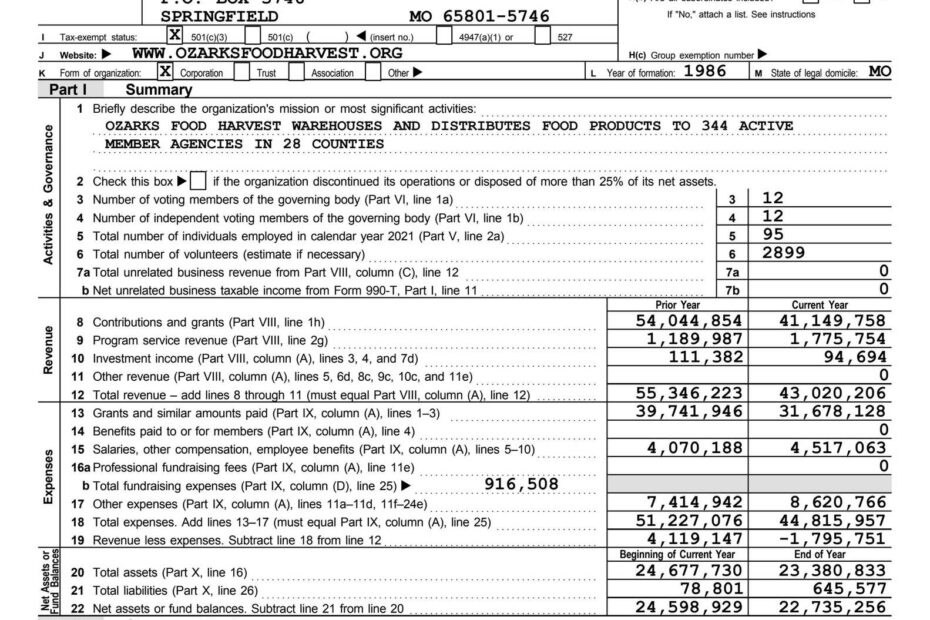

IRS Form 990 EZ is a simplified version of the annual information return that certain tax-exempt organizations must file with the IRS. This form is designed for small to medium-sized organizations with gross receipts less than $200,000 and total assets less than $500,000. It provides a condensed version of the more complex Form 990, making it easier for eligible organizations to fulfill their reporting requirements.

Many non-profit organizations, such as charities, social clubs, and religious organizations, are required to file Form 990 EZ each year to maintain their tax-exempt status. By providing detailed information about their finances, activities, and governance, these organizations demonstrate transparency and accountability to the public and regulatory authorities.

