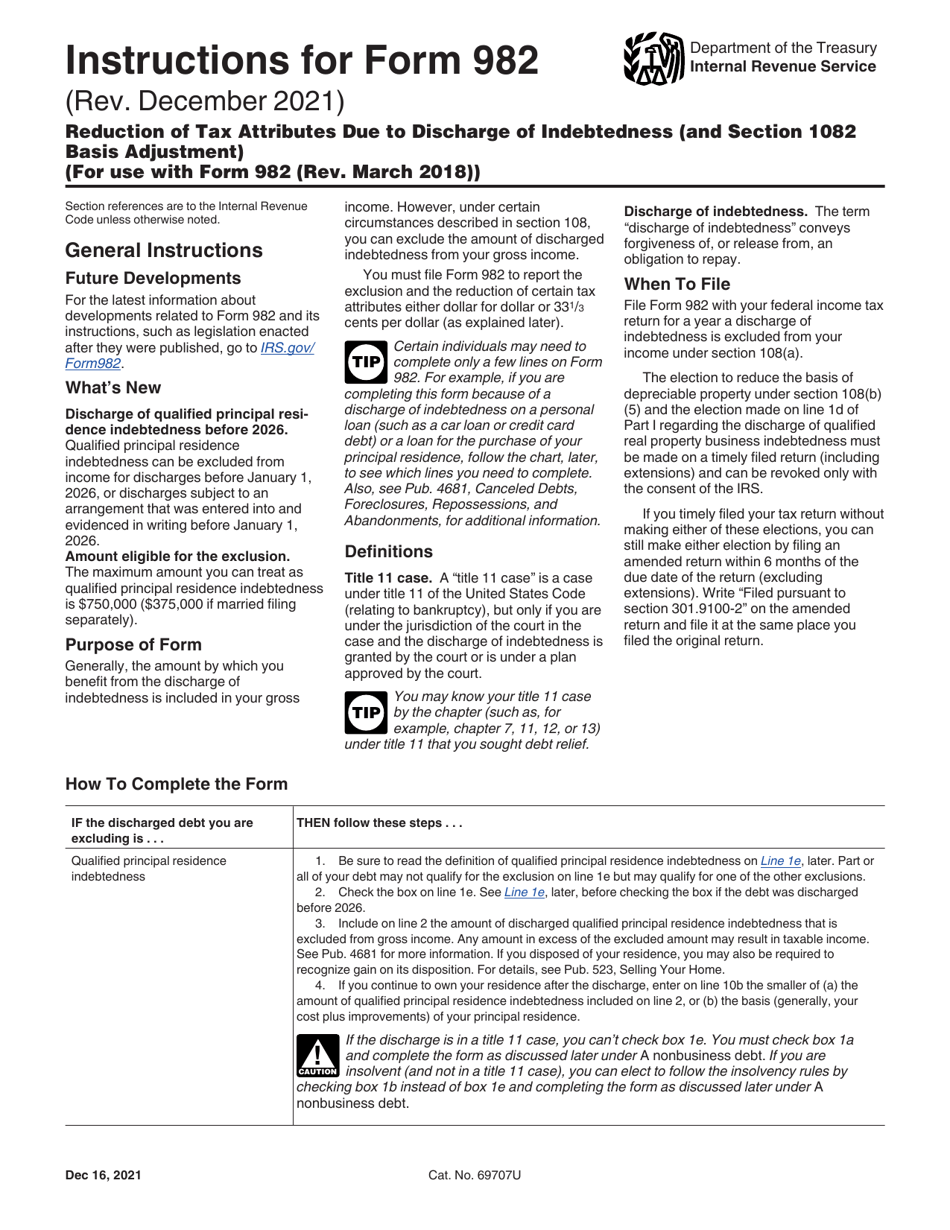

When dealing with cancelled debt, it’s important to understand the tax implications that come with it. In certain situations, the amount of cancelled debt may be considered taxable income by the IRS. However, there is a form that can help you exclude this cancelled debt from your taxable income – Form 982.

Form 982 is used to report the exclusion of cancelled debt from your income, which can help reduce your tax liability. This form is essential for those who have had debt cancelled by a lender, such as credit card debt, mortgage debt, or student loan debt. By filling out Form 982, you can potentially avoid paying taxes on the cancelled debt amount.

