When it comes to filing taxes for your non-profit organization, one important form to be aware of is the IRS Form 990n. This form is also known as the e-Postcard, and it is specifically designed for small tax-exempt organizations with annual gross receipts of $50,000 or less. Filing this form is crucial for maintaining your organization’s tax-exempt status and staying compliant with IRS regulations.

Downloading and printing the IRS Form 990n is a simple process that can be done online through the IRS website. This form is available in a printable format, making it easy for non-profit organizations to fill out and submit their required information. By completing and filing this form on time, your organization can avoid penalties and ensure that it remains in good standing with the IRS.

Easily Download and Print Irs Form 990n Printable

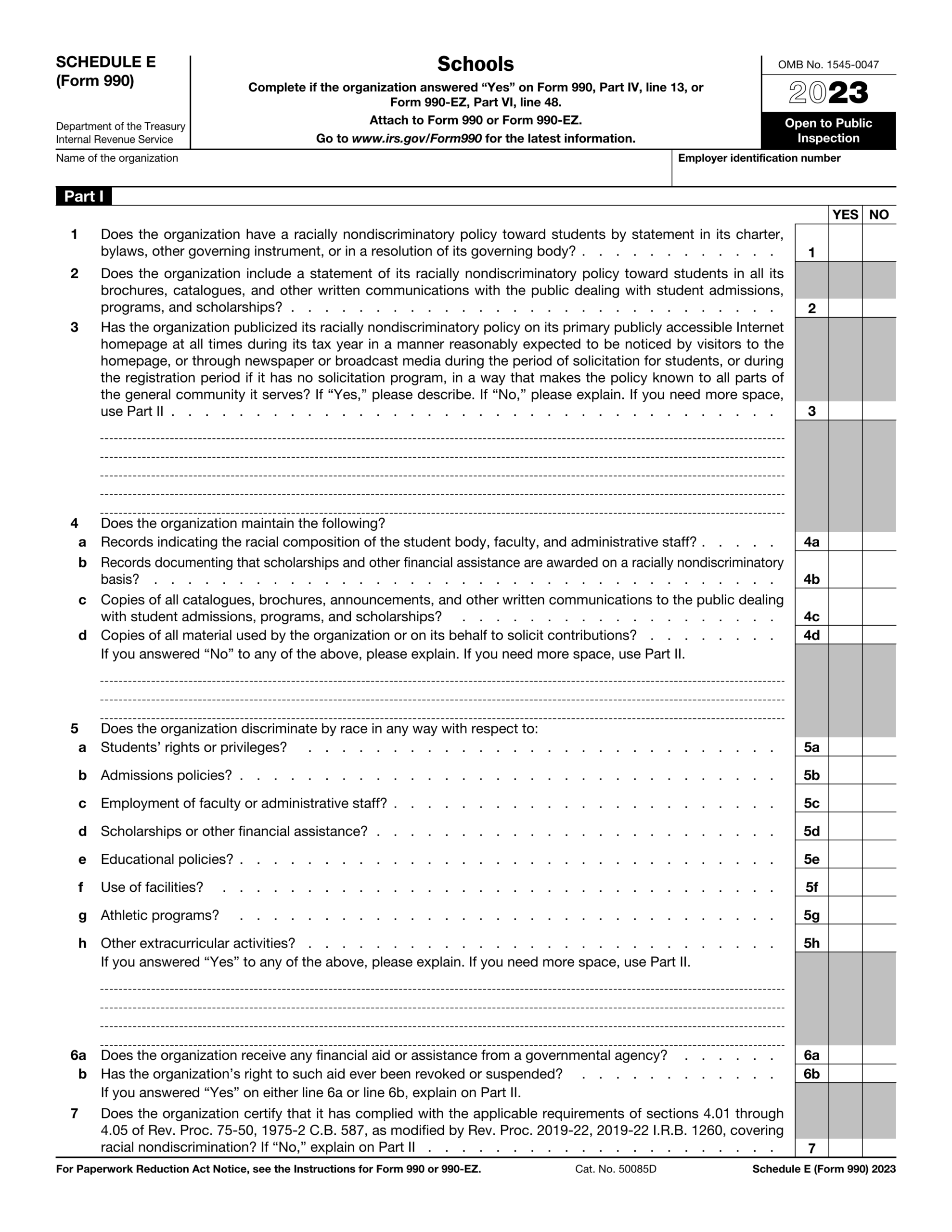

Fill Schedule E Form 990 2024 2025 Create Edit Forms Online

Fill Schedule E Form 990 2024 2025 Create Edit Forms Online

When filling out the IRS Form 990n, organizations will need to provide basic information such as their name, address, and EIN (Employer Identification Number). They will also need to report their annual gross receipts and provide a brief description of their activities. This form is relatively straightforward and can typically be completed in a short amount of time.

It’s important to note that the IRS Form 990n must be filed electronically, as it cannot be submitted in paper form. Non-profit organizations can easily e-file this form through the IRS website, and they will receive a confirmation once it has been successfully submitted. By following the guidelines and deadlines set forth by the IRS, organizations can ensure that they are in compliance with federal tax laws.

In conclusion, the IRS Form 990n is a crucial document for small tax-exempt organizations with annual gross receipts of $50,000 or less. By downloading and printing this form, non-profit organizations can easily fulfill their filing requirements and maintain their tax-exempt status. Staying up to date with IRS regulations and filing deadlines is essential for all non-profit organizations to avoid penalties and ensure continued compliance.