Quickly Access and Print Irs Form 990 Ez Printable

Form 990 EZ 2024 2025 Fill Edit And Download PDF Guru

Form 990 EZ 2024 2025 Fill Edit And Download PDF Guru

Completing Irs Form 990 Ez Printable

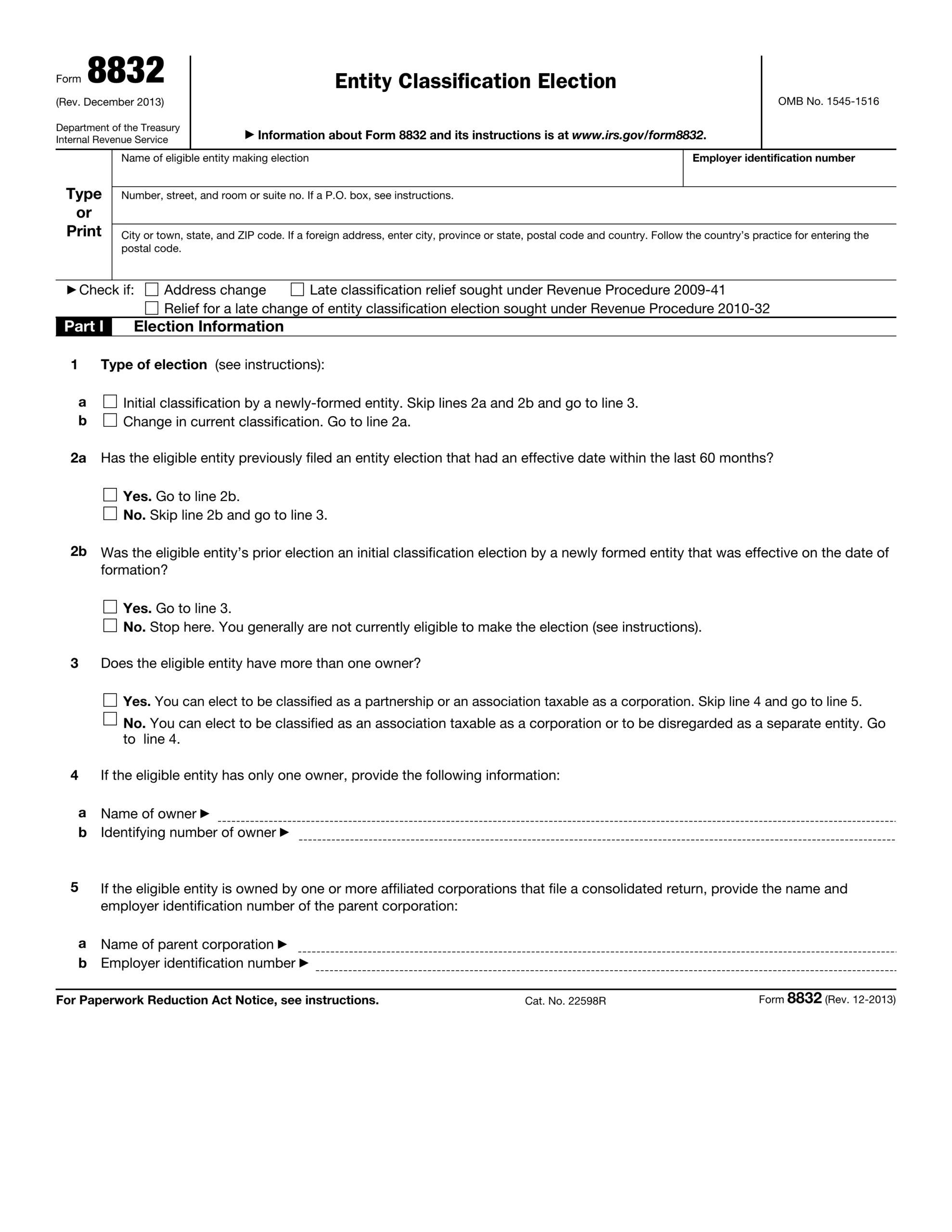

When completing IRS Form 990 EZ, organizations must provide information about their mission, programs, revenue sources, expenses, and key personnel. They must also disclose any significant financial transactions, such as grants, contributions, or loans. The form includes specific sections for reporting compensation of officers, directors, trustees, and key employees, as well as details about the organization’s tax-exempt status and compliance with tax laws.