Save and Print Irs Form 982 Printable

Form 982 Fill Out Printable PDF Forms Online Worksheets Library

Form 982 Fill Out Printable PDF Forms Online Worksheets Library

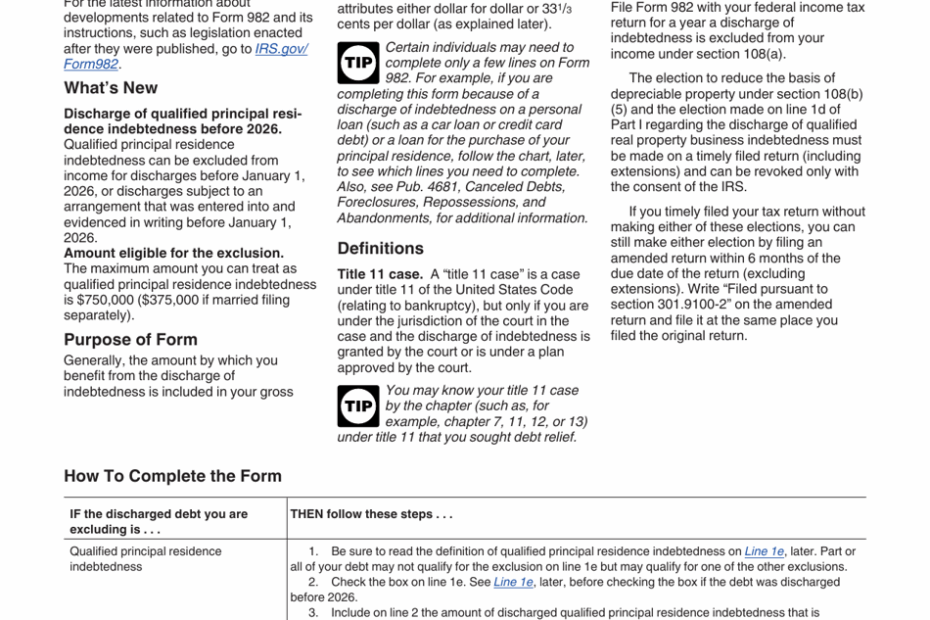

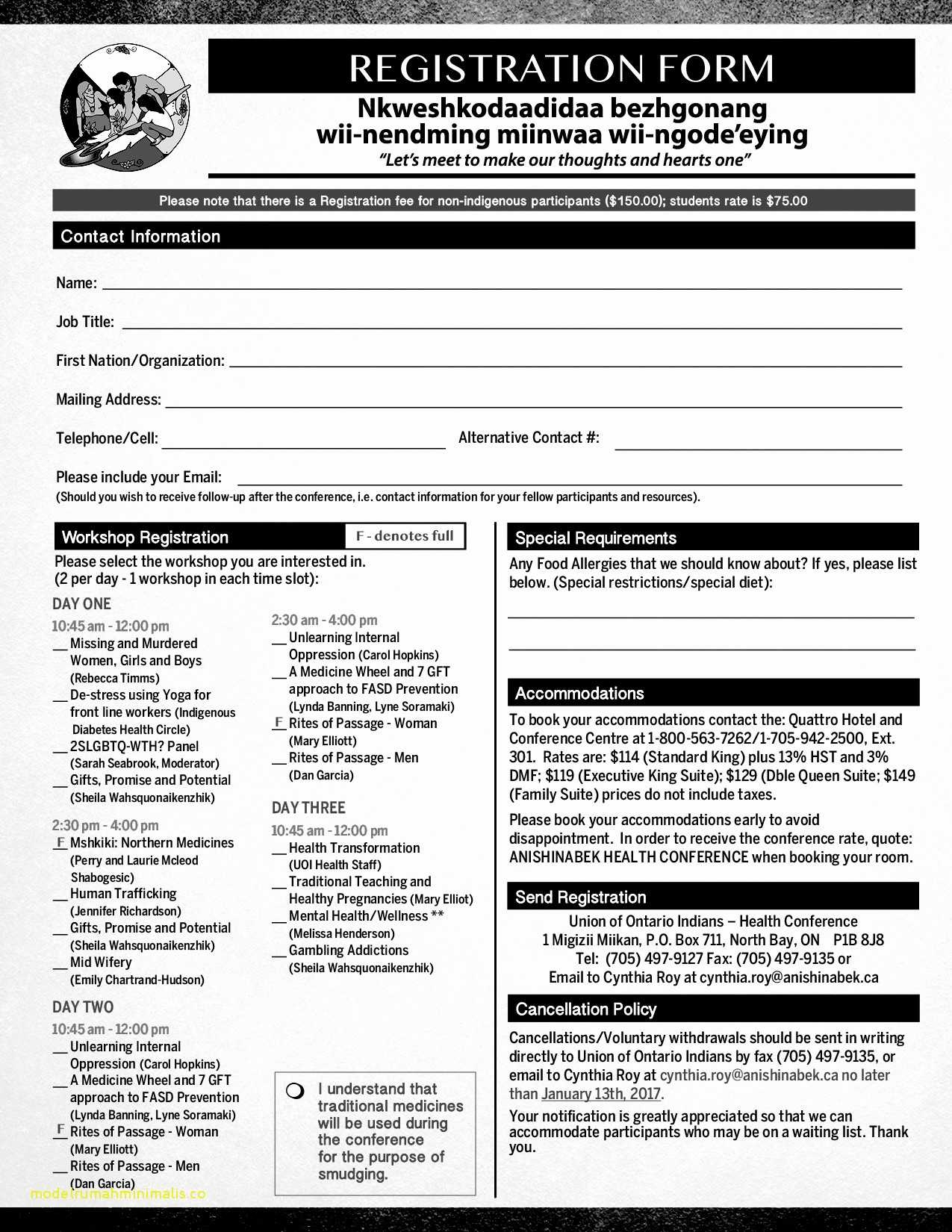

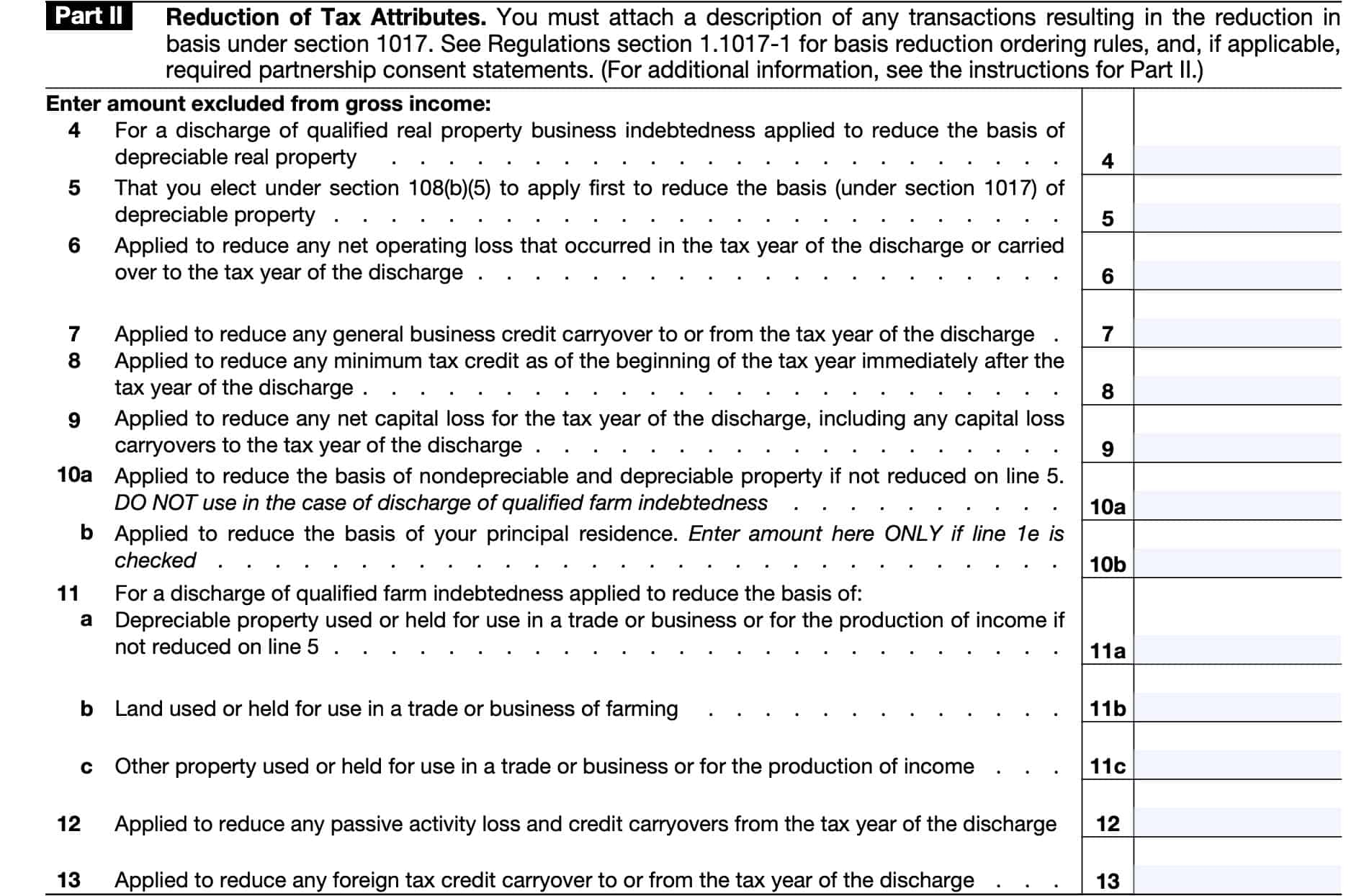

When filling out Form 982, you will need to provide details about the cancelled debt, including the amount cancelled and the reason for the cancellation. You will also need to indicate which exclusion provision applies to your situation, such as bankruptcy or insolvency. It’s important to carefully review the instructions for Form 982 to ensure you are accurately reporting the cancelled debt exclusion on your tax return.

It’s important to note that not all cancelled debt is eligible for exclusion using Form 982. For example, cancelled debt related to gifts or inheritances is not eligible for exclusion. Additionally, any cancelled debt that is considered to be part of income, such as certain types of student loan forgiveness, may not be eligible for exclusion using Form 982.

