your tax return.

Once you have completed the Form W-2, you can either submit it electronically or mail it to the IRS along with your tax return. Make sure to keep a copy of the form for your records in case you need to reference it in the future. By properly completing and submitting the Form W-2, you can ensure that your tax return is accurate and avoid any penalties or audits.

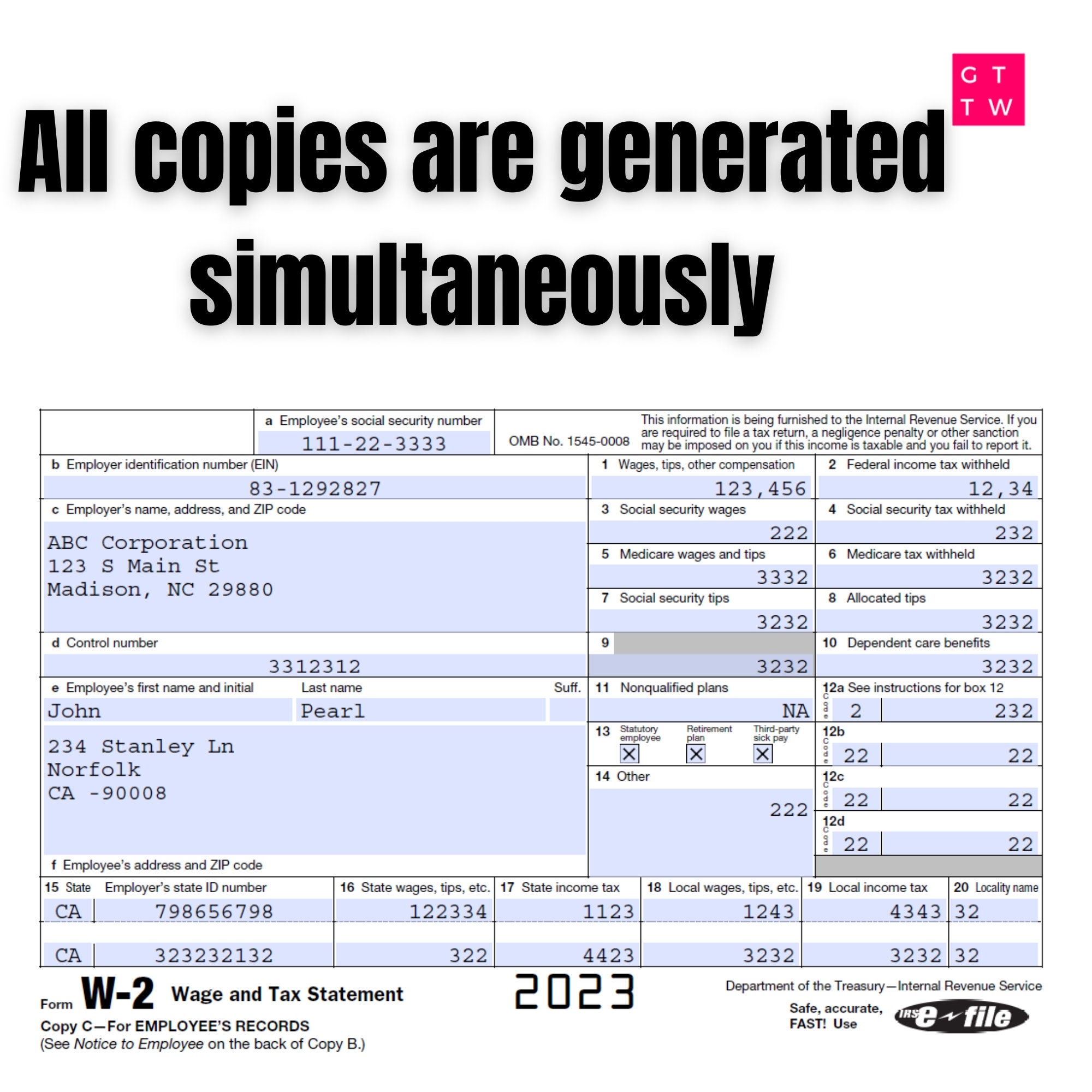

Overall, the IRS Form W-2 is a crucial document for accurately reporting your income and taxes withheld by your employer. By utilizing the printable version of the form for the year 2024, you can easily access and complete the necessary information for your tax return. Remember to review all the information carefully before submitting the form to ensure compliance with tax laws.

Completing your taxes can be a stressful process, but having the right forms at your disposal can make it much more manageable. With the IRS Form W-2 2024 Printable, you can easily access and complete the necessary information for your tax return. Make sure to stay organized and thorough when filling out the form to avoid any potential issues with your taxes.