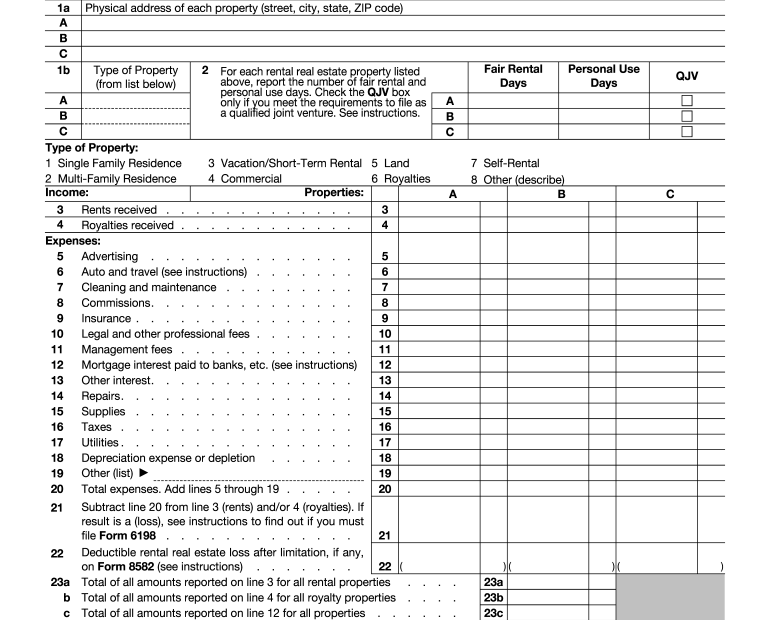

Are you a landlord or property manager looking to report your rental income and expenses to the IRS? If so, you may need to fill out Form Schedule E. This form is used to report income and expenses related to rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It is an essential document for those who receive rental income and want to claim deductions for expenses related to their rental properties.

Form Schedule E is not as intimidating as it may sound. It is a straightforward form that allows you to report your rental income and expenses accurately. By filling out this form, you can claim deductions for mortgage interest, property taxes, insurance, repairs, utilities, and more. It is important to keep track of all your rental income and expenses throughout the year so that you can easily fill out Form Schedule E when tax season rolls around.

Get and Print Irs Form Schedule E Printable

Irs Schedule E 2024 Printable Karry Marylee

Irs Schedule E 2024 Printable Karry Marylee

When filling out Form Schedule E, you will need to provide details about your rental properties, such as the address, type of property, and the amount of rental income received. You will also need to list all expenses related to the rental properties, including repairs, maintenance, utilities, property management fees, and more. Make sure to keep accurate records of all expenses so that you can easily report them on Form Schedule E.

Once you have filled out Form Schedule E, you can attach it to your tax return when filing with the IRS. This form will help you accurately report your rental income and expenses, allowing you to maximize your deductions and potentially lower your tax liability. By keeping thorough records and filling out Form Schedule E correctly, you can ensure that you are in compliance with IRS regulations and avoid any potential audits or penalties.

In conclusion, Form Schedule E is an important document for landlords and property managers who want to report their rental income and expenses accurately. By keeping detailed records and filling out this form correctly, you can claim deductions for expenses related to your rental properties and potentially lower your tax liability. Be sure to consult with a tax professional if you have any questions about filling out Form Schedule E or reporting rental income to the IRS.