Overall, Form 982 can be a valuable tool for those who have had debt cancelled and want to avoid paying taxes on the cancelled amount. By accurately completing this form and meeting the eligibility requirements, you can potentially reduce your tax liability and avoid any surprises come tax time.

In conclusion, Form 982 is a crucial form for those who have had debt cancelled and want to exclude the cancelled amount from their taxable income. By understanding the requirements for eligibility and accurately completing the form, you can potentially save money on your taxes and avoid any penalties for failing to report cancelled debt. Make sure to consult with a tax professional if you have any questions or concerns about using Form 982.

Form 982 For 2024 2025 Fill And Edit Accurately PDF Guru

Form 982 For 2024 2025 Fill And Edit Accurately PDF Guru

IRS Form 982 Reduction Of Attributes Due To Discharge Of Worksheets Library

IRS Form 982 Reduction Of Attributes Due To Discharge Of Worksheets Library

IRS Form 982 Instructions Discharge Of Indebtedness

IRS Form 982 Instructions Discharge Of Indebtedness

Download Instructions For IRS Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness And Section 1082 Basis Adjustment PDF 2018 2025 Templateroller

Download Instructions For IRS Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness And Section 1082 Basis Adjustment PDF 2018 2025 Templateroller

Searching for a stress-free way to take care of your financial needs? Our Irs Form 982 Printable give you a straightforward, safe, and editable solution you can use at home. Be it for personal use, home businesses, or budgeting, printable checks save money and effort without sacrificing professionalism. Compatible with common finance software and designed for easy printing, they’re a wise option to bank-ordered checks. Start printing today and fully manage your payments—no delays, no fees. Explore our free templates and select the one that fits your needs. With our beginner-friendly features, managing your finances has never been this convenient. Access your printable checks for free and streamline your check-writing process with ease!.