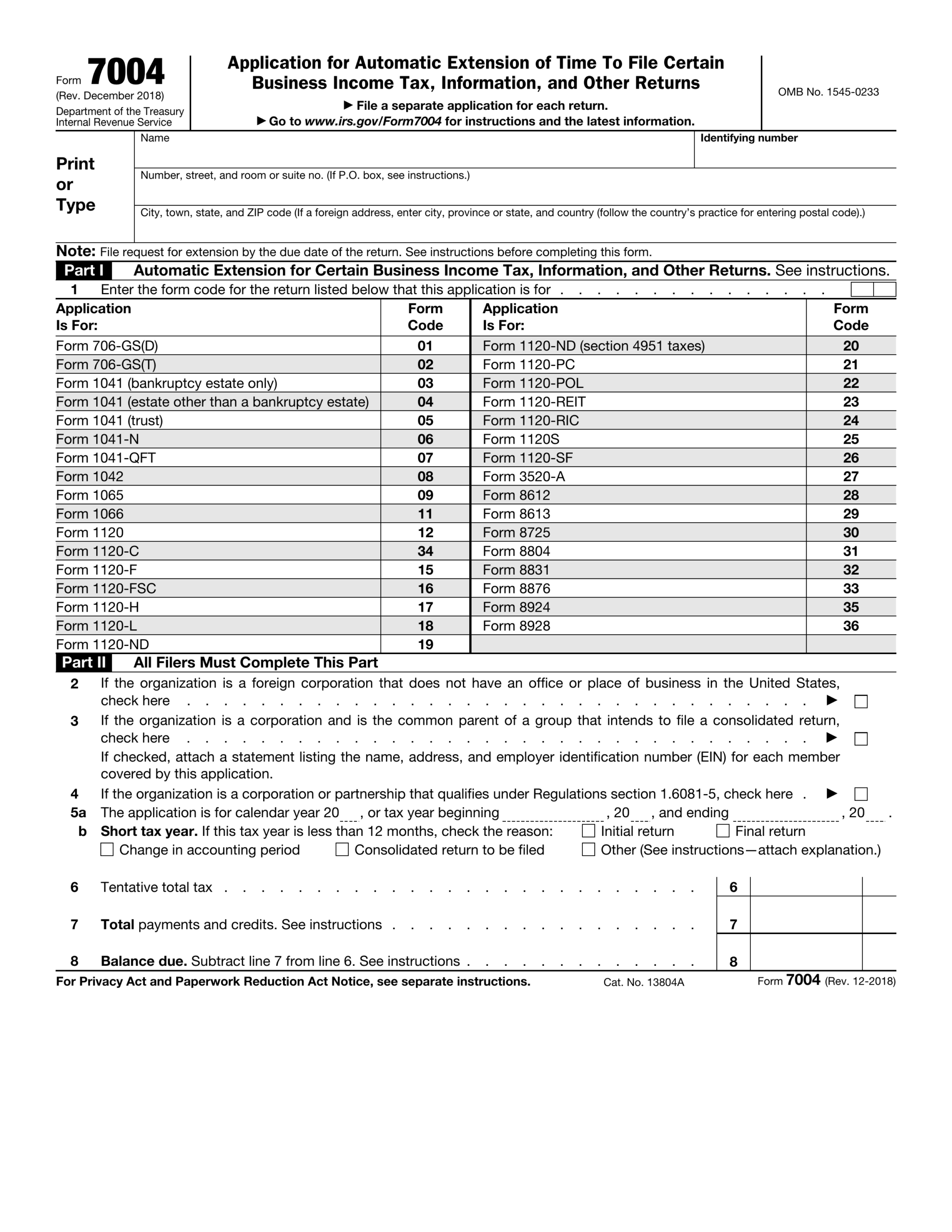

Organizations can download the printable version of Form 990 EZ from the IRS website or request a paper copy by mail. Alternatively, they can use electronic filing options, such as the IRS’s online filing system or authorized third-party software. Regardless of the filing method, organizations must ensure that all required information is accurate, complete, and submitted on time to avoid penalties or loss of tax-exempt status.

It is important for organizations to carefully review the instructions and guidelines provided with Form 990 EZ to ensure compliance with IRS regulations. They may also seek professional assistance from accountants, tax advisors, or legal counsel to navigate the reporting requirements and address any complex issues that may arise. By taking a proactive approach to completing Form 990 EZ, organizations can fulfill their obligations and maintain their status as tax-exempt entities.

In conclusion, IRS Form 990 EZ is a valuable tool for eligible tax-exempt organizations to report their financial information and operational activities to the IRS and the public. By understanding the requirements and completing the form accurately, organizations can demonstrate transparency, accountability, and compliance with tax laws. It is essential for organizations to stay informed about their filing obligations and seek assistance when needed to ensure smooth and successful reporting.