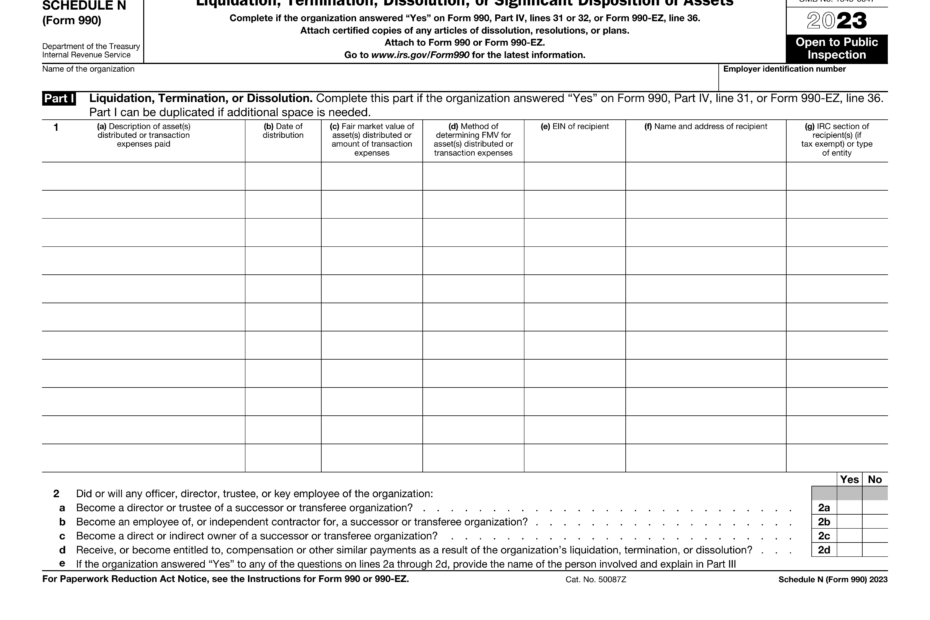

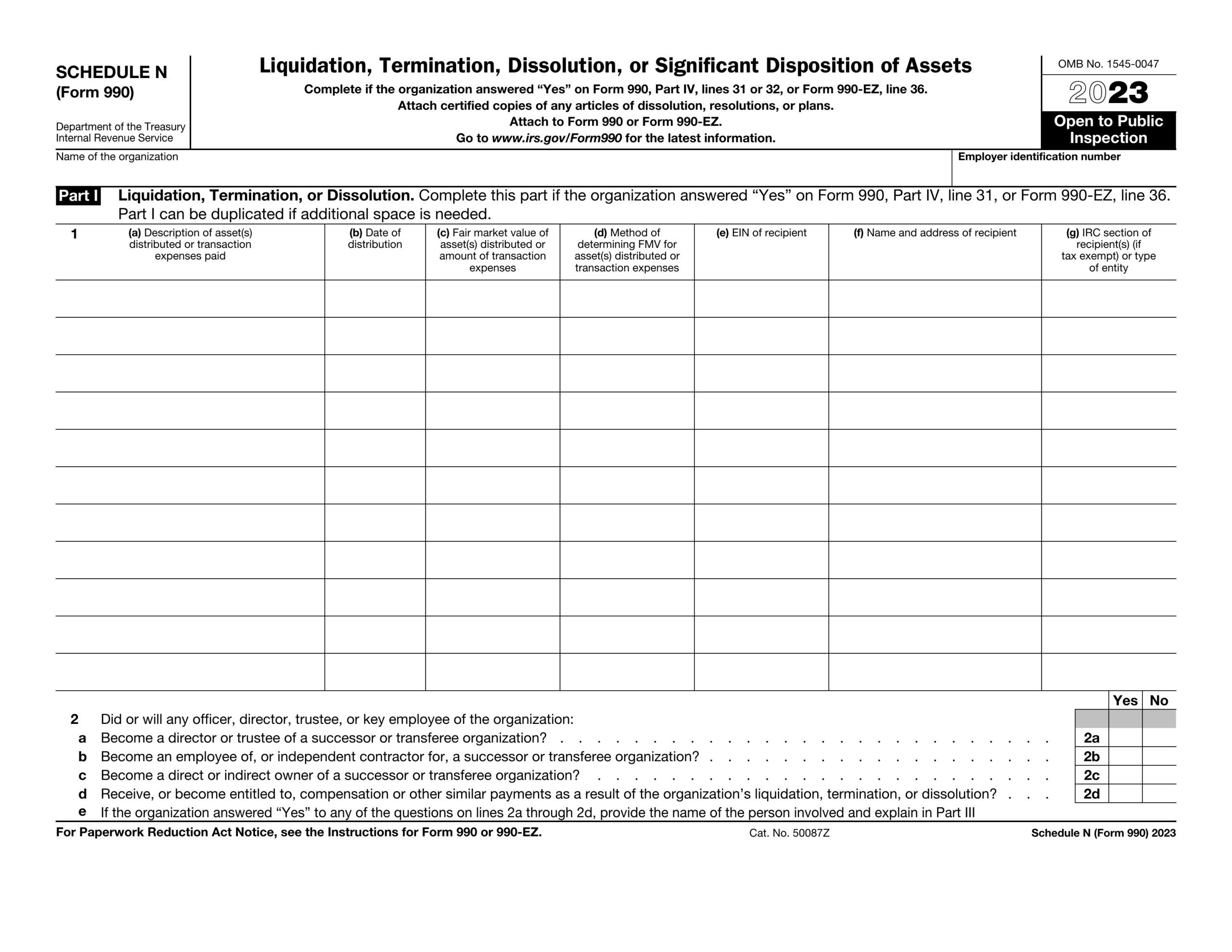

Schedule N Form 990 2024 2025 Fill Forms Online PDF Guru

Schedule N Form 990 2024 2025 Fill Forms Online PDF Guru

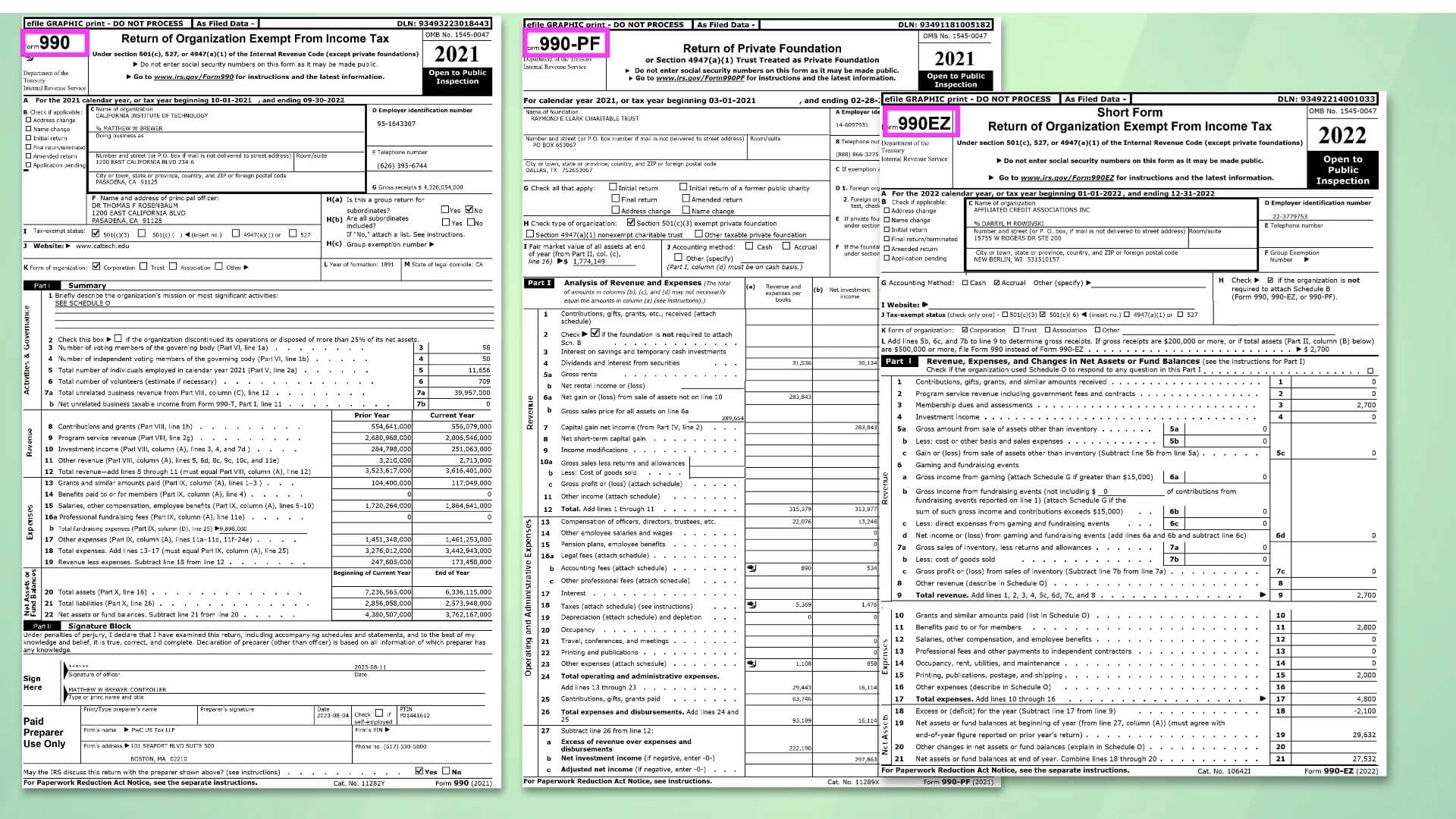

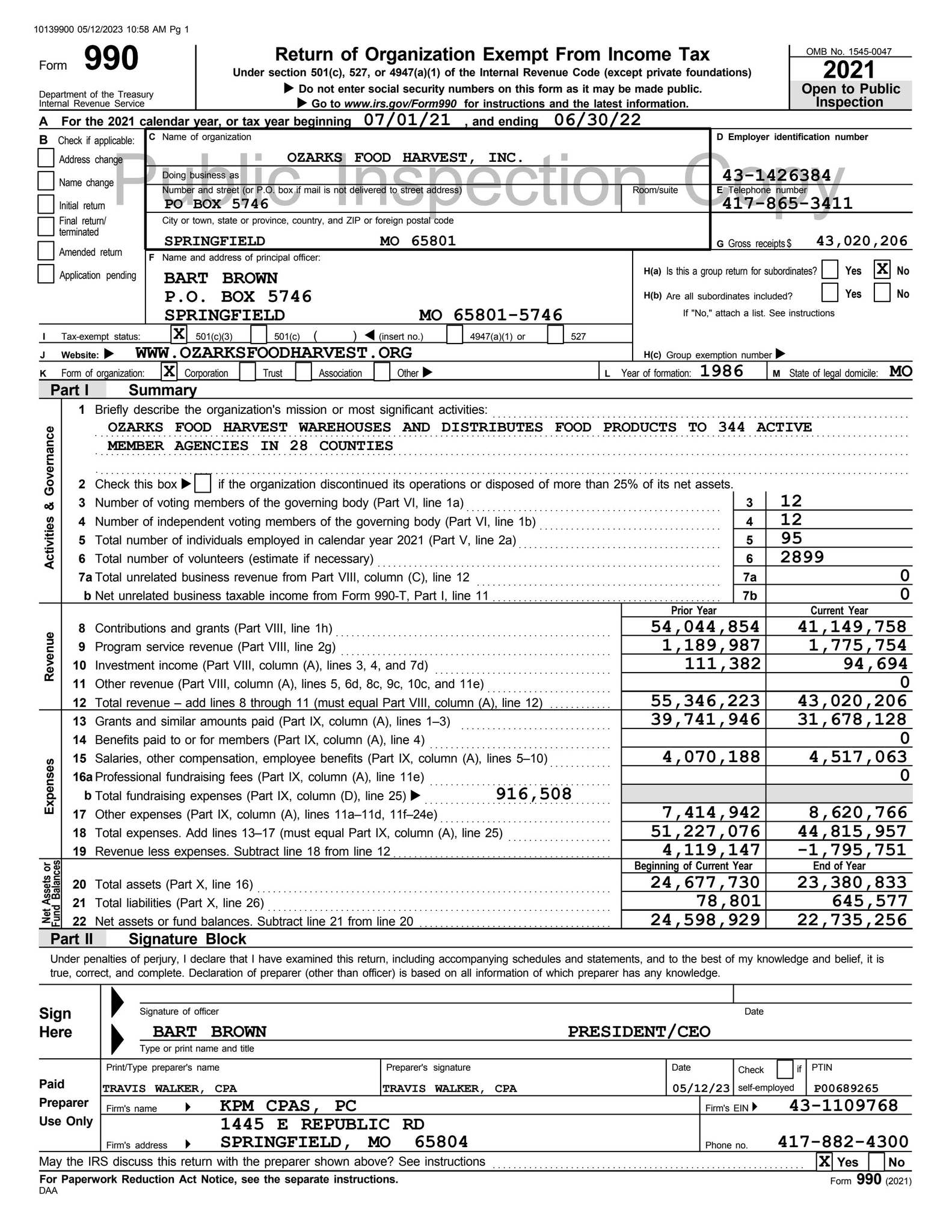

2021 IRS Form 990 By Ozarks Food Harvest Issuu

2021 IRS Form 990 By Ozarks Food Harvest Issuu

Schedule N Form 990 2024 2025 Fill Forms Online PDF Guru

Schedule N Form 990 2024 2025 Fill Forms Online PDF Guru

Need a hassle-free solution to handle your money matters? Our free printable checks give you a user-friendly, safe, and editable alternative you can use at home. Whether for personal use, small businesses, or financial planning, these printable checks save money and effort without sacrificing security. Works well with popular bookkeeping tools and designed for easy printing, they’re a wise alternative to bank-ordered checks. Start printing today and take full control of your payments—no waiting, completely free. Explore our ready-to-use templates and pick the one that suits your style. With our beginner-friendly features, managing your finances has never been this streamlined. Download your free printable checks and optimize your check-writing process with confidence!.